Americans are moving to areas with higher climate risk. Over the past 20 years, counties and neighborhoods at high risk of extreme heat, droughts, wildfires, and floods have seen notably faster population growth than low-risk locations. These migration patterns reflect a variety of reasons—including the appeal of oceans and mountains and the desire to escape expensive housing markets. The pandemic accelerated these trends, with more people moving away from high-cost, relatively low-risk cities like New York and San Francisco to cheaper but higher-risk areas, like suburban Phoenix and coastal Florida. This can make it hard to disentangle the role of climate risk in households’ location choices.

Official statistics often focus on the aggregate economic costs of natural disasters, but physical damage to homes and neighborhoods is becoming increasingly salient to U.S. households. The Federal Reserve Board’s Survey of Household Economics and Decisionmaking finds that 16% of adults reported some disruption from a natural disaster in the previous 12 months, with property damage the most cited category of harm (see figure 1).

Households can reduce their physical and financial exposure to climate risk in a variety of ways, such as moving to safer locations, renovating their homes, or purchasing disaster insurance. But most Americans are not pursuing these strategies—at least, not yet. For policymakers, this raises the question: how can they encourage households, communities, and the real estate industry to reduce Americans’ collective exposure to climate risk so communities do not just survive, but thrive?

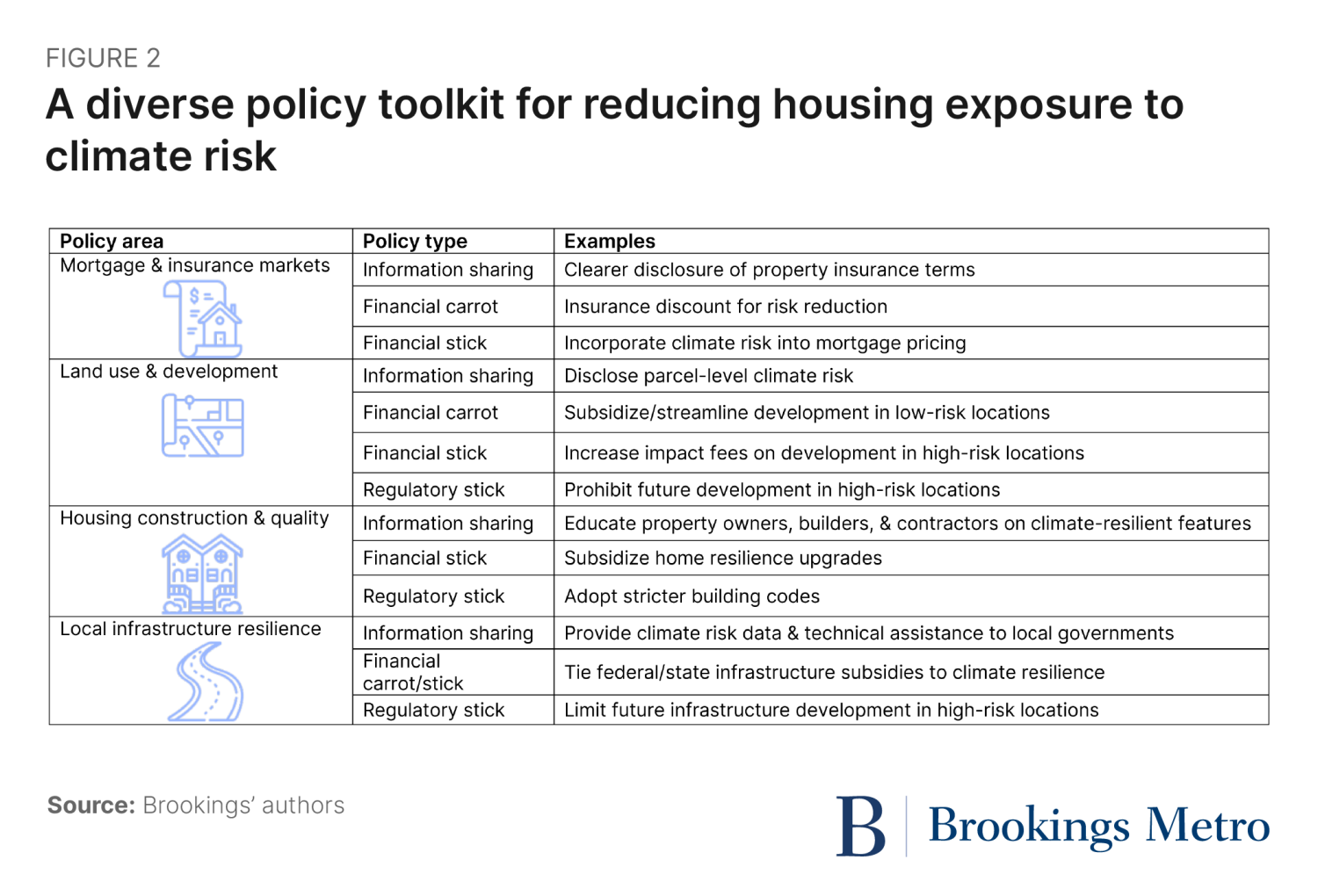

The goal of this research brief is to illustrate the wide range of policy tools that can nudge people to lower-risk housing choices. We focus on four distinct policy domains (see figure 2): mortgage and insurance markets, land use and development, construction quality, and local infrastructure resilience.

Within each policy domain, there are opportunities for federal, state, and local governments, as well as private sector firms and civic groups. The federal government plays a primary role in regulating mortgage markets and providing infrastructure finance, while state governments regulate property insurance markets, and local governments oversee land use. When considering new policy tools, determining how to allocate responsibility for funding, implementation, and enforcement across federal, state, and local agencies is a complicated and important question. Private-sector developers, contractors, real estate agents, and landlords work within the rules created by governments to build, retrofit, sell, and rent homes—responding in predictable ways to financial incentives and constraints.

As discussed in detail below, interventions range from low-cost, light-touch “nudges” (such as better information disclosure) to financial carrots (including tax incentives for home upgrades) to heftier regulatory sticks (like prohibiting development in high-risk locations). It is worth noting that the phrasing light-touch nudges refers to the intended effect on households (efforts to provide them with more options without creating obligations)—not that these levers are politically or technically simple.

Each of the tools presents complex questions about optimal policy design and implementation, questions that have important implications for such measures’ effectiveness and equity. For example, whether more resilient building codes should be only forward-looking or retroactive greatly impacts the number of homes affected, as well as who bears the cost of implementation. The goal of this piece is not to get into the weeds of policy design, but rather to illustrate the range of options. The breadth and depth of this policy toolkit creates political and financial opportunities: policymakers can start deploying the cheaper and/or less controversial levers sooner while building political support and finding resources for the bigger interventions.

Incorporate climate risks into mortgage prices and property insurance

Mortgage lenders and insurance companies share in the financial costs of natural disasters: property owners request payouts from their homeowners’ insurance to repair damage, while mortgage lenders see higher rates of delinquency and pre-payment following disasters. Therefore, in well-functioning markets, mortgage lenders and property insurers should charge higher rates for homes in climate-risky locations.

In practice, the federal government tightly regulates interest rates and fees for mortgages, while state governments determine pricing and availability for property insurance. To date, private firms have a limited ability to vary prices based on geographic differences in risk due to regulations: people who live in low-risk locations are overpaying for these services relative to their true risk, providing an implicit subsidy to people living in high-risk locations. One indicator of this problem is that major insurance companies are no longer issuing new policies to homeowners in states like California and Florida, following multiple years of heavy payouts.

An example of a light-touch intervention that could discourage people from moving to high-risk locations—or at least convince those that do so to be more prepared for disasters—would be requiring lenders and insurers to provide clearer disclosures of both risks and coverage limitations before people purchase homes. Currently, consumers have little information on localized climate risks, such as the expected probability of flooding or wildfire—information that insurers do have. Additionally, consumers often do not understand what property insurance policies cover; for instance, standard policies exclude damage from floods and earthquakes. Following the 2007–2008 foreclosure crisis, federal regulators implemented standardized mortgage disclosure forms to help borrowers understand key terms. Adopting a similar approach for climate risk could be useful.

Potential financial carrots could include offering insurance discounts for property owners—homeowners as well as landlords—who undertake physical risk reduction strategies (discussed below). Public insurance and disaster recovery programs, like the National Flood Insurance Program and Community Development Block Grant Disaster Recovery, should encourage proactive resilience strategies before disasters hit, rather than reactive efforts afterwards.

Heavier financial sticks could include incorporating climate risk–based pricing into mortgages. Lenders could charge higher interest rates and fees for homes in high-risk locations, or require larger down payments. Because most mortgages are underwritten by federally regulated entities (like Fannie Mae, Freddie Mac, and the Federal Housing Agency), implementing climate risk–based pricing would likely require approval from the Federal Housing Finance Agency and/or Congress.

Design land use and development policies to discourage building homes in high-risk locations

State and local governments have a suite of tools that regulate where homes and businesses can be developed. Land use plans, zoning codes, subdivision rules, and related regulations determine which type of structures can be built in which locations, including the approval process for issuing building permits.

A light-touch intervention would be developing consistent rules requiring land owners and/or local governments to disclose climate risks to potential buyers or developers before land parcels can be sold, leased, or developed. Currently, these rules vary across states and localities.

Local and state governments could create a schedule of property taxes and impact fees designed to discourage people from buying or building homes in high-risk locations. For instance, homes in wildfire-prone areas should pay higher taxes to help cover the costs of fire prevention—a cost that local, state, and regional governments often share. Related taxes like user fees for water and sewage should also reflect local variations in climate risk, including in expected future water stress. Higher fees in risky areas serve two purposes: they encourage price-sensitive households to choose safer locations, and they also provide local governments with more revenue to upgrade the climate resilience of infrastructure.

A heavier regulatory stick would be to use zoning and related land use regulations to prohibit development altogether in high-risk locations. While many states and localities require some type of environmental impact review as a prerequisite for building homes, these reviews have failed to curb development in many high-risk locations.

Current regulatory regimes have accomplished just the opposite: excessively strict zoning in relatively safe infill locations often pushes new developments toward riskier, more resource-intensive locations on the fringes of urban areas. Local and state governments should streamline development processes in climate-safe infill locations to reverse this trend.

Managed buyouts to relocate existing residents are politically controversial and quite expensive, but they should be part of the conversation. Current federal and state programs are mostly voluntary. State programs in the greater New York area following Hurricane Sandy took a more decisive approach.

Finding a balance between building enough homes to accommodate population and job growth while reducing exposure to climate risk will not be easy, but both sides of the equation are critical for people’s well-being. Land use policies must curb development in high-risk areas while allowing for higher-intensity residential and commercial development in low-risk areas, especially in regions that already face housing shortages. This type of regional coordination between localities with different localized climate risks may necessitate state government involvement.

Encourage climate-resilient construction techniques and materials for new and existing homes

The nation’s housing stock is aging and was not built to withstand current and future climate stress. The median U.S. home is 40 years old (see figure 3); older homes are less energy efficient, have higher maintenance costs, and typically do not meet current building code standards. Certain construction materials and techniques offer households in high-risk locations more protection from catastrophic damage during climate events. Many states have adopted more stringent building codes over time to address climate resilience; Florida, for instance, now requires wind-resistant roofs and windows. Retrofitting older homes to provide safety and comfort as regional climates change will be essential. For instance, many homes in the Pacific Northwest were built without air conditioning—an increasingly urgent health need as summers get hotter.

Encouraging homeowners and landlords to make existing homes more climate resilient will require better information and some financial support. Federal, state, and local agencies, as well as the private construction industry, could do a better job proactively sharing information with property owners on what building features offer protection against certain types of climate risks, as well as the cost-effectiveness of those upgrades. While affluent homeowners may be able to pay for these upgrades with savings or by tapping into home equity, moderate-income homeowners and small-scale landlords may require subsidies to undertake these upgrades. State and local governments should incorporate cost-effective safety features into revised building codes for new housing. Federal and state governments could provide clearer guidance on which building code features address specific types of climate risks. The most stringent and expensive form of intervention would be to make new building codes retroactive to existing homes—as Los Angeles has done with seismic retrofits.

Make neighborhood infrastructure more resilient

Residential communities rely on a network of physical, economic, and social infrastructure: streets, sidewalks, public transportation, water and sewage systems, parks, schools, and libraries. Much of this existing infrastructure is aging and ill-equipped for climate stresses, from heavy rainfall that overwhelms stormwater management systems to bus shelters that lack shade to protect riders from extreme heat. Local and regional governments as well as corporations that own or operate infrastructure assets (such as utilities and telecommunications companies) will have to make hard decisions about where to invest in upgrading or expanding infrastructure—and where not to invest. They should also consider how routine maintenance of such systems improves, or hinders, performance under climate stresses (such as trash-clogged stormwater drains). These decisions should also reflect localized climate risks to help coordinate with households’ and developers’ actions.

Some local and regional governments are starting to incorporate granular data on climate risk into their capital planning and investment decisions. Federal and state agencies can help share these data more widely, along with guidance and technical assistance on how to use it. Information alone will not solve the problem: many resource-constrained localities will need state and federal assistance to help pay for needed resilience upgrades.

Infrastructure investments can also be a powerful stick to nudge people away from high-risk locations: if localities do not build or grant permission for new roads, water pipes, and sewer connections in flood- and fire-prone areas, then developers cannot build homes there either. States like Arizona are already grappling with the need to curb exurban growth because of projected water shortages. For localities that have traditionally relied on impact fees and housing growth to increase their tax base, saying no to risky development will be politically controversial. Federal and state governments can provide political cover to localities, and save taxpayers money, by withholding matching funds from localities that allow development in high-risk places.

Develop effective, equitable strategies to make homes and neighborhoods safer with careful planning

Persuading Americans to move away from, rather than toward, climate risk will require sustained, coordinated efforts across all levels of government and in multiple policy domains. In this research brief, we have sketched a broad outline of ways to nudge people toward climate safety through better information sharing, fiscal carrots and sticks, and more stringent regulations. Policymakers and researchers working on these problems should keep in mind four important caveats.

First, the details of policy design and implementation are important. Local governments and civic groups vary widely in their financial resources, staff capacity, and technical expertise to undertake climate-resilient investments; designing policies that are realistic about local capacity will be essential to successful implementation.

Second, interventions in all four policy domains—mortgage and insurance markets, land use, building quality, and infrastructure—have potentially complicated implications for equity. For example, disclosing climate risk protects people who are considering moving into high-risk areas, but doing so will likely lower housing prices, decreasing the wealth of long-term homeowners who cannot easily relocate. Policymakers should consider equity implications and develop a strategy to help vulnerable people and communities before making decisions.

Third, further research and experimentation is still needed in several key areas to help with policy design and implementation. In the area of information disclosure for example, experts do not yet know how to share complex and potentially alarming information in ways that people can digest and turn into productive actions. In future briefs, we will develop a research agenda to inform related policy decisions.

Fourth, achieving these policy goals will take time. Developing new policies and revising regulations can be a slow process, and the benefits of redirected capital investments will not be fully apparent for years. This reality provides all the more reason to start developing thoughtful risk-reduction strategies immediately.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

How to nudge Americans to reduce their housing exposure to climate risks

July 27, 2023