Voluntary disclosure programs lead to more tax evasion but can increase revenues

Dominika Langenmayr of the Catholic University Eichstätt-Ingolstadt finds that programs that allow tax evaders to voluntarily disclose unreported assets and be taxed retroactively at a reduced or no penalty increase tax evasion. Despite the rise in evasion, Langenmayr argues that voluntary disclosure policies can increase net revenues by reducing the high administrative costs of prosecuting evaders.

U.S. quantitative easing had a big impact at home and abroad

Saroj Bhattarai of the University of Texas at Austin, Arpita Chatterjee of the University of New South Wales, and Woong Yong Park of the University of Illinois at Urbana-Champaign find that quantitative easing (QE) had a significant impact on both macroeconomic and financial variables in the U.S., increasing output, consumer prices, stock prices, and long-term inflation expectations, and reducing long-term treasury yields. The authors add that, in emerging economies, U.S. QE caused exchange rate appreciations, reduced long-term bond yields, and increased stock prices, but find no significant impact on output or prices.

IMF loans have a big impact on domestic investors, but not much on foreign

Aitor Erce of the European Stability Mechanism and Daniel Riera-Crichton of Bates College find that, while International Monetary Fund (IMF) loans do not stimulate foreign investment, they have a strong impact on domestic investors. Specifically, the authors find that IMF loans reduce capital flight from domestic investors and lead to greater repatriation of foreign savings, with the strongest effects coming during sovereign defaults.

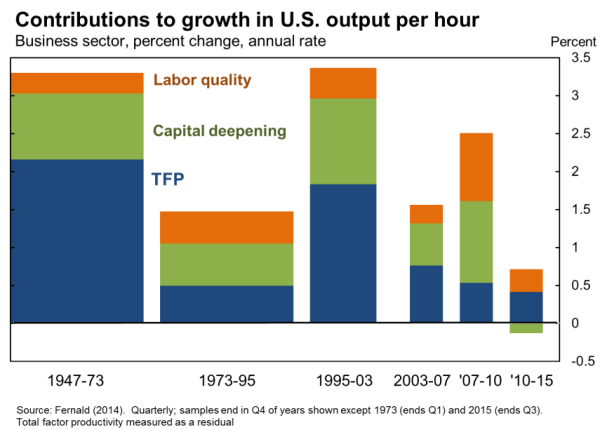

Chart of the week: Accounting for U.S. growth

Shadow banking is not a single, identifiable “system,” but a constantly changing and largely unrelated set of intermediation activities pursued by very different types of financial market actors. Indeed, the very rigor of post-crisis reforms to prudential regulation may create new opportunities for such activities. The aphoristic warning to avoid too much emphasis on fighting the last war, since wholly new risks may have arisen, seems particularly applicable in this area. Yet there is simultaneously the opposite danger that the regulatory response to shadow banking will be too broad and too unidimensional. Indeed, the very term “shadow banking” tilts in that direction. This afternoon, I will try to identify some of the considerations that could help navigate between the perils of underappreciating the risks to financial stability arising from, and the costs from overreacting to, new forms of nonbank financial intermediation. Along the way I will make a few points. One is that, analytically, it is essential to disaggregate the various activities that fall under the loose term shadow banking and to assess the risks and benefits they present on a discrete basis. A second is that, notwithstanding the manifold nature of nonbank intermediation, it remains useful to identify the relationship of specific activities to the prudentially regulated sector. A third is that institutional considerations will be important in defining the potential, and actual, regulatory responses to nonbank intermediation.

—Daniel K. Tarullo, Governor, Federal Reserve Board

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Tax evasion, QE, and more

November 19, 2015