We review markets in the wake of last week’s reciprocal tariff announcement by the Trump administration. Reciprocal tariffs caused wild gyrations in markets last week, including an unusual fall in the dollar that came alongside a sharp fall in S&P 500. Some saw this as a sign that U.S. reserve currency status is under strain, but there may be a more benign explanation. Markets sharply downgraded their expectations for U.S. growth following “Liberation Day.” As a result, interest differentials moved sharply against the U.S., pulling the dollar down. Rather than reserve currency status, the key issue is whether this cyclical downgrade versus its trading partners is justified. After all, the U.S. is a large, closed economy, while many of its trading partners are the opposite. And even if the rest of the world is large relative to the U.S., it is implausible for such a diverse set of interests to align enough for joint response to the U.S.

We also review standard indicators for signs of financial stress. At the current juncture, these are at moderate levels. A large devaluation of the yuan by China in retaliation to U.S. tariffs is the principal risk. Such a devaluation would inevitably—as in past instances—spill over to emerging markets, with lots of potential for adverse spillback to the U.S.

Market reaction to April 2

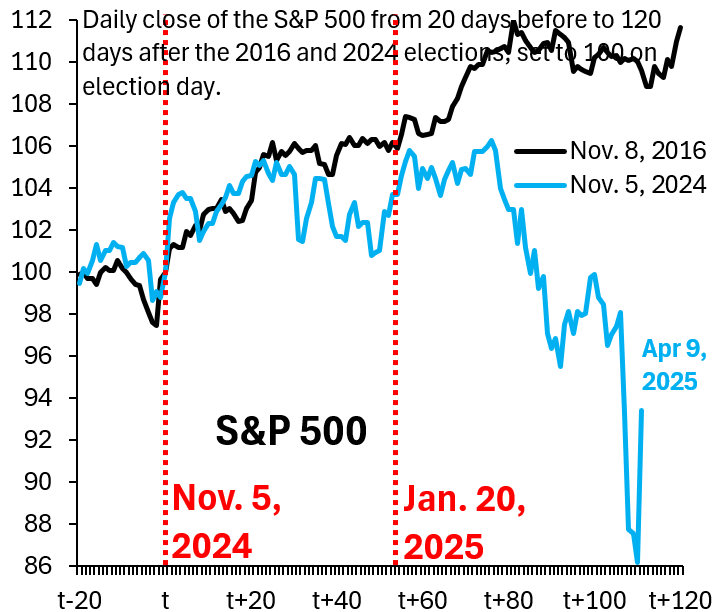

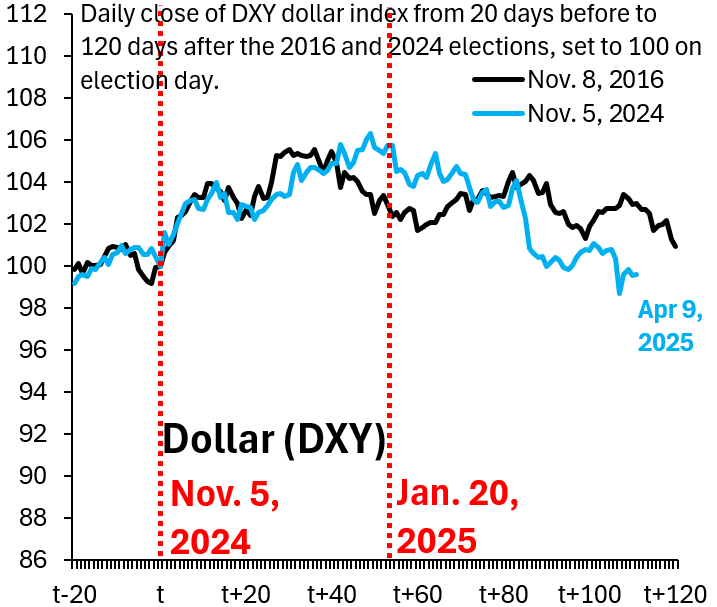

The S&P 500 fell more than 10% in the days following April 2 and—even with yesterday’s rebound—is down a cumulative 12% since its peak just after inauguration (Figure 1). The dollar has fallen alongside the S&P 500 (Figure 2), which has caused consternation because the dollar has typically rallied as market volatility has risen. Some have seen this as a sign that U.S. reserve currency status is under pressure, but we think a more benign explanation is at play.

Figure 1

Source: Bloomberg

Figure 2

Source: Bloomberg

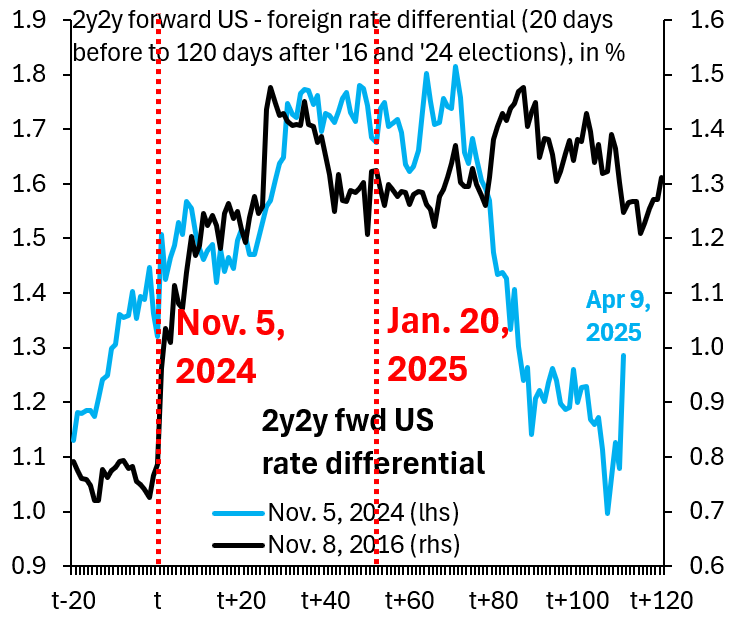

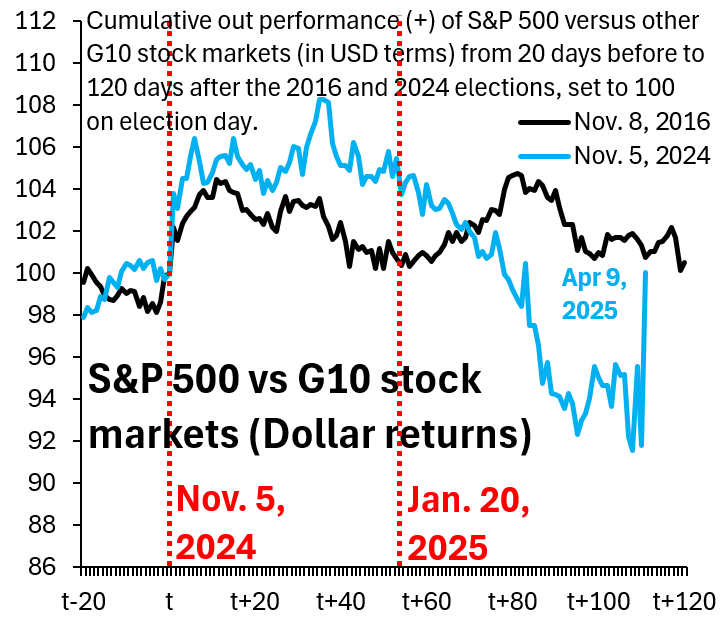

Markets downgraded their growth outlook very sharply for the U.S. in the wake of April 2. As a result, rate differentials moved sharply against the U.S. (Figure 3), which in turn pulled the dollar weaker. We think—rather than focusing on reserve currency status—the main question to ask is whether this cyclical reassessment of the U.S. vis-à-vis its trading partners is correct. After all, the U.S. is a large, closed economy, while many of its trading partners are the opposite. Markets in recent days appear to be having second thoughts on their U.S. underperformance thesis. Rate differentials have begun moving back in favor of the dollar, and S&P 500 underperformance vis-à-vis the rest of G10 stock markets has also ended (Figure 4). Markets’ assessment of the relative winners and losers is thus still up for grabs, though universal falls in stock markets globally—even with the rebound since yesterday’s pause announcement on tariffs against countries that don’t retaliate—say markets think tariffs are growth-negative for the world as a whole.

Figure 3

Source: Bloomberg

Figure 4

Source: Bloomberg

Financial stress indicators and associated risks

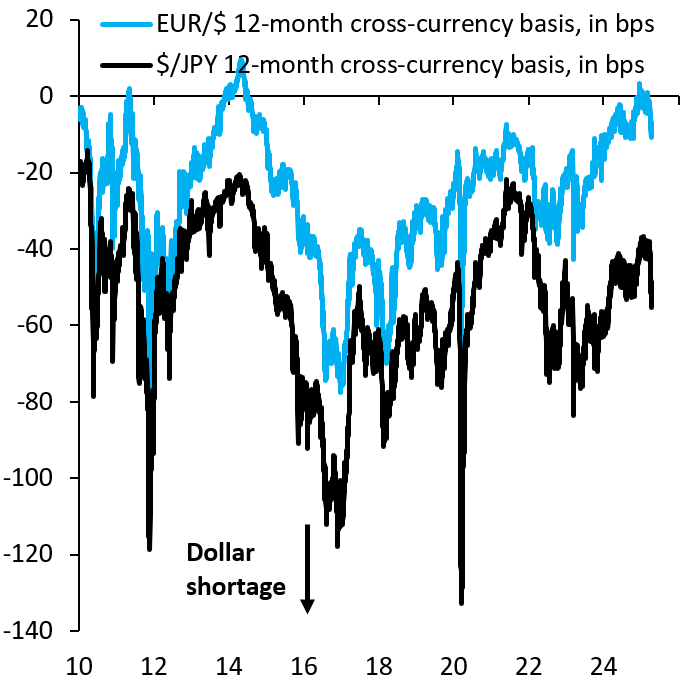

We review two indicators that have been important in recent crises. A widening out in cross-currency basis indicates a violation of covered interest parity. This occurs when banks abroad start to panic about dollar liquidity, converting spot euros or yen into dollars. To hedge their open foreign exchange position, they then use forward markets to sell dollars, which means that the euro or yen ends up being stronger in forward markets than is justified by rate differentials. Cross-currency basis in euro and yen has begun to widen, but this widening is happening from very modest levels (Figure 5).

Figure 5

Source: Bloomberg

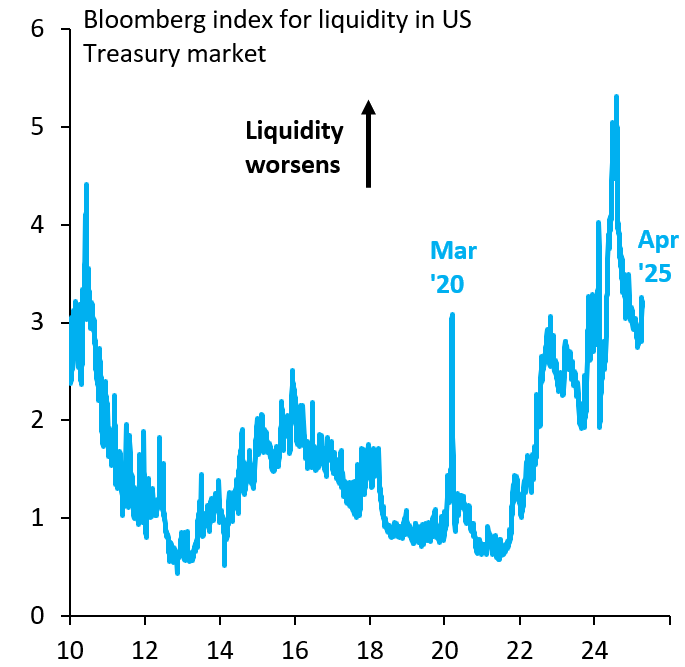

Figure 6

Source: Bloomberg

Bloomberg has a separate indicator on liquidity conditions in the U.S. Treasury market. This measure compares the shape of the U.S. yield curve to a hypothetical “smooth” yield curve. The more kinks there are, the worse is liquidity. This measure spiked in March 2020, when pressure on emerging market currencies due to capital flight caused central banks to sell their Treasury holdings, disrupting the basis trade in the Treasury market. Much as for the cross-currency basis, this measure indicates mounting stress, but the rise is so far quite modest compared to March 2020 (Figure 6).

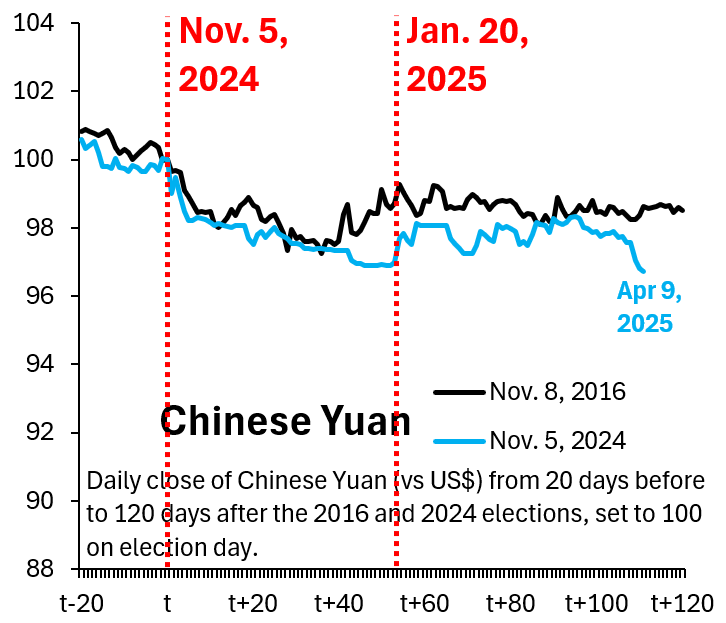

Figure 7

Source: Bloomberg

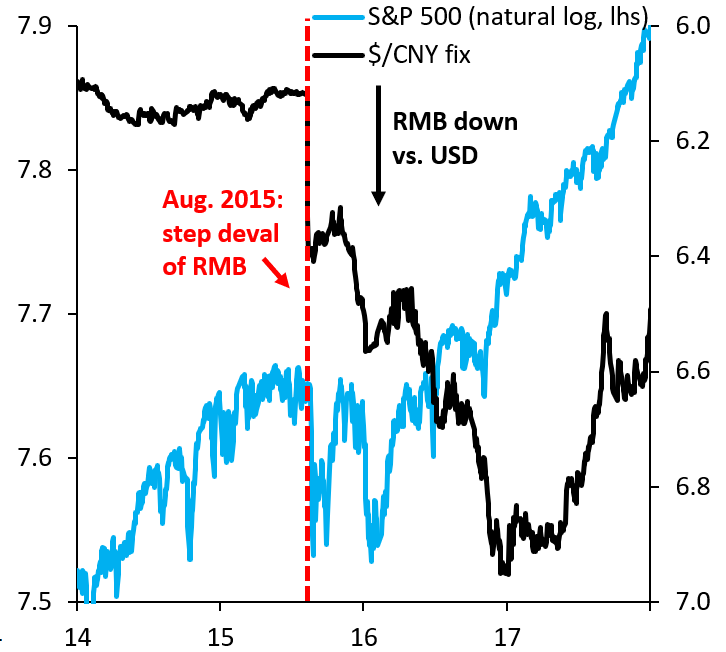

Figure 8

Source: Bloomberg

The main risk scenario to this picture is a large devaluation of the yuan by China. The pace of yuan devaluation has picked up in the wake of April 2, though it is still quite modest (Figure 7). The fall in the yuan—as modest as it is—is notable because the falling dollar means that, if anything, the yuan should be rising against the dollar if China wants to keep the renminbi stable in trade-weighted terms. No doubt, the falling yuan is intended as a signal to Washington. A meaningful devaluation of the renminbi would have severe consequences for global markets. In 2015/6 (Figure 8) and in 2018, devaluation sparked a deep emerging market sell-off that eventually spilled back to the U.S. This is therefore the principal risk to an already tenuous picture.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Tariff turmoil in markets

April 10, 2025