As I wrote last week, Senator Warren’s proposal to write off student debt and offer free public college is expensive, regressive, and leaves many open questions about what will replace student loans for the millions of students that use them for graduate school, at private colleges, or to finance living expenses while enrolled.

I am sympathetic to today’s student loan borrowers—indeed, I’m outraged over the situation. It is an outrage that the federal government offers loans to students at low-quality institutions even when we know those schools don’t boost their earnings and that those borrowers won’t be able to repay their loans. It is an outrage that we make parent PLUS loans to the poorest families when we know they almost surely will default and have their wages and social security benefits garnished and their tax refunds confiscated, as $2.8 billion was in 2017. It is an outrage that we saddled several million students with loans to enroll in untested online programs, that seem to have offered no labor market value. It is an outrage that our lending programs encourage schools like USC to charge $107,484 (and students to blithely enroll) for a master’s degree in social work (220 percent more than the equivalent course at UCLA) in a field where the median wage is $47,980. It’s no wonder many borrowers feel their student loans led to economic catastrophe.

Moreover, these failures are entirely the result of federal government policies. The federal government gutted accountability rules; treated online programs as if they were the same as traditional brick-and-mortar schools; extended credit to students and parents well in excess of financial need or ability to pay; and raised and then eliminated limits on loans to parents and graduate students, allowing many to accumulate eye-popping, unpayable amounts. The government allowed—and often encouraged—people to make bad choices.

If that were the whole story behind the student debt crisis, then yes, there would be a good case for scrapping the system, forgiving loans, and starting from scratch as Senator Warren proposed. But it’s not. Most borrowers use the loan program responsibly to finance high-value investments. Among students in 2009 who had started college six years earlier, 44 percent hadn’t borrowed at all and another 25 percent had borrowed less than $10,000. Just 2 percent had borrowed more than $50,000. At ‘traditional’ 4-year public and private institutions, student outcomes are strong and few borrowers default on their loans. At community colleges—which, net of grant aid, are already tuition free—student loans for living expenses help students stay in school and complete their degrees. Federal loans are the largest form of aid we offer to graduate students. Like popular programs like Social Security, it’s self-financed by its own beneficiaries, with the benefits paid out to students paid in from earlier recipients, making it resilient to the tax- and spending-cuts that have underfinanced most other social insurance programs. And loans are equitable in that individuals who don’t go to college aren’t asked to pay for those that do, and they’re progressive because we offer income-based repayment plans and eventual loan forgiveness for those who can’t pay.

It’s a system worth fixing. And it can be fixed. The simple, obvious, mantra of reformers should be “don’t make loans we know borrowers would suffer to repay.” In practice, that means reversing many of the unwarranted changes of the last two decades: Reinvigorate and strengthen the accountability system and apply it to all borrowers. Restore loan caps for graduate students and parents. Allow private loans to be discharged in bankruptcy. Apply an ability-to-pay standard for parent loans (or get rid of them entirely) and make up the difference for low-income students with grants and loans.

And then, and only then, should we offer relief for the burdens that the errors of the past two decades imposed on students. We should offer relief that is fair, progressive, doesn’t cost hundreds of billions of dollars, and allows the best parts of today’s lending system to continue. It’s possible.

Make income-based repayment universal and automatic

The right approach implements universal and automatic income-based repayment plans for all borrowers and repairs the damage inflicted on earlier borrowers for having failed to make such plans available in the past. Under the currently-available income-based plan Revised Pay as You Earn (REPAYE), borrowers pay 10 percent of their discretionary income (income minus 150 percent of the poverty line) for 20 years (25 years if a graduate borrower). Any remaining balance is forgiven (but potentially subject to income tax).

REPAYE should be the default repayment plan, and all borrowers should be immediately converted to this plan. (Borrowers actively making higher payments under a standard 10 year plan should be able to opt out if they want to repay their loans faster.) Universal and automatic REPAYE would be more progressive, would address the hardships borrowers face, costs less, and offers a sustainable way to offer loans to future students.

Broad enrollment in REPAYE would fix certain problems that plague borrowers. For instance, student debt has delayed or reduced homeownership rates of young borrowers—but mostly because of the effects of default and delinquency on credit scores and access to a mortgage. Research shows that enrollment in income-driven plans like REPAYE reduces delinquency, improves credit scores, and increases the likelihood of homeownership among delinquent borrowers.

Automatic enrollment in REPAYE would be a progressive change because repayment is based on income and family circumstance; it insulates borrowers from facing payments that exceed a reasonable share of their discretionary income. To illustrate, the following table compares the distribution of annual loan payments borrowers are making currently (among households age 25 or older who are not enrolled in school) to a hypothetical situation in which all borrowers were enrolled in REPAYE.

The left-hand panel shows that on average, households with student debt pay about $2,501 per year in payments, but 34 percent are currently not making any payment. On average, loan payments consume 3 percent of households’ gross income. Among borrowers who are actually making payments (columns four and five), the average payment is $3,793 and consumes 4 percent of household income.

Payment amounts, the likelihood of making any payment, and the share of income devoted to loan payments varies substantially across households based on economic and demographic characteristics. For instance, low-income households (those in the bottom quintile) pay about $663 per year, in large part because 71 percent aren’t making payments. Among those that are making payments, however, the average amount is $2,261 and those payments consume 14 percent of their income.

For the hypothetical REPAYE program (the right-hand side of the table), I assume households pay 10 percent of their discretionary income (up to a maximum of 125 percent of the amounts borrowers would pay under a standard 10-year amortizing loan to limit the influence of extreme amounts). I assume that borrowers who are currently not making any payments because they report that they “can’t afford it” or because they are in a forbearance continue to not make payments. (Absent this assumption, high-income and highly-educated borrowers would pay more.)

Under these assumptions, the average household payment is similar: about $2,482 ($19 less than it is now) and 36 percent of households make no payment. However, the distribution of payments across households is quite different. The lowest-income households make no payments, while payments from higher-income households increase. (In part, this is because the current payments of higher-income households are sometimes well below 10 percent of their discretionary income, perhaps because they are on longer-duration repayment plans.)

In addition to reducing payments for lower-income borrowers, REPAYE reduces payments for younger households, for less-educated borrowers (except for some graduate and professional students—largely because I assume those with deferred loans continue having them deferred), and for African-American borrowers. On an annual basis, it’s likely that some borrowers who are currently making no payments would pay something or would when their economic circumstances recovered.

This analysis does not include the value of eventual loan forgiveness offered from remaining balances after 20 or 25 years (or after 10 years under public sector loan forgiveness [PSLF]), which depend on the integral of payments (and income and family circumstances) over many years. While loan discharges offered to persistently low-income borrowers are likely to be progressive, discharges to certain graduate borrowers or under public sector loan forgiveness might not be. (Thus far, the typical PSLF beneficiary seems to be a highly-educated, white-collar professional with an average of $62,515 in federal loans forgiven—about 70 percent more than we offer the poorest Pell Grant recipient over the course of their entire educational career.) On net, my guess is that eventual forgiveness will accrue to low-income households and middle-income borrowers with large debts.

Because it’s unclear what the final forgiven amounts will be, it’s not clear what the total cost is. The fact that annual payments are roughly the same suggests that many borrowers will continue to pay their loans. However, some will simply repay faster; others who would have paid more may have more forgiven. In any case, much of the cost is already baked into budget estimates and the incremental cost would be vastly smaller than forgiving loans outright.

If universal and automatic REPAYE is the goal, then there are several practical steps to take:

Eliminate loan “rehabilitation”, the lengthy and onerous process that defaulted borrowers must currently undertake before getting into REPAYE. Just put them in REPAYE immediately.

Allow the IRS to provide income data directly to the Department of Education for purposes of implementing REPAYE. Or, better yet, allow for loan repayment through the withholding system used to collect payroll and income taxes, amending Form W-4 to ask about student loans, and allowing self-employed individuals to update payments based on their quarterly earnings. It’s not a panacea, but it would make life simpler and easier for borrowers.

Clean up the credit reporting of defaulted or delinquent borrowers enrolled in REPAYE. Especially if loan payments can be made through payroll withholding, borrowers should not be involuntarily defaulting or delinquent because of hardship or unemployment. Eliminating the practice of reporting these periods as defaults or delinquency would remove a key barrier borrowers face when they seek access to credit in the future.

Next, end the Treasury Offset Program—the program that confiscates defaulted borrowers’ tax refunds—and stop wage and Social Security garnishment for student loan borrowers enrolled in REPAYE. Because the Treasury offsets refunds of the Earned Income Tax Credit or Child Tax Credit, the current program effectively cancels the largest social insurance program for working, low-income families, plunging them into deep poverty.

Congress should also eliminate the income tax that applies to discharged debt under current law, as they did for PSLF and for loans discharged for the death or disability of the borrower.

Congress could also improve REPAYE by offering more substantial interest subsidies for borrowers whose payments don’t cover accruing interest. Currently, the government pays 100 percent of unpaid interest that accrues on subsidized loans in the first three years of repayment, and 50 percent of unpaid interest that accrues on subsidized loans after the first three years and on unsubsidized loans during all periods. Because subsidized loans are only available to borrowers with financial need, and because the loan subsidies would only apply in periods of hardship, expanding interest subsidies on those loans are likely to be progressive based both on their family income and their own earnings.

Reduce the burden for borrowers who missed out on REPAYE

Second, millions of borrowers who took loans out years ago were never offered REPAYE and suffered financial hardships because of its absence. While it would be hard to go back and estimate exactly what they should have paid under universal REPAYE, we could void the fees, capitalized interest, or collection costs imposed on legacy borrowers (who should not have accumulated those costs in a rational REPAYE system) and offer them credit against the 20 (or 25) year window for loan forgiveness.

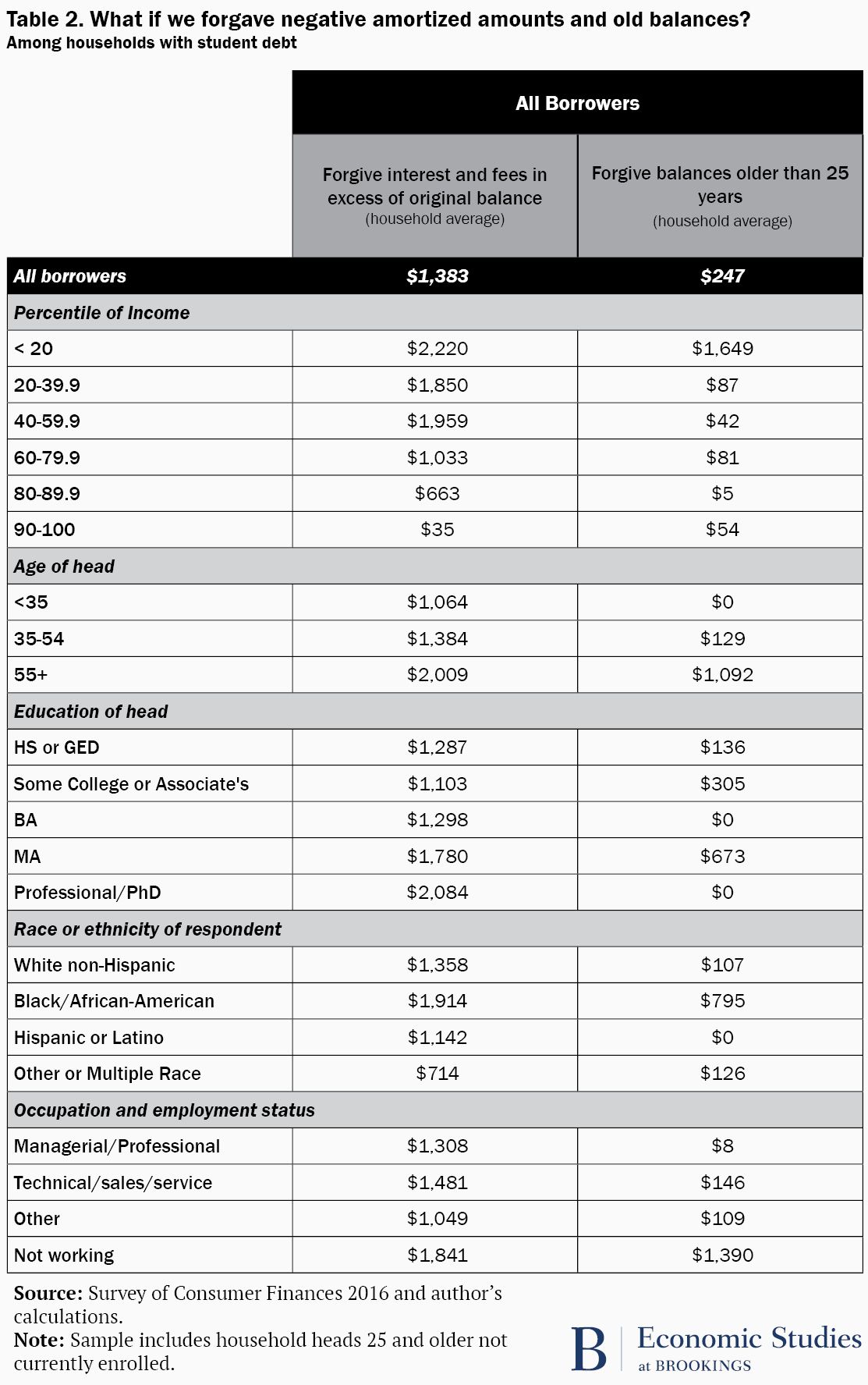

If future borrowers aren’t liable for fees, capitalized interest, or collection costs, then there’s a strong case that those costs imposed in the past should be written down. In practice, capitalized interest and fees are regressive elements of student loan burdens. To get a sense of the distribution of these costs, I looked at the amounts owed by borrowers today that are in excess of the amounts they originally borrowed in the table below.

Whereas 22 percent of loans are owed by borrowers in the bottom 40 percent, they owe 43 percent of negatively-amortized interest. And while the average dollar amounts in accumulated interest are small on average, they are large among those who owe them—about $11,000 for each negatively-amortized borrower. The amounts owed are regressive, with the bottom 20 percent of borrowers owing an average of $2,220 and the top 10 percent $35. The amounts are also concentrated among older, non-working households and are higher among African-American householders.

In a world in which no future borrowers will have to incur the interest, fees, and collection costs associated with defaults, we should relieve prior borrowers of those burdens. Because they are concentrated among low-income defaulted borrowers, relieving those costs is progressive.

Finally, we could give existing borrowers credit for time served as if they had been enrolled in REPAYE since leaving school. This could involve forgiving debt that’s older than 20 years (or 25 if graduate debt). This is cheap (because there is not much debt that old) and progressive (because the people who owe it have struggled a lot). To get a sense of who owes this debt, the second column of data in the table below provides the distribution of debts older than 25 years old. On average, less than 1 percent of total balances are from loans 25 years old or older (an average of $247 dollars per household with student loans). However, most of that debt is owed by low-income households. The average amount owed by the poorest 20 percent of households is $1,649 (8 percent of the aggregate loan balance for those households).

It’s true that those borrowers won’t necessarily have made all payments they should have under REPAYE, but the consequences of those errors are small and in the distant past. Borrowers from the 1990s and early 2000s incurred relatively few debts, paid those debts down at much faster rates than today’s borrowers, and those that still owe balances are relatively poorer and worse off. More recent cohorts of borrowers would spend more time under REPAYE, making payments commensurate with their incomes. All borrowers would see a light at the end of the tunnel.

Other incremental forgiveness options

Policymakers could certainly go further by providing immediate debt relief or by accelerating the timing of forgiveness for certain loans under REPAYE.

In addition to income limits on who qualifies for relief and the total amount of debt forgiveness applied, the other obvious policy lever is to select which loan types qualify. The Department of Education retains information on the type of loan (e.g. subsidized or unsubsidized; graduate or undergraduate) and on the academic level of the borrower at the time the loan was disbursed (e.g., first year versus second year).

For several reasons, prioritizing discharges of subsidized loans to first- and second-year undergraduates is probably the most progressive, least expensive, and most effective way to reduce the economic burden of student loans:

- Subsidized loans are disbursed only to students with demonstrated financial need; we know the borrowers were from lower-income families.

- The dollar amounts for subsidized loans are capped and heavily subsidized to begin with, which makes the cost to taxpayers per face value of loan discharged small.

- First- and second-year loans have the highest rates of delinquency and default, in part because non-completers are a disproportionate share of first-year loan borrowers.

- Discharging relatively small loan balances would eliminate loan burdens entirely for millions of borrowers but at a relatively low cost. For instance, 8.7 million borrowers (19 percent of the total) owe less than $5,000. Forgiving a few thousand dollars of subsidized loan borrowers is likely to knock many more borrowers off the books and at a lower cost than would broader forgiveness plans.

There are many flaws in our student lending programs and too many borrowers are struggling with loans they can’t pay. But that’s a call to fix the system, not scrap it.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

A better way to provide relief to student loan borrowers

April 30, 2019