Editor’s Note: For Campaign 2012, Martin Baily wrote a policy brief proposing ideas for the next president on stimulating America’s economic growth. The following paper is a response to Baily’s piece by Elisabeth Jacobs. Karen Dynan also prepared a response arguing that the housing finance system must be reformed in order to introduce greater certainty into the market.

No reasonable analyst will dispute Martin Baily’s insistence on the necessity of restoring economic growth. But the American economy faces a set of broader, longer-term economic challenges that growth alone will not solve. The country is burdened by high levels of economic inequality and insecurity, which the Great Recession certainly amplified but which it did not cause. Upward mobility, particularly for those at the bottom of the income distribution, continues to fall short as compared to other Western nations. The next administration thus faces the task not only of nurturing a fragile economic recovery, but also of developing a strategy that restores economic prosperity for all Americans.

As Baily says, the near-term problem facing the economy remains weak consumer demand. The ratio of job seekers to job openings remains greater than 4 to 1, more than twice its level in the first month of the Great Recession. In simple terms, there are far more unemployed workers than there are available jobs in today’s economy. Job losses during the Great Recession were so deep that we will need a historically high pace of job growth to return the labor market to its pre-recession levels of employment.

Yet, all was not well in the pre-recession economy.

The period between the end of World War II and the early 1970s was one of broad prosperity, where rapid economic growth translated into broadly shared prosperity. Up and down the income ladder, Americans’ incomes roughly doubled between the late 1940s and the early 1970s. By contrast, the period from the 1970s through the present is characterized by slower economic growth and wildly disparate levels of growth across the income distribution. Income growth for households on the middle and lower rungs of the ladder has slowed sharply, while incomes at the top have continued to soar.

The slow growth of the average American family’s income is a central piece of the decades-long story of rising economic inequality. Women’s increased labor-force participation explains nearly all of the growth in married couples’ family income since the 1970s. Median household income actually fell in the 2000s. Men’s earnings have stagnated (or, according to one widely-cited analysis, declined), while male employment rates have dropped sharply. The result is a highly polarized economy, and a shrinking middle class.

The Great Recession did not create these basic facts, which threaten myriad pernicious impacts. Persistent inequality may hinder a return to economic growth, as stagnant wages for the majority will mean that the bulk of Americans are simply unable to consume at the level that the economy depends on for growth. One study suggests that inequality may have been a driving force behind the financial crisis that precipitated the Great Recession. Others have argued that high levels of economic inequality have the potential to unravel the fabric of democracy by depressing voter turnout and civic engagement and eroding trust in government. And inequality may make upward mobility—the essence of the American Dream—unattainable for many.

America is built on the idea that anyone – regardless of family background – can work hard and succeed beyond one’s parents’ wildest dreams. Yet, research surveying economic mobility over the last several decades suggests that there are reasons to question whether there are serious cracks in the American Dream.

Some studies of intergenerational mobility ask whether those whose parents were at the top (or bottom) of the income distribution relative to America as a whole remain in the same place in adulthood. These studies consistently find that the United States is far more class-bound than our national narrative asserts. In a perfectly mobile America, a child born into a household in the bottom fifth of the income distribution would be no more likely to end up as an adult in the bottom fifth of the income distribution than would be a child born into the top fifth of the income distribution. But, Brookings economist Julia Isaacs points out that about 40 percent of children raised in the bottom of the distribution are unable to escape the bottom. And others have argued that the same holds for a variety of other measures of mobility, including family wealth. America today is not an “equal opportunity” society. Indeed, one study found that Denmark, Finland, Sweden and the United Kingdom all perform better in terms of relative intergenerational mobility than does the United States.

These troubles with economic mobility in America pre-date the Great Recession and raise thorny economic issues requiring the attention of the next administration.

The Great Recession has created enormous economic insecurity for today’s families. Yet economic insecurity in the United States, too, has been slowly rising for decades. A growing body of research tracking the fortunes of Americans over time – relying on repeated looks at the same set of families, rather than simply point-in-time snapshots – suggests that the risk of a substantial short-term loss of income has been on the rise since the 1970s. Much of this rise occurred in the period between the 1970s and the 1990s. Recessions certainly increase the risk of short-term losses. But, the research suggests an underlying structural change as well, as each successive recession has driven the likelihood of severe income losses ever higher. The most recent recession has simply accelerated a preexisting trend.

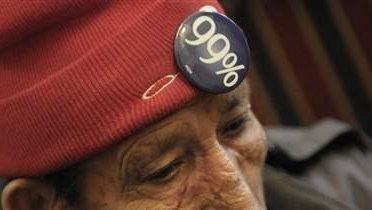

The resonance of the Occupy Wall Street protest movement’s message of “We Are the 99 Percent” suggests that the issues outlined above resonate with the American public. President Obama’s widely cited Osawatomie, Kansas speech spoke directly to these issues of economic inequality, insecurity and opportunity, as did his 2012 State of the Union address’s repeated use of the “fairness” meme. Republican presidential candidate Rick Santorum routinely cites data on the problems with upward mobility in America, and Republican frontrunner Mitt Romney has grappled with how to campaign as a “regular guy,” despite having grown up wealthy and made millions in his own right. Issues of economic justice that reach well beyond the question of how to restore economic growth have already begun to define the 2012 campaign. The pressing question is how to restore economic growth that benefits all Americans while at the same time promoting economic security and economic opportunity. Whichever candidate prevails in November would do well to face these challenges head-on.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).