Studies in this week’s Hutchins Roundup find that workers in states with wider Medicaid access experience more labor market mobility, low- and middle-income households would lose the most from the removal of government mortgage guarantees, and more.

Higher access to Medicaid in a state leads to better labor market outcomes

Ammar Farooq and Adriana Kugler of Georgetown University find that states that provide wider access than others to public insurance coverage through Medicaid and the State Children’s Health Insurance Program encourage residents to move to riskier but higher paid occupations and industries. Moving from a state at the bottom 10% of states in terms of Medicaid generosity to a state at the top 10% makes a worker 7.6% more likely to change occupation and 7.8% more likely to change industry.

Removing public mortgage guarantees would hurt low- and middle-income households

Pedro Gete and Franco Zecchetto of Georgetown University find that removing guarantees from the mortgage market would hurt low- and middle-income households while benefitting high-income households. They find that removing the guarantees would increase the mortgage interest rate for low- and middle-income households, pushing some of them to become renters. On the contrary, high-income households, who tend to take jumbo mortgage loans – loans too large to be guaranteed by the government, – would benefit from decreased mortgage rates, lower price-to-rent ratios and lower taxes.

Separate classrooms for high-achieving minority students improve their performance

David Card of the University of California, Berkeley, and Laura Giuliano of the University of Miami find that establishing separate classrooms for gifted and high-achieving fourth- and fifth-graders in one large urban school system significantly improves reading and math test scores of the minority students compared to those assigned to regular classrooms, but has no significant effects on white students. The authors find that the quality of teachers or peer effects do not explain much of this. Rather, they attribute it to higher teacher expectations and less of the negative peer pressure that can lead high-ability minority students to under-perform in regular classes.

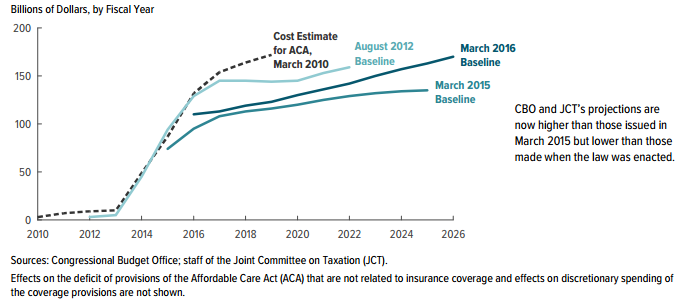

Chart of the week: Net budgetary effects of the Affordable Care Act have been revised

Quote of the week: “[D]evelopments abroad imply that meeting our objectives for employment and inflation will likely require a somewhat lower path for the federal funds rate than was anticipated in December,” says Fed’s Chair Janet Yellen

“… I consider it appropriate for the Committee to proceed cautiously in adjusting policy. This caution is especially warranted because, with the federal funds rate so low, the FOMC’s ability to use conventional monetary policy to respond to economic disturbances is asymmetric. … [I]f the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero. One must be careful, however, not to overstate the asymmetries affecting monetary policy at the moment. Even if the federal funds rate were to return to near zero, the FOMC would still have considerable scope to provide additional accommodation. In particular, we could use the approaches that we and other central banks successfully employed in the wake of the financial crisis to put additional downward pressure on long-term interest rates and so support the economy–specifically, forward guidance about the future path of the federal funds rate and increases in the size or duration of our holdings of long-term securities.”

— Janet Yellen, Chair of the Board of Governors of the Federal Reserve System

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Medicaid, mortgage market guarantees, and more

March 31, 2016