Recent data released by the Obama Administration highlights enrollment in health insurance exchanges or “the Marketplace” which has had many ups and downs over the last months — beginning with the bungled healthcare.gov website as well as optimistic reports from states which have had made great progress in enrolling Americans in the Marketplace as well as expanded Medicaid Programs.

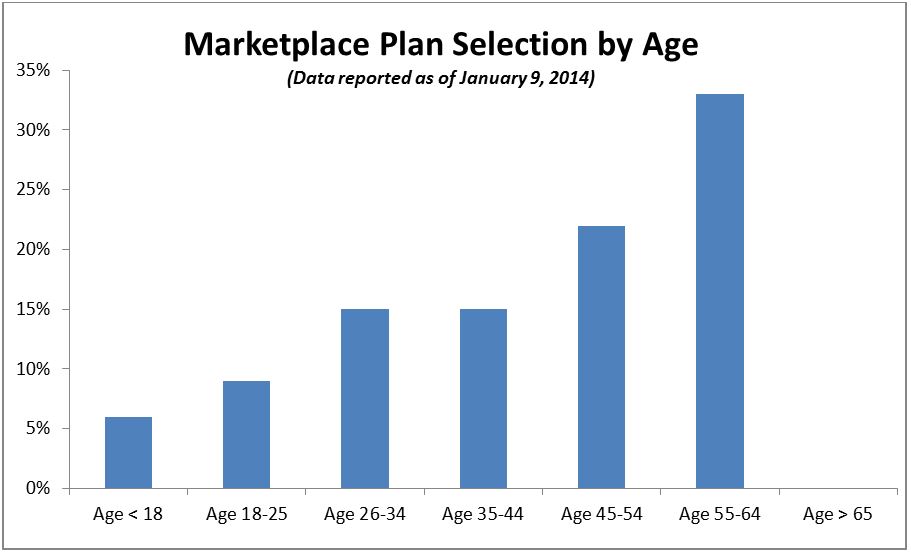

As expected, a surge of individuals – 1.78 million – enrolled in the Marketplace in December, likely to ensure that coverage could begin January 1, 2014. This brings the total of individuals enrolled to 2,153,000 adults enrolled in either a state-based marketplace or a federally facilitated marketplace as of Dec 28, 2013. Several points about this number: it is lower than some had estimated but the enrollment period is still open (until March 31, 2014); additionally, it appears that a majority of the enrolled are between the ages of 45 and 64 (see Figure 1).

FIGURE 1: Enrollment by age

Source: Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation Health Insurance Marketplace: January Enrollment Report, (PDF, 29 Pages), January 2014 Accessed January 16, 2014

These enrollment numbers are not surprising since there is a general expectation that people who have healthcare needs are more likely to enroll in the Marketplace and that younger individuals or those with minimal health needs will enroll later. And while the final numbers remain to be seen, there are some critical aspects built into the Affordable Care Act to mitigate the effects of a potentially skewed enrollment population. In other words, while it might seem that having older, sicker people could result in cost-shifting or larger repercussions to the American public’s pocketbooks, the law’s authors included provisions which help to offset a potentially skewed population.

The ACA includes at least 4 programs/provisions to offset risk:

- A permanent risk-adjustment program: Risk adjustment is a complicated issue but consider it as a corrective tool to balance out differences in risk among specific patients — a way to try and compare apples to apples rather than a flawed apple to orange comparison. The permanent risk adjustment program in the ACA reduces the moral hazard of insurance plans, avoiding more expensive and sicker populations. Insurance companies with a higher proportion of healthier patients contribute to a fund that will, in turn, make payments to insurers with sicker patients (higher cost).

- A transitional reinsurance program that will run from 2014-2016: In addition to the permanent risk adjustment program, a temporary program to offset higher cost of a select pool of individuals with much higher costs was instituted — $10 billion will be collected from health plans, which will then be used to pay plans in the individual market when an individual’s claims exceed $60,000. Plans will be reimbursed for 80 percent of an individual’s health claims between $60,000 and $250,000. In effect, a budget-neutral redistribution mechanism to mitigate the fears of early losses.

- Temporary Risk Corridor Program (also from 2014-2016): A risk corridor basically reduces insurers’ risk by reimbursing insurers for a portion of the excess of their costs if the cost exceeds target amounts in relation to premiums charged. If costs are lower than targets than they will pay a fee. For example, an insurer will be reimbursed for 50% of any costs from 103-108% of the target and 80% of any costs above 108% of the target. On the other side, an insurer will pay a fee equal to 50% of the shortfall if costs fall within 92-97% of the target and 80% of any additional shortfall if costs are less than 92% of the target.

- Community Rating: Beginning in 2014, all insurers selling individual plans must use “adjusted community rating” which allows for insurers to modify what they charge based on:

- Your family size

- Where you live

- If you use tobacco

- Your age

Insurers are limited in how much more they charge for these factors; for example they can’t charge the oldest patients more than 3 times what they charge the youngest.

These provisions did not get much attention in the past but given recent enrollment news as well as the President’s announcement several months ago that insurers could continue to offer policies that would not have met 2014 standards, people are starting to really scrutinize what a risk corridor or a reinsurance program is and how that could help with unanticipated costs. There has also been direct criticism of these programs as handouts to the insurance industry or a bailout.

In sum, do not interpret enrollment trends as fateful sticker shock. Having said that, the fact that these temporary programs expire in 2016 tells us that there is a hypothesis that enrollment trends will be smoothed out by 2016, and given the rocky implementation start as well as the inevitable confounding noise of the 2014 and 2016 elections, there is a long way to go before success or failure can be declared.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edObamacare Exchange Enrollment: What Recent Numbers Don’t Tell You

January 17, 2014