Corporate tax increases reduce employment and income

In an analysis of corporate tax rate changes amongst contiguous counties straddling state borders, Alexander Ljungqvist and Michael Smolyansky of New York University conclude that a 1 percentage point increase in the corporate tax rate reduces employment by between 0.3% and 0.5% and income by between 0.3% and 0.6%. Conversely, corporate tax cuts have no effect during normal economic times, but increase employment by roughly 0.6% per 1 percentage point decrease during times of recession.

Unconventional monetary policy produces stronger spillover effects

Jiaqian Chen, Tommaso Mancini-Griffoli, and Ratna Sahay of the International Monetary Fund argue that asset price and capital flows spillovers from the U.S. to emerging markets are particularly strong during periods of unconventional monetary policy, and are more pronounced in countries with weaker economic conditions. They note that these larger spillovers are likely structural in nature, stemming from the use of new monetary-policy instruments – particularly asset purchases.

Differences in patient characteristics account for roughly half of the geographic variation in Medicare utilization

Using data from Medicare beneficiares who move from one state to another , Amy Finkelstein and Heidi Williams of MIT and Matthew Gentzkow of the University of Chicago find that 40-50 percent of the geographic variation in Medicare utilization can be explained by the characteristics of the patient demand, particularly differences in patient health. The remaining 50-60 percent is attributable to place-specific factors, such as doctor practice patterns.

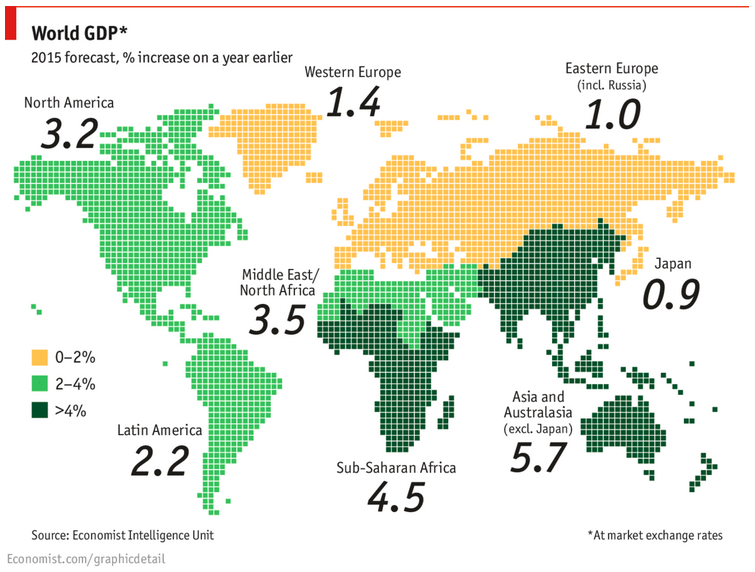

Chart of the week: Economist Intelligence Unit projects 2.9% global economic growth in 2015

Speech of the week—Draghi: Fulfilling obligations “not a national peculiarity of the Germans”

You are under immense pressure. Europe is looking to you, the heads of state or government, as well as the general public and industry. Do you like such challenges, or do you tend rather to suffer under them?

Mario Draghi: It is important for anybody who has responsibility to be aware of the obligations entailed. That accompanies me through the day. That is what gives me strength.

That sounds very Prussian for an Italian.

MD: I believe that fulfilling one’s obligations is not a national peculiarity of the Germans.

–Mario Draghi, President, European Central Bank

If you haven’t already registered, be sure to join us on Wednesday, January 14 at 10:30 a.m. for The Global Financial Crisis: Lessons From History with the University of California, Berkeley’s Barry Eichengreen, and on Friday, January 16 at 9:00 a.m. for The Eurozone: Now What? A Conversation with Lucrezia Reichlin, professor of economics at the London Business School.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Corporate Taxes, Monetary Policy Spillovers, and More

January 8, 2015