Abstract

This paper re-examines government debt management policy in light of the U.S. experience with extraordinary fiscal and monetary policies since 2008.

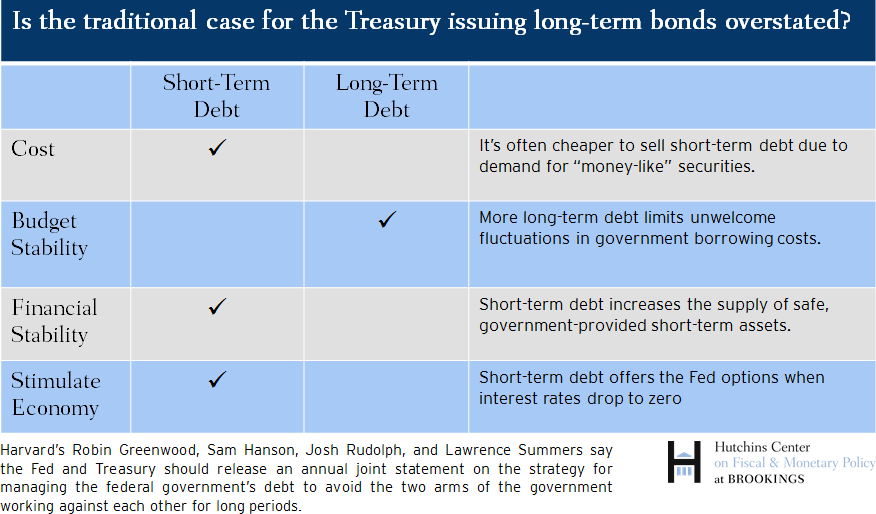

We first document that the Treasury’s decision to lengthen the average maturity of the debt has partially offset the Federal Reserve’s attempts to reduce the supply of long-term bonds held by private investors through its policy of quantitative easing. We then examine the appropriate debt management policy for the consolidated government. We argue that traditional considerations favoring longer-term debt may be overstated, and suggest that there are several advantages to issuing greater quantities of short-term debt.

Under current institutional arrangements, neither the Federal Reserve nor the Treasury is caused to view debt management policy on the basis of the overall national interest. We suggest revised institutional arrangements to promote greater cooperation between the Treasury and the Federal Reserve in setting debt management policy. This is particularly important when conventional monetary policy becomes constrained by the zero lower bound, leaving debt management as one of the few policy levers to support aggregate demand.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).