Much of the U.S. artificial intelligence (AI) discussion revolves around futuristic dreams of both utopia and dystopia. From extreme to extreme, the promises range from solutions to global climate change to a “robot apocalypse.”

However, it bears remembering that AI is also becoming a real-world economic fact with major implications for national and regional economic development as the U.S. crawls out of the COVID-19 pandemic.

Based on advanced uses of statistics, algorithms, and fast computer processing, AI has become a focal point of U.S. innovation debates. Even more, AI is increasingly viewed as the next great “general purpose technology”—one that has the power to boost the productivity of sector after sector of the economy.

All of which is why state and city leaders are increasingly assessing AI for its potential to spur economic growth. Such leaders are analyzing where their regions stand and what they need to do to ensure their locations are not left behind.

In response to such questions, this analysis examines the extent, location, and concentration of AI technology creation and business activity in U.S. metropolitan areas.

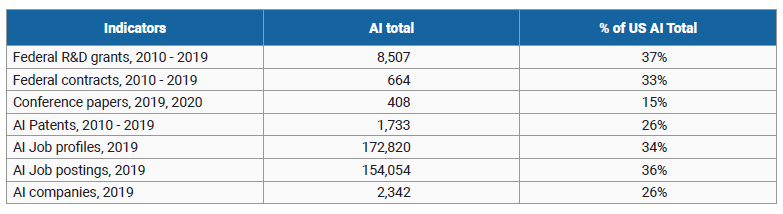

Employing seven basic measures of AI capacity, the report benchmarks regions on the basis of their core AI assets and capabilities as they relate to two basic dimensions: AI research and AI commercialization. In doing so, the assessment categorizes metro areas into five tiers of regional AI involvement and extracts four main findings reflecting that involvement. Overall, the report finds that:

The U.S. AI industry is growing fast but is still emergent and relatively limited in scope

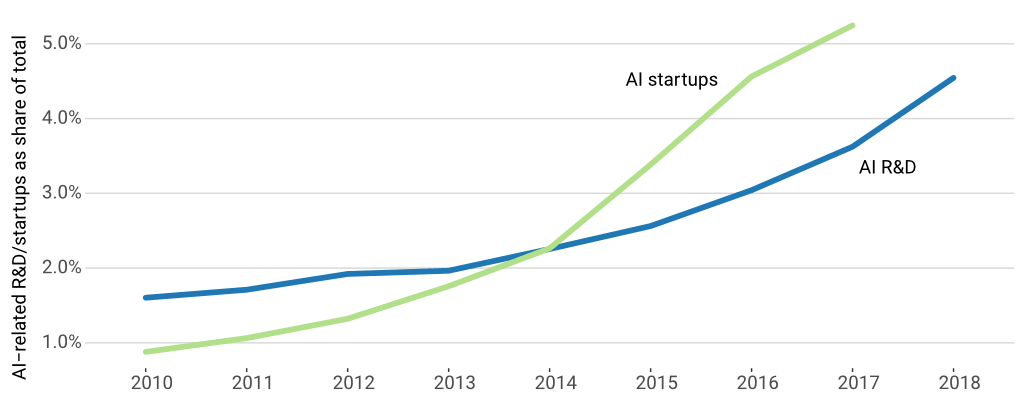

The AI industry is expanding rapidly, with AI-related projects accounting for a substantially larger share of federal research and development expenditures at U.S. colleges and universities. Similarly, newly founded firms that provide AI solutions as a share of all tech startups expanded to more than 5%, from less than 1% a decade ago.

AI R&D and new firms are rising as shares of the U.S. total

Share of AI-related projects in federal R&D expenditures at U.S. colleges and universities, and firms providing AI solutions as share of all tech companies

Source: Brookings analysis of data from Crunchbase and Burning Glass data available via StanfordHAI 2021 AI Index

With that said, the emerging demand for AI workers is still a tiny fraction of the U.S. labor market, with AI job postings accounting for less than 1% of all job postings.

Read more about basic AI growth trends on page 10 of the full report. »

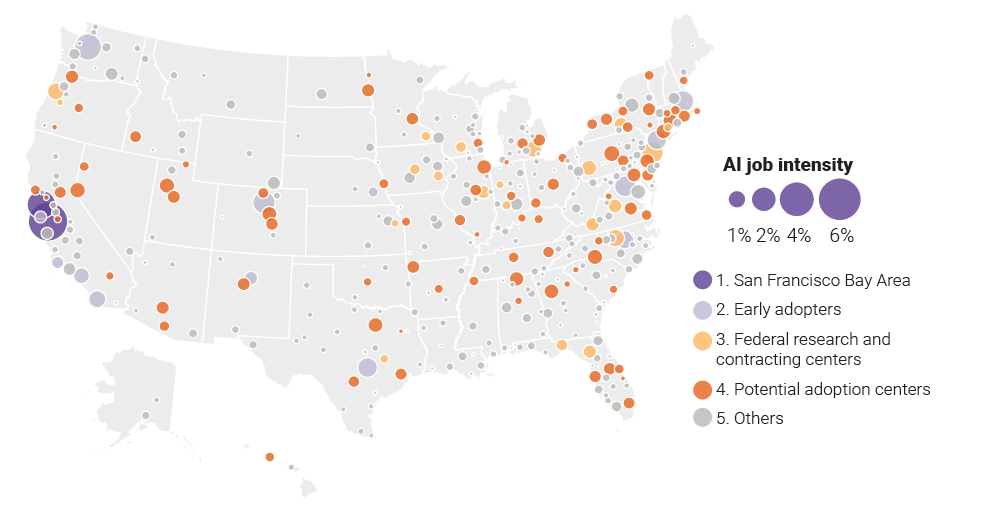

AI activity in the U.S. is highly concentrated in a short list of ‘superstar’ aggregations and early adopter hubs, often arrayed along the coasts

Brookings’s cluster analysis identifies five types of urban AI presence across the metropolitan map. These categories are: the San Francisco Bay Area “superstar” region; 13 “early adopter” metro areas; 21 federal research centers; 87 “potential adoption centers”; and scores of other metro areas with little or no AI activity.

The nation’s emerging AI geography is highly concentrated, with the Bay Area and the 13 early adopters comprising over half of the nation’s current AI activities in federal contracts, conference papers, patents, job postings, job profiles, and startups.

The Bay Area and 13 early adopter metro areas dominate the nation’s emerging AI economy

Share of job postings with AI skills by five types of AI metro clusters

Source: Brookings analysis of Stanford HAI, Crunchbase, STAR METRICS, USPTO, and Emsi data

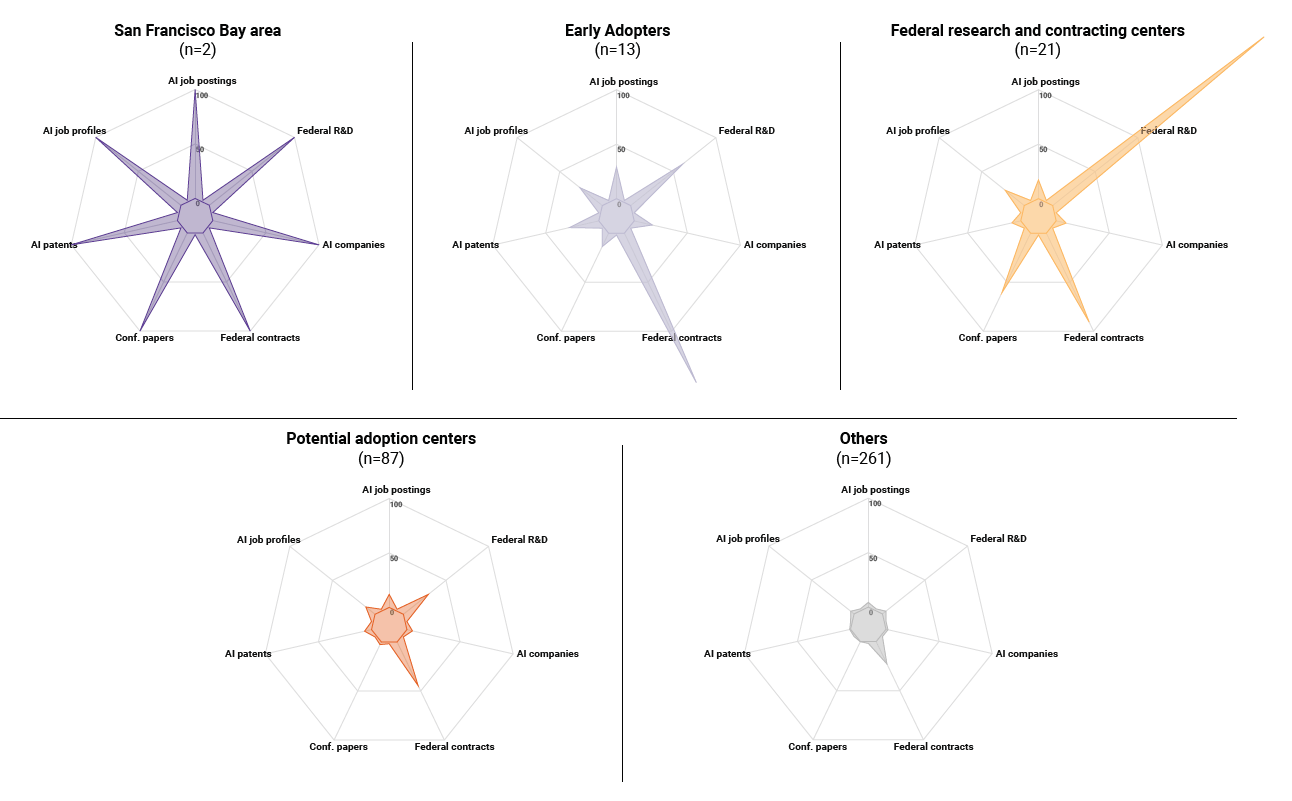

Each of the five identified city types exhibits distinctive patterns of AI capacity and activity. At present, the Bay Area displays all-around preeminence on five of seven indicators.

Five configurations of metro area AI activity can be discerned

Indexed AI capacity levels for five types of AI metro area clusters (San Francisco Bay Area = 100)

Source: Brookings analysis of Stanford HAI, Crunchbase, STAR METRICS, USPTO, Emsi data

Read more about AI city types and their distribution starting on page 13 of the full report. »

To view detailed data for a particular metropolitan area, select a metropolitan area in the interactive feature below.

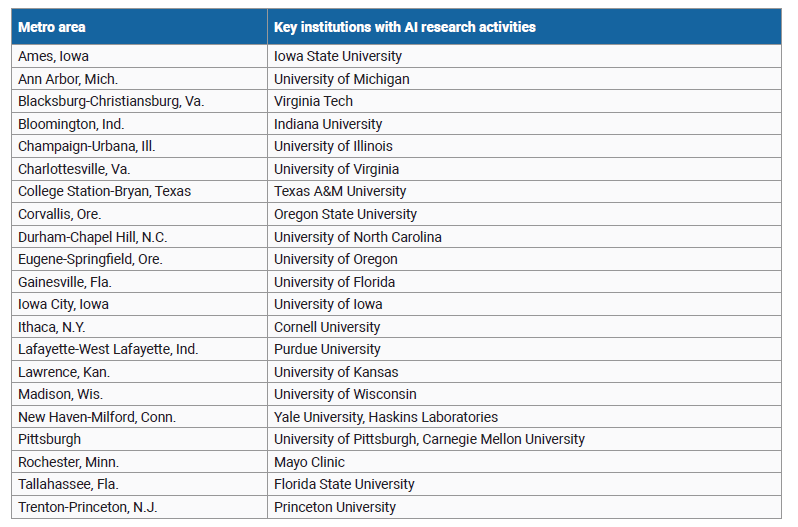

Numerous research and contracting centers owe their standing to federal R&D flowing into major universities

Twenty-one metro areas have built up notable AI positions by leveraging significant federal spending on AI-related projects. At this early stage, AI development in these regions is being inordinately propelled by federal research budgets.

Federal R&D is a major AI driver in numerous university metro areas

Federal research and contracting centers

Source: Brookings analysis of STAR METRICS data

Read more about AI research and contracting centers on page 16 of the full report. »

Nearly 90 additional communities are potential centers of future AI growth, especially where large national or global firms are driving adoption

For now, homegrown AI activity remains more of a future-looking prospect for 87 additional metro areas that have developed some AI research and commercialization capacities, but at levels well below those of the Bay Area, the early adopters, and the research and contracting centers.

To be sure, future developments in these regions matter. Potential adoption centers are frequently major regional hubs anchored by Fortune 500 companies. These cities collectively produce about one-quarter of all U.S. AI patents and companies, and account for more than 30% of AI jobs and workers.

In aggregate, potential adoption centers account for meaningful shares of U.S. AI activity

AI activity in potential adoption centers

Source: Brookings analysis of Stanford HAI, Crunchbase, STAR METROS, USPTO, and Emsi data

The tenuousness of these metro areas’ claim on a major position in the AI economy can be seen in the fact that their minority share of the nation’s aggregate research and commercial activities is divided across nearly 90 locations.

Given that, any AI development strategies among these metro areas must be highly realistic. Most likely, such strategies will need to focus on AI adoption and the exploration of transformative use cases among key local firms and industries.

Read more about AI research and contracting centers on page 17 of the full report. »

The statistics, analysis, and mapping presented here suggest both the relevance of AI for regional economic development and its challenges.

On the upside, AI is a powerful general purpose technology that is growing rapidly and could increase the productivity of many regional economies. AI can and should be part of the discussion as leaders seek to position their locales for post-pandemic vitality.

At the same time, the information in this report suggests that the task of developing a significant AI cluster will be challenging. Wide variations in cities’ starting points, research sectors, and business activities require that locations assess their positioning and capabilities clearly. So too do the “superstar” and “winner-take-most” dynamics of digital and platform economies counsel caution, since they suggest that relatively few places could drive the bulk of medium-term AI-related development.

Given all of that, the present analysis concludes by reviewing a series of initial strategy considerations keyed to each of the AI city types identified in the report. These priorities range from centering local AI ecosystems on ethical use to promoting AI adoption among local firms and addressing the need for diverse talent.

Ultimately, the information and assessments in this report underscore the need not for all metro areas to spring into action right now, but rather to assess their positioning and then consider the way forward.