A skewed income distribution is bad for growth

Era Dabla-Norris, Kalpana Kochhar, Frantisek Ricka, Nujin Suphaphiphat, and Evridiki Tsounta of the International Monetary Fund find that for every 1 percentage point increase in the share of income going to the top 20 percent of earners, GDP growth is 0.08 percentage points lower over the next five years, whereas the same increase going to the bottom 20 percent increases GDP growth by 0.38 percentage points. The authors add that more progressive tax systems and policies focused on increasing human capital are key to reversing inequality in advanced economies.

Low interest rate spreads are the best predictor of banking crises

Mark Joy of the Bank of England, Marek Rusnák and Bořek Vašíček of the Czech National Bank, and the late Kateřina Šmídková find that low interest rate spreads (the rate banks lend at minus the rate paid on deposits) are the best indicator of bank crises. Specifically, when interest rate spreads are at or below 2.7 percent, there is an 8.9 percent chance of a banking crisis occurring between the next 4 and 8 quarters, but only a 4.3 percent chance when spreads are greater than 2.7 percent. When spreads are higher, a flat or inverted yield curve is the best indicator of future bank crises.

Healthcare expenditures for the elderly are highly concentrated

Using data from the Medicare Current Beneficiary Survey, Mariacristina De Nardi of the Federal Reserve Bank of Chicago, Eric French and Jeremy McCauley of University College London, and John Bailey Jones of the University at Albany find that, for those age 65 years and older, medical expenses are highly concentrated, with the top 10 percent of spenders accounting for 52 percent of total expenditures. The authors also note that roughly 65 percent of medical expenditures for the elderly are covered by the government, but those expenses not covered are highly concentrated among a small group people, suggesting that government health insurance is far from complete.

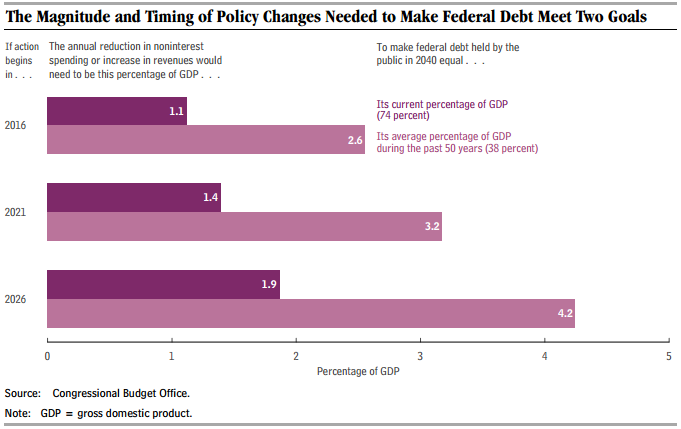

Chart of the week: Fiscal Gap

Quote of the week: ECB’s monetary policies are not intended to kick off a currency war

Does the ECB’s quantitative easing signal a return to currency wars?

There are no currency wars at present. The depreciation of the euro is the result of differences between the euro area and the United States in terms of their respective positions in the economic cycle and, accordingly, their monetary policies. Our partners recognize that our monetary policy decisions are appropriate given the situation in the euro area. This is not a question of seeking to influence the euro’s exchange rate, in respect of which the ECB has no specific objectives.

— Benoît Cœuré, Member of the Executive Board of the European Central Bank

Commentary

Hutchins Roundup: Income inequality, banking crises, and more

June 18, 2015