Chapter

01

ECONOMIC RECOVERY AND GROWTH:

Tackling multiple headwinds

Essay 1

Essay 2

Priority actions to address Africa’s economic recovery

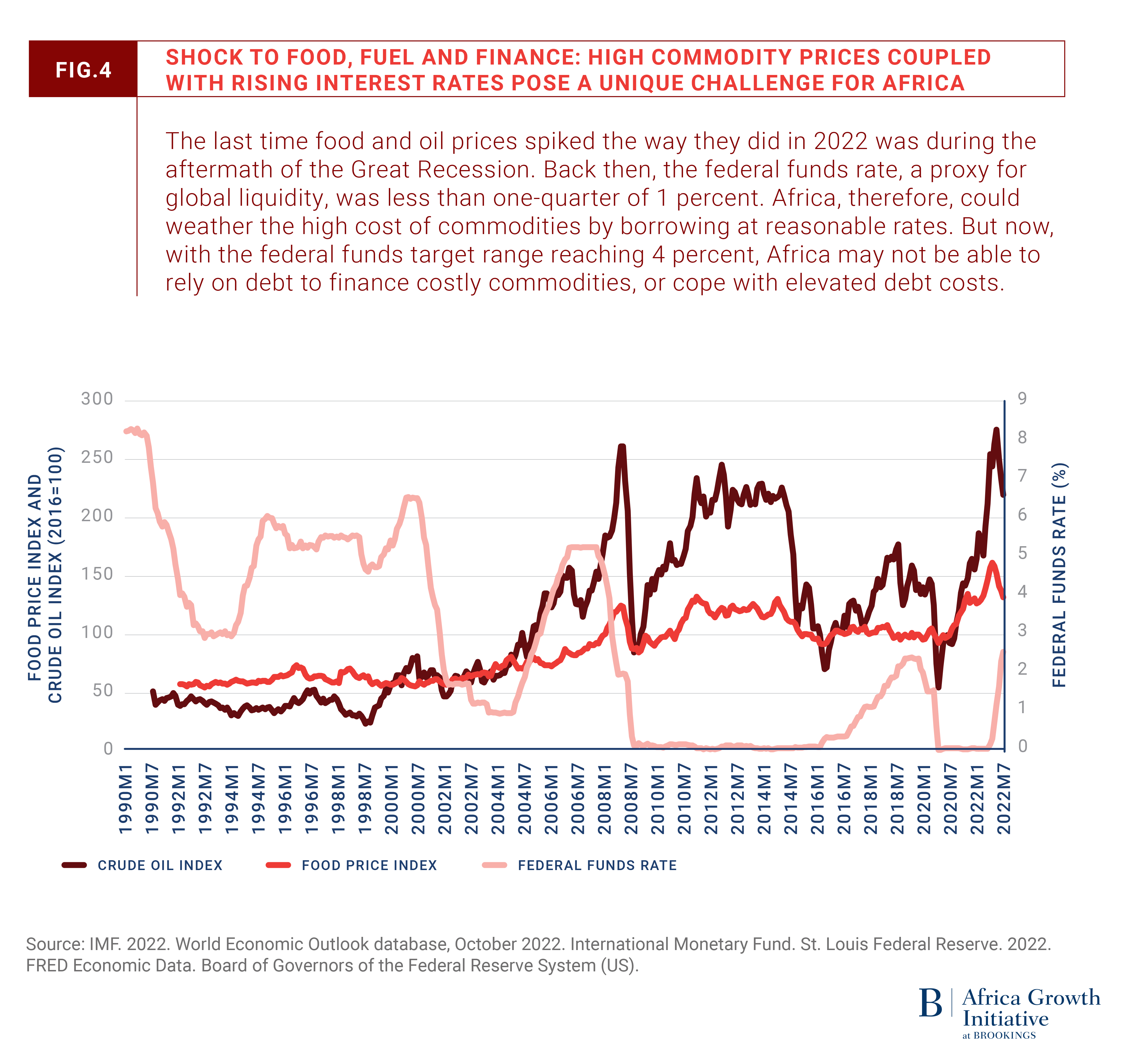

As we begin 2023, Africa’s development is threatened by multiple crises. This time is distinctly different from past episodes, first in the increased frequency of crises, as well as the persistence and deepening of climate and conflict crises. While in 2008/2009 Africa was able to use debt to weather the financial crisis, today, rapidly rising global interest rates and the absence of a well-functioning framework for comprehensive debt reduction and relief, threaten to cut access to international financial markets for many countries. Moreover, deglobalization trends could limit Africa’s ability to use international trade to drive growth.

“While the external environment is precarious and may remain that way for some time given the evolving geopolitical tensions, domestic policy actions do matter, and Africa’s policymakers are not helpless.”

While the external environment is precarious and may remain that way for some time given the evolving geopolitical tensions, domestic policy actions do matter, and Africa’s policymakers are not helpless. The time to act is now, in order to regain lost ground and move towards prosperous economies and resilient, inclusive societies.

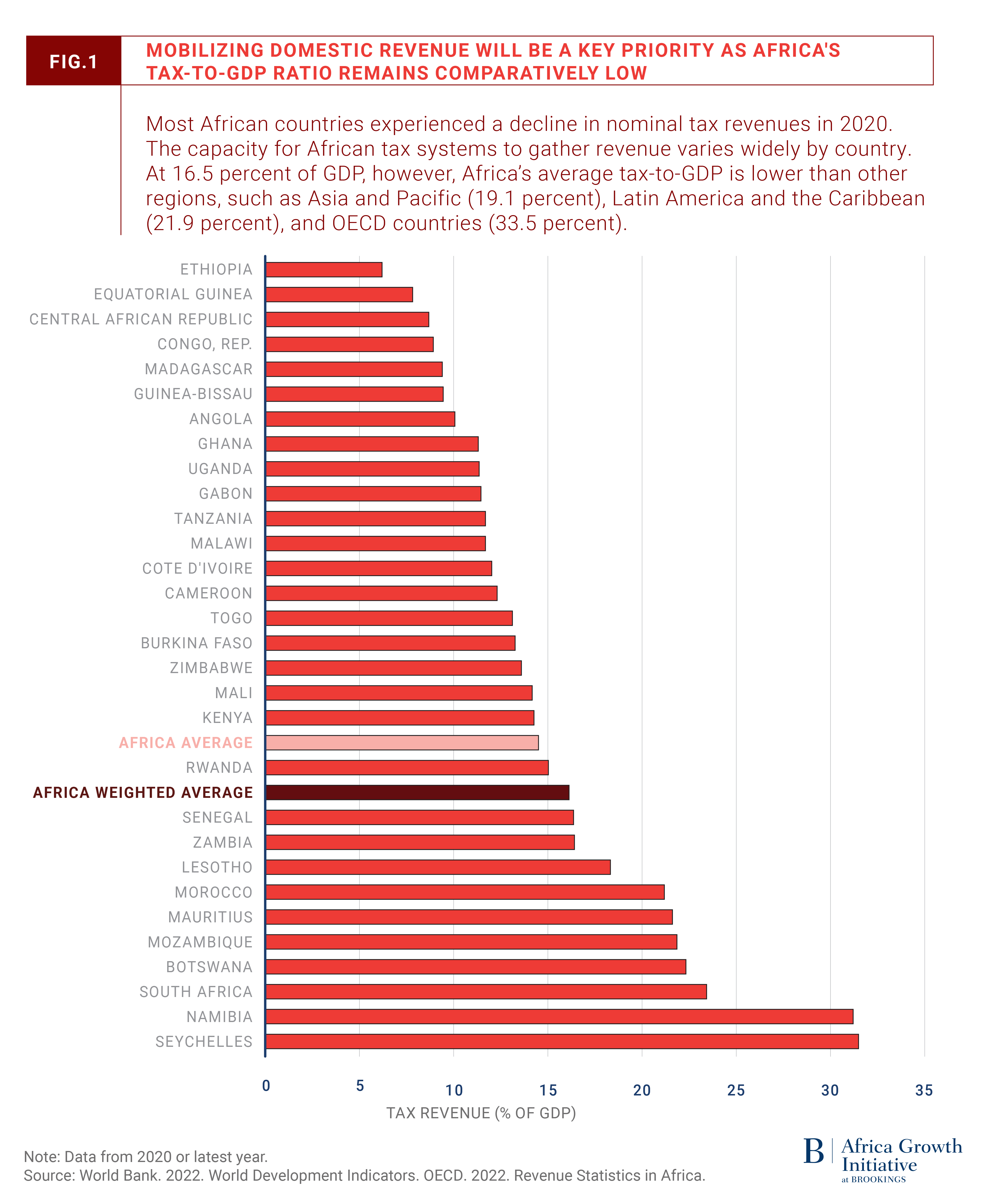

Raise more domestic revenues and spend more efficiently

This is foundational to any credible home-grown solution. The continent collects less revenue than can be generated domestically at current levels of income, with tax revenue as a share of GDP averaging 16.1 percent of GDP for sub-Saharan Africa as a whole—see Figure 1. Strengthening tax administration and expanding tax sources to real estate, sugary products, and eventually carbon, are important opportunities to significantly raise domestic revenue. It is also important to eliminate excessive inefficiencies in both recurrent and capital spending. Countries need to move away from expensive (and often regressive) large-scale generalized subsidies and towards more selective, well-targeted approaches including technology-enabled social protection programs and high value investments such as research and development and infrastructure. Targeted programs allow governments to support the most vulnerable, while effectively supporting specific strategic objectives, and eliminating wasteful expenditure. Public investment programs need to be thoroughly reviewed to weed out poorly conceived investments and ensure limited resources are truly supportive of long-term growth, while strengthening programs that build long-term public investment capacity. Commodity exporters have a huge opportunity to fully leverage current commodity windfalls to build macroeconomic buffers and invest in flagship programs that will address long-term challenges. Finally, African countries need to develop deep domestic (or regional) financial markets, anchored by high savings from national pension funds—and regional sovereign wealth funds more broadly—which will require addressing regulatory constraints.

Enable African entrepreneurship to flourish and support modern competitive economies

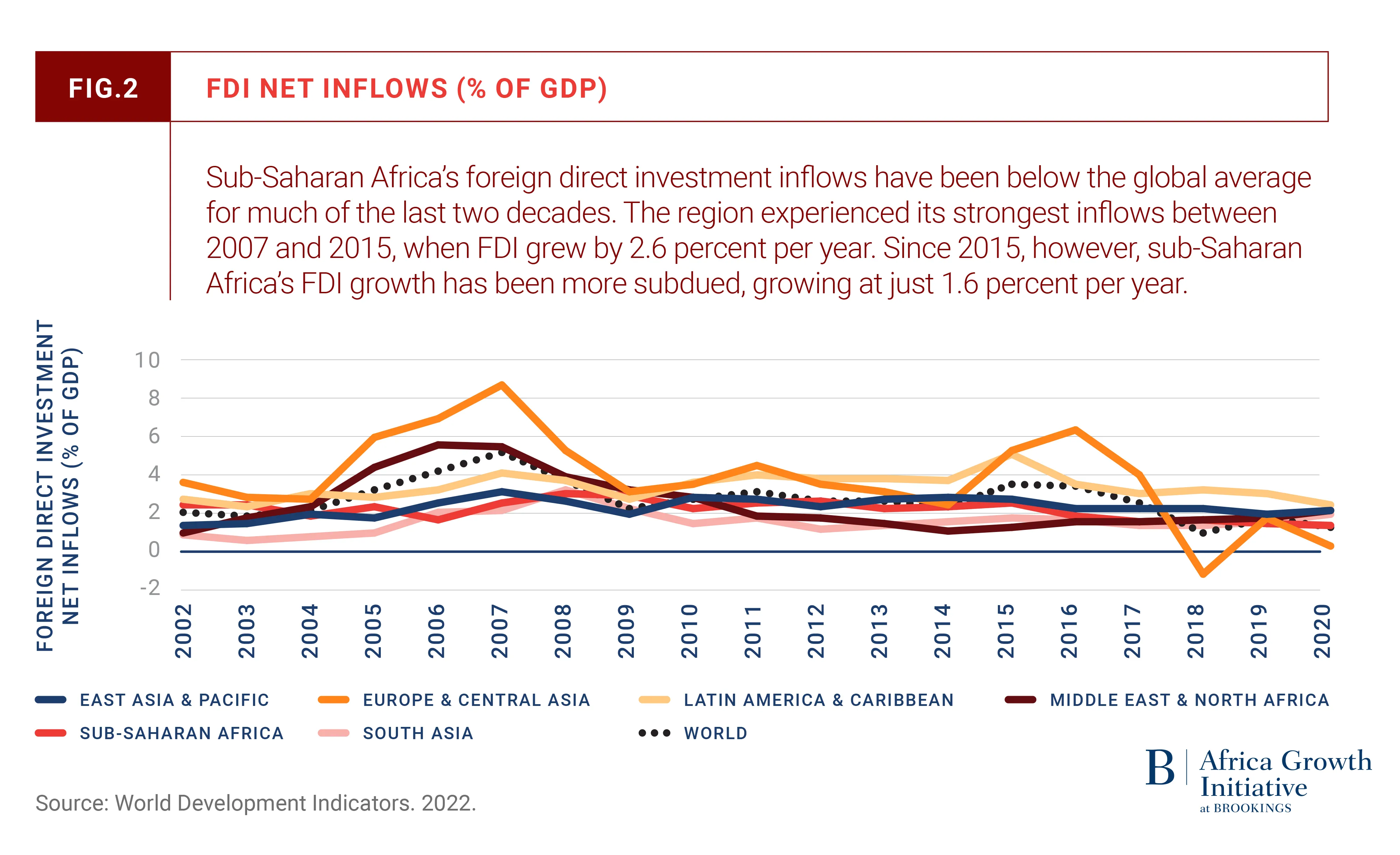

African entrepreneurial talent is evident across the continent. Yet it remains largely untapped.1 African economies are also largely informal and operating at low levels of productivity—making it challenging to provide the requisite number of decent jobs for poverty reduction and to grow the middle class.2 Policymakers can enable the emergence of a more formal, competitive domestic private sector by building competitive markets characterized by stable, transparent, and fair regulatory regimes. Much can be done in the near term and complemented with more medium-term reforms. This will also support foreign direct investment (FDI) inflows which remain at low levels compared to other developing regions—see Figure 2. A related opportunity is enabling the private sector to play a much greater role in closing key energy, transport, and digital infrastructure gaps— which is essential for competitiveness. In energy, private sector participation in off-grid solutions is already contributing to increased energy access in some countries. The private sector is also delivering huge gains in financial inclusion through use of digital technology, widespread connectivity using mobile phones, and telemedicine. Policymakers can help address constraints to scaling up these successes and extending them across the continent. In order to close the infrastructure access gaps, governments will also need reforms to strengthen the performance and financial viability of public sector utilities.

Tap Africa’s huge demographic bulge

Africa’s population is the most youthful globally, with about 60 percent below 25 years.3 The time is now to turn this youth bulge into a demographic dividend to drive growth and development. Investing in the human capital of Africa’s youth is fundamental. Action is needed first to address the significant human capital losses from COVID-19, and to implement clear plans to tackle the silent learning crisis in the region. Children in sub-Saharan Africa are, on average, learning for only five out of the eight years in school due to weaknesses in education systems. A second area for attention is providing jobs for the rapidly growing numbers of unemployed youths.4 Technical and vocational educational training (TVET) programs, in partnership with the private sector, alongside well-designed apprenticeship programs need to be expanded and strengthened to provide requisite labor market skills.[Ibid.] The entrepreneurial talent of Africa’s youth, especially in the startup sector, will also need to be supported to thrive. Finally, the high fertility rate on the continent (4.8 against 2.4 globally), which drives up household consumption and reduces per capita investments in human capital, needs to be tackled. A multipronged approach including keeping girls in school, which will likely reduce child marriages and teenage pregnancy, improving access to family planning programs, and enhancing support to women’s labor force participation is needed.

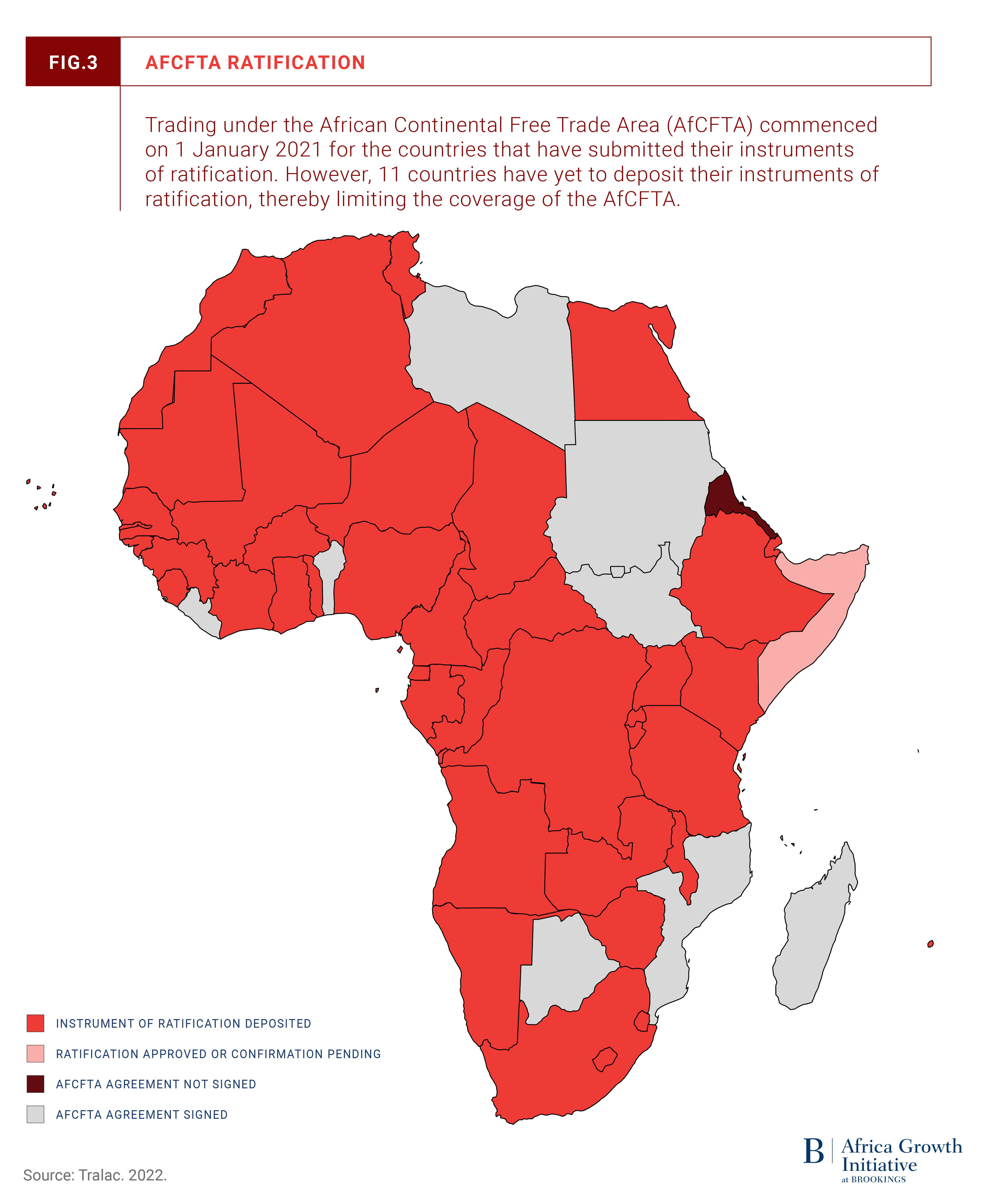

Accelerate the rollout of the African Continental Free Trade Area (AfCFTA)

“Managing the crises will demand a great deal from African policymakers. It will require political will and determination, as well as sound, well-informed judgement.”

This bold initiative by African leaders is a historic opportunity to integrate the continent. Trade within the continent is currently low, compared to intra-continental trade in other regions. A truly integrated continent will support broad improvements in competitiveness over time and is likely to build resilience to global shocks and mitigate, in part, the impacts of deglobalization.5 Implementation of the AfCFTA could also reduce food security risks by promoting intraregional agricultural trade. As of May 2022, 54 out of 55 countries have signed the AfCFTA and 44 have deposited their instruments of ratification.6 Already the Pan-African Payment and Settlement System (PAPSS), led by the Africa Export-Import Bank in partnership with the AfCFTA Secretariat and launched on January 13, 2022 after a successful trial in six West African countries, is a step in the right direction.7 8 PAPSS enables African importers and exporters to settle intra-area trade obligations in their respective national currencies. Policymakers now need to focus on accelerating implementation, supporting trade facilitation, and strengthening regional connectivity, particularly in the key corridors.

Invest in developing Africa’s forward-looking mineral repositories

Several African countries have huge deposits of resources and minerals such as cobalt, lithium, copper, manganese, and nickel which will be key to achieving green transitions. As this transition takes hold globally, the increase in demand will present opportunities for African producers to capture market share and accelerate development. Also, the market for these minerals will likely be different than those for oil and gas. Three issues merit the attention of policymakers. First, is supply management: Leaders and policymakers need to define clear, credible strategies and plans for developing these resources and maintaining investments into the sector. Second, is a strategy for value addition. To use these resources as a springboard for economic transformation, a plan for local value addition, technology and knowledge transfer, and employment generation is needed. This will require difficult negotiations with often very sophisticated multinational corporations, where individual countries may be at a disadvantage. This is an area where regional coordination and cooperation, especially considering AfCFTA, can be helpful. Third, is revenue management: Investing the proceeds from these minerals wisely by putting in place effective mechanisms and frameworks to channel revenues to clearly defined and well-designed investments.

African countries are facing multiple global headwinds while their economies are still bearing the scars of a once-in-a century pandemic. Alone, each of these crises would normally present daunting challenges. But their combined impacts could be catastrophic. We believe that Africans can turn this moment of adversity into an opportunity: To accelerate development by drawing on the internal strengths of their respective nations. Managing the crises will demand a great deal from African policymakers. It will require political will and determination, as well as sound, well-informed judgement. It will also require a willingness to learn and to adapt, patience, and the ability to balance short- and long-term goals.

African economies and overlapping crises: How to respond to the rising global headwinds?

African economies under multiple headwinds

The COVID-19 pandemic triggered a profound setback after a quarter-century of economic and social progress. Insecurity and political instability are becoming pervasive across Africa. The Russian-Ukrainian war is exposing millions of people to food insecurity, and the most vulnerable are the hardest hit as a large share of their income goes to food and transport spending. This is compounded by a harsh drought in the horn of Africa9 that has affected food supply and food security. In parallel to these shocks that will likely have lasting consequences, African economies still suffer from several structural challenges including the effects of climate change.

As of the end of October 2022, the COVID-19 pandemic cost the lives of around 175,000 people, with more than 9 million reported cases in the continent according to the World Health Organization (WHO).10 Thanks to effective policies and “good luck,” the health impact is lower than initially predicted. However, even though Africa is less affected compared to the other regions of the world, the economic impacts remain one of the highest. The real Gross Domestic Product (GDP) declined by 1.8 percent in 202011—for the first time in more than 25 years—pushing 23 million people into extreme poverty according to the World Bank,12 exacerbating inequality, and shrinking fiscal space. Africa’s Human Development Index also fell for the first time in nearly three decades.13 The recovery itself is dragged and uneven because of unequal access to vaccines and slow vaccination progress, protracted conflicts and political instabilities, and the Russian-Ukrainian war. GDP growth is expected to slow down in 2022 (3.7 percent) compared to 2021 (4.8 percent).

According to Institute for Economics and Peace (IEP)’s Global Terrorism Report 2022, six out of the 10 countries most impacted by terrorism in the world are in Africa.14 Four of the six deadliest countries are located in Africa (Mali, Niger, Somalia, and Burkina Faso) and they accounted for 77.3 percent of total terrorism deaths in 2021 (3,223 deaths). This terrorist insecurity triggers political instability. Between 2020 and 2021, at least six successful and one attempted coup were perpetrated in Africa15 (two in Burkina Faso, one in Chad, two in Mali, one in Guinea, one in Sudan, and one attempted coup in Guinea-Bissau).16 This political instability not only impedes economic recovery, but sets back more than 30 years of democratic progress.

“About 30 percent of Kenya’s imported wheat comes from Russia and Ukraine, and in 2021, 44 percent of Cameroon’s fertilizer imports came from Russia. As a result, 346 million people (a quarter of Africa’s total population) are facing severe food insecurity.”

The Russian-Ukraine war further compounds the challenges to economic recovery. The war and subsequent economic sanctions against Russia increased energy prices, triggered food inflation, tightened financial conditions, and caused global uncertainty. Brent oil price went above the $100/barrel mark for the first time since 2014, creating a ripple effect on other prices and challenging the green energy transition.

Although the imports from Ukraine and Russia—as a share of Africa’s total imports—are small, many countries rely on these countries for critical imports including wheat and fertilizers. For example, about 30 percent of Kenya’s imported wheat comes from Russia and Ukraine, and in 2021, 44 percent of Cameroon’s fertilizer imports came from Russia.17 As a result, 346 million people (a quarter of Africa’s total population) are facing severe food insecurity.18 In Kenya, the supply disruption and the increase in wheat price will affect the production and the price of bread, which is the third most consumed food item in the country.

Moreover, the pandemic and war in Ukraine have created a highly polarized world— unprecedented since the Cold War, which undermines the international community’s capability to come together and address the world’s most pressing issues. Under such circumstances, how can African policymakers properly navigate the multiple headwinds?

How African countries can deal with multiple headwinds

Addressing food insecurity diligently

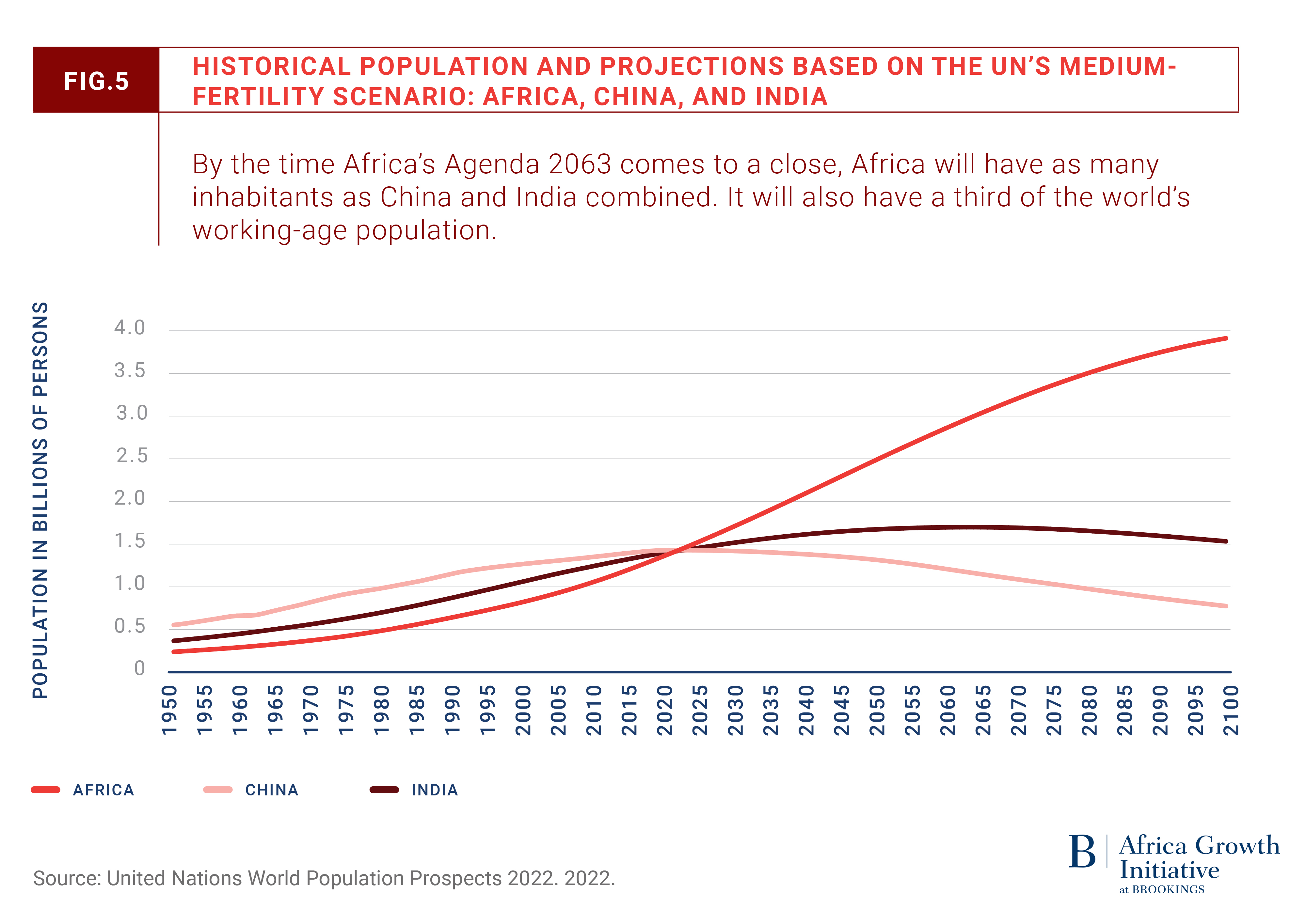

Africa is home to 60 percent of the world’s uncultivated arable land. This contrasts sharply with the African continent’s incapacity to feed itself.19 In 2022, the African population will be equivalent to the Chinese and Indian populations. Figure 5 displays the historical evolution and projections of the population of Africa, China, and India based on the U.N.’s medium fertility scenario. As shown on the graph, Chinese and Indian populations reach a tipping point and will decrease over the coming years.

By contrast, the African population will continue to grow over the next eight decades. In less than 40 years, the African population is expected to be greater than the Chinese and Indian populations combined. Feeding this population under climate change is one of the greatest challenges for Africa.

Beyond the short-term emergency to address the threat of food insecurity caused by the Russian-Ukrainian war, African countries have an opportunity to draw lessons from this crisis and bring their agricultural sector up to par. This includes, but is not limited to, investing in supporting technologies, building fertilizer factories, and building climate resilience by investing in climate-smart agriculture and adaptation. Food security and climate change should be developed into a strategic policy design. Education is also key to improving agricultural labor productivity. Failing to feed a young and fast-growing population can turn the expected demographic dividend into a demographic time bomb.

Fostering macroeconomic stability

The pandemic and the successive negative shocks dramatically deteriorated macroeconomic fundamentals in many African countries, particularly the sovereign debt balance. As of February 2022, 23 African countries were either in debt distress or at risk of it.20 Fiscal space and sound macroeconomic conditions will be key to properly respond to the various shocks faced by African economies. Improving efficiency in public spending, and mobilizing more domestic revenue by increasing tax administration efficiency, can contribute to building fiscal space and a sound macroeconomic framework, which is fundamental to sustaining economic recovery. However, achieving this (i.e., improving tax revenue collection and public spending efficiency) may entail structural reforms including technology adoption and fighting against corruption.

“Governments need to take adequate measures to avoid setbacks in democratic progress. To support an inclusive recovery, governments should engage in reducing people’s vulnerability and developing social safety nets.”

Inclusive and equitable recovery policies

Crises and recovery are uneven within and between countries. While the most vulnerable are hit the hardest, they also experience slower recovery than the others. To ensure that no one is left behind, recovery policies need to be inclusive and equitable. For instance, governments should pay attention to people falling into extreme poverty due to the COVID-19 pandemic and to those at risk of falling under the poverty line, and design policies that could help people to bounce back. Governments can also leverage digital financial services to improve access to finance for the most vulnerable population.

People’s vulnerability, political unrest, and political instability

Insecurity, vulnerability, and social unrest hinder political stability and development prospects. The current food insecurity and terrorism in the Sahel heighten the risk of social unrest on the continent. Governments need to take adequate measures to avoid setbacks in democratic progress. To support an inclusive recovery, governments should engage in reducing people’s vulnerability and developing social safety nets.

Endnotes

- 1. Fox, Louise, Philip Mader, James Sumberg, Justin Flynn, and Marjoke Oosterom. 2020. “Africa’s ‘youth employment’ crisis is actually a ’missing jobs’ crisis.” The Brookings Africa Growth Initiative.

- 2. Coulibaly, B., Gandhi, D., and Mbaye, A. (2019). “Job creation for youth in Africa Assessing the potential of industries without smokestacks.” Africa Growth Initiative Paper 22. Washington, DC: Brookings.

- 3. United Nations. 2022. World Population Prospects. United Nations Department of Economic and Social Affairs Population Division.

- 4. Heitzig, Chris and Landry Signé. “Seizing the momentum for effective engagement with Africa.” 2022. The Brookings Institution. Initially prepared for the National Intelligence Council.

- 5. Mold, Andrew. “The economic significance of intra-African trade—getting the narrative right.” The Brookings Africa Growth Initiative.

- 6. Tralac. 2022. AfCFTA Ratification Barometer. The Trade Law Centre.

- 7. Ogbalu III, Mike. 2022. “Boosting the AfCFTA: The role of the Pan-African Payment and Settlement System.” Chapter Five of Foresight Africa 2022. The Brookings Africa Growth Initiative.

- 8. Africa Growth Initiative. 2022. Foresight Africa Podcast. Episode 8: “New tools for easing cross-border trade in Africa.” The Brookings Africa Growth Initiative

- 9. NASA-Earth Observatory. 2022.“Worst Drought on Record Parches Horn of Africa”. National Aero-nautics and Space Administration.

- 10. WHO. 2022. “WHO Coronavirus (COVID-19) Dashboard.” World Health Organization.

- 11. IMF. 2021. “Regional Economic Outlook Sub-Saharan Africa”. International Monetary Fund.

- 12. Abay Kibrom A., Nishant Yonzan, Sikandra Kurdi, and Kibrom Tafere. 2022. “Africa might have dodged a bullet, but systemic warnings abound for poverty reduction efforts on the continent.” World Bank Blogs.

- 13. UNDP. 2022. Human Development Report 2021/22 https://hdr.undp.org/content/human-develop¬ment-report-2021-22.

- 14. IEP. 2022. “Economics and Peace Global Terrorism Report Measuring The Impact Of Terrorism”. Institute for Economics & Peace.

- 15. The Conversation. 2022. “Vague de coups d’État en Afrique : on les appelle désormais des réinter-prétations constitutionnelles.”

- 16. Assogba, Henri. 2022. “Vague de coups d’État en Afrique : on les appelle désormais des « réinter¬prétations constitutionnelles.” The Conversation.

- 17. Sen, Ashish Kumar.2022. “Russia’s War in Ukraine Is Taking a Toll on Africa.” United Nations Insti¬tute of Peace.”

- 18. FAO, ECA, and AUC. 2021. “Regional Overview of Food Security and Nutrition 2021: Statistics and trends.” Food and Agriculture Organization.

- 19. Plaizier, Wim. 2016. “2 truths about Africa’s agriculture.” World Economic Forum, Davos.

- 20. Harry Verhoeven. 2022. “China has waived the debt of some African countries. But it’s not about refinancing”. The Conversation.

Viewpoints

Staying the course: Strengthening fundamentals despite adversity

Finance Minister Nicolas Kazadi describes the Democratic Republic of Congo’s approach to strengthening economic fundamentals in the context of the pandemic and other shocks.

Nigeria in 2023: Bridging the productivity gap and building economic resilience

Wilson Erumebor details the economic challenges facing Nigeria’s economy and outlines two priorities for structural transformation.

Self-organizing Nigeria: The antifragile state

Andrew S. Nevin, Uma Kymal, Peter Nigel Cameron, and Rufai Oseni explore how Nigerians’ self-organizing impulse impacts the country’s economic development.

In search of new ideas for Africa’s recovery: Sports and creative industries as game changers?

Frannie Léautier and Will Mbiakop argue that sports and creative businesses can play a central feature in Africa’s economic recovery and resilience.

Africa’s sovereign finance toolbox: Building resilience for a sustainable future

Nicole Kearse encourages African governments to use the current moment to reflect on and reassess their current approaches to borrowing and financing.

The banking sector as a partner in Africa’s recovery: A perspective from Ecobank Group

Ade Ayeyemi details how the financial sector can bolster Africa’s economic growth.