This viewpoint is part of Foresight Africa 2024.

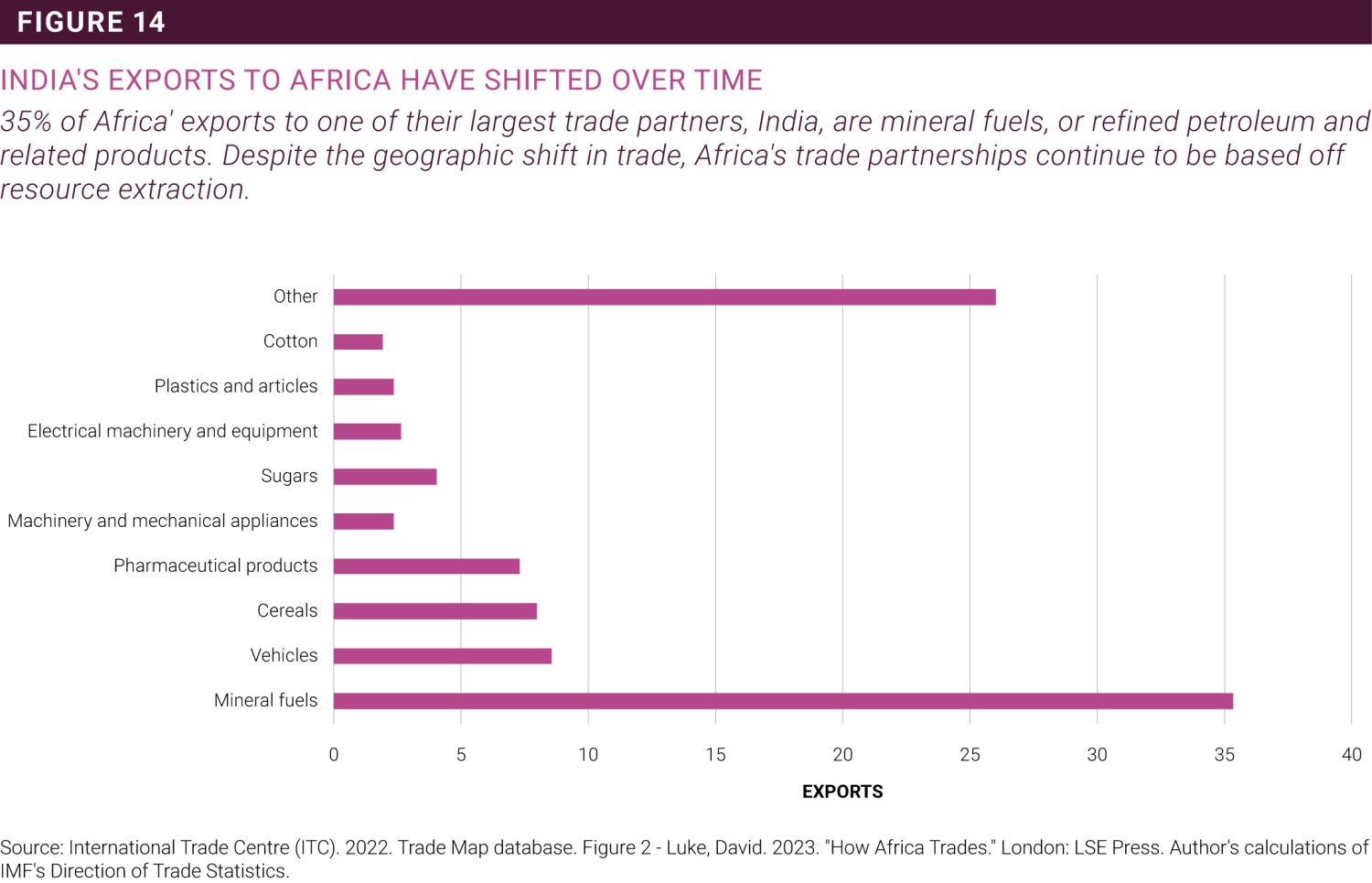

In a sign of the stickiness of the colonial development model of resource extraction—where African countries systematically exported raw materials and natural resources to European powers and imported value-added manufactured goods at higher prices—the round-tripping model, which has been responsible for huge foreign exchange reserve leakages and sustained balance of payments pressures, has persisted, even as Africa’s direction of trade has shifted eastward. According to most recent estimates, hydrocarbons dominate India-Africa trade, with refined petroleum and related products topping India’s total exports to Africa in 2022.1

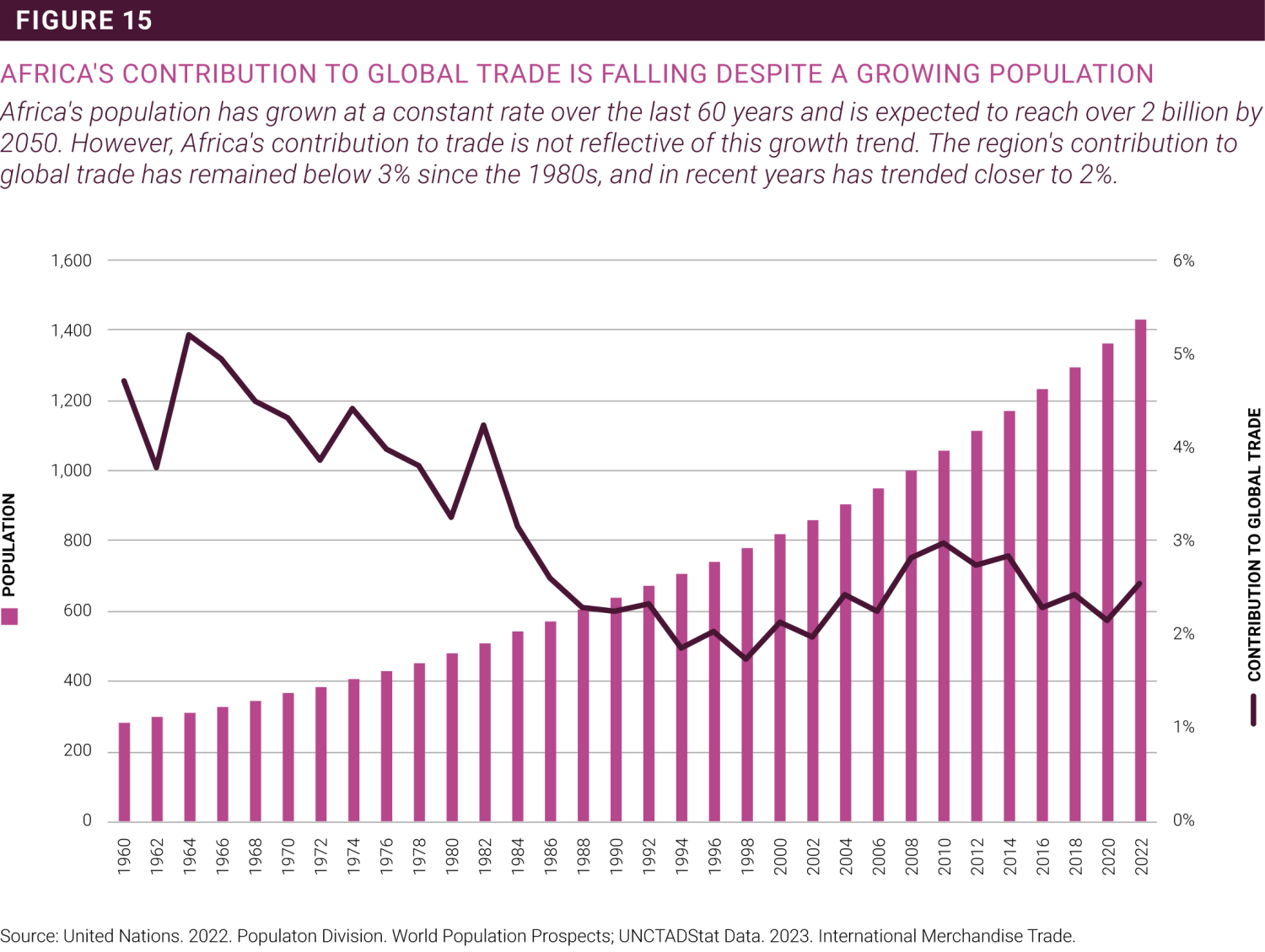

In addition to huge foreign exchange reserve leakages, that colonial development model greatly exposes countries to recurrent adverse commodity terms of trade shocks largely responsible for the high frequency of balance of payments crises and the inexorable rise of external liabilities. And in a world of global value chains where trade is dominated by intermediate and manufactured goods with increasing technological content, it has contributed to a steady decline of African trade in relative terms. The region now accounts for less than 3% of global trade, down from about 5% in the aftermath of independence and notwithstanding the fact that its share of the world’s population has increased steadily to reach 17%.2 Furthermore, it has skewed the distribution of African trade towards extra-African trade—intra-regional trade has remained dismally low, at around 15% of total African trade, compared to 60% in Asia and 70% in Europe.3

However, the African Continental Free Trade Area (AfCFTA)—which establishes one of the largest free trade areas in the world with a market of 1.4 billion people and a combined GDP of USD 3.4 trillion could significantly transform Africa’s trade and economic landscape.4 The AfCFTA has been touted as a game-changer owing to its potential to significantly increase investment flows, with their composition and direction shifting away from natural resources towards labor-intensive manufacturing as corporations take advantage of economies of scale as well as competitiveness and productivity gains associated with the drastic reduction in the risk of investing in smaller markets.5

World Bank estimates show that the AfCFTA could raise Africa’s exports to the rest of the world by 32% by 2035 and catalyze foreign direct investment, which is expected to increase by between 111% and 159%.6 The AfCFTA has brightened African trade and growth prospects. Leveraging its huge potential to transcend the colonial development model of resource extraction will help to accelerate the diversification of sources of growth and exports, propelling the region into a virtuous cycle of robust economic growth and a broader tax base that will strengthen Africa’s foundation of fiscal and debt sustainability.

The AfCFTA has brightened African trade and growth prospects. Leveraging its huge potential to transcend the colonial development model of resource extraction will help to accelerate the diversification of sources of growth and exports...

As corporations take advantage of competitiveness and productivity gains associated with increasing economies of scale under the AfCFTA, lithium-rich countries such as the Democratic Republic of Congo and Zambia will no longer export raw lithium but will instead integrate into global value chains of new energy vehicles as exporters of lithium batteries. Staying with the automotive industry, West African countries such as Liberia and Cote d’Ivoire will no longer be integrated into global value chains only as providers of natural rubber, but instead as global hubs for tire manufacturing, diversifying the sources of growth and expanding employment opportunities. The future of African trade in the AfCFTA era is one in which commodity-based industrialization will become the continent’s modus operandi to foster vertical integration.

But the future of regional trade is also one in which intra-African trade will become a more important component of total African trade to further enhance the resilience of the region to global volatility and negative shocks. Preliminary estimates show that intra-African exports would increase by 109%, led by manufactured goods, especially if the implementation of the AfCFTA is accompanied by robust trade facilitation measures, understandable in a region where the consequences of nontariff barriers—equivalent to an import tariff of 18%—have been just as costly for trade and endogenous growth as market fragmentation.789 But intra-African trade will also drive industrialization because manufactured goods dominate intra-African trade. So, as intra-African trade expands under the AfCFTA, so will industrialization, which will then drive operationalization of the commodity-based industrialization model.

The economies of scale associated with the AfCFTA rationalizes the commodity-based industrialization model, which has the potential to transcend the debilitating colonial development paradigm of resource extraction and mitigate risks associated with the inherent long-term deterioration of commodity terms of trade that have been the bane of African economies for decades.

But the AfCFTA must not be seen as a panacea to decades of economic regression, which has led to a steady decline of Africa’s share of global trade. Although necessary, it is not a sufficient condition for economic transformation and expansion of income-generating opportunities in a region where the colonial development model of resource extraction has consistently exported jobs to sustain Great Depression-era unemployment rates, which stand at more than 30% in Nigeria and perhaps even higher in other countries where informality has become a disguised form of unemployment.

Realizing the huge potential of the AfCFTA hinges on implementing robust trade facilitation measures to increase efficiency and reduce the time and costs of African trade. At the same time, more should be done, including implementing the rules of origin, which are viewed as the industrialization passport that will enable made-in-Africa goods to circulate free of duty within the free trade area and hence fuel commodity-based industrialization.

African governments should also invest aggressively to close their yawning gap in infrastructure (both physical and digital) and in human capital to improve the business environment and foster regional connectivity to sustain cross-border trade flows. Likewise, resisting the rush to bilateral trade deals which frequently lead to trade deflection and either weaken Africa’s voice at the global level or create dissonance is critical, especially for the continent which for far too long has been at the short end of the international trade negotiation stick.

Finally, and perhaps the most challenging of all—considering the sheer number of countries that comprise the AfCFTA, the largest in the world by membership— speaking with one voice will be extremely important to strengthen Africa’s bargaining power in international trade negotiations and shift the boundary of fair trade to a more inclusive process of globalization. Speaking with one voice will also enhance the development of the robust regional value chains needed to effectively implement the commodity-based industrialization model that transcends the extremely costly and sticky colonial development paradigm of resource extraction.

-

Footnotes

- International Trade Centre. 2023. Trade Map. https://www.trademap.org/Index.aspx.

- Luke, D. (ed.) 2023. How Africa Trades. London: LSE Press. https://press.lse.ac.uk/site/books/e/10.31389/lsepress.hat/.

- Wellisz, Chris. 2022. “Freeing Foreign Exchange in Africa.” IMF. https://www.imf.org/en/Publications/fandd/issues/2022/09/Digital-Journeys-Africa-freeing-foreign-exchange-wellisz.

- Signe, Landry. 2023. Project Syndicate. “A Year of Opportunity for Africa.” https://www.project-syndicate.org/commentary/ africa-2023-opportunities-economy-climate-change-by-landry-signe-2023-01.

- Fofack, Hippolyte. 2021. “A Competitive Africa.” IMF. https://www.imf.org/en/Publications/fandd/issues/2018/12/afcfta-economic-integration-in-africa-fofack.

- The World Bank. 2020. “The African Continental Free Trade Area.” https://www.worldbank.org/en/topic/trade/publication/the-african-continental-free-trade-area.

- The World Bank. 2022. ”Free Trade Deal Boosts Africa’s Economic Development.” https://www.worldbank.org/en/topic/trade/publication/free-trade-deal-boosts-africa-economic-development.

- Azour, Jihad and Abe Selassie. 2023. ”The Drive for Trade Integration.” IMF. https://www.imf.org/en/Publications/ fandd/issues/2023/09/Straight-Talk-the-drive-for-trade-integration-azour-aemro-selassie.

- The World Bank. 2020. “The African Continental Free Trade Area.”

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The future of African trade in the AfCFTA era

February 23, 2024