Mr. Chairman, Ranking Member Speier, and distinguished Subcommittee members:

Thank you for inviting me here to share my views on U.S. LNG export policy. My name is Charles Ebinger and I am Director of the Energy Security Initiative at the Brookings Institution. These views are mine alone and do not reflect the views of the Brookings Institution, which does not take institutional positions on any policy issue.

The Energy Security Initiative at Brookings has been studying this issue for the past two years, having published an assessment of the case for LNG exports in May 2012 in our report, Liquid Markets: Assessing the Case for Exports of Liquefied Natural Gas from the United States.[1] In that report, we focused on two determinants of whether the U.S. should allow exports of LNG: what is the feasibility of exporting LNG, and what are the implications? After assessing both factors, my co-authors, Kevin Massy and Govinda Avasarala, and I came to two primary conclusions: first, the negative implications of LNG exports from the lower 48 states, which we believe to be technically feasible, are marginal and outweighed by the benefits; second, as the lynchpin of the globalized economy the United States must continue to espouse free trade and avoid intervening in a global market. Ultimately we believe, as we stated in our report, “that the United States should neither act to prohibit nor to promote LNG exports.”

In the 10 months since the release of this report, more studies and information—some good, some misleading—have surfaced. More opinions are being voiced. Amid the increased volume of debate, however, my opinion has not changed. I still believe that the benefits of U.S. LNG exports are, on balance, a benefit to the United States; that the United States still has the responsibility and the incentive to be an advocate for free trade; and that the U.S. government should not intervene in what should be a market-driven process.

I applaud this Committee for avoiding another acrimonious debate on the pros and cons of LNG exports by spending more time with both the implications of LNG exports and discussing some specifics reforms that might help rationalize the permitting process while clearly protecting the public interest.

Part 1: Implications

Any discussion surrounding the implications of U.S. LNG exports will focus on several considerations including the implications for domestic natural gas and electricity prices, the impact on other consumers of natural gas, and the impact on international prices and geopolitics.

Wellhead Prices

There have been a number of studies that have examined the impact of U.S. LNG exports on domestic prices. When analyzing them, policymakers should identify which study’s assumptions most resemble the existing natural gas market and its likely direction, and which models are most reflective of the complex nature of domestic and global natural gas trade. For instance, assuming realistic volumes of natural gas exports as well as a reasonable supply response by natural gas producers are two critical considerations. It is also important to note that the supply curves in the various studies reflect different interpretations of the economics of marginal production.

Under the most reasonable assumptions (in this case assuming 6 bcf/day of exports), most reports forecast that natural gas prices will be between 2 and 11 percent higher in 2035 than if the U.S. did not export LNG.[2] There are a number of factors that insulate domestic prices from dramatic increases in price as a result of exports. First, as will be discussed later, there is a market-determined limit on how much the United States can economically export, depending on domestic prices, the international gas market, and the global market for competing fuels. Second, the size of the resource base is substantial, an important factor because the EIA estimates that roughly 63% of the gas required to meet demand for LNG export will come from increased domestic production.[3] Finally, the domestic natural gas sector is very efficient and producers are able to respond rapidly to marginal increases in the domestic price.

Figure 1: Study-by-study comparison of the Average Price Impact from 2015-2035 of 6 bcf/day of LNG exports (unless otherwise noted)

|

Study |

Average Price without Exports ($/MMBtu) |

Average Price with Exports ($/MMBtu) |

Average Price Increase (%) |

|

EIA* |

$5.28 |

$5.78 |

9% |

|

Deloitte |

$7.09 |

$7.21 |

2% |

|

Navigant (2010)** (2 bcf/day of exports) |

$4.75 |

$5.10 |

7% |

|

Navigant (2012)*** |

$5.67 |

$6.01 |

6% |

|

ICF International*** |

$5.81 |

$6.45 |

11% |

* Price impact figure for EIA study reflects the reference case, low-slow export scenario.

** Navigant (2010) did not analyze exports of 6 bcf/day.

*** Navigant (2010 and 2012) and ICF International studies are based on Henry Hub price.

Source: EIA, Deloitte, Navigant, ICF International

Power Sector Implications

LNG exports are likely to have a modest impact on electricity prices as well. In the power sector, natural gas has historically been used as a back up to coal and nuclear base-load generation. For such gas used at the margin, the increase in electricity prices as a result of LNG exports will be limited by its competitiveness relative to other fuels: as soon as it becomes more expensive than the alternative for back up generation, power producers will move away from gas. According to ICF International, a $0.64/MMBtu increase in the price of natural gas will result in an electricity price increase of between $1.66 and $4.97/megawatt-hour (MWh), depending on how often gas is used as the marginal fuel for electricity. Deloitte estimates that the price increase of electricity will not be more than $1.65/MWh. EIA estimates that electricity price impacts will be marginal as well (between $1.40/MWh and $2.90/MWh) except in the “high rapid” export scenario. By contrast, the EIA Annual Energy Outlook 2013 estimates that, in its reference scenario, the average price of electricity (across all fuels) in 2035 will be $101/MWh, showing clearly the small impact that the rise in domestic electricity prices will have on consumers.[4]

Industrial Sector Implications

I am similarly skeptical about the negative consequences of exports on our industrial sector. Some of the more vocal industry opponents to LNG exports contend that price increases will reverse the trend of manufacturing investment returning to the United States. I firmly disagree with this assessment. For starters, I don’t believe that multi-billion dollar industrial investments in factories that will be a part of the capital stock for decades will be rendered unprofitable by single-digit percent changes to natural gas prices. As one analyst put it, “if your margins are so thin that [modest price increases] could break them, then there isn’t much benefit to putting up a plant here. Conversely, if it is so beneficial to do it here, then a small change in price probably won’t undermine those benefits.”[5]

For the petrochemical sector, the picture is even more positive. The prospects of large volumes of new supply suggest that the industrial sector’s competitiveness is stable regardless of U.S. export policy. Today the ratio of the price of oil to the price of natural gas is over 25:1. This is well over the 7:1 oil-to-gas price ratio at which the American Chemistry Council (ACC) believes U.S. petrochemical and plastics producers to be globally competitive. European and Asian petrochemical producers use oil-based products such as naphtha as a feedstock, as they lack access to cheap natural gas liquids (NGLs). Increased drilling will likely result in the greater production of the NGLs. This is one of the principal reasons why petrochemical producers are looking to return to the United States, after spending much of the previous decade relocating facilities overseas. According to a March 2011 report by the ACC, a 25 percent increase in ethane—a natural gas liquid—production will yield a $32.8 billion increase in U.S. chemical production.[6] To the extent that increased gas production linked to exports results in increased production of natural gas liquids, they will benefit the petrochemical industry.

International/Geopolitical Implications

Before diving too deep into the international pricing and geopolitical implications of U.S. LNG exports, it is worth reviewing the structure of the global LNG market, which is informally separated into three markets: North America, the Atlantic Basin (mostly Europe), and the Pacific Basin (including Japan, South Korea, Taiwan, China, and India). These markets are separated because of important technical differences that impact the pricing structure for LNG in each market. The North American natural gas market is competitive and prices are traded in a transparent and open market. The Atlantic Basin is dominated by European LNG consumers such as the United Kingdom, Spain, France, and Italy, and is a hybrid of a competitive U.K. market that was liberalized in the mid-1990s and a Continental European market that is partially dependent on oil-linked, take-or-pay contracts. In recent years, the U.K. hub, the National Balancing Point (NBP), has traded at a premium to the U.S. hub, known as the Henry Hub. The Pacific Basin is a more rigid market that depends heavily on oil-indexed contracts that are more expensive than those used in the Atlantic Basin. While they have no central trading hub, the Pacific Basin consumers such as Japan and South Korea currently import LNG based on a pricing formula known informally as the Japan Crude Cocktail, the average price of custom-cleared oil imports into Tokyo. Many Pacific Basin contracts have a built-in price floor and price ceiling depending on the price of oil.

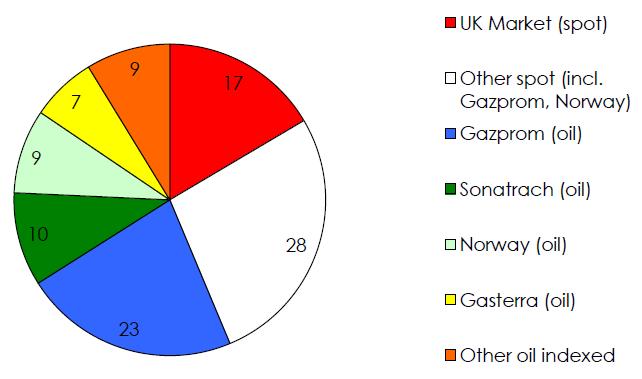

Without exporting any natural gas, the U.S. shale gas “revolution” has already had a positive impact on the liquidity of global LNG markets. Many LNG cargoes that were previously destined for gas-thirsty U.S. markets were diverted and served spot demand in both the Atlantic and Pacific Basins. The increased availability of LNG cargoes has helped create a more competitive LNG market for other consumers. This in turn has helped apply downward pressure to the terms of oil-linked contracts resulting in the renegotiation of some contracts. In 2010 short-term and spot contracts represented 19 percent of the total LNG market, up from only a fraction one decade earlier. This trend is particularly prominent in Europe, where in 2012 nearly half of its gas supply came on a spot-price basis (see Figure 2). As will be discussed later, this trend in the European market towards cheaper oil-indexed rates and increased spot consumption has not only benefited European economies but is also helping loosen the stranglehold of Gazprom, Russia’s state gas company, on our east and west European allies and trading partners.

Figure 2: European Gas Supply by Contract Type (%), 2012

Source: Societe Generale

Although increases in domestic gas production have initiated some changes within the international gas market, any dramatic alterations to the existing structure will depend on the volume that is actually exported. With roughly 37 bcf/day of liquefaction capacity in the global market today, it is unlikely that the U.S. will export a significant portion of the nearly 30 bcf/day worth of applications currently proposed to the Department of Energy. Building an LNG facility requires billions of dollars in investment and years of planning. Prospective exporters must also undergo an intricate and thorough regulatory process and must be reasonably certain that the economic opportunity for any investment exists for two or more decades.

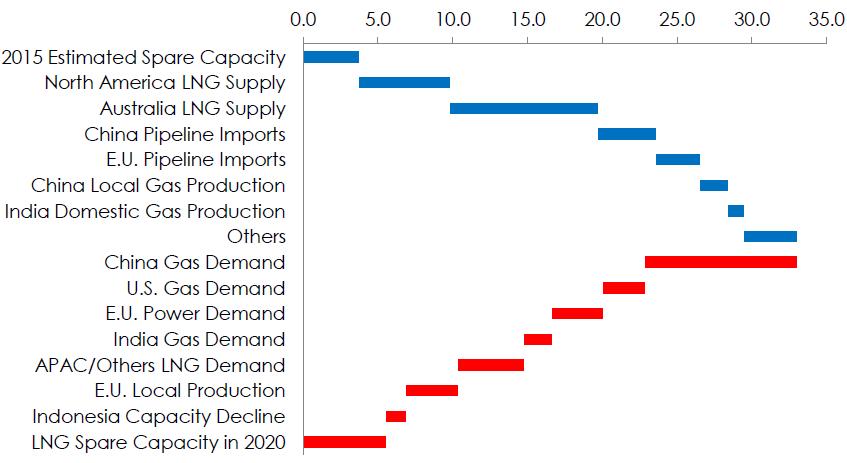

Given these sobering realities, I don’t see very many LNG projects—our estimates predict 4-6 bcf/day’s worth—being constructed before their economic opportunity and early-mover advantage is eroded by increased domestic gas prices (resulting from more gas consumption in the electricity and industrial sectors, sources of demand that are emerging faster than export facilities), decreasing international gas prices, and a more balanced global LNG market. This last point about LNG market equilibrium is critical. Our forecast suggests that from 2015 to 2020, the global LNG market will swing to a surplus, mostly aided by the nine Australian projects that already have or are close to reaching final investment decision (see Figure 3) as well as other new supplies from East and West Africa. Further, pipeline gas (particularly into China), and a stubborn coal market will also compete with gas in global energy markets, particularly those in Asia. Furthermore, as we move beyond 2025, the possibility of other countries—again, China in particular—developing their own shale gas reserves could begin to have an impact on international gas trade.

Figure 3: Global LNG Supply/Demand Balance, 2015-2020 (bcf/day)

Source: Brookings, IEA, EIA, Morgan Stanley, JP Morgan, Credit Suisse

U.S. LNG exports will therefore have a beneficial but not transformational impact on international LNG prices. The market is still largely dependent on long-term contracts and much of the new liquefaction capacity emerging in the next decade (largely from Australia) has already been contracted for at oil-indexed rates.[7] The incremental LNG volumes supplied by the United States at floating Henry Hub rates will be small in comparison. Indeed, importing U.S. LNG at Henry Hub rates includes a number of other costs, such as the cost to liquefy the gas and the cost to ship it on specialized tankers. (Depending on the type of contract, regasification is another cost that can be borne by either the buyer or the seller.) These costs range depending on the transportation distance and the size of vessel. As a reference point, it is estimated that shipments of LNG from the U.S. Gulf Coast to Japan will cost $5-6/MMBtu.[8] These additional costs dramatically reduce the arbitrage opportunity available to exporters.

There is also no guarantee that all U.S. exports will be supplied at floating U.S. prices. LNG export facilities are multi-billion dollar investments that require revenue certainty. Moreover, many of the export facilities are owned by producers of natural gas. John Watson, Chevron’s Chief Executive, said earlier this week that his company’s investments in LNG export facilities does not mean that natural gas will be available to consumers at U.S. rates.[9] Most producers prefer selling long-term supply contracts to reduce the price risk to their investments.

A large increase in U.S. LNG exports will have the potential to increase U.S. foreign policy interests in both the Atlantic and Pacific basins. Unlike oil, natural gas has traditionally been an infrastructure constrained business, giving geographical proximity and political relations between producers and consumers a high level of importance. Issues of “pipeline politics” have been most directly visible in Europe, which relies on Russia for around a third of its gas. Previous disputes between Moscow and Ukraine over pricing have led to major gas shortages in several E.U. countries in the winters (when demand is highest) of 2006 and 2009. Further disagreements between Moscow and Kiev over the terms of the existing bilateral gas deal have the potential to escalate again, with negative consequences for E.U. consumers. The risk of high reliance on Russian gas has been a principal driver of European energy policy in recent decades. Among central and eastern European states, particularly those formerly aligned with the Soviet Union such as Poland, Hungary, and the Czech Republic, the issue of reliance on imports of Russian gas is a primary energy security concern and has inspired energy policies aimed at diversification of fuel sources for power generation. From the U.S. perspective such Russian influence in the affairs of these democratic nations is an impediment to efforts at political and economic reform. The market power of Gazprom, Russia’s state-owned gas monopoly, is evident in these countries. Although they are closer to Russia than other consumers of Russian gas in Western Europe, many countries in Eastern and Central Europe pay higher contract prices for their imports, as they are more reliant on Russian gas as a proportion of their energy mixes.

In the larger economies of Western Europe, which consume most of Russia’s exports, there are efforts to diversify their supply of natural gas. The E.U. has formally acknowledged the need to put in place mechanisms to increase supply diversity. These include market liberalization approaches such as rules mandating third-party access to pipeline infrastructure, and commitments to complete a single market for electricity and gas by 2014, and to ensure that no member country is isolated from electricity and gas grids by 2015.

Despite these formal efforts, there are several factors retarding the E.U.’s push for a unified effort to reduce dependence on Russian gas. National interest has been given a higher priority than collective, coordinated E.U. energy policy: the gas cutoffs in 2006 and 2009 probably contributed to the acceptance of the subsea Nord Stream pipeline, which carries gas directly from Russia to Germany. Germany’s decision to phase out its fleet of nuclear reactors by 2022 will result in far higher reliance on natural gas for the E.U.’s biggest economy. The environmental imperative to reduce carbon emissions—codified in the E.U.’s goal of essentially decarbonizing its power sector by the middle of century—mean that natural gas is being viewed by many as the short-to medium fuel of choice in power generation. Ironically, in the near term the phase out of nuclear power has lead to greater reliance on both domestic coal as well as imported coal from the United States.

Finally, the prospects for European countries to replicate the unconventional gas “revolution” that has resulted in a glut of natural gas in the United States look uncertain. Several countries, including France and the U.K., have encountered stiff public opposition to the techniques used in unconventional gas production, while those countries, such as Poland and Hungary, that have moved ahead with unconventional-gas exploration have generally seen disappointing early results. Ukraine is also at a very early stage in developing its potential shale reserves. Collectively, these factors suggest that the prospects for reduced European reliance on Russian gas appear dim.

The one factor that has been working to the advantage of advocates of greater European gas diversity has been the increased liquidity of the global LNG market, discussed above. Russia’s dominant position in the European gas market is being eroded by the increased availability of LNG. Qatar’s massive expansion in LNG production in 2008, coupled with the rise in unconventional gas production in the United States as well as a drop in global energy demand due to the global recession, produced a global LNG glut that saw many cargoes intended for the U.S. market diverted into Europe. As mentioned previously, with an abundant source of alternative supply, some European consumers, mainly Gazprom’s closest partners, were able to renegotiate their oil-linked, take-or-pay contracts with Gazprom.

Increased LNG exports will provide similar assistance to strategic U.S. allies in the Pacific Basin. By adding supply volumes to the global LNG market, the U.S. will help Japan, Korea, India, and other import-dependent countries in South and East Asia to meet their energy needs. The desire on the part of Pacific Basin countries for the U.S. to become a gas supplier to the region has been underlined by the efforts of the Japanese government, which has attempted to secure a free-trade agreement waiver from the United States to allow exports. As with oil price-linked Russian gas contracts in Europe, U.S. LNG exports—to the extent they occur on a floating Henry Hub basis, have the potential to weaken the market power of incumbent LNG providers to Asia, increasing the negotiating power of consumers and decreasing the price. As U.S. foreign policy undergoes a “pivot to Asia,” the ability of the U.S. to provide a degree of increased energy security and pricing relief to LNG importers in the region will be an important economic and strategic asset.

Beyond the basin-specific considerations of U.S. LNG exports, they will provide a source of predictable natural gas supply that is relatively free from unexpected production or shipping disruption. With Qatar representing roughly one-third of the global LNG market, a blockade or military intervention in the Strait of Hormuz or a direct attack on Qatar’s liquefaction facilities by Iran would inflict chaos on world energy markets. While the United States government will be unable to physically divert LNG cargoes to specific markets or strategic allies that are most affected (gas allocation will be made by the market players), additional volumes of LNG on the world market will benefit all consumers. Further still, even if the volumes exported from the United States aren’t large, there is an ideological geopolitical benefit to U.S. LNG exports. Exports will provide certainty to allies and economic partners around the world that the United States is a steadfast advocate for free trade.

Part 2: Policy Solutions

In that context, I believe a prudent policy is to continue to allow exports. However, there will be a need to reform the existing rules pertaining to LNG exports in order to reduce the risk and uncertainty that is hurting both producers and consumers.

So what does such a policy look like? For starters, I disagree with the two most extreme proposals of a volumetric cap, or a policy where the U.S. automatically approves all applications. Both are treacherous to implement and may increase, rather than decrease uncertainty. A balanced approach is one that doesn’t increase the cost of exporting, but accurately reflects the cost of building a facility at the beginning of the process. I suggest a policy that requires a prospective exporter to have successfully gone through FERC’s pre-filing process and have a portion of its supply contracts signed before being eligible to be considered by DoE for an application to export to non-FTA countries. Both requirements are costly and will encourage only serious projects to move forward.

There will also need to be more clarity on the “public interest” determination, which is currently too vague and creates investor uncertainty. One possibility is to allow the “public interest” to be dependent on the aforementioned two stipulations. In other words, if a company completes its pre-filing process and contracts out a given percentage of its capacity, the exports are deemed to be in the public interest.

One final consideration is to have an audit of natural gas export policy every five years. This would be an important information-gathering exercise. Such an audit would identify what happened to domestic natural gas supply, demand, and prices, and international markets during each five-year period.

I would like to thank the Subcommittee for giving me the opportunity to provide my views on this important issue, particularly in helping move the debate forward. I look forward to taking the Committee’s questions.

[1] Charles Ebinger, Kevin Massy, and Govinda Avasarala, “Liquid Market: Assessing the Case for Exports of Liquefied Natural Gas from the United States,” The Brookings Institution, May 2012. (Brookings 2012) (https://www.brookings.edu/research/reports/2012/05/02-lng-exports-ebinger)

[2] Brookings 2012, pg. 33; Pricing studies include “Effect of Increased Natural Gas Exports on Domestic Energy Markets,” Energy Information Administration, January 2012; “Made in America: the economic impact of LNG exports from the United States,” Deloitte, December 2011; “Resource and Economic Issues Related to LNG Exports,” ICF International, August 17, 2011; “Market Analysis for Sabine Pass LNG Export Project,” Navigant Consulting, August 23, 2010.; and “Jordan Cove LNG Export Project Market Analysis Study,” Navigant Consulting, January 2012. Note that Navigant Consulting’s study of the Sabine Pass LNG project forecasted the pricing implications of 2 bcf/day.

[3] Brookings 2012, pg. 33

[4] Brookings 2012, pg. 34.

[5] Comment by Kevin Book, Managing Director, Research, ClearView Energy Partners, at “Liquid Markets: Assessing the Case for U.S. Exports of Liquefied Natural Gas,” on May 2, 2012 at the Brookings Institution in Washington, D.C. (https://www.brookings.edu/~/media/events/2012/5/02%20lng%20exports/20120502_lng_exports.pdf)

[6] American Chemistry Council, “Shale Gas and new Petrochemicals Investment,” March 2011.

[7] Brookings 2012, pg. 39

[8] For two estimates, see Ken Medlock, “U.S. LNG Exports: Truth and Consequences,” James A. Baker III Institute for Public Policy, Rice University, August 10, 2012 (http://bakerinstitute.org/publications/US%20LNG%20Exports%20-%20Truth%20and%20Consequence%20Final_Aug12-1.pdf); and Robert Smith, “Asian Natural Gas: A Softer Market is Coming,” Presentation to the U.S. EIA International Natural Gas Workshop, Washington, D.C., August 23, 2012.

[9] Ed Crooks, “Chevron explores first Canada gas exports,” Financial Times, March 12, 2013. (http://www.ft.com/intl/cms/s/0/aaa61d84-8b3e-11e2-b1a4-00144feabdc0.html#axzz2NeqtOvnR)

Commentary

TestimonyThe Department of Energy’s Strategy for Exporting Liquefied Natural Gas

March 19, 2013