Since January, when he announced his goal of doubling U.S. exports within five years, President Obama has argued that increasing exports is key to lifting our economy out of the doldrums. As he put it this summer, “Ninety-five percent of the world’s customers and fastest-growing markets are beyond our borders.” But the recent news that, after more than a year of growth, American exports declined in June (as countries such as Germany saw their exports surge) has some wondering how well “Made in the USA” can still sell overseas. Will we be stuck forever selling less and buying more? Not necessarily: Many widespread assumptions about what the United States sells, and to whom, are wrong.

1. Exports have been a shrinking share of the economy.

Given our sizable trade deficit, many people assume that we must be selling less to the rest of the world than we once did. This is not true. Despite the drop in June, U.S. exports grew 14.1 percent from the second quarter of 2009 to the second quarter of 2010, a pace far outstripping the 3 percent growth of the economy overall. In fact, the share of our economy devoted to exports has been growing continuously since its modern low during the Great Depression. Exports now account for roughly 12 percent of GDP, up from 3 percent in the 1930s.

Yet it’s true that we should increase our exports. We still buy more than we sell. And compared with other countries, our exports make up a small segment of our economy. Moreover, recent census data show that most U.S. businesses are focused solely on the domestic market: Only 1 percent of them are exporters.

Our relatively low export levels represent a lost economic opportunity. While domestic consumers struggle with unemployment and debt, demand in many other countries is booming, and that demand could be translated into U.S. job growth. The metropolitan areas that enjoyed the fastest increases in exports from 2003 to 2008 — places such as Wichita, Houston and Portland, Ore. — experienced rapid growth in export-related jobs during that period.

2. Exports come only in boxes.

Although the word “exports” conjures images of gantry cranes and shipping containers, it actually encompasses all purchases of U.S. products by foreign residents. Our exports include not only manufactured objects but also services and intellectual property. Indeed, services account for roughly a third of all U.S. exports, and this share has been growing.

In 2008, the United States exported more than $500 billion in commercial services. The largest segment of these — $113 billion worth — was business, professional and technical services, including management and consulting, research and development, and computer services. Our other service exports include travel and tourism (the services we sell to international tourists, from restaurant meals to hotel stays, count as exports, even though they are enjoyed on U.S. soil), financial services, and Hollywood films.

And when foreigners pay licensing fees or royalties to use intellectual property that has been patented or trademarked by an American individual or company, they’re buying American exports, too. If, for example, a pharmaceutical company in Sweden wants to make a drug invented in New York, a U.S. company can license its intellectual property for a fee. Payments such as these amounted to $91.6 billion in exports in 2008.

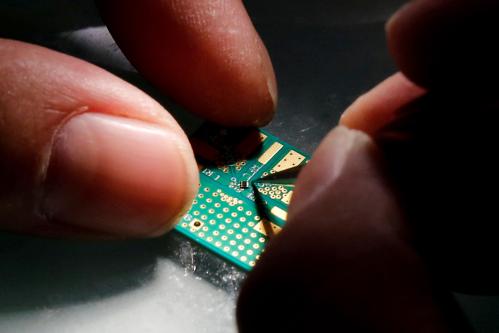

3. U.S. exports are no longer internationally competitive.

With so much emphasis on the decline of American manufacturing (we were once the world’s top exporter), many people don’t realize that the United States ranks third in the world in merchandise exports, just behind Germany and China, according to the World Trade Organization. Certain industries that specialize in high-value exports (integrated circuits, say, or other electronic components) are particularly strong. Exports of transportation equipment, to take another example, grew by 10.6 percent between 2003 and 2008, outpacing the growth in transportation imports.

Once services are added to the calculation, the United States exports a higher value of products than any other country in the world — $1.5 trillion in 2009, compared with Germany’s $1.3 trillion and China’s $1.3 trillion.

Although exports make up a smaller share of our economy than in export-oriented Germany and China, our strength in high-quality services and high-value goods shows that we can compete in the fields where innovation matters most. The U.S. metropolitan areas with the highest rates of innovation (as measured by the number of patents issued per worker) are also the most export-oriented. Moreover, we have found that for every $1 billion in exports by a given industry in a given metropolitan area, wages in that industry in that area increase 2 percent over the wages paid to other workers in the region, regardless of workers’ education levels. This belies the notion — as does Germany’s success — that only low-wage workers can produce goods for the world.

4. Trade with developing countries eliminates jobs for U.S. workers.

In fact, the rise of developing countries has created a substantial number of jobs in the United States. In research we conducted with our Brookings Institution colleague Emilia Istrate, we found that from 2003 to 2008, the value of U.S. exports to Brazil, India and China doubled in inflation-adjusted dollars, accounting for 8.8 percent of U.S. exports in 2008. Put another way, our exports to these countries increased 121 percent over that time period, compared with a 46 percent increase in U.S. exports overall.

Brazil, India and China are increasingly buying American. And as their economic development continues, it will continue to increase demand for U.S. exports. The International Monetary Fund predicts that these three countries will together account for more than 25 percent of world GDP in just five years’ time. This represents an enormous opportunity for American businesses.

Economic theory holds that trade between rich and poor countries raises the wages of low-skilled workers in poor countries but lowers them in rich countries, and there is some evidence that trade between the United States and developing nations reduces the wages of low-skilled U.S. workers and increases their chances of job loss. For this reason, as our economy benefits from increased trade with such countries, we should fund more aggressive and comprehensive unemployment insurance and retraining programs. According to economists at the Peterson Institute, the United States spends less than 1 percent of its annual gains from trade on such “trade adjustment assistance.” Given how much trade is benefiting our economy, that figure should be higher.

5. U.S. exports won’t increase until other countries “play by the rules.”

Politicians frequently complain that other countries aren’t “playing by the rules” when it comes to free trade. What they mean, typically, is that these countries are manipulating their currencies, imposing high tariffs on U.S. products and subsidizing industries that compete with U.S. companies — all of which undercut American exports.

Certainly, these tactics can hurt us. Trade analysts at the Peterson Institute have found that countries such as China, and to a lesser extent Singapore, Taiwan and Switzerland, have undervalued their currencies. This acts like a tax on U.S. exports, making our products more expensive to their citizens. And when foreign governments offer their businesses low-interest loans and direct subsidies, U.S. companies are put at a disadvantage.

But other countries don’t deserve all the blame for the fact that we don’t export more. We have many ways of boosting exports, and we don’t exploit all of them. Innovation, infrastructure and education policy all fundamentally affect the competitiveness of U.S. businesses. Our leaders would do well to study the strategies of cities such as San Jose, Indianapolis and Wichita, which are more export-oriented than the rest of the country.

Wichita doubled its exports between 2003 and 2008, thanks in large part to the success of its cluster of aviation companies. This cluster is supported by a variety of federal, state and local institutions, including nonprofits and private-public partnerships. In addition, the Kansas state government encourages financing for innovative start-ups through the Kansas Technology Enterprise Corporation, which administers the state’s “angels” tax credit for venture capital investments. Such efforts are market-led and market-tested, in contrast to the heavy-handed interventions some other countries use to boost exports.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Five Myths About U.S. Exports

September 5, 2010