Last June, President George W. Bush signed the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA). This policy brief provides an assessment of the tax cut. Our findings suggest that EGTRRA will reduce the size of the future economy, raise interest rates, make taxes more regressive, increase tax complexity, and prove fiscally unsustainable. These conclusions question the wisdom and affordability of the tax cut and suggest that Congress reconsider the legislation, especially in light of the economic downturn and terrorist attacks that have occurred since last summer.

POLICY BRIEF #101

The New Tax Law: An Overview

EGTRRA cuts the highest income tax rates: the 28, 31, and 36 percent rates fall by 3 percentage points, while the 39.6 percent rate falls to 35 percent. A new 10 percent tax bracket is carved out of the 15 percent bracket. Although the cuts in the highest income tax rates phase in slowly, the 10 percent bracket is available immediately. The tax act also expands the child credit and the Earned Income Tax Credit (EITC), reduces marriage penalties, increases subsides for education and retirement saving, repeals the limitations on itemized deductions and phaseouts of personal exemptions, and provides temporary, limited relief from the alternative minimum tax (AMT), a complex law that was designed to prevent aggressive tax sheltering but primarily affects large families or residents of states with high income taxes. The tax act reduces the estate tax and generation-skipping tax between 2001 and 2009 and repeals them in 2010.

EGTRRA also left significant unfinished business, in at least two ways. First, the entire legislation sunsets at the end of 2010. At that point, all provisions that had not already phased out are repealed, and the tax code reverts to what it would have been had the tax bill never existed. For example, the estate tax is repealed at the beginning of 2010 and reinstated at the end.

Second, the tax act raises the number of taxpayers who will face the AMT to 35 million in 2010. About 2 million taxpayers face the AMT currently, and 18 million would have in 2010 under previous law. Few observers believe that the sunset and AMT provisions will remain as currently legislated, but how and when they are resolved significantly affects analyses and conclusions regarding the tax act. We generally analyze EGTRRA as if the sunsets are removed and the AMT is reduced to keep the number of AMT taxpayers the same as under pre-EGTRRA law.

Tax Cuts and Fiscal Policy

Large projected budget surpluses at the beginning of 2001 made tax cuts look affordable and were perhaps the single most popular argument in favor of tax cuts. However, federal budgeting methods seriously misrepresent the government’s fiscal status; more appropriate measures present a far bleaker picture (see Brookings Policy Brief #100, June 2002). The official baseline budget ignores the long-term costs of retirement programs such as Social Security, Medicare, and government pensions. It assumes that real discretionary spending will fall by 1 percent per year on a per-person basis, and that all expiring tax provisions will expire as scheduled, even though they are usually routinely extended. Finally, the budget assumes that 35 million taxpayers will face the AMT in 2010, which few people believe will occur.

Adjusting for these factors significantly affects projections of the surplus. In January 2001, when President Bush took office and the debate over EGTRRA began, the Congressional Budget Office (CBO) projected a ten-year surplus of $5.6 trillion. Removing the retirement programs would have reduced the surplus by $2.3 trillion. Adjusting for the AMT and expiring provisions and maintaining real discretionary spending per capita would have yielded a remaining “available surplus” of just $1.6 trillion (see Brookings Policy Brief #76, April 2001).

By comparison, EGTRRA will reduce revenues by $1.35 trillion between 2001 and 2011. Extending EGTRRA to remove the sunsets and keep the share of AMT taxpayers the same as under previous law raises the revenue loss to $1.7 trillion. Counting the added interest payments required by the increase in federal debt, the tax cut would reduce the surplus by $1.7 trillion or $2.2 trillion through 2011. Either figure exceeds the available surplus as of January 2001.

Accounting for the long-term costs of Social Security and Medicare implies an even bleaker picture. The fiscal deficit over the next seventy-five years was estimated to be about 0.7 percent of Gross Domestic Product (GDP) before EGTRRA was passed. If it is made permanent—as the House of Representatives recently voted to do—EGTRRA will have a sizable impact on the fiscal gap, raising it by about 1.43 percent of GDP.

These findings show that tax cuts are not simply a matter of returning unneeded or unused funds to taxpayers, but rather a choice to require other, future taxpayers to cover the long-term deficit, which the tax cut significantly exacerbates. The fiscal gap—and the expansion of that gap by EGTRRA—implies either that taxes will rise or spending will fall in the future. These changes may have important effects on economic efficiency and the distribution of government benefits, which should be considered part of the analysis of EGTRRA and are discussed further in subsequent sections of this policy brief.

Distributional Effects

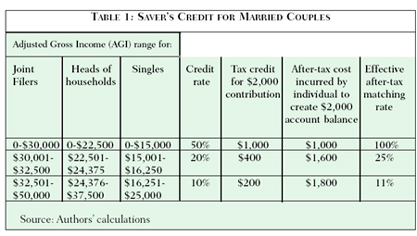

Our preferred measure of the distributional impact of the tax cut is the percentage change in after-tax income. A tax cut or increase that gives every household the same percentage change in take-home income is distributionally neutral—meaning that it holds the distribution of after-tax income constant before and after the policy change. EGTRRA, in contrast, raises after-tax income by 6.3 percent for households in the top 1 percent of the income distribution, compared to 2.8 percent or less for other groups, and less than 1 percent for the bottom quintile (see table 1). EGTRRA, then, will make the distribution of after-tax income less equal.

One way to measure the amount of redistribution is to compare the tax cut households obtain under EGTRRA to their cut if everyone obtained the same percentage increase in after-tax income. Households in the top 1 percent will receive about $25,000 more in tax cuts annually under EGTRRA than under a distributionally neutral tax cut. All of the other groups receive a smaller cut under the legislation than under a distributionally neutral tax change of the same overall magnitude. The top 1 percent will receive 36.7 percent of the tax cut under EGTRRA, far more than its share of federal taxes before EGTRRA (26 percent). The annual tax cut totals more than $45,000 for households in the top 1 percent, a figure that exceeds the sixtieth percentile of the income distribution. Thus, the principal distributional effect of EGTRRA is a tax cut for the top 1 percent of households that is disproportionate relative to every criteria noted in table 1. This tax cut comes immediately after a twenty-year period in which the both the pre- and post-tax income of the top 1 percent grew much faster than for any other group of households.

Economic Growth

EGTRRA has complex effects on economic growth. Lower tax rates will raise incentives for people to work, acquire human capital, save, and invest, but EGTRRA has relatively small effects on marginal tax rates. Treasury data show that a surprisingly large share of households receive no reduction in marginal tax rates, including 72 percent of those who file tax returns and 64 percent of all filers who actually pay positive amounts of income tax. As a result, effective marginal tax rates fall by just two to three percentage points for wages, interest, dividends, and sole proprietorship income.

These changes will create relatively small increases in after-tax wages. Using research estimates of the sensitivity of hours worked to after-tax wages, we estimate that by 2011, EGTRRA will induce people to work about 0.5 percent more hours than they otherwise would have. Lower taxes and incentives for education are also likely to raise the amount of education and training that workers obtain. These effects are difficult to estimate, but using a variety of published studies, we estimate that these items will be about 0.2 percent higher in 2011 due to the tax cut.

EGTRRA will affect private saving by raising the after-tax rate of return, shifting the distribution of income toward higher-income households, who tend to save more, providing new retirement and education incentives, and repealing the estate tax. Our reading of the evidence from economic research suggests these changes will raise private saving by about 0.5 percent of GDP by 2011.

Taken together, the increases in labor supply, education, and private saving induced by the tax cut tax incentives will raise the size of the economy by about 1 percent by 2011. But improved tax incentives are only part of the story. EGTRRA is a set of tax incentives financed by reductions in public saving. The full effects on economic growth include the impact of higher deficits (lower surpluses).

EGTRRA will reduce government saving by about 1.6 percent of GDP through 2011. This reduction is substantially larger than the induced increase in private saving noted above. As a result, national (the sum of public and private) saving will fall. Estimates suggest that about one-third of the decline in national saving will be offset by increased capital inflows from other countries. The net effect of the rise in private saving, the decline in public saving, and the increase in capital inflows will be to reduce the amount of financing available for new investment in the United States. We find that the resulting decline in the amount of physical capital (e.g., machines, structures, etc.) is sufficiently large that, despite the results of improved tax incentives, the overall net effect of EGTRRA will be to slightly reduce GDP—by about 0.3 percent after ten years.

Doubling both the estimated human capital and the private saving response generates a modest boost in GDP—about 0.4 percent by 2011, but the implied behavioral estimates stretch the bounds of established research. Thus, our central conclusion is that EGTRRA will have little or no discernable effect on economic growth in the short run and will plausibly reduce the size of the economy in the long-term. Recent research by the Congressional Budget Office, analysts at the Federal Reserve Board, and Alan Auerbach of the University of California reaches similar conclusions using a sophisticated simulation model of the economy.

Other Economic Effects

Interest, Investment, and Economic Stimulus

Under the conventional view of fiscal policy, increased public debt raises interest rates. For a number of technical reasons, this pattern is only sometimes documented in empirical results. Nevertheless, all major macroeconomic models—including those used by the CBO, the Federal Reserve, and the Council of Economic Advisers in the Clinton administration and the current Bush administration—imply that EGTRRA will have significant effects on interest rates. Our best estimate, using previous findings from these models, is that EGTRRA will raise interest rates by about seventy-five basis points or more over ten years.

EGTRRA affects investment in two ways. Lower tax rates should raise investment; higher interest rates should curtail investment. We find that, for even small increases in interest rates, the net impact of higher interest rates dominates the effect of lower tax rates, so that the net effect of EGTRRA is to reduce investment.

A particular goal of EGTRRA was to spur the economy in the short term, but it seems unlikely to have achieved that goal. Only a small share of last year’s rebates was spent in a timely manner. In August, personal disposable income rose by 1.9 percent, with the rebates issued in July and August responsible for much of the rise, but personal consumption expenditures rose by only 0.1 percent. Surveys suggest that only 22 percent of households receiving the rebate expected to spend it.

Several factors suggest that the rebate was unlikely to stimulate the economy. First, discretionary tax policy has a weak record in stimulating short-term economic activity. Second, the entire rebate equaled just 0.4 percent of GDP in 2001. Even if half of it were spent, the stimulus would have been small. Third, the Federal Reserve was engaged in expansionary monetary policy and possibly would have reduced interest rates by more if the rebates had not existed. If so, the net stimulus due to the rebate would be close to zero regardless of how consumers responded. Fourth, lower-income households have a higher propensity to consume out of current income than others. But 75 percent of households in the bottom income quintile and 37 percent in the second quintile did not receive a rebate. Finally, any EGTRRA-induced rise in interest rates over the past year would hurt the economy, in part by reducing investment.

Economic Efficiency

By reducing marginal income tax rates and repealing the estate tax, EGTRRA has a prima facie claim to raising efficiency, but the eventual efficiency gains may prove illusory. Even among those with positive tax liability, almost two-thirds will receive no marginal tax rate cut, and the projected changes in effective marginal tax rates are small. Some taxpayers will actually face higher marginal rates because of the AMT.

EGTRRA will also generally complicate tax compliance and planning. In a few ways, the new law simplifies taxes—by reducing rates, repealing the limitations on itemized deductions and the phase-out of personal exemptions and simplifying EITC rules. But many other changes make things worse. Besides the sunset and AMT issues, EGTRRA adds several new options for retirement saving, the child credit, and especially education. These new options substantially complicate the choices that people make. For example, EGTRRA created one new education subsidy and significantly expanded two others. As a result, there are now five principal tax subsidies for college education, but each dollar of college payments made may benefit by only one of the programs.

Finally, the most efficient tax policy keeps tax rates constant over time. Standard economic theory shows that cutting tax rates initially only to raise them later is inefficient. Thus, if the financing problems created by EGTRRA force future tax rate increases, the most basic efficiency claims for the income tax rate cuts will be void. Estate tax repeal also has efficiency consequences, but they are complex and not yet well understood by economists.

Government Spending

Some argue that the best reason for a tax cut is to restrict government spending. In the context of EGTRRA, this argument has three parts: spending is or would be too high without a tax cut; a tax cut is the best way to restrict spending; and EGTRRA is the best tax cut to achieve that goal.

Whether spending is too high must ultimately be based on a reader’s judgment. Recent data, however, show that federal outlays were just 18.2 percent of GDP in 2000, the lowest share in 34 years. Thus, government spending is hardly high relative to prior norms.

Would tax cuts effectively restrict spending? The tax cuts of 1964 and 1981 did not lead to sustained declines in spending. From 1992 to 2000, federal spending fell by 4 percentage points of GDP while tax revenue rose. The spending decline occurred across all major components of government spending. Thus, the data suggest that declines in government spending relative to GDP helped produce the budget surpluses of the late 1990s, not that the revenue surge prompted massive spending.

A better way to control spending would be to account more accurately for retirement and the definition of current policy, along the lines discussed above. Like tax cuts, this would reduce the reported surplus. Unlike tax cuts, reforming budget procedures would provide a more accurate picture of the government’s finances, and would not create deeper fiscal problems if it failed to restrain spending. Thus, budget reform would likely be as effective and less risky than tax cuts as a spending control mechanism.

Even if a tax cut were needed to control spending, this does not justify EGTRRA. Government spending predominantly benefits low- and middle-income households. On fairness grounds, a tax cut whose goal is to cut spending should offset the negative impact on these households by giving them a disproportionately large share of the tax cut. EGTRRA, however, does just the opposite—it tilts benefits toward high-income households.

It may even turn out that EGTRRA raises government spending. EGTRRA, combined with the economic slowdown, has wreaked havoc on any notion of budget discipline and has led to abandonment of the previous consensus budget goal of preserving the Social Security surplus, that is, of balancing the non-Social Security budget. Because no new budget framework or budget discipline has been established, interested parties may well see this as an opportune time to push through their own favorite spending programs.

Conclusion

Our findings, based on recent economic research, are stark. We find that EGTRRA was fiscally unsustainable even before the economic downturn and the September 11 terrorist attacks slowed the economy. We estimate that the tax cut will not raise long-term growth, but it will raise burdens on future generations. EGTRRA will also raise interest rates.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).