Content from the Brookings Doha Center is now archived. In September 2021, after 14 years of impactful partnership, Brookings and the Brookings Doha Center announced that they were ending their affiliation. The Brookings Doha Center is now the Middle East Council on Global Affairs, a separate public policy institution based in Qatar.

Since its inception in 1960, OPEC and the world of oil has often been misunderstood or seen as shrouded in mystique or myth. OPEC members have 81% of the world’s known reserves with 66% being in the Middle East and though it now only accounts for a third of world crude oil production, the importance of the organization for the world’s future should not be understated as these are predominately low cost reserves. Analysts are now expecting OPEC members to return to a business as usual approach after OPEC, in November 2014, unexpectedly refused to play its traditional role of supply regulator and price stabiliser by altering its oil production output. Unexpectedly, its major player Saudi Arabia, who traditionally took on the role of swing producer, remains eerily silent on the matter when many of its fellow members are calling for a cut in production to push prices back up. Some might speculate that Saudi Arabia recognises that the market has experienced a structural shift and so has its power and it is no longer keen to play the game. This time the difficulties of rebalancing supply and demand go beyond its capabilities and economic sense.

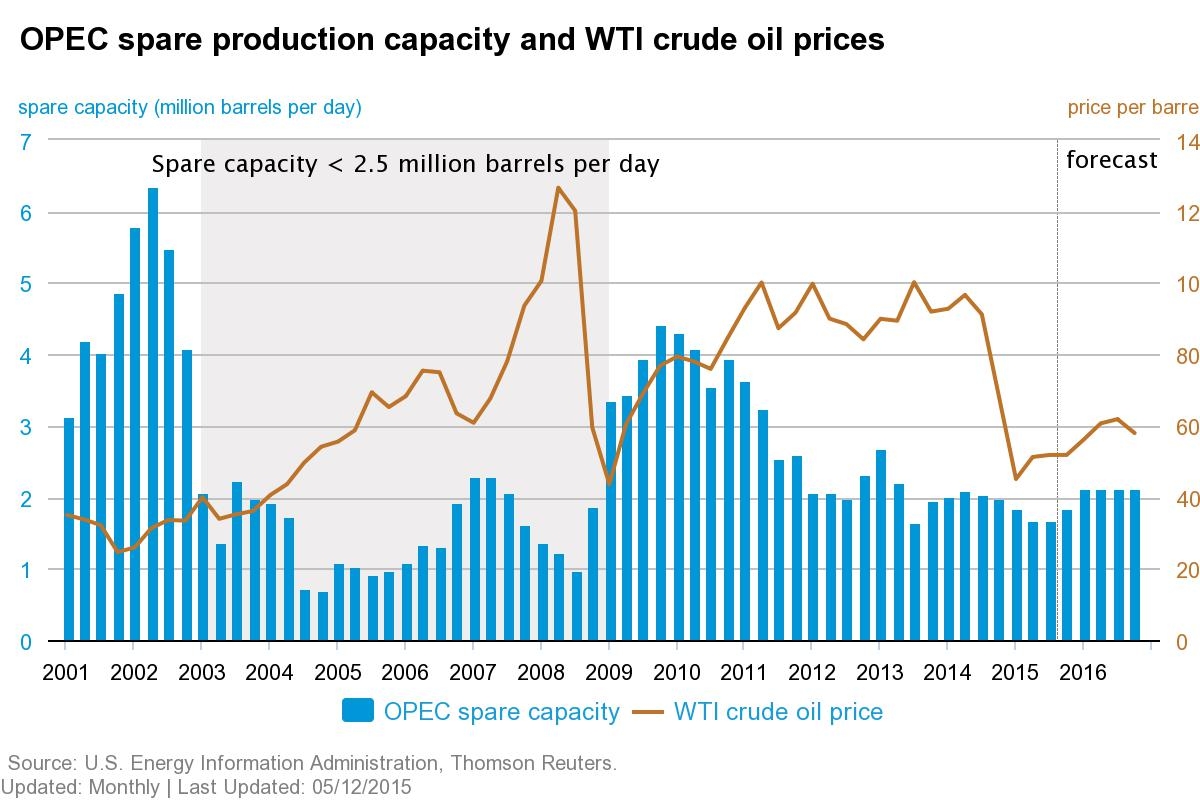

Historically, the major fluctuations in prices have usually been beyond the control of OPEC and were the result of geopolitical conflicts, regional wars or speculative financial activity in paper oil on futures markets. But, the current collapse is simply one of oversupply in the market which would have previously been dealt with by the OPEC swing producer, Saudi Arabia, reining in its own production. The current oversupply has been like a virtual oil tsunami stemming from the non-OPEC producers and, specifically, the US shale oil producers who in 2011 expected economic recovery and a growth in world oil demand. Just three years ago in early 2012 much of the debate was about a tight market with little spare capacity. Today, after the spectacular growth in US shale oil output there is a glut with the price unexpectedly falling some 50% within a year. OPEC countries are not the culprits but are the victims suffering a collapse in revenues and now seem reluctant to give up even more market share.

An economy dependant on a single raw material

Oil for the countries of OPEC has been pivotal in their economic and political development, but it is also a crucial tool in their diplomatic relations between themselves and with the oil consuming nations of the East and West. Increasingly, the majority of the OPEC members have become single commodity dependent economies at a time when they are losing their market power and are now suffering more than others as their fiscal revenues collapse as the oil price tumbles. Back in 1973 OPEC produced 29.3mbd of crude oil. Today, that figure remains bizarrely virtually unchanged at 30.1mbd having fallen to 26.4mbd in 2009. Back in 1973 OPEC had nearly 60% of the market today due to rise of non-OPEC producers that share has fallen to 30% to about one third of the market in 2015. 30mbd of a market of some 93mbd means OPEC can no longer play the role of price maker but has in reality become a price taker. Dr Fadhil Chaladi whose seminal work on OPEC, Oil Policies, Oil Myths (2010) dispels the myth of the market power of OPEC and who would argue that OPEC never acted as a true cartel but fixed price at the behest of the US and western governments. So, far from acting as an oligopolistic cartel OPEC has failed to maintain its market share by allowing self-defeating pricing and production policies to reduce its influence on the market. It has let prices rise at the behest of its competitors, the high cost non OPEC oil producers such as the USA, leading to the development of expensive offshore oil fields such as the North Sea, Gulf of Mexico and Brazil. Expensive capital intensive onshore fields like the Canadian tar sands and more recently the US shale oil and gas fields have now come on stream recovering their capital set up costs while the low cost Middle Eastern fields remain neglected and underdeveloped as high prices and increasing revenues have been, until now, sufficient to meet their fiscal requirements. OPEC lost its market power by allowing new entrants into the market and failed to develop its own low cost supply. Failure to follow oligopoly economic theory has led to a market where there are now more than a few suppliers. Oil has been found around the world from Africa to Asia, South America to the Arctic new fields have come on stream or have been proposed. New technologies have rejuvenated old oil fields and made possible development of the US shale oil and gas revolution. Meanwhile George Bush Snr. and the American administrations that followed him have nearly achieved his goal of energy self-sufficiency and never having to rely upon oil from the Middle East. To add to their woes OPEC members have lost further market power by becoming the victims of their own economic development by failing to predict the rapid growth in their home energy demands. Saudi Arabia, Kuwait and the UAE have been involved in dash for gas policies and increased investment to boost their production capacity in gas and oil to meet home demand and also to raise their export potential further. Too little too late seems to be the maxim as OPEC has witnessed its own death as its market power diminishes.

The New Oil Market

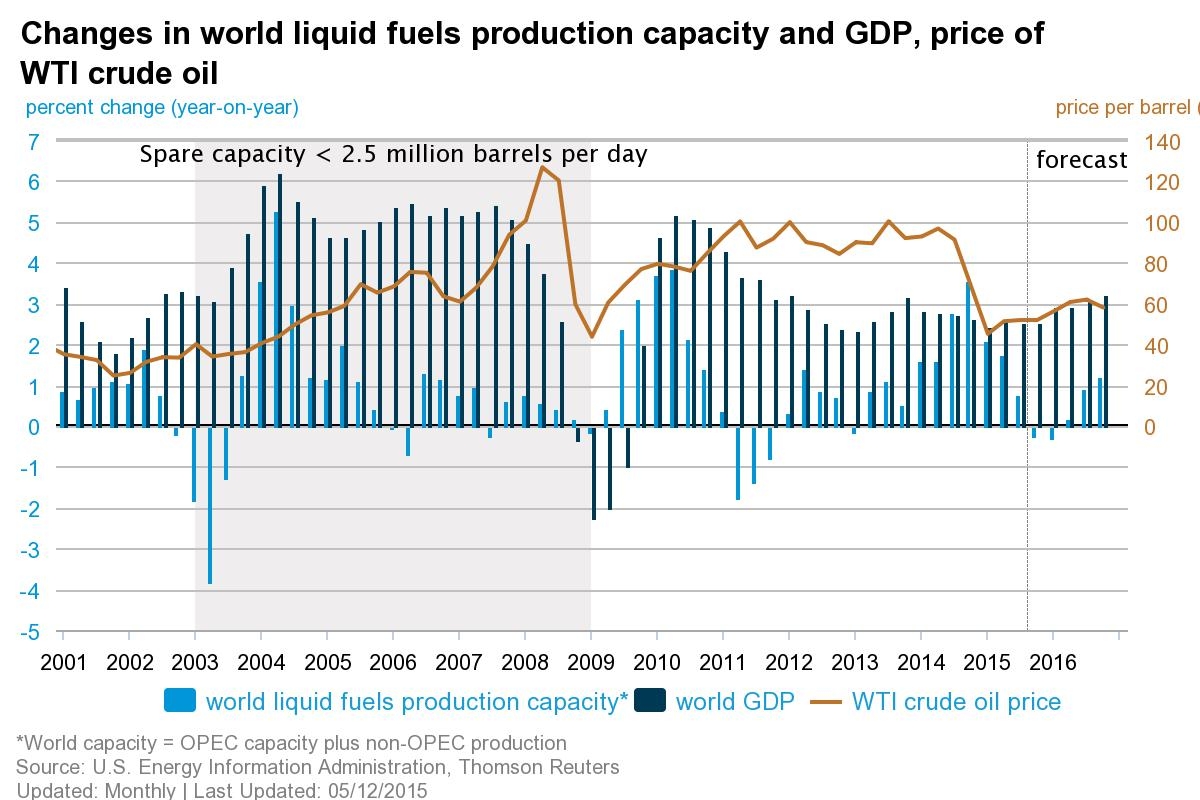

As OPEC output has remained around 30mbd for the past 40 years demand has continued to rise from 55mbd in 1973 to over 90mbd today. Supply has kept up with demand and more recently the pace of oil production growth has raced ahead of the growth rate in demand as the non-OPEC producers raise their output. Both Russia and the US produce more than 10mbd each. The US production reached 11mbd in 2014 and is expected to reach 13mbd usurping Saudi Arabia as the number one oil producer. Its crude oil production increased by 16.2% (1.4mbd) in 2014 the largest ever increase since 1940. The rapid development of unconventional shale oil and gas has been spectacular economic success story unleashing a virtual tidal wave of oil onto the market. The world’s largest oil consumer has seen imports fall to 7mbd of crude and 2mbd of oil products while export of crude remain prohibited by law its exports of oil products is racing towards 5mbd. Since 2010 some 3mbd of crude once destined for the US is looking for new buyers. The rapid rise of US oil & gas production, falling imports in the country, falling consumption due to energy efficiency measures and the rapid rise in oil products exports have had a significant impact on the market. Canada, Russia and the Caspian Sea producers have all been engaged in increasing production capacity and output has consequently risen taking the non-OPEC production beyond 60% of the market. In 1997 demand for oil stood at 62mbd, peak oil theorists and financial speculators pedalled tales of doom and gloom for the world economy unless energy efficiency could be improved and new sources of energy found as oil would run out soon. The world economy boomed, good steady growth rates were abundant in the developed world whilst spectacular growth rates were experienced in the developing world. Oil demand grew by 50% but oil supply kept on coming as high prices attracted new investment. There was never to be a shortage but the financial collapse and the subsequent economic recession of 2008 was to change the world economic landscape and choke the growth in demand for oil. The oil market stagnated at 90mbd and has only grown by trickle since. Experienced economic commentators and financial speculators who had grown up reading Matthew’s Trade Cycle and Keynes’s theories at university looked upon the recession as yet part of another business cycle of boom and bust. US economic recovery confirmed their expectations as the world’s largest consumer economy came back from the brink in 2011 but unlike previous cycles there seemed to be no multiplier effect upon the rest of the world. Europe lay financially crippled as a two tier Europe emerged with the southern economies crippled by debt and unprecedented unemployment rates condemning a generation to a life of poverty failing to show significant signs of revival. Even historically low interest rates failed to bring back consumer confidence. Western consumers who were so traumatised by the financial collapse of 2008 have opted to reduce their debt burden and only spend cautiously avoiding being tempted by low rate credit offerings. Consumers have a mind-set of once bitten twice shy which has been fuelled by the austerity economic policies of many western governments. If the government is reducing its debt burden so should we is the new philosophy of consumerism as our grandparents were right to tell us only spend what you earn. This failure to revive consumer confidence has damaged the growth rates of export led economies of South East Asia and in particular China. One might have expected a slowdown in economic growth rates as the China economy develops but the recent slowdown reflects upon the failure of Europe to significantly recover and now the US recovery seems to be faltering as even low oil prices seem unable to boost consumer confidence. Company profits may be up and stock markets at record levels but the profitability comes mainly from cutting costs and increasing productivity rather increasing sales to consumers. Only the low cost and a few high priced exclusive retailers win as austerity economics widens the gap between “the haves and the have-nots.” The financial collapse of 2008 still haunts world markets. It created a world economic recession, it did irreparable damage to consumer confidence, traditional economic theories have become obsolete and the threat of deflation and a double dip recession more apparent. Politicians and economic commentators are in the last chance saloon hoping that low oil prices will have the desired multiplier effect upon economic recovery.

An Unregulated Market

For the past twelve months we have witnessed the workings of a free market in oil. OPEC has stood on the sidelines refusing to play ball as the prices collapsed. Geopolitical events in Nigeria, Libya, Iraq, and Yemen have had a minor impact upon price but have failed to stem the downward trend. Speculative revivals based on falling stocks, oil rig counts dropping and economic recovery have boosted some future prices but supply is still growing faster than demand as the recent investment in production capacity building runs its course. Is OPEC capable of playing the game of high price collaboration when the market is so saturated or will it remain a spectator and its members become just another supplier on the free market. Chaladi predicted “the absence of OPEC would cause a reversion to a chaotic free-for-all oil market-which in today’s market conditions, would damage world energy supplies and bring market anarchy.” North American output accounts now for over 15mbd (16% of the world market equal to 50% of OPEC’s output) produced in a free market uncoordinated manner thereby subject to the vagaries of boom/bust cycles that unregulated commodity markets endure and whose economic inefficiency was highlighted by Keynes in the 1920s. It seems unfair to expect OPEC to sacrifice its output when the major players US, Russia & Canada can choose their own course of action even producing more in anticipation of price rises. The US also has the advantage of its shale oil being of better quality than most Arab crude oil thereby commanding a higher price and would rapidly gain market share if crude exports were allowed by the Obama government. Most expert oil market analysts insist that an oil price of around $70 would be a fair price for most, if not all producers. To achieve this in current market conditions would take a 4% reduction in supply which seemingly can only come about by timely intervention in the market or having the boom/bust approach of a chaotic free market run its course which means having shortages and gluts in the market which would undermine economic planning in all markets. Economic stability versus economic chaos seems to be the choice but can intervention be left to a group of now relatively small suppliers who themselves face geopolitical chaos amongst its members. Libya’s oil supply varies by as much as 500,000mbd due to its civil war. If the sanctions against Iran are dropped does it have significant spare production capacity to flood the market? Will Iraq production continue to develop at a rate of knots despite its problems with ISIS in the north and put even more pressure on supply? Will unrest in Nigeria spill over once again into a fight for control of its oil industry? Can Saudi Arabia keep control of the oil supply of its OPEC members when religious bigotry, ethnic unrest and corruption blight the Middle East landscape? The task of regulating and intervening in the market seems to be beyond the capacity of the current OPEC membership. Can OPEC be expected to cut its output from some 30mbd to 26mbd when the International Energy Agency is predicting that the US will increase its crude oil production in 2015 by 8%?

A new regulation for a new OPEC

The case for intervention is strengthened by the rising number of supply and demand variables in the market, which can only increase price instability and uncertainty and create further obstacles to long term capital investment. On the demand side, the continued Eurozone crisis and the economic slowdown in Asia make forecasting demand difficult. The growth in energy efficiency, alternative energy options, the falling price of substitutes and uncertain government energy policies only complicate the matter. The recent unexpected slowdown in the US economy only highlights this dilemma. On the supply side the rapid development of shale oil in the US, potential shale oil fields elsewhere in the world, significant developments in Africa with the discovery of increasing amounts of light crude fields, the rapid growth in oil production from the politically volatile Iraq, civil war in Libya, the possible re-emergence of Iran as a major player all point to uncertainty and likely future oversupply. Since 1960 we have accepted intervention by OPEC acting as a supply regulator usually acting to dampen price rises. The International Energy Agency (IEA) which represents 28 producers has three times intervened in the market the last time in 2011 dumping 60mb at 2mbd per day over 30 days to protect the fragile economic recovery as the Arab spring in Libya threatened supply and fuelled price speculation. The intervention reduced the price by some $9 with more than half of the oil came from the US Strategic Petroleum Reserve. In the past it has been rumoured that OPEC has invited Russia to join but it has acted as an observer at OPEC meeting and declined full membership. The Organization is open to increasing its membership and it therefore seems logical that the IEA and OPEC should either join forces or open up a dialogue over the oversupply. The solution that Keynes would propose would be that of co-ordinating buffer stocks rather than allow a free for all market which is beginning to come to fruition. Saudi Arabia and other OPEC members have offered discounts on long term contracts in Asia securing their market share as they are threatened by non-OPEC producers. There is likely to be no change to OPEC’s output following the comments of Kuwait’s OPEC governor Nawal Al-Fuzaia in February so if we want to see stability rather than the volatility of boom and bust, price wars, and large fiscal deficits in developing nations others will have to join OPEC or act in tandem to regulate the market price and supply. Both OPEC and the IEA have the capacity to stabilize the market by devising a suitable intervention model to achieve their common interest of price stability. Keynes’ case with regard to building up buffer stocks is undeniable and achievable and would reduce price volatility and paper oil speculation. The benefits, to the small oil producers and the crude oil-dependent economies would be the stabilisation of fiscal budgets. Economic planning would be more certain as transportation costs and energy costs would be known. OPEC’s rule created stability, consumers always got their oil, there was cooperation between the producers and the consumers who as Keynes suggested always have common interests but the market changes have already commentators claiming the death of OPEC. If it has died it needs to rise like a phoenix from the ashes and become even bigger than before if we are to be saved from the economic inefficiencies of an unregulated essential commodity market and its subsequent chaos.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Long live the price maker

July 5, 2015