What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Contractionary policy shocks strongly affect distressed firms

Since the Federal Reserve began raising interest rates to rein in inflation in March 2022, the number of distressed firms in the economy – firms with a high probability of default – has risen sharply. Using quarterly firm-level data from Compustat, Ander Perez-Orive and Yannick Timmer of the Federal Reserve Board show that contractionary monetary policy shocks reduce investment, borrowing, and employment more for distressed firms than other firms. For instance, they find that distressed firms reduce their total investment by approximately 3.7% two years after a one standard deviation contractionary monetary policy shock, while healthy firms show no statistically significant changes. With the current share of distressed firms at around 37 percent, the authors estimate that the recent policy tightening is likely to have larger effects on aggregative activity than in most tightening episodes since the late 1970s, with the effects most likely to be noticeable in 2023 and 2024.

Urban wage premium decreases even as urban-rural earnings gap persists

The earnings gap between urban and rural workers fell between 1940 and 1980 but has increased substantially since then. Using Census data, Kyle Butts and Taylor Jaworski of the University of Colorado and Carl Kitchens of Florida State find that the reasons for the urban-rural wage gap have changed over time. The average urban worker was making over 30% more than the average rural worker in both 1940 and 2010, but this measure overstates the earnings gap because urban and rural workers are often employed at different jobs. After controlling for job titles and qualifications, the “urban wage premium” has been decreasing steadily over time, from 12% in 1940 to 5% in 2010. The authors argue that the relative importance of job sorting has gone up over time, as the movement of highly educated workers to urban areas now explains more than 75% of the urban-rural earnings gap, but only explained 50%-60% of the earnings gap between 1940 and 1980.

Online banks pass through federal fund rate increases to customers

Isil Erel of Ohio State and coauthors found that in 2022, online banks passed through a larger proportion of increases in the Federal Reserve’s key short-term rate than their brick and mortar counterparts. In response to a 1 percentage point increase in the Federal funds rate, online banks raised yields on deposit accounts by roughly 0.30 percentage points more than traditional banks. Consequently, online banks saw a net inflow of interest-bearing deposits while traditional banks experienced outflows. This finding persisted even after controlling for banks’ customer demographics, size, market power, and lending capacity. The growing popularity of online banks, the authors conclude, will likely continue to increase the extent that monetary policy passes through to bank depositors.

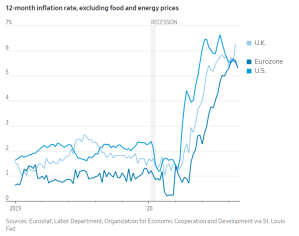

Chart of the week: Core inflation falling in Eurozone and US but rising in UK

Chart courtesy of The Wall Street Journal

Quote of the week:

“Many of the problems we have seen at these banks—interest rate risk, liquidity risk, poor risk management—are not caused by any evolution in banking. These bank failures and recent stress in the banking system have highlighted key deficiencies in risk management practices, and key deficiencies in supervisory priorities. The Federal Reserve and other banking agencies have been trying to determine what more can be done to respond to the recent stress, but we also need to reflect on how reform efforts can lead to the best results, while minimizing unintended consequences,” said Michelle Bowman, member of the Federal Reserve Board of Governors.

“…A real concern is whether regulatory reform could have the unintended consequence of hollowing out the mid-sized tier of banks, effectively preventing the largest banks from facing new competition. If we believe in the virtue of competition as a way to spur innovation and improve customer choice, we need to be cautious about less risk-sensitive regulatory and supervisory expectations. If we were to apply some of the same heightened standards for banks with $50 billion or $100 billion in assets as we have for banks with trillions of dollars in assets, this inevitably would create pressure to merge to create economies of scale to lessen the cost of regulatory compliance, resulting in further bank consolidation. By doing so, we would eliminate the current dynamic banking system that incorporates institutions regulated in tiers. We would prevent the next large bank from growing to be a viable competitor, and essentially permanently and officially designate a handful of banks as “too big to fail,” despite years of policymaker efforts fighting against the perceived government guarantee of only the largest banks. Our goal should not be to create a “barbell” of banking institutions based on size, with a small number of too-big-to-fail banks at the large end of the spectrum, and some smaller community banks at the low end.”

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Contractionary policy shocks, urban wage premium, and more

June 29, 2023