With tax season around the corner, thousands of certified volunteer programs across the country are gearing up to offer free tax return preparation services to millions of low- and moderate-income taxpayers, military families, people with disabilities and seniors.

In addition to free tax assistance, many of these programs invest in outreach and education efforts to make sure residents in their community know about important tax provisions they may qualify for, including the Earned Income Tax Credit and the Additional Child Tax Credit. Both of these credits for low-income working families are refundable, meaning that if the credit exceeds the taxes owed, filers can receive the remainder as tax refunds. Together, these two provisions keep millions of workers and their families out of poverty each year.

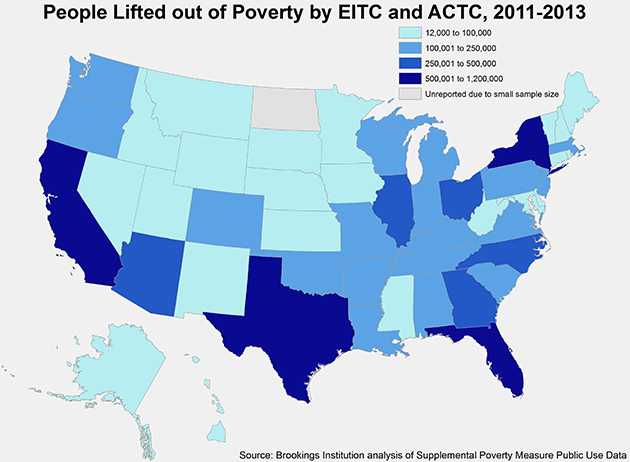

The U.S. Census Bureau’s Supplemental Poverty Measure suggests that without the EITC and ACTC the nation’s poverty rate would have been 2.9 percentage points higher in 2013. The impact of these credits was even more pronounced for children: together the EITC and ACTC reduced the child poverty rate by 6.4 percentage points.

New state-level estimates show that every state shared in the anti-poverty effects of these credits, from the District of Columbia to Texas, where the credits lifted 1.2 million residents—including over half a million children—out of poverty. (For detailed state data, see this table.)

The key to maximizing the anti-poverty impact of these provisions—as well as the range of other positive effects associated with them—is to make sure eligible workers and their families claim the credits they qualify for at tax time.

As outreach efforts around these important policies and tax preparation services ramp up for this tax season, we’ve updated our profiles of the EITC-eligible population at the state and metro area level to help inform those efforts. With this information, organizations can not only get a sense of the size and makeup of the EITC-eligible population in their community, but they can also tailor their outreach strategies based on information about the types of industries and occupations that tend to employ these workers and the most common languages eligible filers tend to speak.

Visit our EITC Interactive and Resources page to find the full complement of the latest national, state, and metro area data on the EITC-eligible population.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Fighting Poverty at Tax Time through the EITC

December 16, 2014