This viewpoint is part of Foresight Africa 2024.

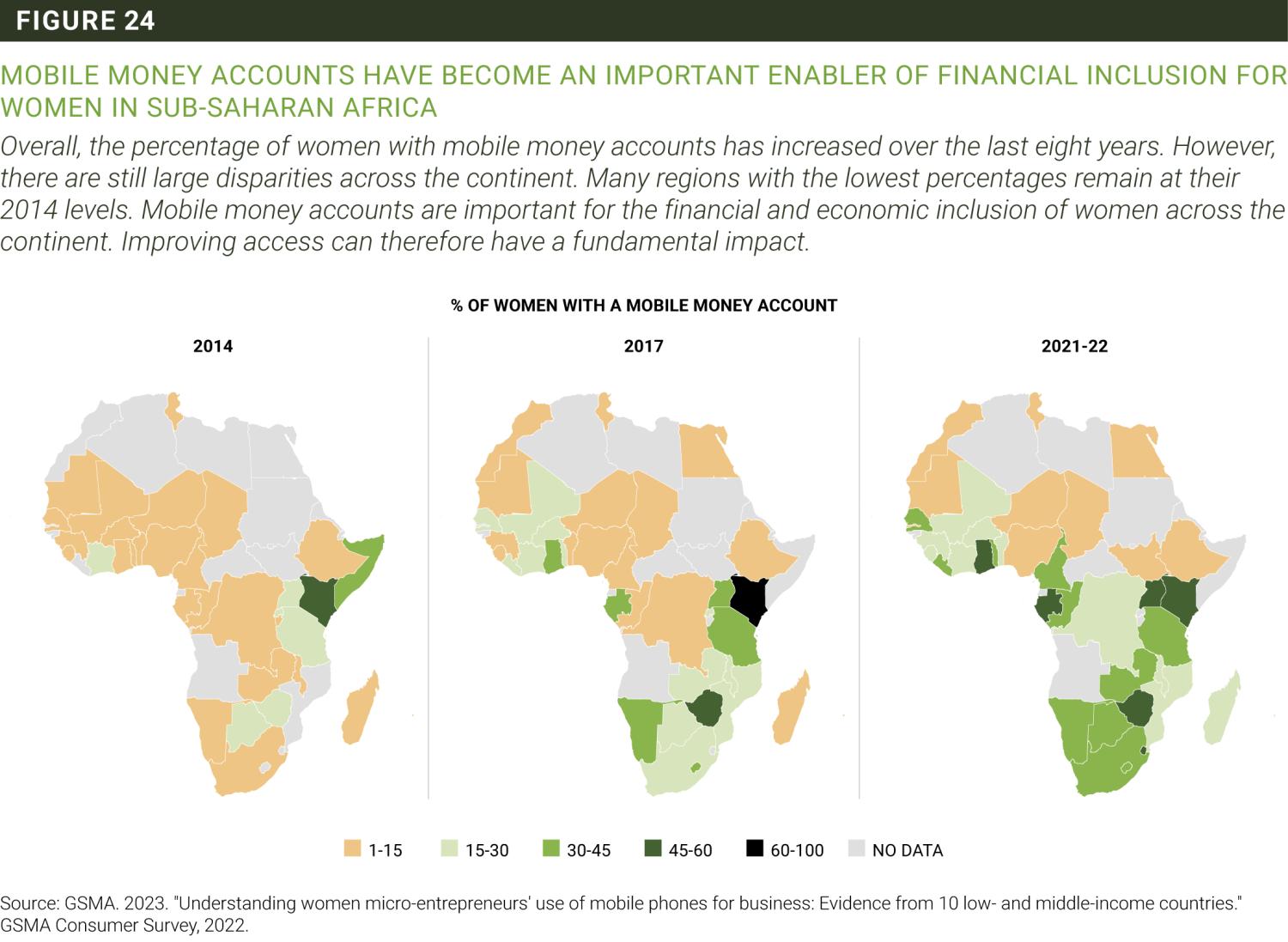

In the 10 years leading up to 2021, the share of women in sub-Saharan Africa who owned a financial account more than doubled to reach 49%, according to data from the Global Findex. Since 2017 alone, account ownership rates for women in the region increased 12 percentage points, driven entirely by increased adoption of mobile money accounts.

Mobile money is a financial service offered by a telecom or a fintech firm that partners with mobile network operators independent of the traditional banking network (this is different from traditional banking services accessed through a mobile phone). Mobile money services are typically enhanced by local mobile agents, where women can conveniently deposit even small amounts of cash to make payments, pay bills, send remittances, or store money outside of the home.

Some countries even saw a substitution between brick-and-mortar bank accounts and mobile money, which might suggest that already-banked women retired their financial institution accounts in exchange for a mobile money account, or that a disproportionally higher share of adults adopted mobile money accounts. Two striking examples include Cameroon, where account ownership for women increased from 30% in 2017 to 49% in 2021, including a 26 percentage point increase in mobile money accounts, and Ghana, where account ownership for women increased from 54% to over 63%, including a 21 percentage point increase in mobile money accounts.

The continued growth in financial access is excellent news, given evidence showing the ways women benefit from having their own financial accounts. These include greater personal safety and less exposure to theft, more say over how household resources are spent, and greater ability to receive money from friends and family in the event of an emergency.

The benefits grow as women gain experience using their accounts more often and for a wider variety of purposes, including to make and receive digital payments, store money, save, and borrow. For example, when the Global Findex began asking women account owners whether they make digital payments from their accounts in 2014, most women that received a payment into their account appeared to cash out at an agent as soon as they were able. Today, however, almost all account holders who receive digital payments also make them directly from their accounts. This increased willingness to keep money in an account is also motivating a larger share of women to shift their savings habits from informal methods, such as Rotating Savings and Credit Associations popular in sub-Saharan Africa, to using their account. In many countries, mobile money operators are offering savings products, like “e-ROSCAs”, which leverage existing social networks, while offering a safer way to save and build a financial relationship to access credit, insurance, and other financial services. This increase in formal savings gives women more resources to invest in education and healthcare, or to manage an adverse event—all documented ways in which they use financial services.

Given the proven benefits of financial inclusion for the women of sub-Saharan Africa, it is critical that governments and providers continue to take steps to enable access for the 50% of women who remain unbanked. One way is to focus on barriers to phone ownership that women on the continent still face and which prevent them from accessing mobile money. According to the GSM Association, the mobile gender gap is driven by a range of social, economic, and cultural factors, including the affordability of handsets, literacy, and digital skills.1 In addition, though slightly more than half of the unbanked adults in the region have a mobile phone, millions do not, including 37% of all women,2 according to Gallup World Poll and Findex data. This is not just a problem of network access but also one of documentation, given that 1 in 5 unbanked women report lack of an official government-issued ID prevents them from opening an account. For example, in Niger, only 45% of women have a mobile phone—and only 56% of women have ID. Governments can help close the mobile phone gender gap by increasing women’s access to a national identification document, which is typically a requirement for obtaining both financial and mobile phone services.

Given the proven benefits of financial inclusion for the women of sub-Saharan Africa, it is critical that governments and providers continue to take steps to enable access for the 50% of women who remain unbanked.

Efforts to increase access should also include initiatives to manage exposure to financial risks. Women with low education and limited financial experience are more likely to be exploited when using financial services. In fact, around 35% of all women mobile money account holders say they cannot use their account without help from a friend or agent, which makes them more vulnerable. Providers can mitigate this risk by designing products that women can use safely and confidently on their own. Effective onboarding can also help, given research showing that women get better at using their accounts with practice and learn to avoid extra agent fees. Policymakers also have a role to play by crafting and enforcing strong consumer protection programs and policies—including effective recourse mechanisms.

Financial accounts, and particularly digital financial services, are living up to their promise as key enablers of economic empowerment for women. Ensuring that the momentum continues to build will require regulators, advocates, and financial providers to continue to invest in the infrastructure and policies that will help expand access.

-

Footnotes

- GSM Association, 2023. The Mobile Gender Gap Report 2023. GSMA: London.

- Gallup World Poll Survey, available at: https://www.gallup.com/analytics/318875/global-research.aspx.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Digital finance boosting women’s financial inclusion in sub-Saharan Africa: Emerging evidence

March 7, 2024