If you want more content like this, subscribe to our newsletter.

This week in Class Notes:

-

- Barriers in the housing search process contribute to residential segregation by income.

- Greater Medicaid eligibility promotes many positive outcomes for children, including increased college enrollment, lower mortality, decreased reliance on the Earned Income Tax Credit, and higher wage incomes for women.

- The large gender gap in wage expectations closely resembles actual wage differences, and career sorting and negotiation styles affect the gender pay gap more than prospective child-related labor force interruptions.

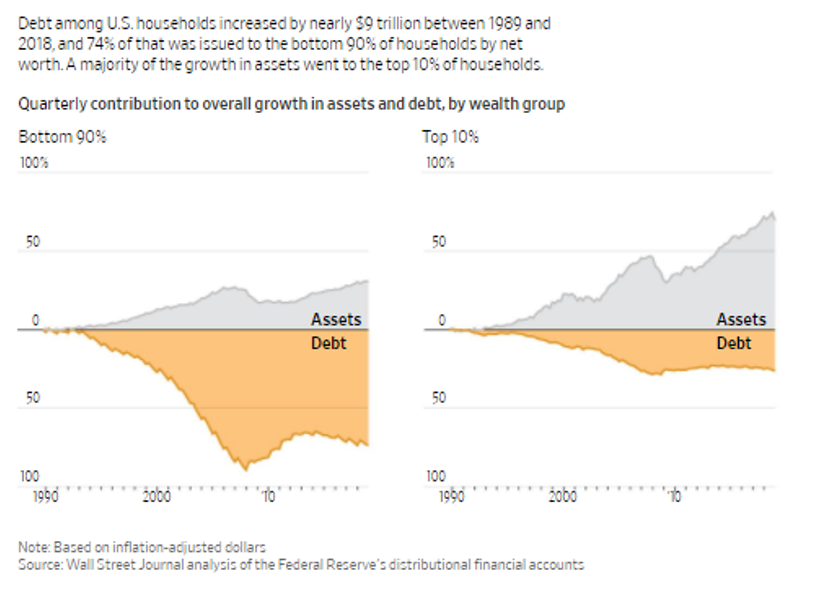

- Our top chart shows that the majority of the debt increase among U.S. households over the last three decades was distributed among the bottom 90% of households by net worth, while the majority of asset growth was concentrated among the top 10%.

- Noah Smith opines that automatic college applications may help narrow the U.S. educational achievement gap.

- An occasional Spotlight section features Daniel Markovits’ reflections on the dangers of a falsely meritocratic society.

- Finally, check out our own Marcus Casey’s piece on how policymakers can help businesses retrain their workers.

Creating moves to opportunity: Experimental evidence on barriers to neighborhood choice

Low-income families in the United States tend to live in neighborhoods that offer limited opportunity for upward mobility. One explanation for this pattern is that families prefer these neighborhoods for other reasons, including affordability and proximity to family and work. An alternative explanation is that families do not move to high-opportunity areas because of barriers in the housing search process. Bergman et al. test these explanations by randomly providing customized search assistance, short-term financial support, and landlord engagement to low-income families to reduce the barriers associated with moving to a high-opportunity neighborhood. The authors find that the intervention increased the proportion of families who moved to high-opportunity areas by 40%. Interviews with the families reveal that addressing each family’s specific needs was critical to the program’s success. The conclusion: redesigning affordable housing policies to provide customized assistance throughout the housing search process could reduce residential segregation and increase upward mobility substantially.

Long-term impacts of childhood Medicaid expansions on outcomes in adulthood

Greater Medicaid eligibility has many positive effects on children, according to Brown et al. The authors use administrative tax data to examine the impacts of childhood Medicaid eligibility expansions on outcomes in adulthood at each age between 19-28. Greater eligibility was found to increase college enrollment and decrease fertility, especially through age 21. Starting at age 23, women had higher wage income. Both men and women had lower mortality rates. These adults also collected less from the Earned Income Tax Credit and paid more in taxes. Cumulatively, the federal government was estimated to recoup 58 cents of each extra dollar spent on Medicaid for children.

Gender differences in wage expectations: Sorting, children, and negotiation styles

Using survey data from 15,000 German college students, Kiessling et al. document a significant gender gap in wage expectations that closely resembles actual wage differences, The authors explore the relationship between expected wages and various factors including college major, intended occupation, child-rearing plans, perceived and actual ability, personality, perceived discrimination, and negotiation style. Sorting and negotiation styles (with women bargaining for lower wages than men) were found to affect the gender gap in wage expectations much more than prospective child-related labor force interruptions. Given the importance of wage expectations for labor market decisions and wage outcomes, the results provide one explanation for persistent gender inequalities.

Top chart

Between 1989 and 2018, the inflation-adjusted value of U.S. household assets rose by $66.5 trillion, while debt increased by nearly $9 trillion. This week’s top chart shows that the majority of this debt increase was distributed among the bottom 90% of households by net worth, while the majority of asset growth was concentrated among the top 10%.

Choice opinion

“This system [automatic college application] would make applying for college — even if only the local community college — the default for all high school students. The application process would go from being an opaque, complex, expensive process to a simple, universal piece of the high school experience. It would go a long way toward leveling the playing field between children of low-income parents and their wealthier peers. By doing so, it would make American society fairer, increase economic opportunity, and help discover some of the hidden talent that is currently going to waste” writes Noah Smith in Bloomberg News.

Spotlight

This week’s Spotlight features an excerpt from Daniel Markovits’ forthcoming book The Meritocracy Trap. In “How Life Became an Endless, Terrible Competition”, Markovits explains how a meritocracy, once lauded as a champion of social mobility, now excludes everyone outside of a narrow elite:

“Hardworking outsiders no longer enjoy genuine opportunity. Only one out of every 100 children born into the poorest fifth of households, and fewer than one out of every 50 children born into the middle fifth, will join the top 5 percent. Absolute economic mobility is also declining and the drop is greater among the middle class than among the poor. Meritocracy frames this exclusion as a failure to measure up, adding a moral insult to economic injury.”

Markovits goes on to describe the ways in which even meritocracy’s beneficiaries now suffer on account of its demands, as those who manage to claw their way to the top must work with crushing intensity, ruthlessly exploiting their expensive education in order to extract a return. The solution? Open and inclusive education and a renewed emphasis on middle-class jobs.

Self-promotion

In “Policymakers can help businesses retrain their workers”, Marcus Casey proposes ideas for improving skill matches between employers and employees across firms of all sizes, including making federal and state tax credits available to firms that provide retraining programs for at-risk workers, supporting the expansion of apprenticeship programs by providing tax credits to firms for bringing in expertise to train workers, and providing funding, personnel, and other incentives to local colleges to facilitate the development of programs better suited to employer needs.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Class Notes: Barriers to neighborhood choice, wage expectations, and more

Wednesday, September 4, 2019