President Barack Obama took the very symbolic gesture of delivering his much anticipated speech on fiscal reform and deficit reduction from a podium at George Washington University, an institution of higher learning, including schools of medicine, public health and nursing. By doing so, he signaled the desire to infuse a sense of responsibility in the next generations- those who will ultimately inherit our fiscal woes if we continue on our current path. The auditorium was packed with students who probably have not yet contributed significantly to Medicare or social security much less had any experience with entitlement programs, but the President appealed to their sense of patriotism and national identity by recalling the great ability of Americans to come together around a set of problems, find common ground and once again be the envy of the world’s eye. The message was simple: if we don’t make some tough decisions now we will pay for it dearly in the future. And the future isn’t that far away.

First, some deficit basics:

Deficit 101

| 2011 CBO Estimate | 2021 (ten year window) CBO Estimate | President’s Goals | |

| Publicly Held Debt (mostly in the form of Treasury Department issued securities to cover outstanding cost) | 9 trillion dollars=62% of Gross Domestic Product (GDP) | Scenario 1: 77% of GDP Scenario 2: 97% of GDP |

Reduction of 4 trillion over 12 years |

| Deficit | 9.8% of GDP | Scenario 1: 2.9-3.4% of GDP Scenario 2: 6.6% of GDP |

2.8% by 2016 |

Scenario 1: Current Law (assumes laws that are supposed to expire will be allowed to and that we will cut physician payments according to Sustainable Growth Rate)

Scenario 2: Based primarily on following possibilities:

- Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 or modified estate and gift taxation do not expire on December 31, 2012

- Alternative minimum tax is indexed for inflation after 2011

- Medicare’s payment rates for physicians are held constant at their 2011 level (no cuts through the SGR)

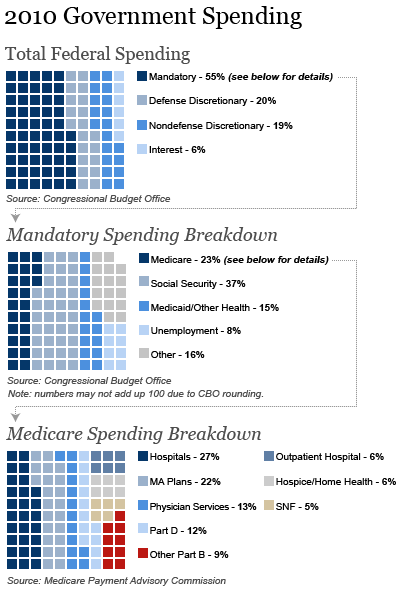

Figure One: Breakdown of Current Federal Spending (Overall, Mandatory, Medicare)

President Obama stated that the Affordable Care Act will reduce the deficit by a trillion over the next ten years. The Congressional Budget Office (CBO) estimates a reduction of $210 billion but does state that there could be more savings depending on appropriations. President Obama proposes building on these savings with additional Medicare and Medicaid savings of $480 billion over the next 12 years. He does so by employing the following levers of action for health spending reduction:

- Accountability by reducing waste and abuse and strengthened regulatory/enforcement mechanisms.

- Accelerated Delivery System Innovation through an emphasis on safety and quality.

- Revisiting the Federal-State relationship in Medicaid and the Children’s Health Insurance Program (CHIP).

Accountability and Strengthened Regulatory/Enforcement Mechanisms

- Strengthened Independent Advisory Board with a more ambitious spending target of GDP per capita + 0.5% (note that the Presidential commission set the target at GDP + 1%). The plan also includes additional enforcement powers for IPAB. The proposal is light on details and it is not clear if this can be done through Executive/Administrative action or if legislative action would be required.

- Speed availability of generic drugs and prohibition of “pay for delay” (this was also included in the President’s 2012 budget proposal)

- Promote accountability in Medicaid by clamping down on States’ use of provider taxes to lower their own spending and establish upper limits on Medicaid durable medical equipment

- Recover erroneous payments from Medicare Advantage

Accelerated Delivery System Innovation

- Earlier this week, Don Berwick premiered the patient safety initiative that the President highlighted today and building on the vision of reducing hospital acquired infections and preventing medical errors will help to cross the quality chasm identified by the Institute of Medicine many years ago. The Administration is estimating that an emphasis on safety and quality will save $50 billion over the next ten years in Medicare and billions more in Medicaid as well

- IPAB will also accelerate some innovations through promoting value-based benefit design to emphasize prevention- details on this are sparse but likely to follow work done by Chernew and others in this area.

Revisiting the Federal-State Relationship

- In a bold but necessary move, the President proposed to replace the current Federal matching formulas with a single matching rate for Children’s Health Insurance Program and Medicaid spending that rewards States for efficiency and automatically increases if a recession forces enrollment and State costs to rise. This has generally been an area that the federal government has not been able to master- that is, finding an approach to work with states that acknowledges their unique economies yet adopts a more standardized mechanism for calculating the match contribution. Given the unprecedented activity at the state level in health reform (development of exchanges, etc) , the reforms around CHIP and Medicaid are well timed to emphasize the federal-state relationship. Details around the match rate have not been released and will be important in determining whether costs can be contained.

- In addition, the President is calling on an enhanced Federal-State partnership by asking the National Governors Association (NGA) to make recommendations for ways to reform and strengthen Medicaid with an emphasis on dual eligibles which is a huge cost driver in Medicaid and Medicare.

Opportunities to Build On the President’s Vision

The President acknowledged that there won’t be agreement on everything he proposed and he welcomes new ideas. Here are a few for consideration:

The Independent Payment Advisory Board

Some of the ideas, especially around improving the IPAB have been reflected in other bipartisan consensus efforts, such as Bending the Cost Curve II in which Mark McClellan and others advocated for an IPAB which is not seen as the punitive body of last resort but rather a catalyst of real delivery system change. In their report they describe some improvements to the current IPAB which would be worth heeding including:

- Expand membership criteria to recruit knowledgeable representatives of the entire health system and other experts, particularly those of provider groups. Attracting the right talent pool will require sensitivity to time commitment and avoidance of overly broad conflict of interest disqualification.

- Authority to advance proposals which will move our payment system away from the current fee for service, relative value unit (RVU) dependent reimbursement model- this expansion might be alluded to in the President’s vision to promote value-based benefit design but it is not clear from the available information.

Additionally, in order to be fair and equitable, IPAB should be able to make recommendations on hospitals- this point specifically was highlighted by the Presidential Deficit Reduction Commission.

Emphasize Payment Reform through Health Care Professionalism

The President alluded to the desire to move away from some of our current perverse financial incentives:

“We will change the way we pay for health care – not by procedure or the number of days spent in a hospital, but with new incentives for doctors and hospitals to prevent injuries and improve results. “

But there is room to improve; allow for health care professionals to have some flexibility within Medicare and Medicaid to demonstrate their ability to bend the cost curve through innovation in payments. By building on some of what was included in the Affordable Care Act around pay for performance, etc, the Administration should consider allowing for health care professionals to come forward (much like they are encouraging ideas from Governors) with payment models that will incentivize every clinician’s innate desire to be their best. Encouraging the Center for Medicare and Medicaid Innovation to partner with professional organizations, for example, to leverage their clinical registries and promote episodic/bundled payments around certain high volume procedures/conditions will in turn lead to clinical peer review and adjudication that is centered in the notion of professionalism and patient-centered care. Cardiologists working with primary care physicians to prevent patients form suffering an acute myocardial infarction will move from fiction to reality when we remove the perverse financial incentives that prohibit team-based care and clinical collaboration.

While these payment reforms are piloted, Medicare could alter benefits over time (without reducing actuarial value) based on evidence of better quality and lower costs. For example, beneficiaries who participate in high-value ACOs or beneficiaries with serious illnesses who choose providers that offer a bundle of services (surgery, chronic disease management) at a lower cost should share in the savings. This model could satisfy a bipartisan effort towards truly patient-centered care in which consumers have better options and clinicians deliver their best care.

The Future

There is plenty more out there and surely in the days, weeks and months to follow, more ideas will flow. Hopefully there will be some lessons learned from some of the other members of the Federal health care family such as the Department of Defense (Tricare) and the Department of Veterans Affairs where we have a great deal of knowledge around quality of care, electronic health record implementation, changing provider behavior through nonfinancial incentives.

Beginning in May, Vice President Biden will start meeting what will inevitably be characterized as the Gang of 16 or the Sweet Sixteen or some other moniker- Four members of Congress selected by Senators Reid, McConnell and Speaker Boehner and Minority Leader Pelosi. It will be up to this group to help give some legs to the President’s proposal and I am certain health care will be a popular topic of discussion for the newly minted task force; certainly an opportunity for inspiration, innovation and ingenuity.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edThe President’s Deficit Reduction Plan: Implications for Health Care

April 14, 2011