The Retirement Security Project at Brookings recently released a new research paper by Katharine G. Abraham of the University of Maryland and National Bureau for Economic Research and Benjamin H. Harris of Brookings. “Better Financial Security in Retirement? Realizing the Promise of Longevity Annuities” discusses the potential for longevity annuities to impact retirement security, examines barriers to the market for these products, and offers solutions to heighten consumer awareness and strengthen the market.

Experts from a variety of backgrounds reflected on the paper and its implications during a public event at Brookings on Thursday, November 6th. Henry Aaron of Brookings and David John of AARP joined Harris on a panel devoted to the economics of longevity insurance, moderated by David Wessel, also of Brookings. Donald Fuerst of the American Academy of Actuaries, J. Mark Iwry of Treasury, and James Mumford of the Iowa Insurance Commission participated in a second panel, moderated by Howard Gleckman of the Urban Institute, dedicated to understanding barriers to the development of the market for longevity annuities.

Audio, video, and a transcript of the event are available here and a summary of the key takeaways from the paper and the event follows.

During the first panel Harris remarked that the current retirement framework where Americans “save like hell during your working years and hope you don’t live too long” is insufficient. He called for a paradigm shift, indicating that instead of taking chances guessing at our own lifespan, we should actively mitigate our own longevity risk—the risk that we’ll outlive our assets—by using a small share of retirement assets to purchase a longevity annuity. If you know your longevity annuity will kick in at, say, age 80, you can more comfortably spend down your retirement savings between your retirement date and your 80th birthday.

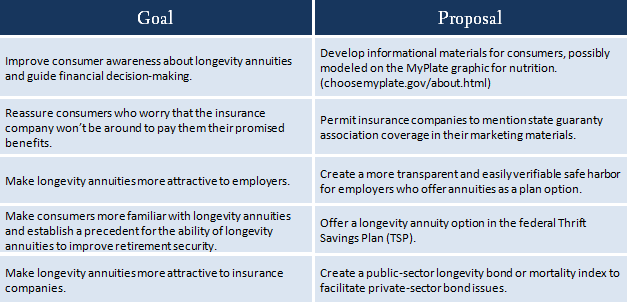

In their paper, Abraham and Harris propose five ideas to accomplish this shift and encourage growth in the longevity annuity market:

However, other panelists were somewhat skeptical about the market for longevity annuities. Responding to a question from Wessel about the fact that longevity annuities seem to be targeted at those in the 75th to 90th income percentile, Aaron described it as a niche product that doesn’t fully address the problem of asset depletion among retired Americans. John observed that market size would depend in large part on product structure and presentation to consumers. He also noted that longevity annuities won’t be right for everyone, since we all have different life expectancies—based on factors such as race, gender, and socio-economic status—and therefore different levels of longevity risk.

The second panel delved into more technical issues related to longevity annuities. Iwry commented on recent Treasury guidance on annuities, saying that he and his colleagues hope to transition “the 401(k) plan from a do-it-yourself model to a more effective retirement security vehicle” by encouraging employers to offer annuities. Fuerst addressed the question of adverse selection, which cropped up during both panels, by noting that it didn’t seem to pose a real threat to the longevity annuities market. People are bad at predicting their own longevity more than five years out, he said, and longevity annuities are typically purchased decades before they are expected to start paying out. “It’s very difficult to predict today what your health status is going to be like 20 years from now.” He also recommended that consumer funds used to purchase longevity annuities be invested in high-quality fixed-income instruments, so that monthly payments would be determined in part by market performance—as a low-risk option to grow interest in longevity annuities. Instead of receiving a specific, pre-determined monthly payment, consumers might receive a little more than expected if their investment earned more than expected, or a little less if their investment earned less than expected. In keeping with Abraham and Harris’s optimism about future growth in the longevity annuities market, Mumford said to expect stronger insurance companies in the future and called on regulators and insurance companies to educate the public about longevity products and their associated risks.

Commentary

Shifting Retirement Security Paradigms: When “Save Like Hell and Hope You Don’t Live Too Long” Isn’t Enough

November 10, 2014