Introduction

I would like to thank Chairman Terry, Ranking Member Schakowsky and the members of the Committee for the opportunity to present my testimony today on the Global Investment in American Jobs Act. I have had the opportunity over the past twenty years or more to do research on issues of productivity, competitiveness and the impact of foreign investment, looking not only at the United States but also at Europe, Japan, Korea and many emerging markets.

The American economy today is improving but fragile. Real GDP growth is expected to be around 3 percent in the first quarter of this year but only about 1 percent in the second quarter and be well below 3 percent for the second half of the year because of the impact of payroll tax increases and the sequester. The number of jobs is increasing but too slowly. After flat-lining in the middle quarters of 2012, business investment picked up in the fourth quarter, but we need a lot more investment in order to create the jobs needed to raise living standards.

To a great extent, the performance of our economy over the next 10 years or so depends on the contributions here at home of U.S. workers and companies. The competitive position of this country in the global economy will play a vital role and I applaud the House for proposing a comprehensive review of how to make the U.S. economy a more attractive place to invest for foreign companies. In the years after World War II, it was American companies that went overseas, bringing with them technology and business expertise as well as capital. These companies helped spread prosperity to the rest of the world, a process that is still happening. But today successful, productive companies from around the world are investing in America, bringing jobs, capital and, in some cases, new technologies and business efficiencies. The auto company that exports the most outside North America is BMW. Toyota makes the bestselling cars in America in its factories here; and Siemens is helping fix the electric power grid.

The inflow of foreign direct investment slowed as a result of the Great Recession, not surprisingly, but there is tremendous potential to increase that flow now and in the future, bringing additional jobs and boosting the economic recovery. Making America a location that attracts good foreign companies is very important and, by the way, those same factors will also make it more attractive for U.S. multinational companies to locate more of their investment here at home.

The Pattern of Foreign Direct Investment

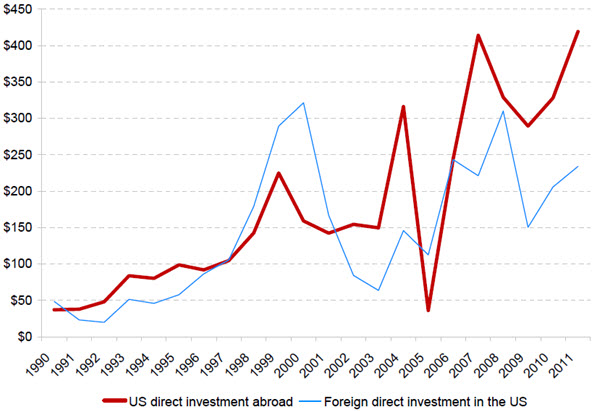

Figure 1 below shows the inflow of foreign direct investment to the United States and the outflow of direct investment by U.S. companies overseas. The figure shows that the magnitudes of the inflow and outflows are comparable, although the outflow has been larger than the inflow for all but one year since around 2001. There was a surge of foreign investment into the U.S. market at the time of the technology boom in the 1990s, which dropped sharply when that boom subsided. The level of foreign inflows has not reached its 2000 peak since then. Is it a problem that the outflows exceed the inflows? The U.S. economy attracts huge amounts of capital from around the world every year. The McKinsey Global Institute estimated that between 2000 and 2007, 85 percent of the international capital available in the world (in the form of total current account surpluses) came to the United States, largely in the form of purchases of financial assets. Almost certainly, the U.S. economy became too reliant on foreign capital at that time. The capital inflows were the counterpart to the large current account and trade deficits and the easy access to funds contributed to the housing boom and subsequent bust. Direct foreign investment inflows are different, however, in that they are stable and brings jobs and production. Bringing in more foreign direct investment, even while we rely less on foreign purchases of U.S. financial assets, would be a plus for the economy.

Figure 1: Foreign Direct Investment in the United States and U.S. Direst Investment Abroad, Annual Flows, 1990-2011 (in billions of dollars)

Source: U.S. Department of Commerce

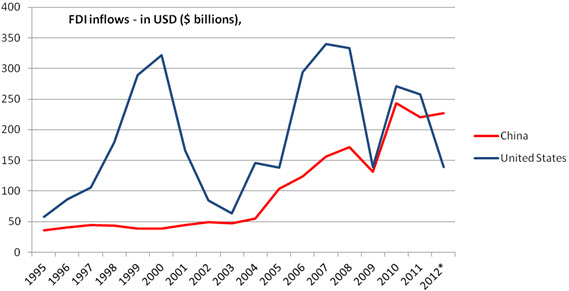

Figure 2 below looks at direct investment inflows to China compared to the United States. Over the entire period from 1995 to the present, direct investment in the United States was far greater than the flow into China. Of course, China traditionally put up barriers to foreign investment and even today many companies report that it is hard place in which to invest and do business. In 2012, however, based on the first three quarters of data, direct foreign investment into China exceeded the flow into the United States. Is this a matter of concern? Yes and no. China’s economy is growing rapidly and will likely become larger than the U.S. economy in the future. It is not surprising that multinational companies want to access China’s labor pool and its market. It is also notable that the direct investment flowing into China is not coming primarily from U.S. multinationals. Some American companies, like GM or Ford, have set up business in China, but most of the investment in China is from Taiwan, Korea and elsewhere, not from the U.S. On the other hand, the recent weakness in investment inflows in the past few years, visible in Figures 1 and 2, may be indicative of the lack of relative attractiveness of the United States to foreign investors.

Figure 2: Foreign Direct Investment into China and the United States

Source: World Bank, OECD. * Figures for 2012 obtained by annualizing the first three quarters.

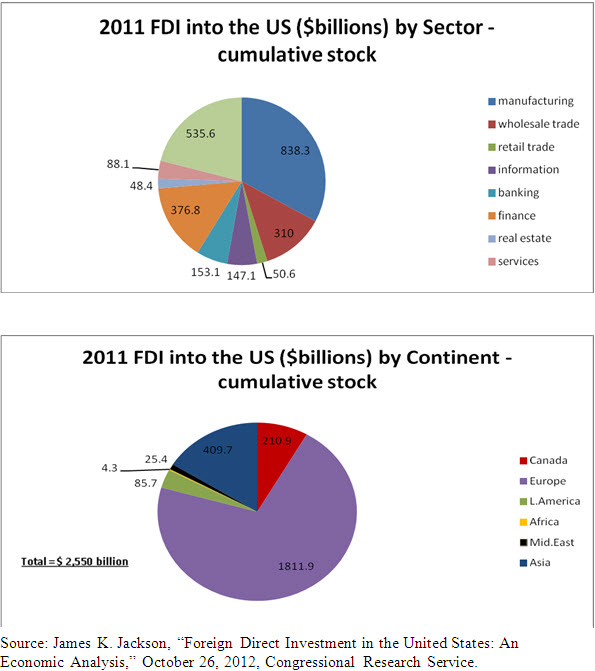

Figures 3 below shows information about the stock of foreign direct investment located in the United States by industry and, below that, by country. Two points are notable. First, a disproportionate fraction of foreign investment coming to the United States is in the manufacturing sector. This important sector makes up less than 10 percent of the economy today but a much larger share of foreign investment stock. Over the past twenty years or more there has been concern that the U.S. economy is not devoting enough of its investment to manufacturing, having an adverse impact on competitiveness and contributing to the large chronic trade deficit. It is notable that foreign-based multinationals have shown greater willingness to invest in manufacturing operations and are adding to competitiveness. Second, by far the largest proportion of the foreign investment (71 percent) comes from European countries, with the next largest coming from Asia, notably Japan, but also Korea. The UK, Netherlands, Switzerland, Germany and France are the largest investors from Europe. This pattern of investment coming from Europe and Asia is not perhaps surprising since these economies are among the most developed with global leading companies, strong technologies and efficient business practices. These countries are also strong allies of the United States. The economic problems in Europe and Japan help explain the decline in the inflow of investment. When foreign companies are stressed at home they are less willing to invest here.

Figures 3: The Cumulative Stock of Foreign Investment in the United States by Industry and by Geography.

The Pros of Foreign Investment in the United States

1. Foreign companies can bring new technologies and efficient operations. Overall, the U.S. economy remains the global leader in both productivity and technology, but there are large variations by firm and by industry. We cannot expect to be the country that is the source of every innovation or every good business idea, and we are not. Research that compares productivity across countries has found that the biggest benefits of innovation come from its dissemination through the economy. American innovations in computers and semiconductors now contribute to economic growth around the world. German innovations in auto parts are used by the American auto industry. Foreign direct investment is crucial to distributing innovations and allows the U.S. economy to benefit from the global pool of new ideas.

2. Foreign direct investment provides capital for jobs in America. American corporations are on average very profitable, partly because they are well-run compared to companies world-wide, but also because they set high target rates of return before they are willing to invest. U.S. corporate strategy has emphasized being lean in the use of capital and avoiding making large, risky investments unless the expected returns are high. Without making any judgment on this practice, it means that there are opportunities in America for investment and job creation where projected returns are pretty good but where U.S.-based companies are reluctant to commit the necessary capital. Foreign companies based in Asia now own and operate much of the steel capacity based in the United States. As I will discuss shortly, the energy boom is attracting many foreign companies to build highly capital intensive new plants making petrochemicals in America. Infrastructure is an area where foreign investment could make a contribution to U.S. economic performance.

3. Foreign direct investment increases the competitive intensity of the U.S. economy. A basic tenet of economics since Adam Smith has been that competition benefits consumers. Markets with a dominant single producer or with an oligopoly of companies that reach tacit agreements to limit price competition will result in prices that are too high. More recently, economic research has stressed the dynamic benefits of competition in putting pressure on all market participants to cut costs and develop new and innovative products. Global companies that have established their positions in their own domestic markets can provide important competitive pressure to American industries where the domestic companies have become complacent.

The Cons of Foreign Direct Investment in the United States

1. Foreign investment can displace jobs and production in domestic companies. There is little question that the arrival of Asian and European auto companies producing in North America has resulted in a decrease in the number of jobs in the traditional American companies in the industry. Many of those jobs were unionized. Many Americans look back to a time in history when domestic companies dominated the economy and foreign competition was minor. Much of the apprehension is about imports and the trade deficit, but the changing identity of companies producing in the U.S. market is also a concern.

2. Foreign takeovers of American companies can be motivated by a desire to capture American technology. The fight among countries and companies to take advantage of technology is older than the industrial revolution. Alexander Hamilton orchestrated an effort to bring European technology to post-revolutionary America, while today China is doing its utmost to push its economy into the twenty-first century by grabbing as much technology from around the world as it can. One reason that American companies have been reluctant to invest more in China is because of concerns about violations of property rights. The U.S. government, of course, already has in place safeguards to prevent the capture of vital technologies by foreign entities and all foreign takeovers have to be vetted. The hard question is whether or not this process is striking the correct balance between protecting vital American interests and excluding foreign investors who could contribute positively to our economy.

3. In the event of an economic downturn, foreign-owned companies may protect home country workers and operations at the expense of their U.S. operations. Some multinational companies produce the same, or very similar, products in different locations around the world. These companies have a choice about how to allocate production in situations where they have overcapacity. If workers in their home country have reached agreements to protect their own jobs, the company may decide to keep full employment at home and cut production elsewhere. This concern is a legitimate one, but should not be overstated. Shifting production is costly and most foreign-owned companies with significant operations in the United States are concerned about the long term sustainability of their U.S. operations.

Balancing the Arguments

Although there are real concerns about foreign direct investment, the benefits greatly outweigh the costs. On balance, international trade is beneficial to Americans but the case for expanding trade is a hard one to make to skeptical voters. By contrast, the case for encouraging foreign investment is much easier to make. New green field investments clearly create jobs and benefit local communities. Takeovers of domestic companies by foreign companies are also generally beneficial, providing an infusion of capital and new management that can prevent established companies from failing and allow them to make investments.

How to Make the United States More Competitive

1. Get the macroeconomics right. Chronic U.S. trade deficits since the early 1980s have been sustained by an equal shortfall of domestic saving over investment. The best policies in the world will not restore American competitiveness in the long run as long as there is gap between national saving and investment. Reducing investment is not the right approach. Alternatively, national saving will need to increase once the recovery has taken a firmer hold. There are few if any tools by which government can influence private saving; thus, the increment to national saving will be achieved most effectively by reducing or eliminating the federal budget deficit over the next ten years. It is clear from the past that insufficient levels of national saving drove up the exchange rate, priced U.S. exports out of foreign markets and swelled the volume of imports.

2. Work for trade agreements. Balance in international trade needs to be a more focused objective of U.S. foreign policy. In past negotiations, the United States traded access to U.S. markets for foreign political support or access of U.S. financial firms to foreign markets, to the detriment of admittance for U.S. exports. A major German auto company is siting an assembly plant in Mexico because that country’s free trade agreements will allow it to use the plant as an export platform to Latin America and elsewhere. In addition to obtaining more trade agreements, there is also a need to develop greater international consensus on appropriate guidance for exchange rates.[1]

3. Improve the Corporate Income Tax. The mobility of capital, technology, and production facilities makes the national taxation of production as opposed to consumption increasing impractical. The marginal rate of corporate taxation in the United States is too high, particularly in relationship to the tax rates of other countries, inducing firms to locate overseas. The United States needs to follow the lead of other countries in shifting toward greater reliance on consumption-based taxation.[2]

4. Improve skills. Both American companies and foreign companies investing in the United States say that the skills of the U.S. workforce are comparatively weak. It lags behind many other countries in developing effective vocational education and job training programs, and the educational attainment of young workers is falling behind that of countries like Canada, Japan and Korea. Furthermore, U.S. 15-year-olds rank 25th in math and 17th in science in PISA scores among OECD nations. Germany is an example of a country that has used a high-quality vocational education system to improve the skills of its workforce. While there is no space here to elaborate on what changes should be made, greater attention needs to be paid to reversing the deterioration in workforce skills.

5. Repair and improve infrastructure. Similarly, the country suffers from a deteriorating physical infrastructure that raises the costs of production. The extraordinarily low level of current interest rates suggests that now is a good time to borrow funds to finance the repair and modernization of those systems. The adoption of such a program is constrained by a concern that it is simply an excuse for added deficit spending. That issue can be addressed within a capital budget framework in which each investment is financed with amortized debt for which a portion comes due in each year and is repaid with an explicit tax or dedicated revenue source over the duration of the bond issue. Such financing, if matched by a credible dedicated revenue source, would not add to concerns about an unmanageable level of general fund debt.

6.Take advantage of the energy boom. U.S. natural gas resources have nearly doubled since 2003, driven by the development of shale deposits nationwide. The United States has the second largest recoverable shale gas reserves in the world at 24 tcm (trillion cubic meters), after China’s reserves of 36 tcm. However, the United States is substantially ahead of the rest of the world in having started to tap these reserves at increasing scale. By 2020, shale gas is expected to add 10-15 billion cubic feet per day over current levels and grow to over 25 percent of total gas production. Along with shale gas, light tight oil (LTO) production has also developed rapidly. Current LTO production estimates for 2020 are between 5 and 10 million incremental barrels per day, although even higher numbers are possible. There are environmental dangers involved in this new wave of energy production but with the right regulation it should be possible to develop the oil and gas fields responsibly. It is expected that natural gas will be priced in the United States at $4-6 per million BTUs, well below the $12 price range in Europe and $16 in Asia. Oil prices are set globally, but it is likely that U.S. domestic prices will carry a differential below imported oil and the greater security of domestic supply will be an attraction for users. Cheap natural gas will also keep electricity prices down.

The energy revolution is already making America more competitive. Global companies are investing in new plants here to take advantage of the low price of energy and natural gas as a feedstock. For example, in 2012, Shintech Louisiana LLC, a Japanese company, invested an additional $1.3 billion in a PVC plant in Louisiana.[3] Methanex Corp. (Canada) invested $550 million in the United States in summer 2012 to construct a methanol production facility in Louisiana. This was the corporation’s first U.S.-based facility in over a decade.[4] Sasol Ltd. (South Africa) agreed in December 2012 to build an “integrated gas-to-liquids (GTL) and ethane cracker complex” in Louisiana. This project alone is estimated to create 1,253 jobs directly, “with salaries averaging nearly $88,000, plus benefits,” and thousands of additional indirect job gains. Total investment is estimated to be between $16 billion and $21 billion, with ultimate value approximated at $46 billion by a Louisiana economic impact study.[5] Foreign direct investment is thus making an important contribution towards exploiting new energy sources for the benefit of the economy.[6]

Conclusion

The Obama Administration has been working to make it easier for foreign companies to build new plants and create jobs here. An interagency effort is underway to create one-stop-shopping for companies and I applaud the effort by this subcommittee to seek out ways to make America a more attractive location for foreign companies to invest. More needs to be done to coordinate federal agencies and states and localities in terms of permitting and meeting environmental requirements. Companies also report that the process of obtaining permits is much too slow and too complex.

On balance, foreign direct investment coming to the U.S. economy has been beneficial, generating jobs, making-capital intensive investments and diffusing technology developed in other countries to our economy. There are legitimate concerns about protecting our technology and workers, but these challenges can be met. America is already an attractive place for foreign companies to invest and policymakers should make sure our competitiveness is sustained and enhanced.

[1] A greater reliance on market-determined exchange rates would be preferable in most cases, but countries differ widely in their stages of development and ability to rely on such mechanisms.

[2] The United States also attempts to tax the foreign income of U.S. companies, albeit with a deferral. Most other countries use a territorial-based system in which income is taxed only in the country in which it is earned.

[3] Mark Crawford, “Hot United States FDI Sectors: Advanced Manufacturing,” Area Development Online, http://www.areadevelopment.com/LocationU.S.A/LocationU.S.A2012/U.S.-FDI-sectors-advanced-manufacturing-262000987.shtml.

[4] “At the Epicenter of the U.S. Industrial Rebirth,” Louisiana Economic Development,” http://www.louisianaeconomicdevelopment.com/led-news/articles/at-the-epicenter-of-the-us-industrial-rebirth.aspx.

[5] “Sasol Announces Largest Manufacturing Investment In Louisiana History, Creating More Than 7,000 Direct And Indirect Jobs,” Louisiana Economic Development, December 3, 2012, http://www.louisianaeconomicdevelopment.com/led-news/news-releases/sasol-announces-largest-manufacturing-investment-in-louisiana-history,-creating-more-than-7,000-direct-and-indirect-jobs.aspx?c=News%20Releases&id=39.

[6] There are exaggerated claims being made about the extent to which the energy boom will improve U.S. competitiveness and create manufacturing jobs. The discovery of new ways to extract natural gas and oil may make the U.S. self-sufficient in energy and reduce the trade deficit, but it will also increase the value of the U.S. dollar, partially or fully offsetting the cost advantage of cheap energy. This is an example of the “Dutch Disease” that afflicted Dutch manufacturing some years ago when large gas reserves were discovered.

Commentary

TestimonyDiscussing the Global Investment in American Jobs Act of 2013

April 18, 2013