Since the start of the second Trump administration, I’ve been on the sanguine end of the spectrum where the dollar is concerned. It took many decades to build U.S. reserve currency status, which is unlikely to unravel in just a few months even if policy uncertainty amid tariff back-and-forth is very elevated. Indeed, with a few exceptions, the fall in the dollar since inauguration has looked cyclical, with markets unwinding the U.S. “exceptionalism” trade whereby foreign investors sent large inflows into the U.S. in recent years. Markets have been scaling back their view on U.S. outperformance in other words, while reserve currency status was never seriously in doubt.

This may be changing. The dollar has been falling in recent days as U.S. interest rates have risen, which is deeply worrying price action because—much like in the case of the U.K. in late 2022—it raises the possibility that a fiscal risk premium is building, as markets exit U.S. Treasuries and the dollar (primarily for Europe based on anecdotes). In this post, I survey the fall in the dollar since inauguration and present analytics on what might be going on. The picture is worrying.

A building risk premium in the dollar

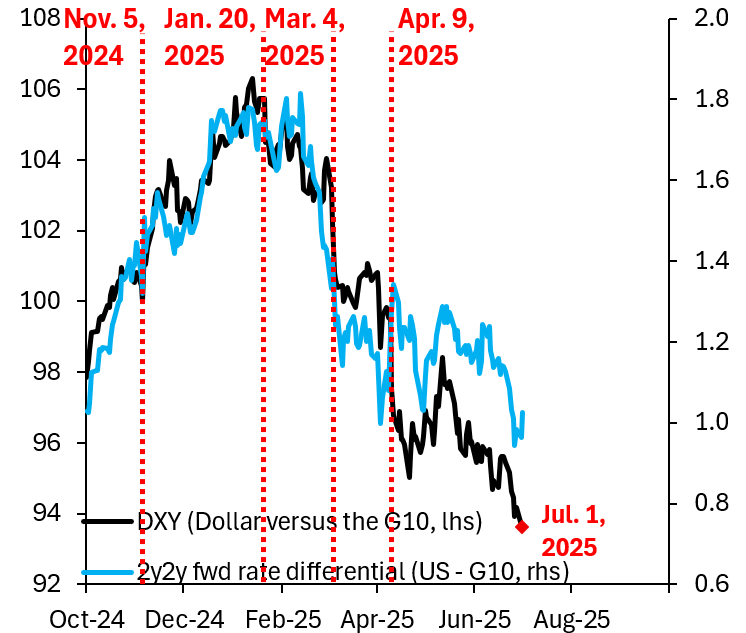

Until recently, a lot of commentary on the dollar was too alarmist. That’s because a material part of the dollar decline since inauguration was due to Germany’s surprise fiscal stimulus announcement in early March, which caused the dollar to fall 4% on a trade-weighted basis. Factoring this in, the dollar was essentially unchanged from election day on November 5, which the emerging market index in Figure 1 (blue line) illustrates. However, a more worrying dynamic has taken over in recent weeks, with the dollar falling sharply against its G10 peers (black line). What is especially worrying is that the latest fall comes amid rising U.S. interest rates, which is something that has tended to support the dollar. Figure 2 shows the dollar against other advanced currencies alongside the 2y2y forward interest differential (similarly trade-weighted), where—especially very recently—the dollar has been falling even as the interest differential has risen. This combination—a falling currency even as rate differentials rise—is deeply worrying. It harkens back to 2022, when the U.K. experienced what was essentially a debt crisis, with rising yields and a falling pound.

Source: Bloomberg

Source: Bloomberg

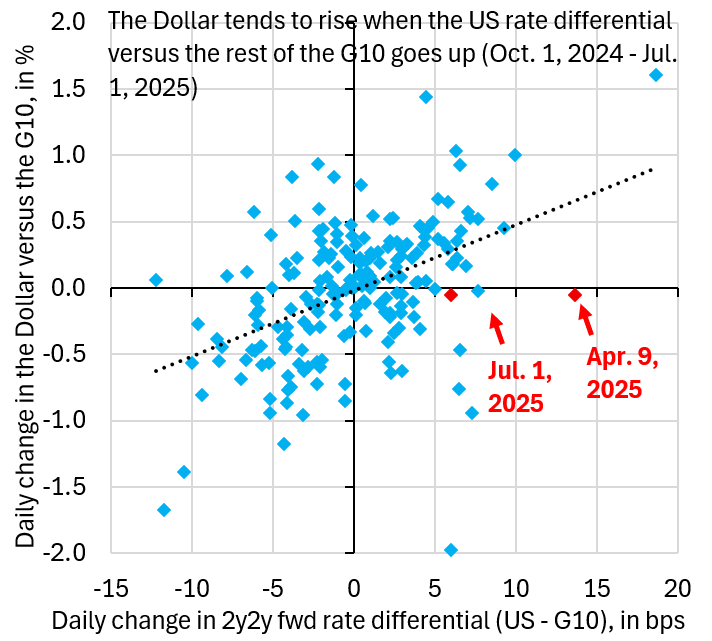

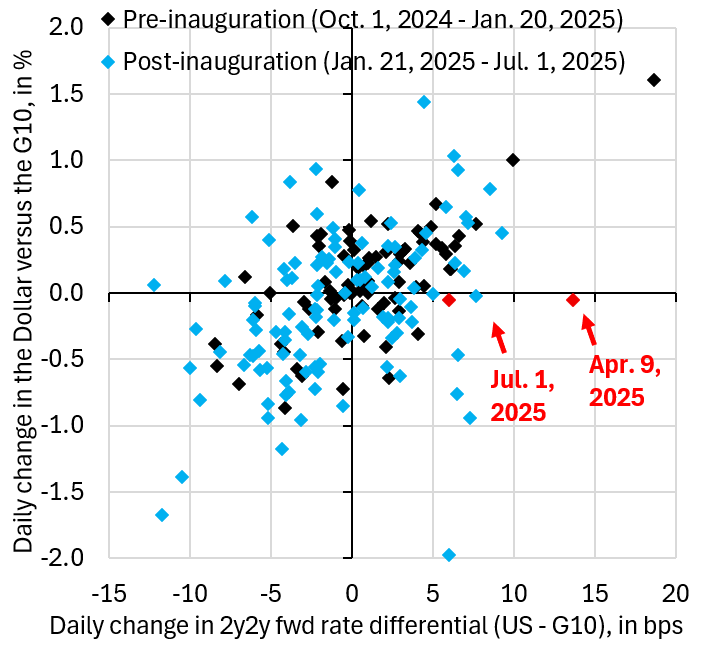

To put recent developments in perspective, Figure 3 shows daily changes in the dollar (vertical axis) and the 2y2y forward interest differential, i.e., it shows the same exact data as in Figure 2, except that now it is shown in changes and not levels. Historically, a rise in the interest differential tends to boost the dollar, as more hawkish market expectations for the Fed tend to go hand-in-hand with stronger growth or higher inflation. The announcement and subsequent pause of reciprocal tariffs in early April is a notable exception to this, as the April 9 data point shows. The dollar failed to rise even as rate differentials moved sharply in favor of the dollar. This was the Treasury market turmoil that saw President Donald Trump backtrack on reciprocal tariffs. Recent price action (the latest data point is July 1) is similar, if not quite as extreme, and has echoes of the 2022 episode in the U.K. Figure 4 shows the same chart splitting out pre- (black) and post-inauguration (blue) data points. In general, there is little evidence that the link between the dollar and rate differentials is changing, but early April and recent price action are worrying.

Source: Bloomberg

Source: Bloomberg

This kind of counterintuitive price action is highly unusual for the dollar and may be a signal that—after many years of very loose fiscal policy—tariff uncertainty is now bringing things to a head. We will be posting regular updates on the dollar in comings months, given that it is—in the end—the ultimate metric for global confidence in the United States.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Worrying signs for the US dollar

July 3, 2025