Many provisions in the 2017 Tax Cuts and Jobs Act (TCJA) are scheduled to expire at the end of 2025. Policymakers will face significant pressure to extend at least some of the expiring TCJA provisions, and will encounter important fiscal trade-offs. Beyond these trade-offs, the reopening of the tax code in 2025 is also an enormous opportunity to rethink tax policy. In this policy proposal Kimberly A. Clausing (UCLA School of Law and PIIE) and Natasha Sarin (Yale School of Law and Yale School of Management) describe a menu of promising potential reforms that have the ability to improve the tax code across multiple dimensions.

There is much to be gained from approaching tax reform in 2025 with the goals of raising revenue, increasing progressivity, enhancing efficiency, and improving global cooperation. Should policymakers choose to take it, this is a moment that will offer a chance to reverse the dominant trends of recent decades, which have reduced fiscal sustainability due to increases in spending without commensurate revenue-raising.

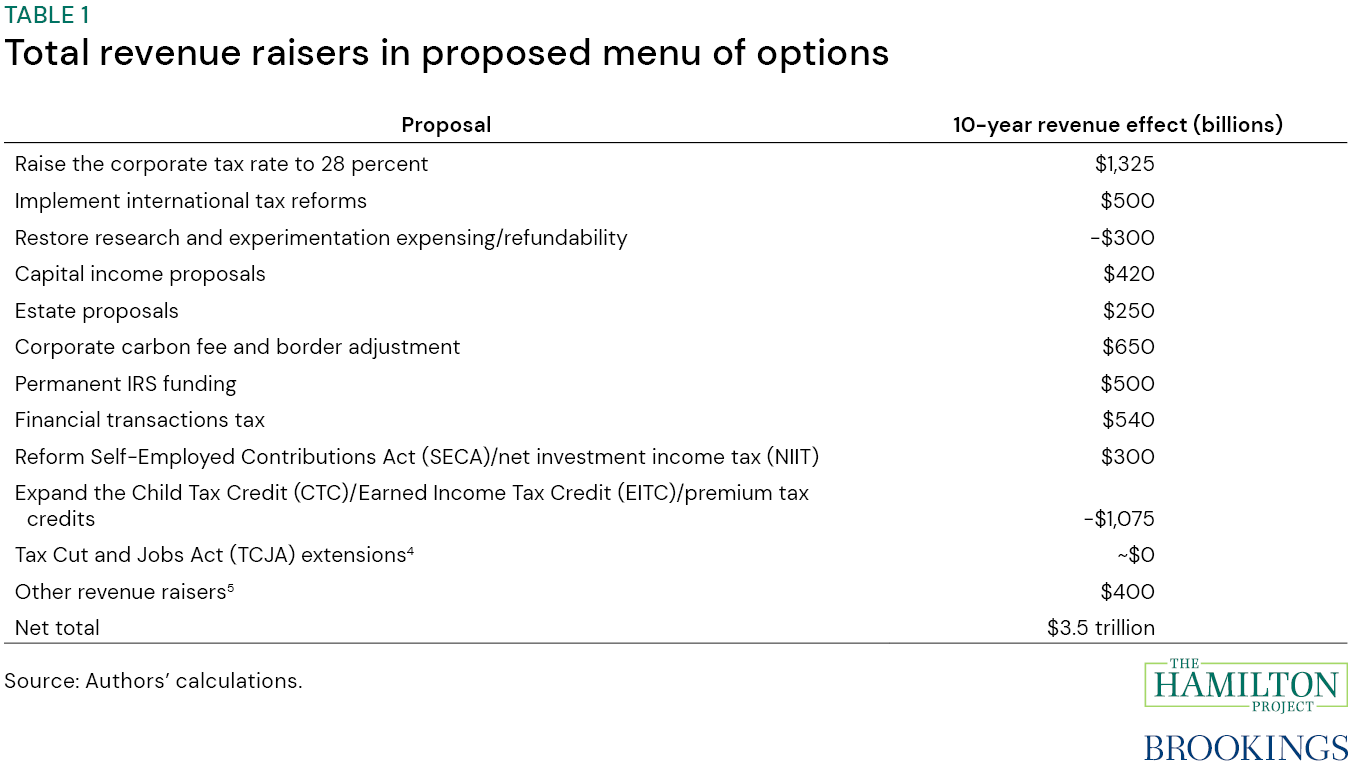

The TCJA sunsets necessitate a policy conversation. At a bare minimum, Clausing and Sarin argue that policymakers should aim for a revenue-neutral reform. However, given the significant fiscal needs facing the United States, aspirations should ideally be far loftier. They argue that policymakers should set ambitious revenue-raising targets and offer a menu of policy reforms that, if taken together, could raise $3.5 trillion over the course of the next decade and be a substantial downpayment on our long-term fiscal sustainability. These reforms would also create a more progressive tax system and reduce preferences in the code that enable high-earners and profitable multinational corporations to avoid tax liabilities.

The challenge

Clausing and Sarin lay out key principles that guide their subsequent tax policy reform suggestions.

The proposed policy changes would restore fiscal responsibility. In addition to fully paying for all proposed TCJA extensions, and proposed expansions in the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC), the full menu raises enough to cut the primary deficit in half over the coming budget decade, thus stabilizing the debt-to-GDP ratio. They argue that the U.S. fiscal system simply cannot afford a one-way tax ratchet where Republicans cut taxes and Democrats raise taxes, but only on those at the very top.

The proposed policy changes would build a more progressive tax system, while asking more from a broader swath of taxpayers. While tax increases are never popular, the after-tax income reduction for those at the top of the distribution will far exceed any increase on those outside the top. Indeed, for many families with children or those receiving the EITC, there will be a net tax cut from this package.

The proposed policy changes promote efficiency. Through their proposal menu, Clausing and Sarin seek to achieve revenue and fairness objectives while avoiding unnecessary distortions and inefficiencies. In many cases, they focus on tax bases that are relatively efficient, or on tax instruments that reduce existing distortions between types of income. This allows more revenue potential without resorting to excessively high tax rates.

The proposed policy changes can all be scaled up or down. All of the proposals that Clausing and Sarin consider have myriad options and dials that can be tuned to more narrowly or more broadly target any tax changes.

The proposed policy changes are consistent with U.S. leadership in an evolving world economy. Both the international tax policy changes and the climate policy changes work to align U.S. policymaking with what the rest of the world is doing, in a way that allows for improved solutions to the longstanding and vexing global collective action problems of tax competition and climate change.

The proposal

At the end of 2025, almost all of the individual, estate, and pass-through provisions of the Tax Cuts and Jobs Act (TCJA) will expire. This looming expiration creates an important opportunity to improve tax policy along multiple dimensions at the same time that TCJA provisions are evaluated for possible extension. Table 1 overviews the menu of tax policy options that together have the potential to raise about $3.5 trillion over the coming decade, while improving the progressivity and efficiency of the tax system.

Tax Cut and Jobs Act extensions: Clausing and Sarin do not believe that TCJA should be wholesale extended. And they argue that any TCJA extensions must be paid for. They propose extending the revenue-neutral combination of higher standard deductions, exemption removal, and a more generous CTC. They also propose a revenue-neutral extension of the state and local tax (SALT) cap and the alternative minimum tax (AMT) changes. They recommend against extending other elements of TCJA, including the pass-through income deduction, the higher estate tax threshold, and most individual rate cuts.

Raise the corporate tax rate to 28 percent. A 28 percent corporate tax rate is midway between current law and the pre-TCJA rate and would reverse half of the permanent 14-percentage-point cut in place since 2018. Increasing the corporate tax rate would provide a progressive and efficient source of revenue, since much of the corporate tax base is “above-normal” returns (excess profits).

International tax reforms: Tax reform presents an opportunity to consolidate a hodgepodge of minimum taxes into one minimum tax regime that is consistent with what the rest of the world is doing, thus increasing the stability and certainty of international tax rules while also reducing compliance costs for multinationals themselves. They propose a 21 percent per-country minimum tax on the foreign income of U.S. multinational companies. They also propose to make changes that are consistent with the 2021 international tax agreement, including changing the structure of the research and experimentation credit in a revenue-neutral way.

Capital income proposals: Taxing capital income is an important part of a progressive tax system, since capital income is far more concentrated at the top of the income distribution and is more lightly taxed than labor income, as tax policy changes over prior decades have reduced capital taxation relative to labor taxation. Clausing and Sarin propose increasing the long-term capital gains and dividend rates by 5 percentage points. An important step toward reducing capital income tax preferences would be the introduction of carryover basis, such that taxpayers would adopt the adjusted basis of the decedent on assets that they inherit; this would reduce the “lock-in” effect. They also propose eliminating the carried interest loophole.

Estate proposals: Clausing and Sarin propose returning to 2009 estate and gift tax parameters, which would lower the estate tax threshold while raising the estate tax rate.

Corporate carbon fee and border adjustment: Clausing and Sarin propose that the climate tax policy provisions in the IRA be complemented by measures that gradually introduce an economy-wide corporate carbon fee in the U.S. Households would be protected from any direct costs and there would be minimal impacts on either gas prices or utility bills. This policy would further international cooperation on climate change mitigation policy.

Permanent IRS funding: Clausing and Sarin propose reversing the recent IRS funding recissions, thus providing the agency with an additional $21 billion of enforcement resources to deploy in the coming decade. Second, they propose creating a stream of permanent mandatory funding to support the new hires and capacity that the agency will build up in coming years.

Financial transactions tax (FTT): Clausing and Sarin propose a small FTT of 3 basis points per transaction, which would raise significant revenue with very little impact on market liquidity or the cost of capital. An FTT can play a helpful role in capital markets by discouraging excessive speculation.

Reform Self-Employed Contributions Act (SECA) and Net Investment Income taxes (NIIT): In order to create uniform treatment, Clausing and Sarin propose closing the tax preference for SECA and NIIT taxes. Doing so would raise substantial revenue in a progressive manner, while also reducing tax-induced distortions in organizational form, and decreasing the incentive to misclassify income.

Expand the Child Tax Credit, Earned Income Tax Credit, and premium tax credit: The EITC and the CTC provide critical support for low- and moderate-income families in the U.S., and the premium tax credit makes health insurance more affordable. Clausing and Sarin propose expanding the generosity of these credits, prioritizing expansions that reach the lowest-income households who are in greatest need. For that reason, they emphasize full refundability of the CTC so that low earners are not receiving less support for their children than higher earners.

-

Acknowledgements and disclosures

We received helpful feedback from Lauren Bauer, Josh Bivens, Leonard Burman, Gabriel Chodorow-Reich, Alan Cole, Brian Deese, Wendy Edelberg, William Gale, Marc Goldwein, Este Griffith, Andrew Grossman, Ben Harris, Chye-Ching Huang, David Kamin, Wojciech Kopczuk, Charles Landow, Adam Looney, Chuck Marr, Mark Mazur, Ellen Nissenbaum, Eric Ohrn, Wendell Primus, Sarah Schaefer, Les Samuels, Catherine Wolfram, Danny Yagan, Owen Zidar, Eric Zwick, Hamilton project staff, and participants at the Hamilton Project authors’ conference. We also received helpful research assistance from Carissa Chen, Olivia Howard, and Randall Jones.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The coming fiscal cliff: A blueprint for tax reform in 2025

September 27, 2023

Key takeaways: