Ever since inflation reared its ugly head, economists have been arguing about whether it is a transitory problem or a structural problem, with some economists going so far as to distinguish between “good” inflation and “bad” inflation. But political scientists think about inflation as it impacts the American voter and in that respect the problem is much clearer. Even if the economists who think inflation will decline this year turn out to be right, the effect on working-class voters may be disastrous for Democrats in the midterm elections.

As inflation keeps rising, the Biden administration cannot ignore what people are experiencing in their daily lives. Overwhelming numbers of Americans list inflation as a big worry. However, as prices rise in the most visible parts of the economy—food, gas and electricity for example—the impact has been different for lower and higher-income Americans. A recent AP-NORC poll found that “half of people in households earning less than $50,000 a year say that price increases have had a major impact on their finances. Only a third of those in households earning more than $50,000 say the same.”

A Gallup poll found similar results. Seventy one percent of households earning less than $40,000 reported that inflation was causing them severe (28%) or moderate (42%) hardship. While only 29% of households earning more than $100,000 reported severe (2%) or moderate (26%) hardship. Finally, 71% of people earning over $100,000 reported that price rises caused them no hardship.

Think of it this way. Some people go through the grocery store adding up the items as they put things in their cart to make sure that they have enough money to pay the bill when they get to the checkout counter. Others simply put the items that they want in their cart without worrying about the total. These are two very different groups. For the former, inflation is a daily source of anxiety, especially in two places most Americans cannot avoid—the gas station and the grocery store. For higher-income Americans, inflation is a cause for concern, but its impact is less serious.

The correlation between income and education is straightforward: college graduates earn more than high school graduates (because exit poll data on income of voters in 2020 is incomplete, but educational attainment is not, we use education as a proxy). It is not surprising that among people with no college education 13% report severe hardship and 40% report moderate hardship because of inflation. For people with a college degree the impact is much less dramatic; only 4% report severe hardship and 26% report moderate hardship.

The people who feel the impact of inflation most are also those who cast critical swing votes in the last two presidential elections, where a wide education gap has opened up between the two parties. Among voters with a B.A. or more, Biden got 61% of the vote, up from Hillary Clinton’s 57% in 2016. This total included 57% of white voters with a college degree or more, 69% of Latinos, and 92% of African Americans. The gap in support for Biden among whites with and without college degrees was 24 points; among Hispanics with and without college degrees, 14 points. By contrast, there was no education gap whatever among Black voters. Voters with incomes under $50,000 are a large group. They made up 38% of the vote in the 2018 midterms and 35% of the vote in 2020.

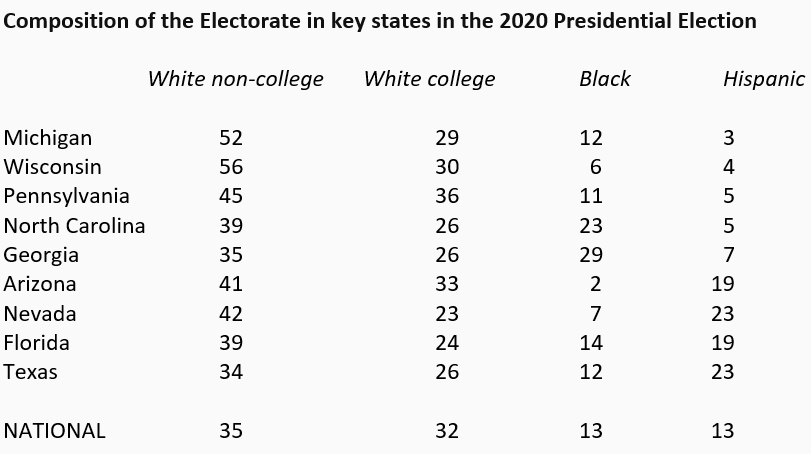

Biden won the 2020 election in part by improving his vote among working class white voters in contested states. In Michigan and Wisconsin, for example, white non-college voters constituted more than half of the electorate (52% and 56%), swamping the number of Black and Hispanic voters in those states. In fact, as the following table shows, white non-college voters outnumber Black and Hispanic voters combined in all but two contested states, Georgia and Texas, where they are about even. Given that not all minority voters, especially Hispanics, vote for Democrats, one can see that to even hope to retain the House and/or Senate, Democrats must cut into the white non-college vote—as Biden did in the 2020 election—while reversing the flight of working-class Hispanics from the Democratic ranks.

These are voters Democrats need. All too often, Democrats’ enthusiasm for expanding social programs blinds them to the concerns of the large number of families who don’t want (and may not benefit from) social programs but who live from paycheck to paycheck and worry about paying their bills.

As President Jimmy Carter found out, inflation, whether temporary or structural, is bad politics, especially when political margins are close. The public will be unforgiving toward a president who appears to be unaware of or indifferent to their top concerns, and right now inflation is one of them. According to a recent poll, 54% of Americans see the pace of price increases as the best measure of how the economy is doing, compared to just 19% who see the unemployment rate as a measure of how the economy is doing.

President Biden must be seen as working as hard to rein in inflation as to enact key economic legislation. He cannot control the Federal Reserve Board, whose actions can affect the demand for goods and services, but he can have an impact on their supply, especially by unclogging the supply chain. Making sure that grocery store shelves are fully stocked would be a good start.

This said, the administration’s political hopes should be modest, at least in the short term. Public beliefs about economic conditions tend to lag well behind changes in these conditions, and it would take a rapid decline in the inflation rate by this spring at the latest to alter the negative public judgments of the administration’s handling of this matter. Besides, it is unlikely that the current inflationary surge will subside quickly; economic history suggests otherwise.

Bringing down the rate of inflation will have a significant political impact on the 2024 presidential election, but the administration would have to get lucky to achieve this result in time for the 2022 midterms.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Inflation politics is clearer than inflation economics

January 14, 2022