The defining characteristic of a safe haven investment is that it protects your principal. In return for that protection, investors accept lower yields than on assets with comparable cash flow, which is what the academic literature calls a “convenience yield.” Recent papers—including Du et al. (2018)—have documented the erosion of this convenience yield for the U.S. In this blog, I revisit this question and expand their analysis to other advanced economies, to see where the convenience yield is becoming more pronounced. Switzerland is emerging as a key safe haven, though the small size of its government bond markets obviously limits its capacity to absorb foreign inflows. This is no doubt why gold is rallying so much. Markets are hunting for viable safe havens.

Measuring the convenience yield across advanced economies

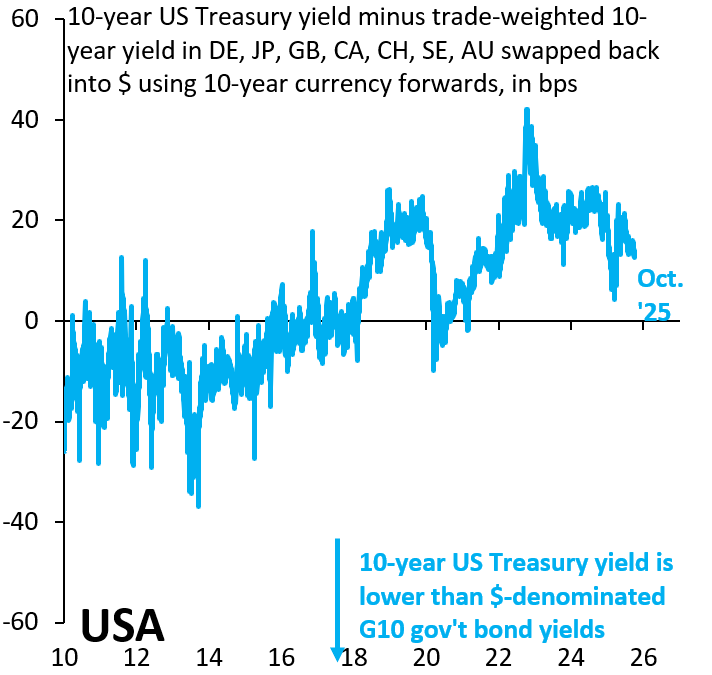

In this post, I follow Du et al. (2018) in measuring the convenience yield on 10-year U.S. Treasuries versus a trade-weighted average of seven other advanced economies: Germany (DE), Japan (JP), the U.K. (GB), Canada (CA), Switzerland (CH), Sweden (SE), and Australia (AU). I use 10-year FX forwards to hedge foreign yields back into U.S. dollars. The difference that emerges is a violation of covered interest parity between government bond yields in the U.S. and abroad. Figure 1 below shows what this difference looks like for the U.S. It used to be the case—up until around 2015—that Treasuries enjoyed a convenience yield, i.e., were lower than the comparable yield on foreign government bonds. However, that convenience yield has eroded and become a risk premium in recent years. There’s a temptation to think that this erosion of the convenience yield stems from current erratic U.S. policies on tariffs and the administration’s pressure on the Fed, but—for better or worse—there’s no sign of that. If anything, the premium on 10-year Treasuries, which peaked in 2022, seems to have abated somewhat in recent years. However erratic and ill-advised some of the current administration’s policies may be, markets do not assign an obvious risk premium to the U.S. as of today.

Source: Bloomberg

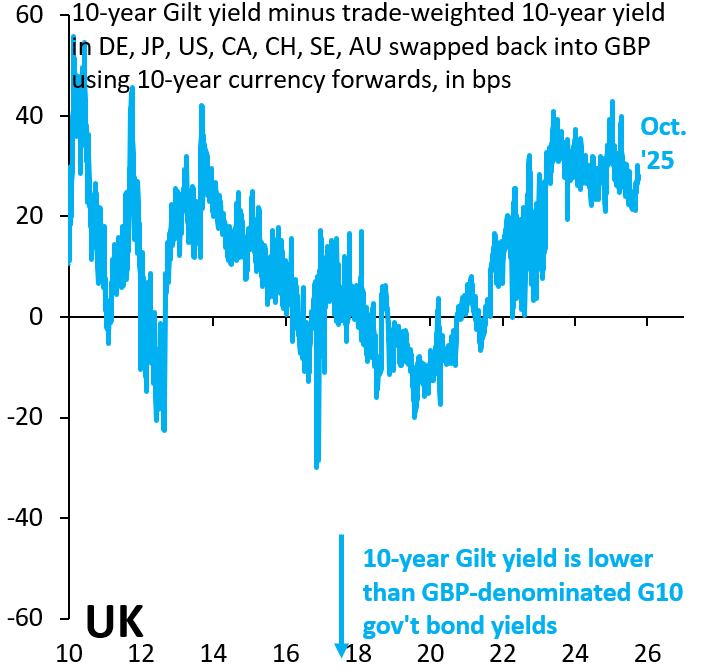

Source: Bloomberg

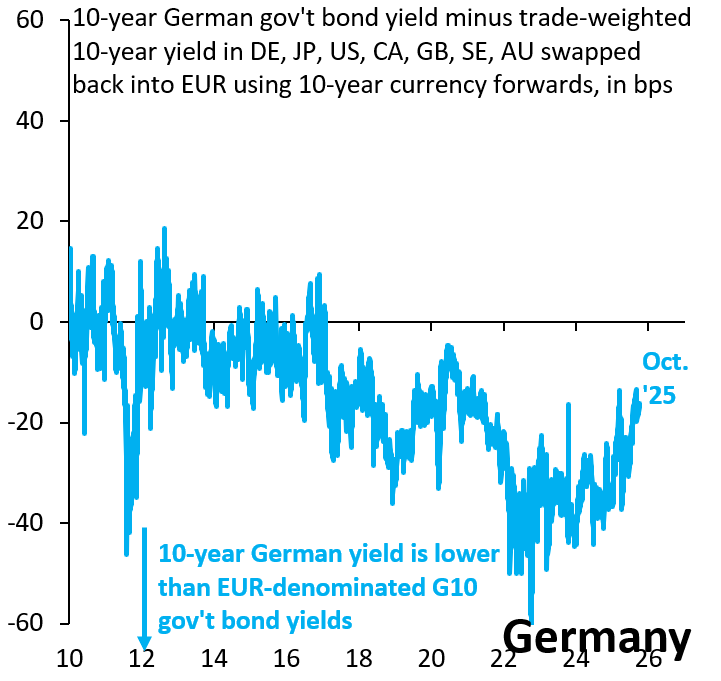

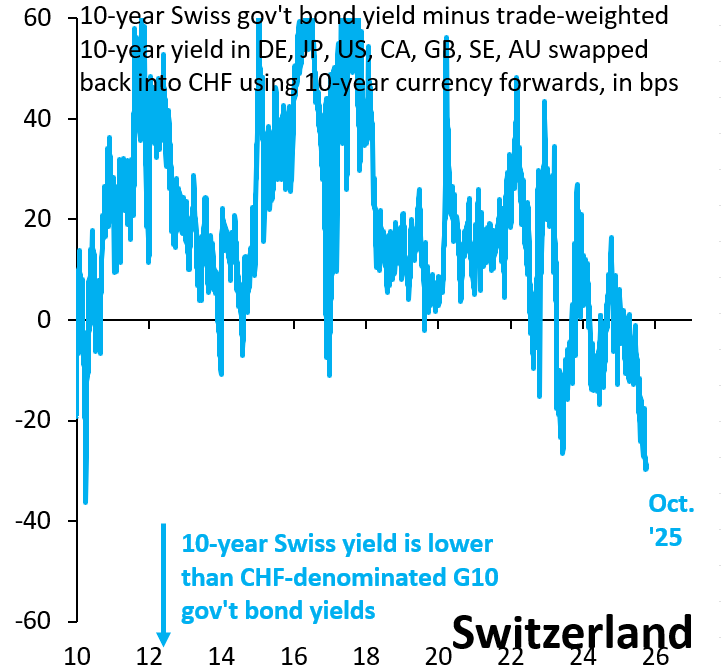

Figure 2 repeats this exercise for the U.K. It shows the equivalent gap of the 10-year gilt yield versus the trade-weighted foreign yield, where I again use 10-year currency forwards to hedge foreign yields back into British pound terms. Unlike the U.S., the U.K. never enjoyed an obvious convenience yield, though its differential was trending down and briefly negative before the COVID-19 pandemic. Ever since the gilt market blowup in 2022, the U.K. has struggled with a sizeable risk premium, which currently is double that of the United States. Figures 3 and 4 repeat this exercise for Germany and Switzerland, two countries that have traditionally been considered safe havens by markets. While Germany in the past enjoyed a very large convenience yield, which peaked in 2022 during the global hiking cycle, its convenience yield has been eroding steadily in recent years, possibly a reflection of recent fiscal stimulus and the softening up of Germany’s debt brake. In contrast, Switzerland as seen its convenience yield rise drastically in recent days, likely linked to the mounting crisis in France and potential for contagion to the rest of the euro periphery. But even prior to recent days, the global tariff shock had caused markets to seek out Switzerland as a safe haven, with its convenience yield rising sharply.

Source: Bloomberg

Source: Bloomberg

A closer look at the erosion of the US convenience yield

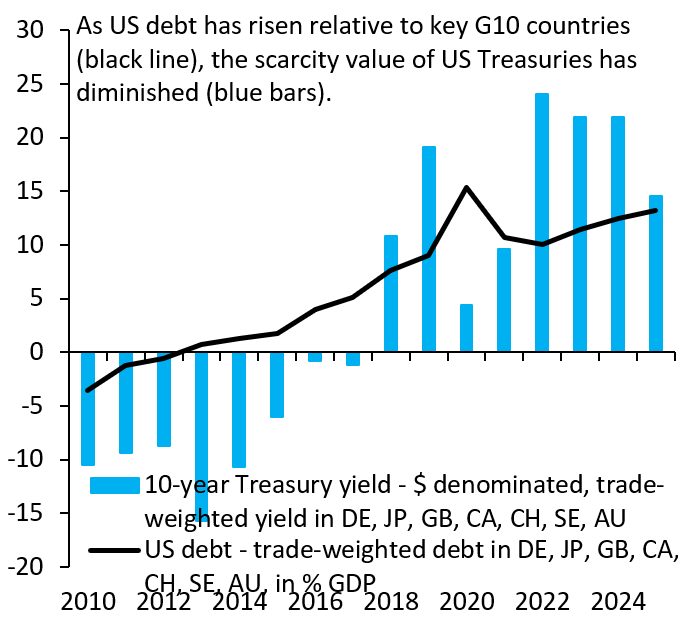

It is never straightforward to interpret why markets do what they do. However, the erosion of the U.S. convenience yield coincides with mounting U.S. government debt relative to its G10 peers. Figure 5 shows the annual average for the differential in Figure 1 (blue bars) together with the trade-weighted difference of U.S. debt in percent of GDP versus its G10 peers. The erosion of the U.S. convenience yield coincides with the steady rise in U.S. debt vis-à-vis the rest of the G10. The emergence of Switzerland as the preeminent new safe haven is no doubt in part linked to its low government debt, which stands at only 37% of GDP. In short, if the U.S. wants to recapture its convenience yield of old, the path to do that involves fiscal consolidation and debt reduction.

Source: Bloomberg

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The search for a new global safe haven

October 2, 2025