Executive Summary

Our predictable world of full-time employment and stable occupations is being transformed by digital change. The automation of tasks by artificial intelligence (AI) and robotics technologies is moving beyond factory work, retail checkout, and customer service, exposing occupations that range from computer programming and research to marketing and graphic design. Meanwhile, new digital business models in retail, transportation, entertainment, and education continue to expand, portending a different future blend of human and machine intelligence and a workforce in which non-employment work arrangements—individual-institution relationships that are not traditional employment but involve alternative arrangements including freelance work, platform-based gig work, and microentrepreneurship—are the norm rather than the exception. The importance of workforce capacity development has never been greater. Our societal mechanisms that ensure a high standard of living and facilitate sustained prosperity across the population must evolve.

In this report, I highlight forthcoming challenges in the United States that require the greatest attention. The digital disruption of occupations will not be geographically balanced and will likely affect areas of the country with higher mobility frictions, threatening efforts to transition the workforce to new roles and occupations. Part of the solution will come from expanding opportunities for platform-based work, which in turn will require steps to expand the social safety net to support the ensuing increases in income volatility, a greater need for benefits portability, and deeper support for the creation of small businesses. In parallel, workforce capacity building strategies must move beyond “reskilling,” creating new institutions offering cohesive bundles and essential scaffolding that actively enable the actual transition of people across occupations while allocating greater resources to enable the move from traditional employment to non-employment work arrangements.

1. Introduction

The work that individuals perform to earn a living has evolved constantly. At the turn of the 20th century, about 40% of the U.S. workforce were farmers; by the turn of the 21st century, less than 2% of the workforce were engaged in this profession. Today, digital forces are accelerating the pace of this change in the mix of U.S. workforce occupations. Common high-employment roles like retail checkout and factory work have already undergone extensive automation as cost-effective technological systems capable of creating an acceptable customer experience or production quality level have been built. Over the coming two decades, similar technological thresholds will be crossed in a range of other high-employment occupations—customer service, graphic design, legal assistance, driving a long-haul truck—and even skill-biased professions like software engineering may require a lot less human input in the future.1

It is natural to view the primary impact of technology on human employment as stemming from automated systems replacing human workers in performing a fixed set of tasks. However, an equally important source of change is the transformation of the fundamental business models to ones that require a different mix of work that relies less on humans. For example, while it is true that many in-store retail jobs may have been replaced by automated checkout systems, many more have been displaced by the growth of online retailing and the popularity of sites like Amazon in the U.S. that have lowered the fraction of retail that occurs in stores, while also creating new roles in warehouse operations and package delivery.

A parallel trend driven in part by digital technologies has been the lowering of the dependence of the workforce on traditional full-time employment as their way of earning a living and the rise of independent work. The growth of non-employment work was discussed widely between 2015 and 2020, most saliently in the context of the emergence of gig work and sharing economy platforms like Uber, Lyft and DoorDash. As I discuss in what follows, the growth of non-employment work has accelerated dramatically over the last four years, albeit somewhat under the radar.

This dual transition—in occupations and in work arrangements—of the U.S. workforce is already under way. A 2023 report from the McKinsey Global Institute reported that of the estimated 8.6 million U.S. workers who transitioned occupations between 2019 and 2022, more than half moved out of occupations identified as highly exposed to displacement because of digital change—food services, customer service and sales, office support, and production work. Correspondingly, as illustrated by Figure 1, according to research done by MBO Partners and Emergent Research, the number of members of the U.S. workforce doing some form of independent work has almost doubled during this period, from under 39 million in 2020 to over 72 million in 2024, and the number of people who are categorized as full-time independent workers has more than doubled, from 13.6 million in 2020 to 27.7 million in 2024.

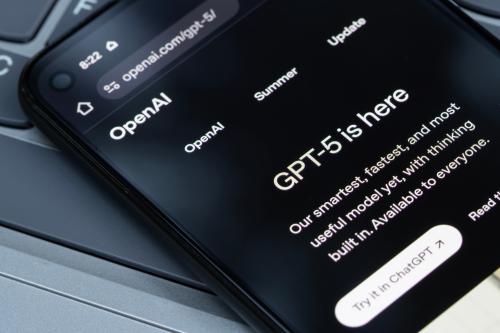

Put together, these forces portend a high level of structural volatility in the labor market over the coming decade. Granted, forecasts about which activities, tasks, and occupations are most exposed to digital displacement or automation vary across studies and evolve over time as new AI abilities emerge. Nevertheless, I believe that the acceleration of AI innovation catalyzed by generative AI and the emergence of ChatGPT has increased the likelihood of widespread occupational transition in the next decade.

The labor market effects of the newest generation of digital technologies (including generative AI) are likely still at their very early stages. A select group of companies like the Swedish financial services company Klarna has declared they have stopped hiring humans and have been more aggressive than most in embracing generative AI for customer service. In contrast, most companies will spend many years ironing out the kinks in their implementations of generative AI before substantial displacing effects on the demand for human talent and labor manifest. In what follows, I highlight some key dimensions of this labor market disruption that require immediate policy attention.

2. The challenge of geography

A critical and somewhat underexplored dimension of this impending change is the geographic variance in its effects. The workforce disruption due to AI will be felt more acutely in certain geographic areas of the U.S. This is not surprising—the distribution of occupations across the country varies widely by region, with familiar patterns of high-tech work being concentrated in the Northeast and in California and manufacturing work being more prevalent in the South, and occupations vary in the extent to which they are exposed to automation.

Many studies have discussed this geographic divide, including recent research by my colleague Robert Seamans and his coauthors.2 A pioneering 2019 study published by the Brookings Institution summarizes a unifying finding, concluding that:

...less-educated Heartland states and counties specialized in manufacturing and low-end service industries could be especially hard-hit by automation in the AI era, whereas well-educated states and counties along the Boston-Washington corridor and on the West Coast appear less exposed.

Granted, a more recent analysis that focuses on generative AI exposure suggests these patterns may be shifting, and further, new occupations will emerge in parallel. However, it is unlikely that the work these new occupations will generate will be perfectly aligned with those areas most exposed to displacement. Further, business model changes and other geopolitical developments could play an important role in shaping the eventual distribution of work opportunities across the country.

The need to consider geographic shifts in work when formulating capacity development policy is illustrated well by the changes in manufacturing employment in the United States between 1960 and 2020. Over this period, a combination of forces that included computer-based automation, trade policy, and the shift towards knowledge work in the economy led to a contraction in the fraction of the nonfarm U.S. workforce engaged in manufacturing occupations, from over 25% in 1960 to less than 10% in 2020.3

While this absolute reduction was undoubtedly a significant shift, the actual pace at which manufacturing jobs were lost over the last couple of decades (estimated at about 300,000 annually between 2000 and 2019) is small compared to the 36 million people who voluntarily leave their jobs each year. The more significant impact of these changes stems from their uneven distribution across the country. The largest percentage losses in manufacturing over these 60 years were not just in the Midwest region of the United States but also in the Northeast, in particular in the New England census region, where manufacturing as a share of total employment dropped from about 40% in 1960 to less than 10% in 2020.4 In contrast, the number of manufacturing jobs in the U.S. South has roughly kept pace with the dramatic workforce growth in the region during this period, accounting for a steady 10% or so of employment.5 Consequently, today the U.S. South is currently home to close to half of the country’s manufacturing jobs.

This geographic shift of manufacturing from the Northeast and Midwest to the South has likely been caused by, among other factors, immigration patterns, trade policies, and business model changes. While it may be too early to project the exact pattern of geographic disparities in the impending digitally-driven workforce changes, especially given the heightened uncertainty around trade and immigration policy today, a key point to recognize is that factors other than occupational exposure will play a role (and perhaps a larger role) in the eventual regional distribution of work opportunities in America.

Capacity planning for the 21st century must thus factor in barriers to geographic mobility. A useful but underexplored dimension of such policy may be around homeownership. Prior research has shown that homeowners are less likely to move in response to market shocks, and thereby suffer a slightly negative impact on their labor income when they are re-employed.6 Subsequent studies have confirmed that homeowners with high loan-to-value ratios, or those who would be forced to sell their home at a loss (a state sometimes referred to as “equity lock-in”), are also less likely to move.7 A particularly difficult barrier is thus presented to those homeowners whose mortgages are “underwater.” Current geographic patterns of home equity levels suggests that there may be a correlation between the geographic disparity in occupational exposure to AI-driven automation and the disparity in the barriers to mobility presented by one’s mortgage being underwater. Indeed, a 2024 analysis of home equity concluded that “upscale markets in Northeast and West continue to have highest levels of equity-rich homeowners,” while the “Midwest and South have largest shares of seriously underwater mortgages,” an eerie mirroring of the key findings associated with occupational exposure to automation from the 2019 Brookings study discussed earlier.

The shackles that geographic immobility places on being able to transition jobs and occupations may be eased by the growing adoption of non-employment work arrangements. Often, these independent work arrangements are remote, which can mitigate the geographic barriers to occupational transitions discussed above. As I explain in what follows, with appropriate policy interventions, the rise of independent work could mitigate rather than exacerbate the labor market disruption caused by artificial intelligence.

Much of the recent discussion about independent work and the social safety net has focused on changes induced by the growth of platforms like Uber, Lyft, Airbnb and DoorDash, and the associated challenge in worker classification. When one recognizes that these platforms reflect a broader phenomenon that I have previously termed “crowd-based capitalism,” the deeper policy imperatives start to become clear. Under the crowd-based capitalism model, many of the economic activities traditionally performed by large, hierarchical organizations that employ full-time workers are instead delegated to a distributed and heterogeneous crowd of producers of varying size, independence, and capability. A more detailed discussion can be found in Sundararajan (2018).8

There is a dizzying range of different provider-platform relationships that already exist today. Creators on platforms like YouTube, TikTok, and Twitch rely on their respective platforms for income derived from ad-supported content. A recent study estimated that the number of such creators had crossed 8 million in the U.S. by 2022. Millions of independent sellers use the Amazon platform to reach tens of millions of Amazon consumers. Millions of hosts generate short-term accommodation revenue through the Airbnb, VRBO, and Booking.com platforms; similarly, tens of thousands of personal vehicle and small fleet owners depend on peer-to-peer car rental platforms Getaround and Turo to run their car sharing businesses. Hundreds of thousands of freelance workers use the labor platform Upwork. In the future, numerous invisible, direct-to-consumer commercial kitchens will depend on platforms like UberEats, DoorDash and Grubhub for their food orders. These examples illustrate the scope and variety of crowd-based capitalism today. In the future, other industries that include software engineering, health care, energy, and education are likely to see the further ascendance of crowd-based capitalism business models.

Non-employment arrangements have grown rapidly over the last decade. As highlighted earlier, over 40% of the 2024 U.S. workforce gets all or part of their income from non-employment work. However, the funding model of the social safety net in the United States is structured in a manner that makes full-time employment a prerequisite for receiving benefits and other safety net protections.

As I discussed in my testimony to the New York Senate Standing Committee on Internet and Technology in 2019, our current model of funding the social safety net assigns certain responsibilities to the institution—the employer. Other obligations are assigned to the individual—the “employee.” Other roles are taken on by the state. While it was relatively straightforward to frame the individual-institution relationship in the second half of the 20th century as being either employee-employer or not, the individual-institution relationships in the 21st century world of work are more diverse and complex.

A number of independent workers have no single associated “institution” that can step in and play a role analogous to that of the role of “employer.” Besides, even among those workers who rely on one or more platforms for their work, there are numerous dimensions that shape the strength of their relationship with their platform(s). These dimensions may include who sets prices—the platform, the provider, or a combination; whether the platform makes production financing available to providers; whether providers offer their own customer support or rely on centralized customer support from the platform; whether the platform provides logistics capabilities of different kinds; the mechanism by which customers are assigned to providers; whether different forms of risk minimization like insurance or escrow are provided by the platform; and whether the platform requires exclusivity. A more detailed discussion of these dimensions can be found in Sundararajan (2016).9

This variation aside, the level of independence that a provider has in their relationship with the platform is typically higher than the level of independence an employee has from their employer. To better prepare for the 21st century world of work, we must revisit the responsibilities of these three parties—the individual, the institution, and the state—for situations where there may not be an institution involved at all, and even in others where there are differing levels of dependency that the individual has on the institution (or the platform). There are many reasons why it is not reasonable to expect the same level of responsibility or contribution from a platform as we do from a traditional employer. As discussed above, platform-provider relationships vary widely. The relationship between the Google Play Store and an Android app developer is quite different from the relationship between Amazon and a worker on its Mechanical Turk platform. Additionally, the nature of the relationship between the platform and provider is fundamentally different from the relationship between an employer and an employee. The platform does not pay the provider for their labor or talent, but instead typically provides services (for example, access to demand; search, discovery, and matching; trust and risk management; logistics and delivery, and access to intellectual property) to the provider in exchange for what is typically a fraction of the provider’s revenue. Furthermore, such relationships are generally non-exclusive. With providers earning money through more than one platform, the platform exerts less (or no) directive control over its providers, and the level of flexibility enjoyed by the provider is very different from that of an employee.

The United States should extend basic safety net protections to all workers—irrespective of their work arrangement—by passing legislation that expands portable benefits and creates new individual-platform-government partnerships. A recent proposal to create government-sponsored gig worker benefits platforms represents one possible policy direction. As highlighted at a recent Brookings Institution roundtable, many ongoing federal legislative efforts could strengthen the safety net for people in non-employment work arrangements. These include the Retirement Savings for Americans Act of 2023 and the Portable Benefits for Independent Workers Pilot Program Act that could strengthen the social safety net for independent workers by affording portable benefits or national public retirement. Specifically, the Portable Benefits for Independent Workers Pilot Program Act plans to use $20 million to fund grants for testing and developing portable benefits models, and these pilots would form the basis for a report for Congress and recommendations to the Labor Department, with the vision of seeding a future nationwide portable benefits system. In parallel, the Retirement Savings for Americans Act aims to facilitate the creation of a national retirement benefits system, featuring federal matching contributions to address the needs of Americans excluded from the employer-centered retirement system.

4. Mitigating heightened income volatility

While expanding the portability of current benefits is clearly critical, the ongoing shift of the U.S. workforce towards self-employment creates an additional new societal challenge—a higher level of both short-run and long-run income volatility faced by workers. Not surprisingly, people whose work is through a non-employment arrangement are susceptible to larger income swings than those who receive a predictable salary. Figure 2 (which uses data from the Panel Study on Income Dynamics) illustrates this further, measuring the fraction of the workforce that saw both a substantial rise and a substantial fall in their year-to-year income during a 12-year window between 2003 and 2015. As illustrated, the self-employed were 44% more likely than the consistently full-time employed to see both a 20% rise in income over a two-year period and a 20% fall in income over some other two-year period, and almost twice as likely to see a 50% rise and a 50% fall.

Put differently, people who hold full-time jobs are much less likely to experience large income swings than people who are either consistently self-employed or who switch between full-time employment and self-employment. While not illustrated, the same data shows that the frequency with which the self-employed experience these kinds of swings is also greater.

This heightened income volatility and unpredictability associated with non-employment work highlights a gap in the current social safety net that reflects both a short-term and longer-term future need. An implicit “benefit” of full-time employment has been the employer taking on the role of an insurer of sorts—while the exact output of a worker may vary across days or weeks, the employer often smooths out the employee’s income stream, paying them a predictable (and previously contracted) amount biweekly or monthly. The mathematics of insurance suggest that providing this kind of short-run smoothing could be done at least as effectively (and perhaps more so) if the risk is spread over a larger group of volatile income streams.

For example, a federal or privately-provisioned mechanism of this kind could involve independent workers paying a small fraction of their income (a premium of sorts) into a system that keeps their weekly or monthly income levels above a worker-specific lower bound, thereby allowing someone who does not draw a salary to avail of the budgeting and future spending planning that full-time employees take for granted. Such a system may, for example, increase the rate at which independent workers can qualify for financing like home mortgage loans (which still sometimes requires proof of employment). I highlight this latter form of financing because (i) homeownership remains a critical mechanism by which U.S. residents build wealth, and (ii) self-employed homeowners hold mortgage loans at lower rates than those who are employed even after controlling for income.10

Independent workers who stop working for a period, either voluntarily or otherwise, face a different kind of income volatility that reveals a deficiency in the structure of U.S. government benefits that provide workers with income when not working. The very name of the benefit program—“unemployment insurance”—highlights the gap. Designed for an era where work was synonymous with employment, the few hundred dollars that states pay out for 16 to 26 weeks as one is “looking for a job” are largely unavailable to independent workers. A brief respite during the COVID pandemic—the Pandemic Emergency Unemployment Compensation (PEUC) program of the CARES Act which also provided independent workers with “unemployment” benefits comparable to those received by people who were employees—was terminated in September 2021. Extending the income smoothing benefits of unemployment insurance to the growing fraction of the workforce with non-traditional work arrangements must be another policy imperative associated with 21st century workforce capacity planning.

As a growing fraction of the workforce transitions to new occupations, the frequency of these gaps in income generation and the associated volatility will increase. This highlights a separate yet equally important policy imperative — developing a new transition education infrastructure, which I discuss below.

5. Beyond reskilling: Towards occupational transition with dignity

The U.S. higher education system is the envy of the world. In the 2025 QS World University rankings, 10 of the top 25 global universities are in the United States, and 50 U.S. universities rank in the top-300, a depth that is unrivaled by any other single country. One of the country’s signature accomplishments of the 19th and 20th century, our world-beating university system prepares millions from around the world for the transition from high school to one’s first occupation. An equally compelling educational need in the 21st century is a system that enables exposed and displaced workers to prepare for and transition to their future occupations mid-career rather than early-career.

As discussed above, while studies vary in their estimates of the scale and pace of the impending workforce transition, there is broad agreement that it is coming. McKinsey Global Institute estimates that 12 million U.S. workers will need to transition to a new occupation by 2030. The World Economic Forum’s 2025 Future of Jobs report estimates that “on average, workers can expect that two-fifths (39%) of their existing skill sets will be transformed or become outdated over the 2025-2030 period.” There is no dearth of discussion about this impending AI displacement and the need for occupational transition. However, the U.S. still lacks a robust system to transition workers to new occupations at scale.

It is helpful to distinguish between those mid-career workers who will transition within—employees who move into a new occupation but stay in the same organization—and those who will transition out—employees who leave their current organization for a new one or independent workers who must seek an entirely new client base. Granted, many companies as well as state and local governments have invested in a variety of reskilling programs. These may aid those who are transitioning “within,” especially when being skilled for specific pre-identified roles within their current organization.

However, the new skills themselves are but a modest part of what is necessary to seed a successful mid-career occupational transition for those employees who will have to find a new organizational home and the independent workers who need to build a new pipeline of business. Rather, a more integrated and carefully designed mid-career transition education system must emerge for workers who must transition out—one that melds reskilling with a host of other enablers and scaffolding.

America’s college system leads the world today not just because it offers the most rigorous or advanced curriculum but because universities have recognized that what one needs to transition successfully into one’s first adult career goes well beyond mere skilling. The university experience is a celebratory rite of passage that is viewed as an accomplishment, today’s anthropological “coming of age” ritual, designed as a product that is more complex than just a series of courses, and whose value goes far beyond the work skills one acquires. University students learn critical thinking. They become adept at learning new things. They access formal and informal organizations—from student clubs to social gatherings—that allow discovery of career options and what one might be good at, while also seeding the building of a professional network. Senior students and others provide mentoring. Many universities offer robust placement services. And, of course, a critical dimension of the value of a college education comes from the branded credentials that the degree confers.

It will not be possible, of course, for someone transitioning mid-career to dedicate four years (or even two) pursuing this change, so focused packages of education of shorter duration are warranted. Nevertheless, the complex “bundle” that is the university degree could form a starting blueprint for what might be offered by a multifaceted, world-class educational infrastructure for mid-career transition. Design guidance may also emerge from organizations that have successfully aided individuals to cross other boundaries and find new opportunities—from Laboratoria in South America that, over a six-month program, transitions women who typically are employed in domestic work or construction into being data scientists and computer programmers to organizations that expand work opportunities for different segments of the population like Opportunity@Work and Braven.

Each of these programs provides clues that inform the essential scaffolding that reskilling and upskilling must be bundled with. Mid-career reskilling must be preceded by mechanisms allowing workers to discover what new occupation they are suited for or might be most appropriate for them, perhaps aided by well-established automated systems based on skill transferability or one’s interests, values, and aptitude.11 The bundle must also include mentoring of some kind. My ongoing research suggests that peer mentors, especially those who have actually gone through the same transition from one occupation to another, will be far more effective at aiding occupation transition than more senior or accomplished mentors or coaches with whom the workers may be less able to relate or empathize. Systems that accompany mentoring which aid professional network formation will help build confidence and keep workers motivated to continue the difficult process of reinvention. Branded credentialing and job placement services as part of this new bundle will accelerate the occupational transition with dignity.

Since occupational transitions may increasingly be accompanied by a change in work arrangement, there are advantages to bundling in supplementary education that prepares workers for non-employment work arrangements. For example, highly focused education about pricing, financial management, accounting, and the law could allow a newly minted freelance worker to understand how a posted hourly wage maps to take-home hourly pay after factoring in taxes and commissions, how many hours they should plan to work each week to hit earning targets, how to avoid wage theft, and how to budget for irregularity in income streams. Other basic knowledge that could aid the work arrangement transition include learning about client acquisition and managing client relationships, time management in the absence of a manager, communication skills, and how to adapt to an evolving freelance and platform landscape.

6. Concluding remarks and policy priorities

As the 20th century world of full-time employment gives way to a far more complex and dynamic labor market, a new approach to workforce capacity development and a fundamental rethinking of the social safety net is essential. In this essay, I highlight how the geographic redistribution of work could amplify the disruptive effects of AI and automation, and why lowering barriers to geographic mobility and access to remote independent work could complement steps being taken to prepare the workforce for their next careers. In parallel, I argue why it is imperative that workforce capacity planning must move beyond mere reskilling or upskilling efforts. As opportunities for platform-based and other forms of independent and gig work continue to grow, the extent to which these new arrangements will be part of the solution may also depend on how successfully we expand the social safety net to manage income volatility, make benefits more portable, rethink funding models in a manner that is inclusive of the growing fraction of the workforce in non-employment settings, and educate the workforce about how to operate outside of the traditional confines of a full-time job.

A critical national policy priority could be to create and support education institutions that enable mid-career transitions with dignity, recognizing that the scaffolding is at least as important as the skilling. This new national education infrastructure must offer holistic short-duration bundles that supplement skill development with talent discovery, networking, credentialing, mentoring, and placement, perhaps guided in part by the experience of corporations that have already transitioned significant fractions of their workforce to new roles. The displacement effects of AI will accelerate in the coming years, and any reshoring of work envisaged by recent industrial and trade policy changes will only occur if accompanied by robust workforce capacity development.

In parallel, elevating the importance of the safety net for non-employment work arrangements and a more robust inclusion of non-employment work in the national statistics is a critical yet often ignored policy imperative. The growing prominence of these new work arrangements means that the 21st century safety net cannot be built by misguided worker reclassification efforts like California’s AB5 that imagine a world in which every platform worker is an employee. Legislators must instead recognize that the new reality of work transcends employment. The path to a well-protected workforce rests on expanding and refining federal legislative efforts like the Retirement Savings Act and the Portable Benefits for Independent Workers Pilot Program Act, while examining the experience of pioneering portable benefits efforts from states like Washington.

These two priorities could be supplemented by focused policy efforts that learn from history to overcome the inertia of geography and the precarity risks posed by heightened earnings volatility. New federal financing programs that alleviate the barriers to mobility caused by negative home equity along with federal insurance efforts that smooth both short-term and longer-term income variability will go a long way in complementing workforce capacity development and mitigating any further destabilizing effects caused by inequality in access to economic opportunity. Artificial intelligence and platforms can lead to inclusive growth, but this path is far more likely when the rapid technological innovation occurs within a carefully crafted policy architecture.

-

Acknowledgements and disclosures

I am grateful to the Brookings Institution for funding, to Freddie Mac for funding that supported prior research that laid the groundwork for some of the findings reported in this essay, and to Julia Coff, Amandeep Gill, Welby Leaman, Sanjay Patnaik and Robert Seamans for helpful comments and discussion.

-

Footnotes

- Billings, Jay Jay, Alexander J. McCaskey, Geoffroy Vallee, and Greg Watson. “Will Humans Even Write Code in 2040 and What Would That Mean for Extreme Heterogeneity in Computing?” arXiv, December 19, 2017. http://arxiv.org/abs/1712.00676.

- Felten, Edward, Manav Raj, and Robert Seamans. “Occupational, Industry, and Geographic Exposure to Artificial Intelligence: A Novel Dataset and Its Potential Uses.” Strategic Management Journal 42, no. 12 (December 2021): 2195–2217. https://doi.org/10.1002/smj.3286.

- Data based on author’s calculations of manufacturing employment and total employment data.

- Data based on author’s calculations of Bureau of Labor Statistics (BLS) data.

- Data based on author’s calculations of BLS data.

- Winkler, Hernan. “The Effect of Homeownership on Geographic Mobility and Labor Market Outcomes.” SSRN Electronic Journal, 2011. https://doi.org/10.2139/ssrn.1724455.

- See, for example, Sterk, Vincent. “Home Equity, Mobility, and Macroeconomic Fluctuations.” Journal of Monetary Economics 74 (September 2015): 16–32. https://doi.org/10.1016/j.jmoneco.2015.04.005. Also, see Bloze, Gintautas, and Morten Skak. “Housing Equity, Residential Mobility and Commuting.” Journal of Urban Economics 96 (November 2016): 156–65. https://doi.org/10.1016/j.jue.2016.09.003.

- Sundararajan, Arun. “Crowd-Based Capitalism, Digital Automation, and the Future of Work.” University of Chicago Legal Forum 2017, no. 1 (February 5, 2018). https://chicagounbound.uchicago.edu/uclf/vol2017/iss1/19.

- Sundararajan, Arun. The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism. First MIT Press paperback edition. Cambridge, Massachusetts: The MIT Press, 2017.

- This finding is based on unpublished analysis conducted using data from the American Community Survey public-use microdata set (PUMS).

- See, for example, Dawson, Nikolas, Mary-Anne Williams, and Marian-Andrei Rizoiu. “Skill-Driven Recommendations for Job Transition Pathways.” Edited by Shihe Fu. PLOS ONE 16, no. 8 (August 4, 2021): e0254722. https://doi.org/10.1371/journal.pone.0254722.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).