On Aug. 8, the news broke that President Trump was replacing IRS Commissioner Billy Long. Long was the sixth person since January to serve as IRS commissioner, a role that is supposed to be a five-year position. The sudden move echoes the rapid turnover of the first Trump administration. The total number of people who have acted as IRS commissioner in 2025 now rests at seven, which is without precedent since the agency’s inception.

Unprecedented workforce losses

But while Long’s brief tenure has made headlines, what matters far more is the mass firing of regular IRS employees, upon whose daily and unheralded work American taxpayers depend, and the exodus of top career civil servants, many of whom resigned or were removed for their efforts to defend taxpayer privacy against unprecedented incursions from the Department of Homeland Security and DOGE.

Long brought very limited experience in tax administration to his role as IRS commissioner. Long, formerly a Republican congressman, had cosponsored legislation to abolish the agency. His primary dealings with tax policy involved promoting a nonexistent tax credit and liberally encouraging businesses, some of questionable eligibility, to claim a fraud-ridden tax credit. His brief tenure was marked by controversy.

Far more significant is the absolutely unprecedented cut in the IRS workforce this year. As of May, one-quarter of the IRS workforce had left, according to a report from the Treasury Inspector General for Tax Administration. About one-quarter of the agency’s revenue agents are gone, and the unit of the agency focused on the highest earners appears to have been hard-hit. Customer service positions have also been decimated, raising alarms from the Taxpayer Advocate. An organization representing IRS managers is calling it “the most dire leadership environment the IRS has experienced,” a startling claim given the agency’s well-publicized challenges in the 2010s.

The administration appears to have realized, belatedly, the impending disaster. The agency’s budget request states that without hiring over 11,000 customer service employees for the next filing season, “most taxpayers would be unable to reach the IRS by phone or receive answers to questions related to tax compliance. Taxpayers that do get through would face long wait times.” Just last week, the IRS posted and then removed over 4,000 customer service job openings. Of course, even if the IRS manages to get jobs online, the mistreatment and mass firing of federal employees this year will make it immensely difficult for the agency to attract talent, and even immediate hires would be seriously behind schedule. Though tax season may seem far away to the average tax filer, the IRS would usually already have hired its service staff for the coming tax season because helping people with their taxes requires extensive training.

Departure of top civil servants

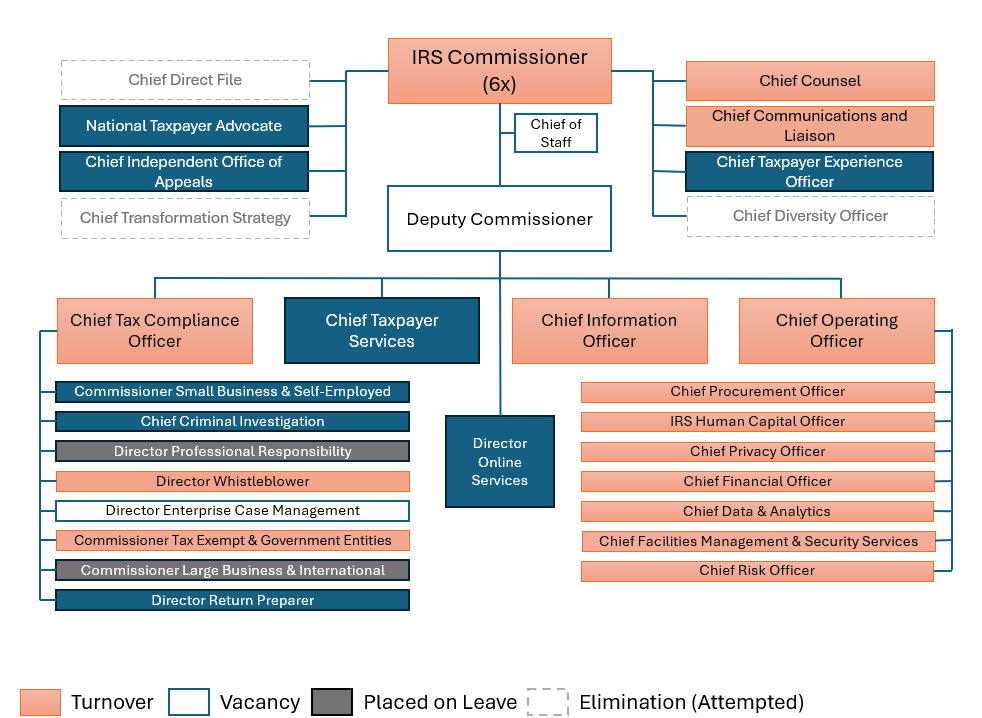

Equally worrying is the loss of top career civil servants. The figure below summarizes the departures since January.

Changes in senior leadership at IRS since January 2025.

Source: Author’s determinations using information compiled from organization charts and news reports.

Crucially, many have left in response to the administration’s drive to use tax data to locate and deport millions of immigrants. After the announcement of a memorandum of understanding between the IRS and ICE, the acting commissioner and the chief privacy, financial, and risk officers all resigned. Around the same time, as many as 50 senior IT executives at the agency were also put on leave. Most recently, the acting chief counsel, Andrew De Mello, was pushed out over his objections to the ICE data sharing. That De Mello raised strenuous objections to the plan is particularly notable, given that he had been seen as a Trump ally. De Mello was promoted to acting chief counsel after the previous acting counsel objected to agreements proposing unprecedented data-sharing. Long’s departure came as the White House continued to pressure the agency to turn over taxpayer data.

During Trump’s first term, turnover in senior leadership was tempered in important ways by a bulwark of qualified, dedicated civil servants in federal agencies. This time, the damage is far more severe. To date, career officials have shown remarkable tenacity in performing their legally mandated responsibilities to protect taxpayer data. But with the loss of leadership, the guardrails are weakening—and the likelihood of a competently run tax season dims.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The IRS faces unprecedented leadership turnover

August 12, 2025