The Congressional Budget Office updated its long-term projections for the budget and the economy. Here are the bottom lines:

- Worry a little less about the near-term budget deficit.

- Worry a little more about the longer-term deficit.

- Worry a lot about the pace of economic growth over the next decade.

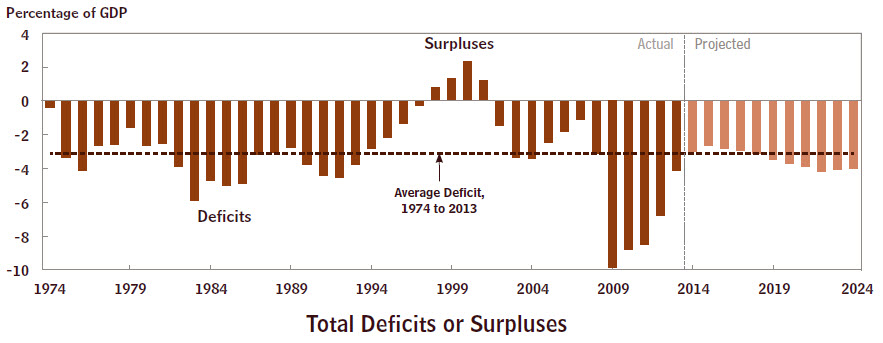

If Congress sticks to current tax and spending laws and if the economy performs as the non-partisan agency expects, then the annual budget deficit (the difference between revenues and spending) will fall from the 4.1% of gross domestic product recorded in fiscal 2013 to 3.0% in the current fiscal year (which ends Sept. 30) and to 2.6% next year.

Source: The Congressional Budget Office’s Budget and Economic Outlook, 2014 to 2024

All that is reasonably comforting. After all, the deficit exceeded 10% of GDP during the worst of the recession and there were plenty of pessimistic forecasts about how large it would be today. The deficit is coming down—indeed, it’s coming down too fast if you listen to the Obama administration and sympathetic private economists. Taxes have been raised. Spending was restrained by the sequester. Interest rates have been low. Health care costs have been growing slowly. This year’s deficit is expected to come in at $514 billion, which is $46 billion lower than the non-partisan agency projected back in May 2013; that’s largely because of big payments to the Treasury from Freddie Mae and Freddie Mac.

The bad news is in the long-run: CBO’s deficit outlook is gloomier by $1 trillion over the next time. Even in Washington, that’s a lot of money. (Deficits over the next decade are expected to be about 12% greater than CBO projected a year ago.)

This change isn’t due to runaway spending or tax cuts or a sea change in health care costs. Indeed, CBO says legislation Congress has passed since its May 2013 projections actually reduced future deficits.

Rather, CBO has scaled back its projections of economic growth. And that matters: A slower growing economy yields less in tax revenues, and, thus, larger deficits and more debt. It is a strong reminder that the slower the U.S. economy grows, the harder it will be to reduce deficits and, importantly, to reduce the government’s total debt.

CBO estimates if the economy grows just one-tenth of a percentage point slower each year for 10 years, the cumulative deficit will be $311 billion greater than the $7.9 trillion it is now projecting.

CBO economists do expect the pace of economic growth to quicken for the next few years and predict that unemployment will fall steadily to 5.8% by the end of 2017, close to the agency’s definition of full employment.

But after that, CBO has changed its mind. It anticipates the U.S. GDP in 2023 will be about 2% lower than it projected back in February 2013; that means about $300 billion less in goods and services

About 1.5 percentage points of that downward move reflects a more pessimistic view of the economy’s growth potential, in part due to the long-lasting effects of the Great Recession. (The remainder represents the economy falling short of its potential.) CBO economists expect both productivity and the nation’s capital stock to grow more slowly than its previous estimates.

CBO sees a dark cloud hovering over the U.S. economy for years to come: a shrinking share of Americans will be working or looking for work. This “labor force participation rate,” as economists call it, fell from 66% in late 2007 to 62.9% in late 2013.

Of that three-percentage-point drop, CBO says about 1.5 percentage points reflects the aging of the population and the steady march of baby boomers to retirement. Another 1 percentage point is blamed on “the recent weakness in the economy” which has “led some people to drop out of the labor force temporarily because their job prospects are poor.” Presumably, many of them will find work once the economy regains its health.

But CBO says that “limited opportunities for job-seekers in recent years have caused some people to leave the labor force permanently.” Those dropouts account for about one-half percentage point of the decline in labor force participation; that’s about 775,000 workers.

Contributing to the long-run economic forecast, CBO also predicted that the Affordable Care Act will reduce the total number of hours worked in the economy between 1.5% and 2.0% between 2017 and 2024 more than it had anticipated. Because of various ACA subsidies and taxes, some people will work fewer hours than they otherwise would; some won’t work at all. Most of the effect will be on lower-wage workers so overall wages paid will decline by about 1%., CBO said. That’s roughly double the effect CBO estimated in 2010.

CBO emphasized that its basic deficit projections assume that Congress will hold annually appropriated spending to the limits set in current law, and cautioned that “may be quite difficult.” Under those caps, annually appropriated domestic and defense spending will come to 5.2% of GDP in 2024, the lowest share in any year since 1962, the earliest year for which data is available. If Congress ultimately allows this spending to keep up with inflation, the deficit will be about $870 billion or 12% larger than the basic projection, CBO said.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The Three Bottom Lines from the New CBO Long-term Outlook

February 4, 2014