2003 dividend tax cut did not increase corporate investment or employee compensation

Using corporate tax return data from 1996 to 2008, Danny Yagan of the University of California, Berkeley finds that the 2003 dividend tax cut neither boosted corporate investment nor employee compensation, in contrast to what he claims the legislation was intended to do. Instead, the tax cut led to an increase in corporate payouts to shareholders.

Rising unemployment and a drop in wealth reduced household spending during the Great Recession

Dimitris Christelis of the Center for Studies in Economics and Finance, Dimitris Georgarakos of Goethe University Frankfurt, and Tullio Jappelli of the University of Naples Federico II find that for every 10% loss in housing and financial wealth during the Great Recession, household spending dropped by 0.56% and 0.9%, respectively. They also note that that those who lost their jobs reduced household spending by an additional 10% on average.

When deciding when to cut spending, the timing of fiscal multipliers matters most

Kevin Fletcher and Damiano Sandri of the International Monetary Fund argue that when deciding whether or not to delay fiscal consolidation, the current size of fiscal multipliers should not be the primary consideration. Instead, the difference between current and future multipliers should be the greatest concern. If current multipliers are higher than those in the future, delaying fiscal consolidation is beneficial, but if the multipliers are constant over time, there is no significant advantage to delaying.

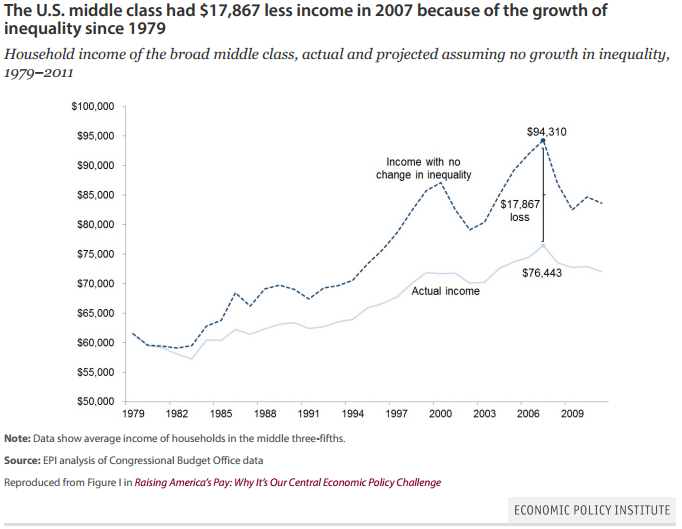

Chart of the week: Income inequality

Quote of the week: While other forms of household indebtedness fell from 2008-2013, student loan debt “bucked the trend” and continued to grow

“In 2010, aggregate outstanding student loan balances surpassed credit card indebtedness, and in 2013 eclipsed a trillion dollars. During the historic household deleveraging that took place between 2008 and 2013, student debt bucked the trend, and was the only form of household credit that continued to increase each year… [F]or the 2009 cohort of graduates, only 17 percent of their original debt had been paid down after five years. More than 20 percent of high-balance student borrowers owe more now than when they graduated in 2009. For the 2005 cohort of graduates, only 38 percent of their original student debt had been paid down, on average, nearly ten years after graduation.”

– William C. Dudley, President of the Federal Reserve Bank of New York

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Dividend Tax Cuts, Household Spending, and More

March 12, 2015