What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

The expanded child tax credit boosted household and child-related spending

In 2021, the American Rescue Plan (ARP) temporarily increased annual child tax credit amounts from $2,000 per child to $3,000 for children ages 6 to 17 and $3,600 for children under 6, made it fully refundable, and dispersed credits monthly. Using data from the Consumer Expenditure Interview survey, Jake Schild of the Bureau of Labor Statistics and co-authors find that families spent 75% of the expanded payment on average, and mainly on necessities: for every $100 of the credit, families spent $28 on food, $31 on housing, and $15 on child-related goods and services. Lower-income households spent a larger share of the credit, around 85%. Transfer programs like the child tax credit improve long-term child outcomes by reducing family stress and increasing family investment in child well-being, the authors say. The expanded ARP tax credit offered these benefits to families previously excluded from the 2017 child tax credit.

Clean air health benefits of German cash for clunkers program exceeded its costs

Ines Helm of the University of Munich and Nicolas Koch and Alexander Rohlf of the Mercator Institute on Global Commons and Climate Change study the air quality improvements from a 2009 German cash for clunkers scheme by comparing air quality changes in regions with more clunkers – cars older than nine years – to those with fewer clunkers. They found that the scheme increased the number of cars scrapped and new cars bought. While some of the purchases were “pulled forward” from future years – that is, the individuals trading in their cars would have done so soon, anyway – many were not, resulting in the rejuvenation of the German car fleet. The policy led to a 7% average reduction in nitrous oxide emissions relative to 2008 and modest but statistically insignificant reductions PM10 pollution. The authors estimate that the health and mortality benefits of the reduced nitrous oxide emissions alone exceeded the €5-billion price of the policy, with the greatest benefits accruing to inhabitants of urban areas.

Stock returns are likely to slow in the future

The exceptional stock market gains over the past three decades are to continue, says Michael Smolyansky of the Federal Reserve Board. The increase in stock prices between 1989 and 2019 was largely due to a reduction in interest expenses and corporate tax rates, he finds. Lower interest rates and corporate tax rates explain over 40% of the real growth in corporate profits. Further, the decline in risk-free rates fully explains the rise in price-to-earnings (P/E) multiples over this time period. Stock price growth must come from either earnings growth or an expansion in P/E multiples. Because interest and tax rates are unlikely to continue falling, profits and stock prices are likely to rise more slowly in the future than they have in the past few decades, the author concludes.

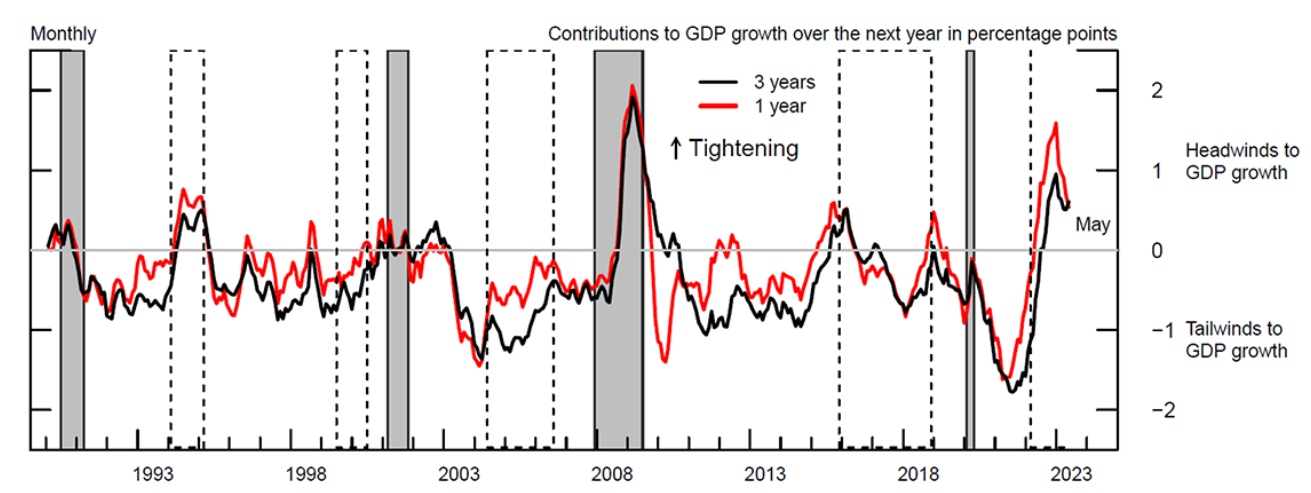

Chart of the week: New Fed index shows recent easing of financial conditions

Chart courtesy of Federal Reserve Board

Quote of the week

“[T]he second phase of the inflation process is now starting to become stronger. Workers have so far lost out from the inflation shock, seeing large real wage declines, which is triggering a sustained wage ‘catch-up’ process as they try to recover their losses… And since wage bargaining in many European countries is multi-annual and inertial, this process will naturally play out over several years… While this ‘catch-up’ has long been factored into our inflation outlook, the effect on inflation from rising wages has recently been amplified by lower productivity growth than we had previously projected, which is leading to higher unit labor costs. Alongside past upward surprises, this is a key reason why we recently revised up our projections for core inflation, even though our expectations for wages remained broadly the same,” said Christine Lagarde, president of the European Central Bank.

“Two features of the current business cycle are contributing to this dynamic – and both could linger, too. The first is the resilience of employment relative to GDP growth. Typically, we would have expected slowing economic growth over the last year to have somewhat reduced employment growth. But for the last three quarters in particular, the labour market has been performing better than an ‘Okun’s law’-based regularity would suggest…. The second feature contributing to weaker aggregate productivity is the composition of employment growth, which is concentrated in sectors with structurally low productivity growth. Since the pandemic, employment has grown most in construction and the public sector, both of which have seen a decline in productivity, and in services, which has seen only meager productivity growth. These trends could also persist in some of these sectors over the next few years given the relative weakness of manufacturing and long-term shifts towards employment in services. All this means that we will face several years of rising nominal wages, with unit labor cost pressures exacerbated by subdued productivity growth.”

-

Acknowledgements and disclosures

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Child Tax Credit, cash for clunkers, and more

July 6, 2023