This post discusses my monthly update of the Barnichon-Nekarda model. For an introduction to the basic concepts used in this post, read my introductory post (Full details are available here.)

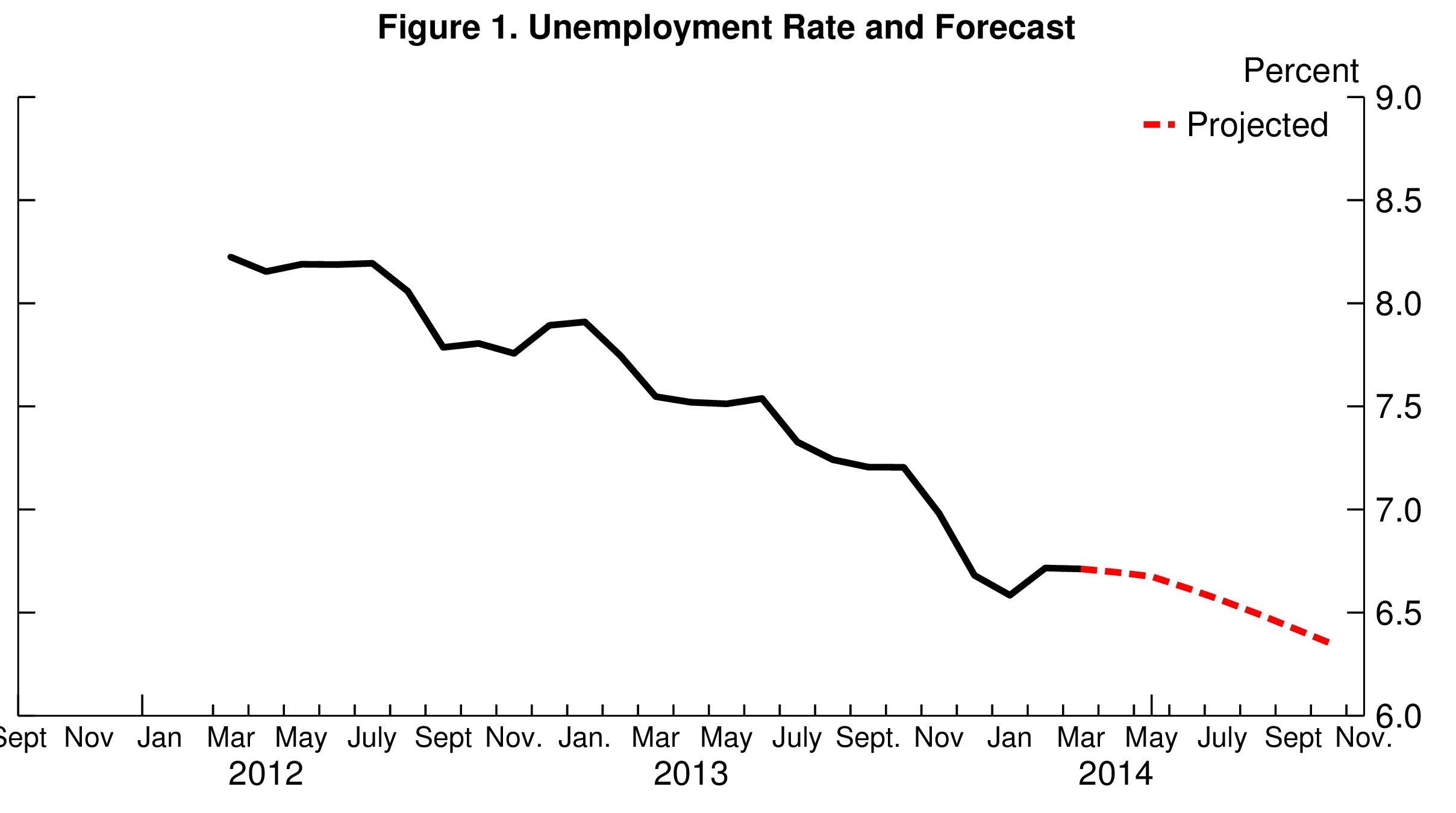

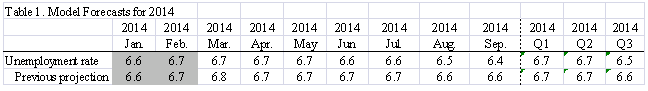

In March, the unemployment rate was steady at 6.7%, in line with last month’s forecast. Going forward, the contour of the forecast is broadly unchanged with a very slow decline in unemployment over the next 6 months. I anticipate an unemployment rate unchanged at 6.7% in April, decreasing to 6.4% by September.

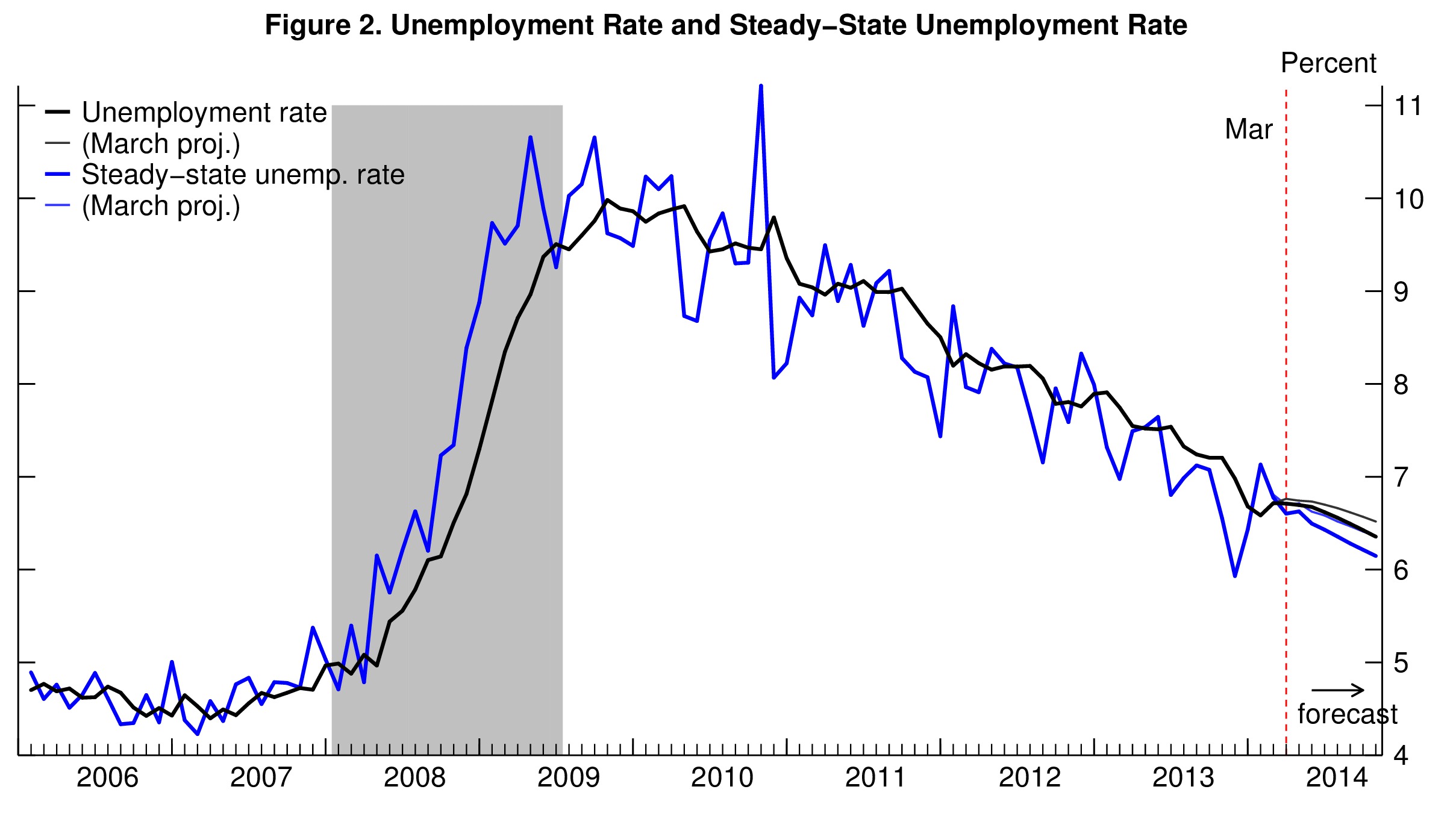

This model’s forecast can be easily understood by looking at the projected behavior of the “steady-state” unemployment rate. The steady-state unemployment rate, the rate of unemployment implied by the underlying labor force flows—the blue line in figure 2— stands currently at 6.6%, just 0.1% lower than the actual unemployment rate. Our research shows that the actual unemployment rate converges toward this steady state. With a steady-state unemployment rate only slightly below the actual rate, there is no strong “steady-state convergence dynamic” pushing the unemployment rate down. Instead, the behavior of the unemployment rate is dictated by the behavior of the steady-state unemployment rate. The model anticipates the steady-state unemployment rate (SSUR) to decline slowly over the coming months with a steady-state rate of 6.2% by September (figure 2), implying a slowly declining unemployment rate over the next 6 months.

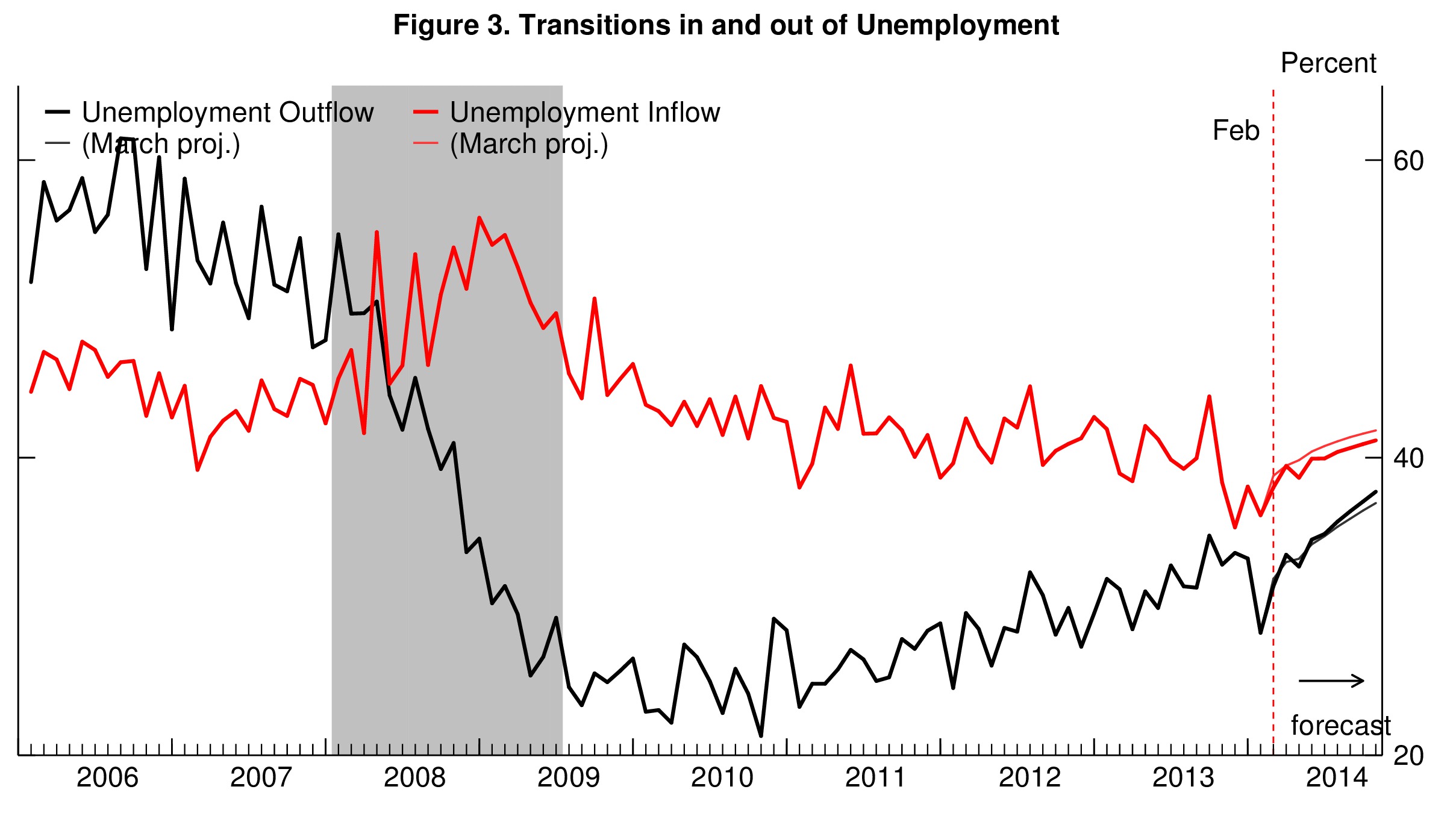

To forecast the behavior of steady-state unemployment (and hence of the actual unemployment rate), the model propagates forward its best estimate for how the flows in and out of unemployment will evolve over time. The forecasts for the flows are little changed compared to last month. However, with the recent decrease in unemployment insurance (UI) claims (capturing new layoffs), the model anticipates a slower increase in the flows into unemployment that implies a slightly faster decline in the steady-state unemployment rate.

To read more about the underlying model and the evidence that it outperforms other unemployment rate forecasts, see Barnichon and Nekarda (2012).

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Unemployment to Remain Steady in April

May 1, 2014