Content from the Brookings-Tsinghua Public Policy Center is now archived. Since October 1, 2020, Brookings has maintained a limited partnership with Tsinghua University School of Public Policy and Management that is intended to facilitate jointly organized dialogues, meetings, and/or events.

Americans are frustrated with the imbalance in the U.S.-China economic relationship. From January through October of this year, the United States had imported $381 billion of Chinese goods, mostly manufactures; it exported $92 billion in return, mostly soybeans, aircraft, and passenger vehicles. The imbalance is slightly lower if services are included (the 340,000 Chinese students in the United States represent American exports of education services). And a new imbalance that has developed recently is that there is more Chinese direct investment flowing into the United States than in the other direction. This does not reflect the fact that China is a bigger investor in the world—just that China itself remains quite closed, while the United States is very open.

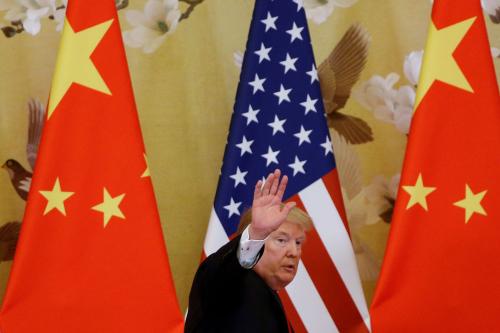

If President Trump wants to play hardball with China, a good place to start would be restricting the acquisition of American firms by China’s state-owned enterprises. The Obama administration just stopped the purchase of Aixtron, a German chip maker with significant U.S. operations, on national security grounds. But there have only been a handful of such moves over the years. In general, the United States is very open to foreign investment, including mergers and acquisitions. So far in 2016, Chinese companies have more than doubled the record $106 billion of overseas deals that they announced in 2015. The United States is the number one foreign destination for Chinese investment.

If President Trump wants to play hardball with China, a good place to start would be restricting the acquisition of American firms by China’s state-owned enterprises.

Some of the other economic measures directed at China that have been floated during the election season either do not make sense or carry a large risk that they will backfire on the U.S. economy. Calling China a currency manipulator made sense 10 years ago; but since then, the currency has appreciated significantly, and over the past 18 months the People’s Bank of China has been intervening to keep the currency high, not low. This is the opposite of currency manipulation. Imposing large import tariffs both violates our World Trade Organization (WTO) commitments and invites retaliation. If tariffs are aimed only at China, then production will easily shift to other low-wage locations. If they are aimed at all developing countries, then that is a general trade war that will be lose-lose. We may not export a lot to China, but we export a lot to the world. And our exports to China are significant for certain sectors and communities. There are global rules on trade which it is in our interest to respect.

For direct investment, however, there are no global rules. The United States is open to foreign investment, including mergers and acquisitions, because we think it creates jobs and raises productivity. If a foreign firm is willing to pay more for a U.S. asset, then there is a presumption that they will make better use of the asset and the American economy and workers will benefit. So, what’s the problem with Chinese investment in the United States? The problem is that China is not a typical capitalist economy. First, it is itself quite closed to foreign investment. It has allowed significant amounts of foreign investment in specific manufacturing industries, hence those value chains stretching deep into China. But in key sectors—such as automobiles—it requires foreign firms to operate in 50:50 joint ventures, in the process sharing their technology with Chinese state firms. In the service sectors, which is where the majority of FDI globally occurs, China is almost completely closed. This includes financial services, social media, telecom, logistics, health care, and education. China is less open to direct foreign investment than other large emerging markets such as Brazil, India, or Russia. In these service sectors in particular, it is difficult for America to sell to China if it cannot invest there.

The second problem with China’s outward investment is that the closed sectors are dominated by state-owned enterprises whose managers are appointed by the Communist Party. They earn profits behind protected walls and then go out in the world to buy their competitors. There is no presumption that this current pattern of investment benefits the American economy. What would actually benefit the U.S. economy would be if China opened up its foreign trade and investment regime and the United States were able to export more. In both services and manufacturing, it is difficult for U.S. firms to export as much as they could if they cannot invest in the target economy.

Because there are no global rules on direct investment, China can close off important parts of its market, restricting opportunities for American firms and workers. We should not change our basic openness to foreign investment, which has served us well. But restricting acquisitions by foreign state enterprises is a sensible precaution. We should not expect China to change its investment restrictiveness anytime soon, but a tougher U.S. stance makes it more likely that the two sides will eventually negotiate an investment agreement that opens up China’s markets.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Playing responsible hardball on China’s trade and investment

December 7, 2016