You can read here a Dec. 2 Financial Times column on this same topic by Darrell Duffie.

The accelerating digitization of financial markets creates a clear and immediate need for a sovereign instrument that combines the safety of U.S. Treasury credit, the liquidity of overnight funding, and the transparency of on-chain settlement. The Treasury has an opportunity to meet this demand and to increase financial stability in digital-asset markets by issuing a new security, Perpetual Overnight Rate Treasury Securities (PORTS). These notes would be issued and redeemable at par, daily. Given their attractiveness as collateral and as a settlement medium, PORTS would likely yield below the Secured Overnight Financing Rate (SOFR), with a spread that depends on the supply. If we are right that there is significant latent demand for PORTS, the need to issue longer-maturity Treasuries would decline, saving taxpayer borrowing costs. PORTS would also advance the current U.S. administration’s strategy of further empowering the dollar with stablecoins.

Why does the market need these instruments?

As on-chain activity grows, the demand for tokenized dollars will rise commensurately. Whatever form these tokenized dollars take—whether stablecoins, government money market funds, or tokenized deposits—there will be a growing quantity of money-like claims offering daily redemption backed by somewhat longer-duration assets that need not trade at par. A loss of confidence in the par redeemability of these instruments could generate large redemptions across on-chain dollar proxies, which could cause these instruments to depeg. If these dollar proxies are widely used as collateral, self-fulfilling expectations of cascading failures would be triggered.

PORTS could be used by stablecoin issuers as a safe and transparent form of same-day liquidity. As one of us said at the Federal Reserve Board’s October 2025 Payments Innovation Conference, all forms of tokenized dollars will compete around transparency, convertibility, and risk. Issuers of tokenized dollar instruments who are the first to hold all their assets on-chain, with no credit risk, and with the most convincing par convertibility will be awarded the lowest haircuts and therefore will win the adoption race. PORTS would be issued and redeemed daily at par by construction and could be held on or off chain at Fixed Income Clearing Corporation, Bank of New York, or other safe custodians.

For some large-value financial plumbing applications, such as Treasury repos and securities lending, tokenized PORTS could also serve as the cash settlement medium, at least until banks are able to make payments with their Federal Reserve deposits in a tokenized form.

Traditional financial markets are migrating towards 24/7 trading. Market participants therefore need to be able to move value 24/7. Otherwise, they are forced to significantly overcollateralize positions. This same dynamic exists in crypto markets, driving the massive adoption of stablecoins. In both traditional and novel settings, no market participant wants to use more capital than necessary. Organizations that are slow to adopt the tools necessary for 24/7 trading will be at a significant disadvantage, will achieve lower returns, and will lose higher-quality human capital. While crypto markets have generated a demand for $300 billion of stablecoins, they are a tiny fraction of the size of traditional financial markets. As Citibank writes in their recent stablecoin report: “As more financial assets from bonds and equities to commodities are tokenized, a corresponding form of digital money is needed for settlement. Stablecoins provide the liquidity and interoperability required to trade these assets seamlessly on-chain, becoming the default settlement layer for tokenized markets.” Caroline Pham, the acting chairman of the CFTC, refers to stablecoins as “the killer app for collateral movement.” Regulators and core-market service providers will not want to stake financial stability on an assumption that there will be no systemic dependence on tokenized dollar instruments.

Issuance considerations and yield curve implications

All PORTS issuances, new and previously issued, would be fungible (having the same CUSIP identifier). As a pilot, Treasury could achieve similar benefits by issuing non-perpetual notes having a fixed final maturity date and a design that is otherwise identical.

Treasury would announce a target for the average outstanding amount of PORTS as part of its quarterly refunding announcement. Treasury and its agents would manage daily auctions to achieve these targets.

Assuming that PORTS have meaningful uptake at rates below SOFR, Treasury would be able to reduce longer dated issuance, driving swap spreads tighter and flattening the yield curve, with potentially significant taxpayer savings.

How could issuance, interest remuneration, redemption, and tokenization work?

On each business day, owners of record receive that day’s interest at the rate determined in the previous day’s auction and will have the option to redeem their notes at par on the same day. Treasury may announce a maximum redemption amount for a given day to ensure that it has sufficient funds in the Treasury General Account and from new issuance to cover redemptions.

The quantity of new notes to be issued on a given day would be announced in advance according to a standard schedule—for example, one week ahead. PORTS would be issued in a uniform-price auction to authorized direct bidders.

From the perspective of investors, the most effective design for PORTS would be based on same-day auction settlement. With this, buyers bid the interest rate, to be paid on the next business day, at which they are willing to pay par on the auction date. A buyer can submit multiple bids, each consisting of a quantity and money-market interest rate.

For example, suppose Treasury announces an issuance of $40 billion and total bids submitted at each rate are $30 billion at 3.01%, $20 billion at 3.02%, and $25 billion at 3.03%. The stop-out rate is therefore 3.02%. All bids at 3.01% are awarded the full bid amounts of PORTS. Bids at 3.02% are each awarded half of their respective bid amounts. Bids at 3.03% are not awarded any notes. On the next business day, all outstanding PORTS, including the newly issued notes, pay owners interest at a money-market rate of 3.02%.

An alternative design can be based on staggered-day settlement. In this case, bids are at the interest rate determining the discount for next-day settlement.1 The staggered settlement design is unusual, in that the cash consideration is paid by investors the day before they receive their securities. The advantage over same-day settlement is the extra day allowed for the Treasury and its agents to distribute the securities into the accounts of auction awardees. Whether the settlement design is same-day or staggered, the economic interest rate on previously issued securities and newly issued securities is equal to the auction stop-out rate.

Same-day settlement, for both issuance and trading in the secondary market, would require reworking conventional operational steps used in the Treasury market. Operational experts have told us that taking PORTS from concept to practice is not necessarily ruled out but would be a substantial effort.

Conventionally, the redemption of Treasury securities is all-or-none. To our knowledge, the Treasury has never allowed some investors to redeem a Treasury security while allowing other owners of the same security to continue to hold it. Building new “pipes” for the selective redemption of Treasury securities would be daunting. It may be possible, however, to leverage the Treasury’s existing system for stripping a Treasury security. On any business day, an investor now has the option to submit to the Treasury an interest-bearing Treasury security with a given CUSIP and to immediately receive in exchange separate “strip” securities, one for the principal and one for each coupon. Each of these strips has its own CUSIP. Adaptation of this system might allow redeeming investors to submit PORTS to the same system and receive in exchange “redeemed PORTS,” which have their own CUSIP and receive no further payments. Meanwhile, other owners of PORTS can continue to hold their unredeemed securities and receive interest payments.

Pending no-action relief from the SEC, owners of Treasuries held at the Fixed Income Clearing Corporation will be able to hold their Treasuries on-chain in tokenized form, where they could be used, for example, as repo collateral. A recent transaction of this type was reported in Bloomberg.

Conclusion

Perpetual Overnight Rate Treasury Securities (PORTS) would meet the clear and immediate need for a sovereign instrument that combines the safety of Treasury credit, the liquidity of overnight funding, and the transparency of on-chain settlement that is driven by the accelerating digitization of financial markets. By providing a risk-free, daily redeemable instrument, PORTS would lower Treasury’s borrowing costs, strengthen the resilience of both traditional and digital-dollar markets, and extend the reach of U.S. monetary sovereignty into emerging financial infrastructures. The resulting gains in transparency and efficiency would accrue not only to the Treasury and U.S. taxpayers, but also to the stability of the global financial system.

Frequent questions

Would the amount of “cash” stored in the Treasury General Account (TGA) need to be very large, in case many investors suddenly decide to redeem?

The TGA would be sized for the amount of redemptions that the Treasury believes is appropriate. The Treasury can announce a cap on daily redemptions, which could be enforced, if necessary, by rationing.

If the redemptions are rationed, wouldn’t that cause the price of PORTS to fall below par?

Each day, the price of PORTS at the auction is automatically par because the auction stop-out rate is bid to the level at which investors are willing to pay par at the auction. If the redemption cap is binding some day, or in any case, selling PORTS in the secondary market is an alternative way for investors to liquidate their PORTS. The secondary market price would be close to par because the auction price is par. Redemption is a useful feature for PORTS, but is not strictly necessary.

What quantity of PORTS might be demanded for the applications that we have described?

The demand would likely be large, although hard to estimate. In a recent report, Citibank projected a “bull case” for total stablecoin outstanding of $4 trillion by 2030. If stablecoin issuers, in aggregate, back, say, 25% of that issuance with PORTS, the associated demand for PORTS would be on the order of $800 billion. Looking at one of the most important applications, repurchase agreements, one could gauge the potential demand for PORTS from the size of the overnight repo market, which exceeds $10 trillion. Netting could reduce the demand for repo cash settlement instruments to, say, $5 trillion. If, speculatively, 20% of repo volumes migrate to a blockchain setting and if there remains no good substitute for PORTS such as tokenized Federal Reserve deposits, that application would imply something like $1 trillion of demand for PORTS. Other potential sources of demand for PORTS include use as clearinghouse margin and as the cash leg for stock lending, which could add hundreds of billions of dollars of demand for PORTS. Overall, although this is very hard to predict, total demand could be extremely large if PORTS are supplied to meet the total demand at other wholesale risk-free overnight interest rates, such as SOFR or the interest rate paid to banks on their Federal Reserve balances (IORB). Historically Treasury bill rates have tended to be lower than IORB whenever the supply of T-Bills has been relatively low. Similarly, if the Treasury were to offer a smaller supply of PORTS than the potential demand, the auction market for PORTS would clear at rates that are lower than IORB.

Could there be an incentive for a bidder in a PORTS auction to influence the stop-out rate in order to benefit from changing the interest compensation on previously purchased PORTS?

We don’t believe this is likely or effective. Generally, investors compete for the opportunity to buy PORTS by bidding rates near other overnight risk-free rates. Adding artificially high-rate bids would not significantly affect the stop-out rate. An investor bidding abnormally low rates could cause the stop-out rate to shift downward. The ratio of costs to benefits for this behavior would be similar to the case for a bidder in conventional Treasuries that has a short when-issued position. The risk of detection would be higher for investors with larger outstanding positions.

Is there a safe and effective alternative to PORTS for backing the cash leg of systemically important financial market settlements?

The IOSCO international standard for the cash settlement asset used in systemically important financial market infrastructure is central bank deposits (“reserves”).2 At this point, tokenized Federal Reserve deposits are not available.

How about the alternative of conventional Treasury Floating Rate Notes (FRNs)?

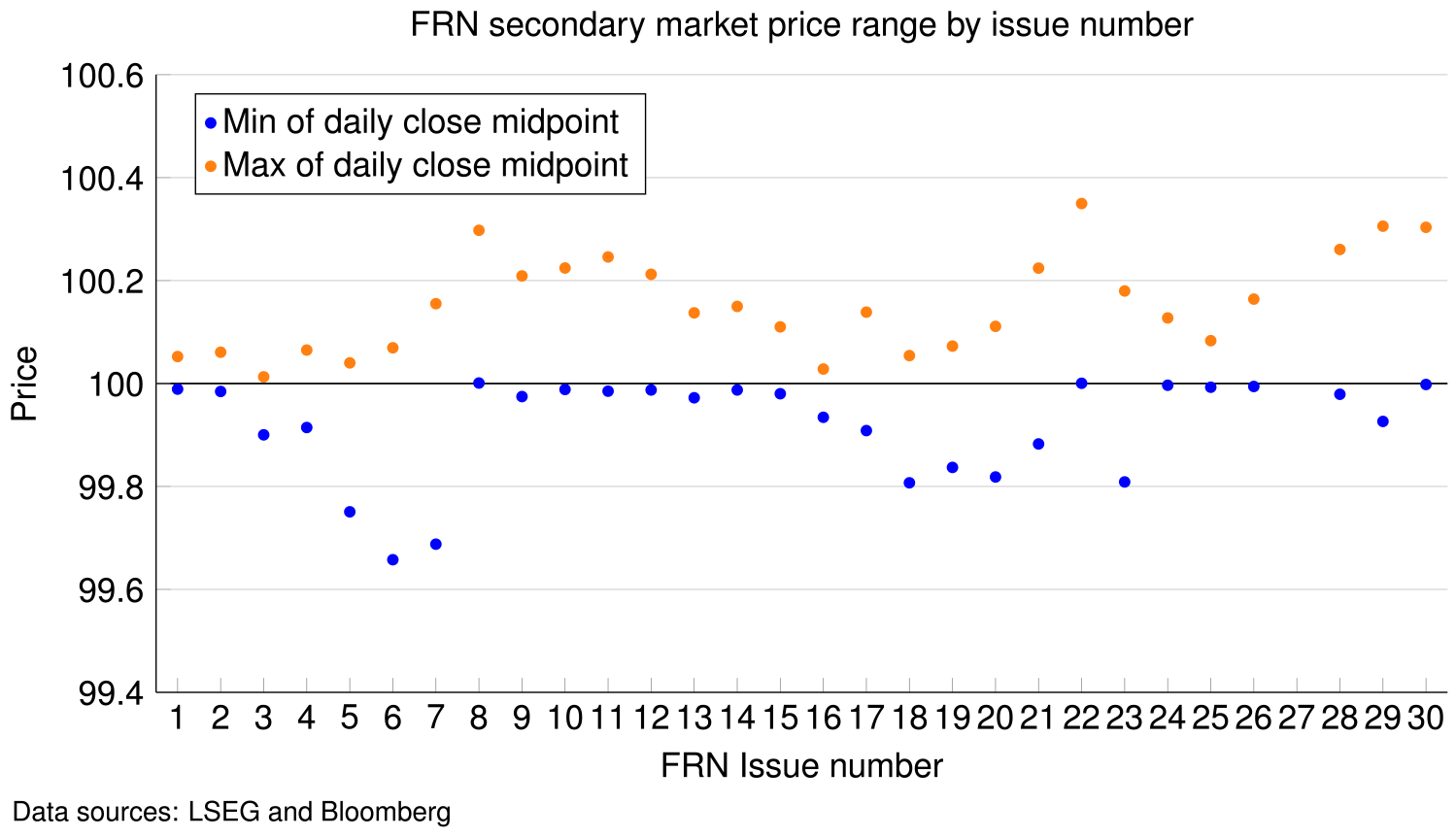

The prices of conventional Treasury FRNs sometimes diverge substantially from par, as shown in the figure below, based on data kindly shared with us by Professor Urban Jermann of the University of Pennsylvania. The underlying causes for this par divergence are explored by Hartley and Jermann (2024). Conventional FRNs are therefore not a suitable substitute for the uses for PORTS that we have described.

-

Acknowledgements and disclosures

The authors are very grateful for research assistance from Trevor Golub and helpful comments from Jonathan Hartley, Urban Jermann, Frank Keane, Donald Kohn, Brian Sack, David Wessel, and Nate Wuerffel,

Donald R. Wilson, Jr. is the Founder and CEO of DRW Holdings, LLC and a member of the Board of Directors of Digital Asset Holdings, LLC, in which DRW owns a minority interest. Digital Assets developed the technology used for the Canton Network transaction described in a Bloomberg report linked to this post. The authors did not receive any financial support from any entity for this paper. No outside party had the right to review this work before publication, and the views expressed are solely those of the authors.

-

Footnotes

- In this case, notes received in settlement are ex-coupon. That is, awardees do not receive interest on the newly issued notes on the settlement date. For example, if the stop-out rate is 3%, all awarded bids are settled with a payment on the auction date at a price of 1/(1+ 0.03 x T/360), where T is the number of days between the auction day and the next business day. For example, with an auction on Tuesday and settlement on Wednesday, T=1. With an auction on Friday and settlement on Monday, T=3.

- IOSCO writes: “The goal of Principle 9 is for FMIs to use central bank money where practical and available or to otherwise use a settlement asset with little or no credit and liquidity risk that is readily convertible into central bank money or other liquid assets in both normal and stressed circumstances. One of the fundamental purposes of central banks is to provide a safe and liquid settlement asset.”

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edThe case for a new floating rate Treasury note

December 2, 2025