Gains in the labor market have stalled, according to today’s employment report. Payroll employment increased by just 18,000 jobs in June, the smallest increase in eight months, and the unemployment rate ticked up to 9.2 percent. Increases in private employment slowed sharply over the past two months, while government employment continued to fall.

In previous postings, we have looked at the median earnings of both men and women to explore their long-term employment and earnings trends. For men, we found that earnings have been on the decline because of stagnant wages and declining employment. For women, earnings have increased rapidly as more women entered the labor force armed with higher levels of education—able to command higher salaries.

This month we explore the trends in earnings and employment for America families, looking both at two-parent and single-parent families. Indeed, the question about how men or women are doing separately may not capture how the average family is doing. To help tell the full story we examined the earnings for households with children during the past thirty five years.

The numbers suggest that the typical American family is earning more, but almost entirely because parents are working more—not because they are earning more per hour. This is one more indicator that, even before the recession, the labor market was presenting challenges for many American families.

How Is the American Family Doing?

The American Dream is for each generation to do better than the one before. For past generations, this meant that better education, improved technologies, and global opportunities enabled typical workers worker to reap higher rewards and provide a better quality of life for their families. Blue-collar workers worked hard to send their children to college so that they could get white-collar jobs and provide the next generation of children with still greater opportunities.

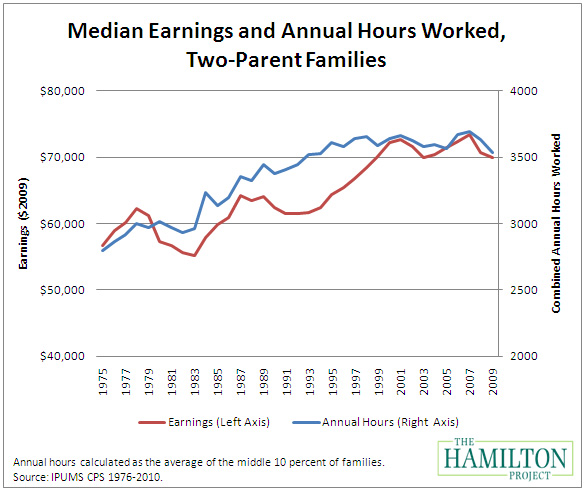

But at least one measure of well-being suggests that families may be struggling to fulfill the promise that each generation can do better than the last. Although median wages for two-parent families have increased 23 percent since 1975, the evidence suggests that this is not the result of higher wages. Rather, these families are just working more. In 2009, for instance, the typical two-parent family worked 26 percent longer than the typical family in 1975.

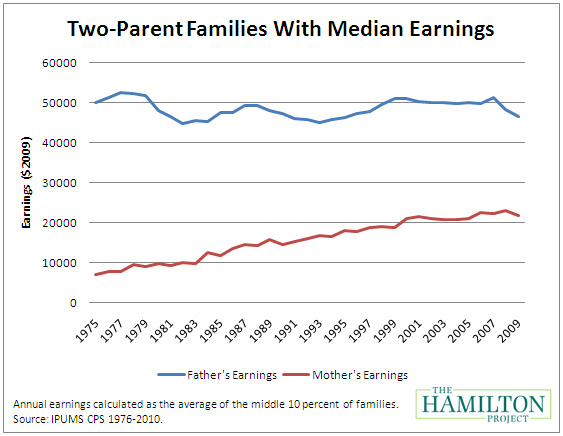

Families earning the median income now work about 3500 hours, on average, compared to 2800 hours in 1975. The 26 percent increase in hours worked mainly reflects increases in work outside of the home among women. In fact, among two-parent families with median earnings, the hours of men were relatively constant over time, while hours worked by women more than doubled from 1975 to 2009. It was this increased contribution to work outside of the home, mostly by women, rather than wage increases, that led to higher earnings for the typical two-parent family.

Focusing on the median American family’s earnings obscures some facts that paint an even less rosy picture about the state of the typical American household. The fraction of men between the ages of 30 and 50 who are married with children has declined dramatically from 70 percent in 1975 to 47 percent today. Low marriage rates appear to be related to the poor job prospects for many American men. Indeed, looking at men between ages 30 and 50, the probability of marriage is over 10 percentage points higher for men near the 75th percentile of the earnings distribution than for men at the median earnings level.

With fewer people getting married, fewer children are living in two-parent families. Indeed, single-parent families now make up about 35 percent of all families with children, compared to 17 percent in 1975. Annual hours worked by single-parent families have increased a dramatic 53 percent since 1975, but earnings have increased even more—about 69 percent. This increase in earnings and hours largely reflects rising labor force participation among women, who head most single-parent families, and increases in their wages as women entered higher-paying jobs and achieved higher education levels. Nevertheless, because only one earner is present, the median earnings of single-parent families is still only about $16,500, less than one-fourth that of a two-parent family.

As one would suspect, earnings may not fully capture the total earnings parents take home at the end of the day. For both single-parent and two-parent families, the increased earnings that women have brought to the table require additional expenditures in child care and transportation. For example, for families in which the mother works, child care costs represent approximately 6.4 percent of family income on average, according to the Census Bureau.

The June “Job Gap”

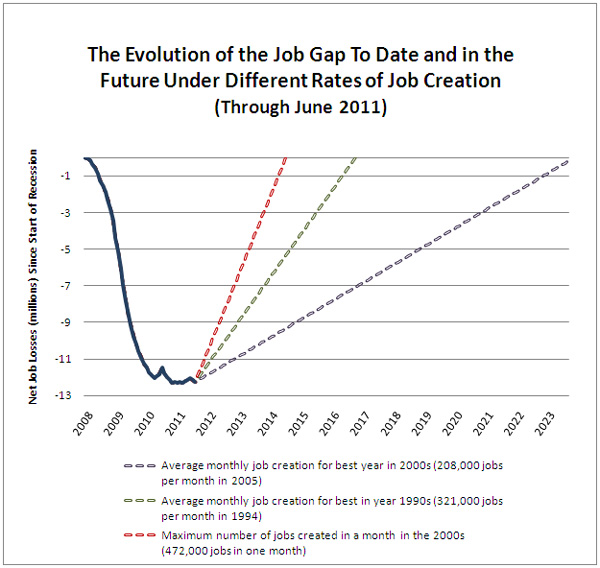

As in previous months’ postings, The Hamilton Project updates America’s job gap, the number of jobs that the U.S. economy needs to create in order to return to pre-recession employment levels while absorbing the 125,000 people who enter the labor force each month.

June’s “job gap” is estimated at 12.3 million jobs, up 150,000 jobs from May.

The chart below shows how the job gap has evolved since the start of the Great Recession in December 2007, and how long it will take to close under different assumptions for job growth. The solid line shows the net number of jobs lost since the Great Recession began. The broken lines track how long it will take to close the job gap under alternative assumptions about the rate of job creation going forward.

If the economy adds about 208,000 jobs per month, which was the average monthly rate for the best year of job creation in the 2000s, then it will take until October 2023—over 12 years—to close the job gap. Given a more optimistic rate of 321,000 jobs per month, which was the average monthly rate for the best year of job creation in the 1990s, the economy will reach pre-recession employment levels by September 2016—over five years.

Conclusion

The health and stability of the American family remains a key bellwether for the economic wellbeing of our country. As suggested in previous postings, however, there is growing evidence that the promise of the American Dream is at risk. This analysis paints a picture of rising family incomes driven largely by an increase in hours worked, particularly among mothers. Increasing labor force participation—and higher wages—by working women have contributed more significantly to the rise in family earnings. But this has only helped the typical family tread water; the increased participation by women in the workforce has not overcome the drag caused by the stagnating wages of the typical working man.

At the same time, we are witnessing a rise in single-parent households, led primarily by women. On a positive note, one-parent households are experiencing higher earnings due to higher wages. But, when compared to the median earnings of the two-parent household, they still lag behind.

The Great Recession was officially declared over by the National Bureau of Economic Research in June 2009, but millions of American workers are still unemployed. Furthermore, stagnating wages threaten the promise that each generation can do better than the last. New and innovative policies are needed to help spur economic growth and create jobs. In the fall of 2011, The Hamilton Project will announce the winner of its recent prize competition—seeking new ideas for creating jobs and boosting productivity. The winning submission and other policy proposals will be featured at an event in Washington, DC.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The Great Recession May Be Over, but American Families Are Working Harder than Ever

July 8, 2011