Content from the Brookings Doha Center is now archived. In September 2021, after 14 years of impactful partnership, Brookings and the Brookings Doha Center announced that they were ending their affiliation. The Brookings Doha Center is now the Middle East Council on Global Affairs, a separate public policy institution based in Qatar.

In the midst of widespread popular discontent with the regime led by the Hirak movement, resource-wealthy Algeria continues to struggle with the same socioeconomic challenges it has faced for a decade. Only now, the country’s economic standing has been further complicated by the ongoing coronavirus pandemic and the recent drop in oil prices. The former has slowed investment and consumption, while the latter has decreased export revenues.

What is at the root of the oil and gas giant’s current struggles, and what steps can the Algerian regime take to address them?

Resource curse

The widespread popular discontent sweeping through Algeria is partly triggered by multidimensional inequality and economic hardship. The repercussions of the coronavirus pandemic and associated lockdown measures, together with the 2020 drop in oil prices, have exacerbated the vulnerabilities of the Algerian economy. The economy suffers from several structural issues relating to a mismanagement of accumulated rents in the 2000s, an unfavorable business environment dominated by the military, and a constrained private sector. Most importantly, the economy is overly dependent on oil and gas, which are susceptible to price fluctuations.

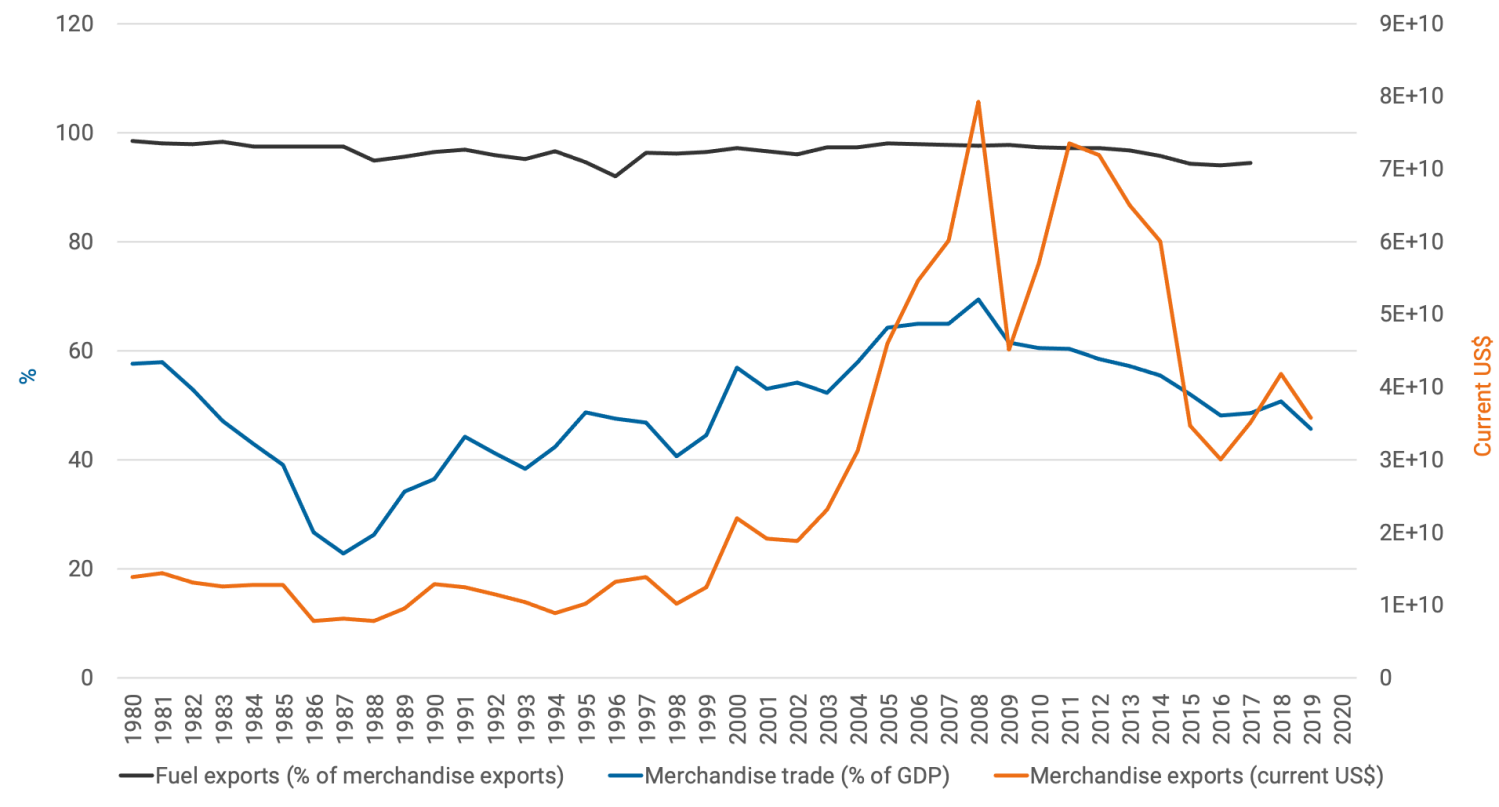

Indeed, oil and gas rents represented 19% of Algeria’s 2018 gross domestic product (GDP) and an estimated 40% of the 2018 government budget, while fuel exports accounted for 94% of the merchandise exports in 2017 (see Figure 1). Given recent strains on the national budget, it is projected that Algeria’s state-owned oil and gas company Sonatrach (which controls more than 75% of total hydrocarbon production) must set the price for a barrel of oil at $118.20 in 2020 and $135.20 in 2021 to break even fiscally.

FIGURE 1: Fuel and merchandise exports

However, Algeria continues to accumulate a significant fiscal deficit projected to reach 16.5% of GDP in 2020 and 14.8% in 2021, due to lower hydrocarbon export revenues. Oil and gas demand has plummeted: In the first two months of 2020, crude and condensate export volumes were down by 27 percentage points year-on-year while gas export volumes were down 26 percentage points. Furthermore, COVID-19 harshly affected some of Algeria’s key gas customers; as of April 2020, piped gas exports to Spain were down by 44% year-on-year.

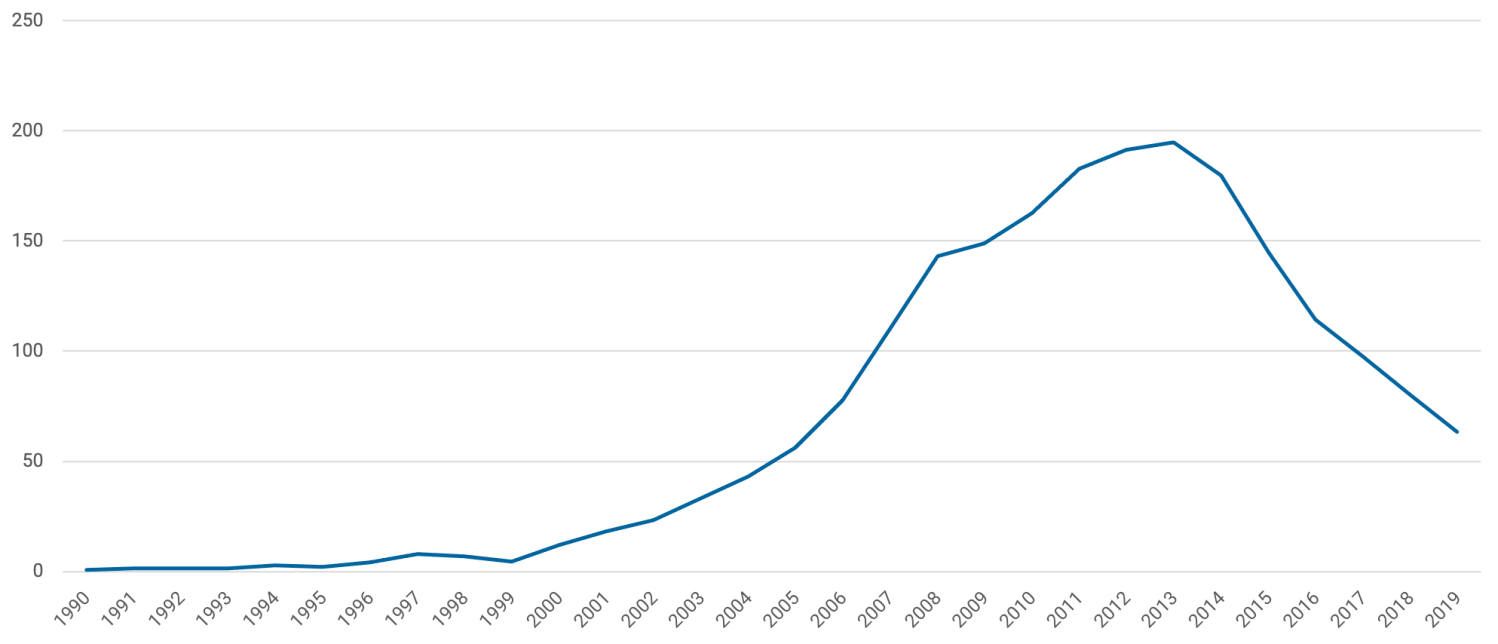

This situation has been exacerbated by the fall in oil prices, which dropped to a record low of $16-17 per barrel in April 2020 and are expected to remain below $45 through 2021. Furthermore, the lower demand on fuel exports coupled with falling prices are expected to further deplete Algeria’s foreign exchange reserves. These are projected to reach $44 billion by the end of 2020, continuing the downward sloping trend since 2014 when they stood at $195 billion (see Figure 2). Overall, according to the latest International Monetary Fund (IMF) projections, the economy is estimated to contract by 5.5% in 2020.

FIGURE 2: Total foreign reserves minus gold (current, billion US$)

Persistent inequality

These revenue cuts have forced the state to review its fiscal policy. In May 2020, it announced a 50% cut in public spending and the postponement of several promised economic and social projects. Such moves might cause greater discontent within the ranks of the Hirak, which is demanding root-level reforms that would eradicate corruption and socioeconomic inequalities.

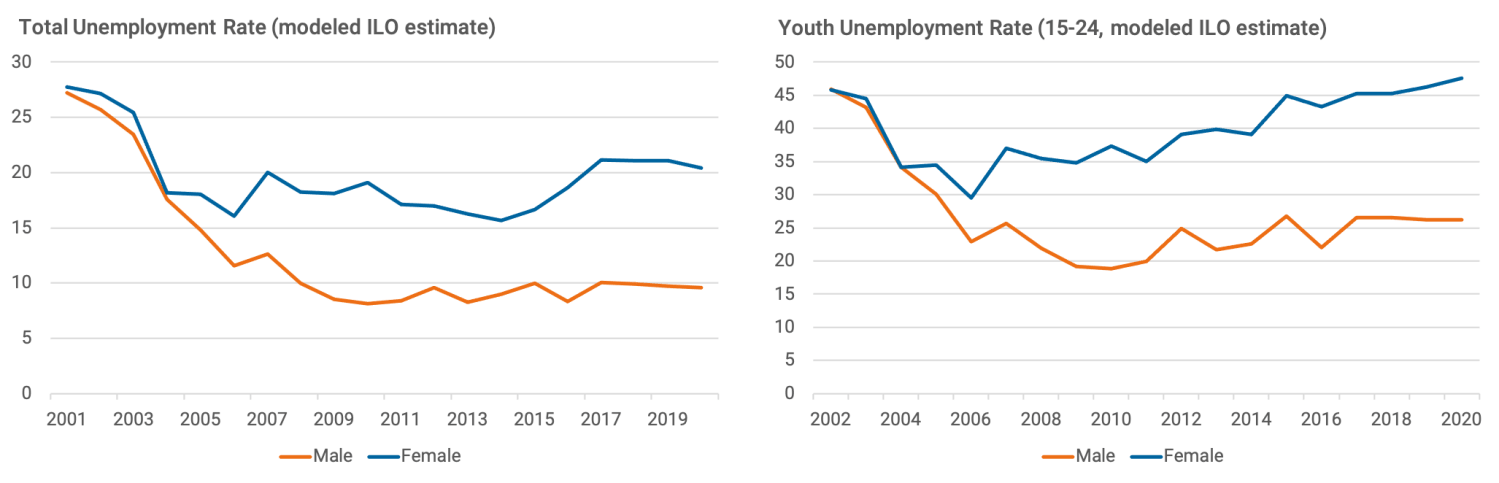

Indeed, Algeria suffers from multilevel disparities including between genders, regions (urban/rural), and income brackets. Over the past decade, total male unemployment has leveled at around 10%, and youth male unemployment at 26%; for women — especially young women — unemployment continued to rise, thus widening the gender gap (see Figures 3 and 4). Hence, Algerian women who wish to enter the labor market have fewer and fewer chances of being hired, compared to their male counterparts.

FIGURE 3: Total unemployment rate and youth unemployment rate (15-24)

That said, the state has tried to enhance the business regulatory framework in favor of women to grant them higher access to economic opportunities. Algeria’s Women Business and Law Index score increased by 17 points over the last 20 years (but it continues to lag behind neighboring Morocco and Tunisia). The country has also shown improvement in terms of income distribution. According to the latest available data, income inequality has decreased far below its neighbors’ levels. Yet, while the richest 10% of the population accounted for 23% of the 2011 income, the poorest 10% accounted for only 4%. In terms of inequalities in consumption, the gap between the rich and the poor is almost 28%.

Moreover, Algeria still faces disparities between rural and urban areas. Although the gap in terms of access to basic infrastructure and utilities has decreased over time, other disparities persist. People living in Algeria’s Sahara and the Steppe, for example, suffer from double and triple the national poverty average, respectively.

Outlook: Diversify, diversify, diversify

With limited fiscal space to cover government expenses and finance national projects, the state has little option but to cut spending and raise more domestic debt financed through its central bank. Coupled with the ongoing political crisis, this will likely fuel further social unrest. The regime can address this temporarily by seeking long-term loans from foreign lenders. However, this is an unlikely scenario as the regime has avoided selling debt abroad since 2005 due to its negative experience borrowing from the International Monetary Fund (IMF) in the 1990s and having to restructure billions of dollars in foreign loans.

To achieve long-term change, the Algerian state must prioritize deep reforms that restructure the economy away from oil and gas dependency. Algeria’s non-hydrocarbon exports are equivalent to around 2% of its total exports, meaning it is one of the most hydrocarbon-dependent countries in the world. However, according to the IMF, its current oil and gas reserves will be depleted by the mid-2030s and mid-2050s, respectively. Algeria should have set the stage for a massive diversification plan two to four decades ago like other resource-wealthy states such as Indonesia and Malaysia. Yet, the regime still has some space to make reforms if it slows the rate of domestic consumption growth by lowering subsidies on hydrocarbons, thereby slightly delaying those depletion dates. A potentially profitable sector in Algeria (post-COVID) is tourism, which can serve as an alternative source for foreign currency. To make the country an attractive international destination and encourage investment in this sector, however, the regime will have to invest heavily in security, accommodation, and its image; it will also have to reform its strict visa rules.

Another way to achieve long-term change is to promote a private-sector-led growth model. Currently, the Algerian economy follows an oversized public-driven growth model, which has constrained the business environment and the development of the private sector. On the Ease of Doing Business Index, Algeria scores poorly and ranks far behind neighboring countries by 20 to 25 points. The country ranks short specifically in terms of access to credit (181 out of 190 economies), protecting minority investors (179), registering property (165), and starting a business (152). Such constrains limit entrepreneurship opportunities and chances of startup survival, which are crucial to developing a sustainable private sector able to absorb incoming cohorts of young graduates and contribute to non-oil and gas related growth.

In the meantime, over the medium term, the state needs to gradually diversify its stream of revenues, rebuild fiscal buffers, and continue reorienting non-priority spending.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Algeria must prioritize economic change amidst COVID-19 and political crisis

December 2, 2020