Editor’s Note: This report is based on a recent article, “Rule of Law Matters,” a contribution to the Symposium on the Future of Law and Development, in the Northwestern Law Review. This version includes charts.

Analytical insights can be derived from events and case studies, even if caution in generalizing is warranted. With this in mind, we start by reflecting upon three disparate circumstances, centuries and worlds apart—institutions in Kenya and in the United States today, and those ruling the mighty seas hundreds of years ago. Although convention may classify these events as disparate, a common thread among them emerges: each challenges established wisdom on the rule of law at very basic and practical levels. In each case, de facto application of rule of law fundamentally departs from the de jure. Since much of the attention has fallen on the de jure, this departure has repercussions for how the rule-of-law field is approached in general and for practical strategies in particular.

First, consider Kenya in 2007. The main aid donors, led by the World Bank and the United Kingdom’s aid agency, DfID, tended to praise the governance reform efforts of the Kenyan authorities, including those on legal initiatives and anti-corruption.[1] Subsequently, in the run-up to the presidential elections, these top donors, also including the United States, flooded the Kenyan government with funds. Kenya’s government was even awarded a special international prize recognizing its good governance efforts.[2]

Elections were held a few short days after the last 2007 World Bank press release in Kenya, which announced approval of funding yet another project for the government.[3] The elections were widely regarded by external organizations, such as the EU, and by many Kenyans[4] as rigged, in what was the culmination of years of systemic political corruption that infiltrated key legal and judicial institutions. Civil strife erupted and the full extent of the breakdown of law and order was exposed at a dire cost—thousands of lives were lost and vast socio-economic damages were inflicted.[5] Yet, the main aid donors appeared to be shocked that such corruption, electoral mismanagement, and turmoil could take place in Kenya.[6]

Around the same time and half the globe away, some rule-of-law institutions were being quietly undermined inside the world’s superpower: the United States. In April 2004, amidst euphoric financial sector growth, a meeting was held in the basement of the Securities and Exchange Commission (SEC).[7] The top executives of the main Wall Street investment banks gathered to weigh in on proposed SEC regulations that would relax restrictions on their investment houses.[8] A scant 55 minutes later, the investment bankers emerged with SEC approval; the new regulations exempted the investment groups from the leverage restrictions that apply to commercial banks, allowing the banks to massively expand their debt.[9]

In return for the green light to an enormous expansion of indebtedness, the investment banks agreed that the SEC would have more oversight over them, for which a special unit would be formed.[10] In practice, the oversight did not take place. In fact, the head of the SEC never created or staffed any such oversight unit.[11] The resulting financial debacle that followed is now well known. What is insufficiently appreciated is the fact that various manifestations of “soft” and “hard” forms of regulatory and legal capture by the elite financials were a factor leading to the crisis.[12]

Rewind to over 300 years ago when it seemed that naval shipping was an effective institution ensuring law and order on the seas. Partly abetted by the industry’s own internal organization and tendency to abide by the law,[13] commercial shipping also thrived. These two organizations—naval and commercial shipping—contrasted sharply with the institution that encapsulated all that was anathema to law and order: piracy. But as it was with both the official (and superficial) assessment of the (“well governed”) Kenyan government and of the (booming) U.S. financial industry, there was much more to the whole industry of overseas shipping than met the eye. Again, as detailed below for the shipping industry, excessive focus on the de jure, and inattentiveness to the de facto rule of law and regulatory regime, has resulted in formalistic misinterpretation of the actual reality.

These three admittedly idiosyncratic illustrations force us to think again. That these events occurred at all, against expectations, gives rise to questions about many conventional premises held in the law and development and rule of law fields. For starters, they may illuminate why billions of dollars channeled by donors to countless law and development projects have generally not fared well.[14] Yet, they also illustrate that rule of law challenges are rife beyond the development field. The traditionally sharp divide between developing and developed countries implied in “law and development” might not be that helpful any longer.

Building on these three illustrations, coupled with the empirical analysis suggested here as well, five observations can be made. They are interrelated and thus not mutually exclusive, and are focused on what in my view constitute some shortcomings in the rule of law writings from a policy analysis perspective.[15]

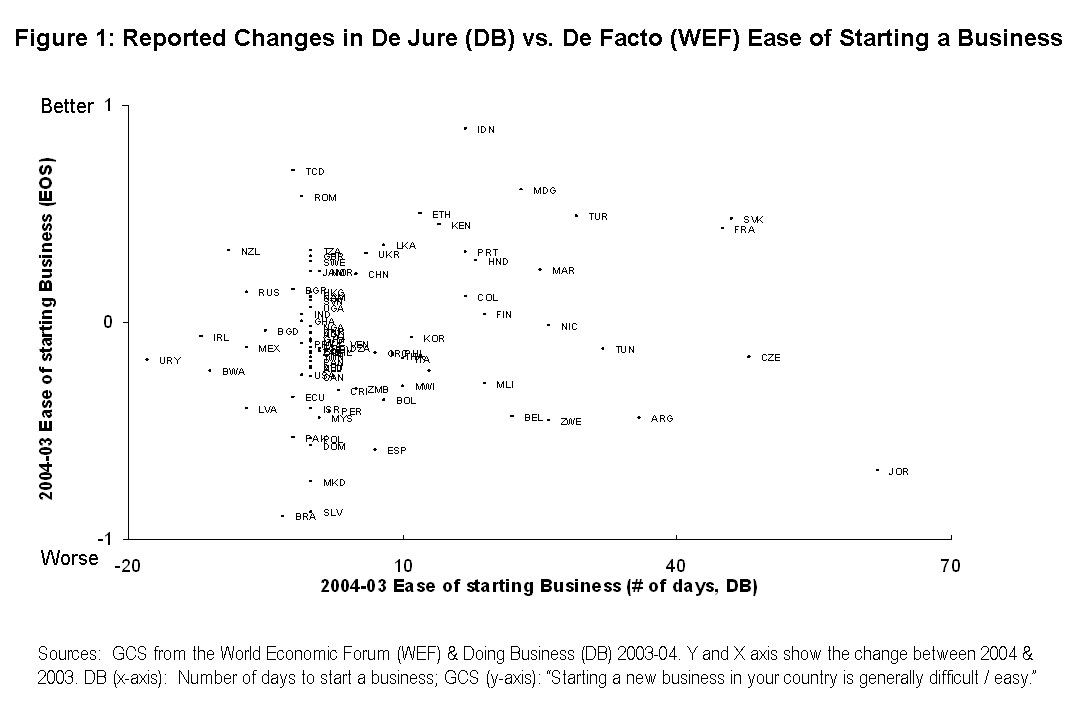

First, as hinted, there has been an excessive legalistic focus on de jure aspects in the rule of law, to the detriment of the de facto reality. Focus on the de facto implementation of adopted laws matters because such implementation tends to deviate from what is codified by fiat. The gap between de jure and de facto is vast in scores of countries. Practitioners in those countries (and project staff in donor agencies) often know in advance that many donor-mandated legal covenants adopted by fiat are unlikely to be implemented in practice.

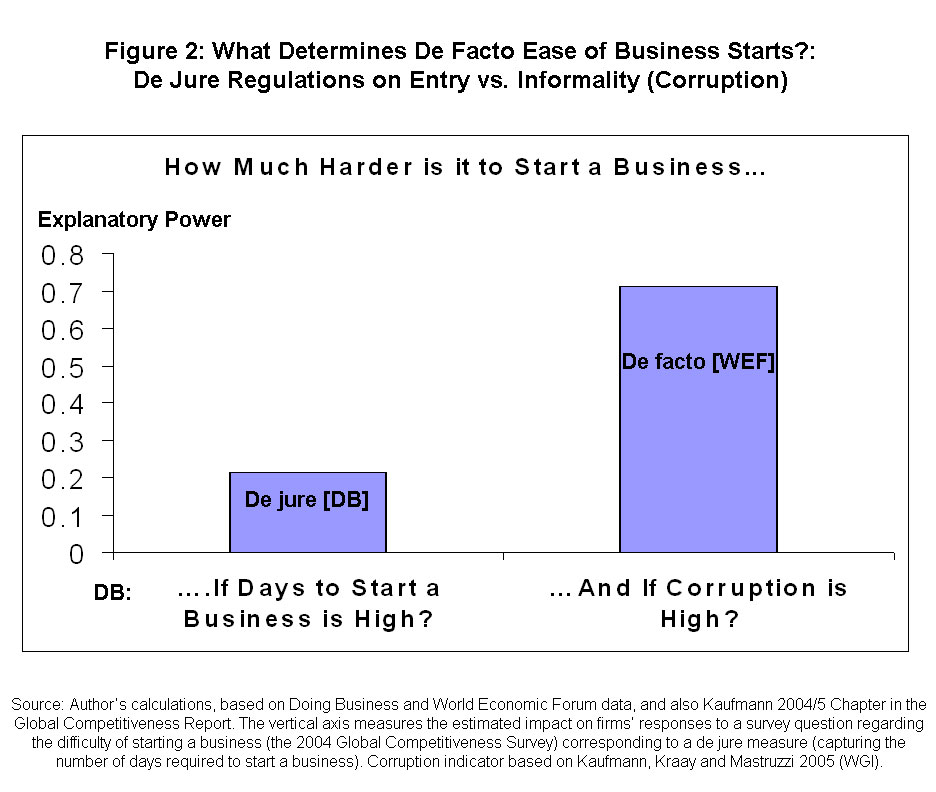

This leads to the second concern: the gap between the de jure and the de facto is in large measure due to the informality in the application of the rules of the game in the legal and regulatory institutions. Insufficient attention is paid to the workings of such informal rules of the game. Instead, the formal de jure approaches tend to dominate in legal writings. We have found, empirically, that informality, through corruption and other such distortive implementation institutions, is more indicative of how long it takes for a firm to start operating in many emerging economies than the de jure legal requirements for business start-up.

This is shown in Figures 1 and 2 below. Figure 1 suggests the extent of the gap between the de jure and the de facto regarding the legal and regulatory requirements to start a business around the world. Such gap is particularly acute in developing countries, even though there is also a gap in wealthier countries. Figure 2 shows that informality, in this case corruption, explains much more than formal rules as a determinant of what it actually takes to start a business.[16]

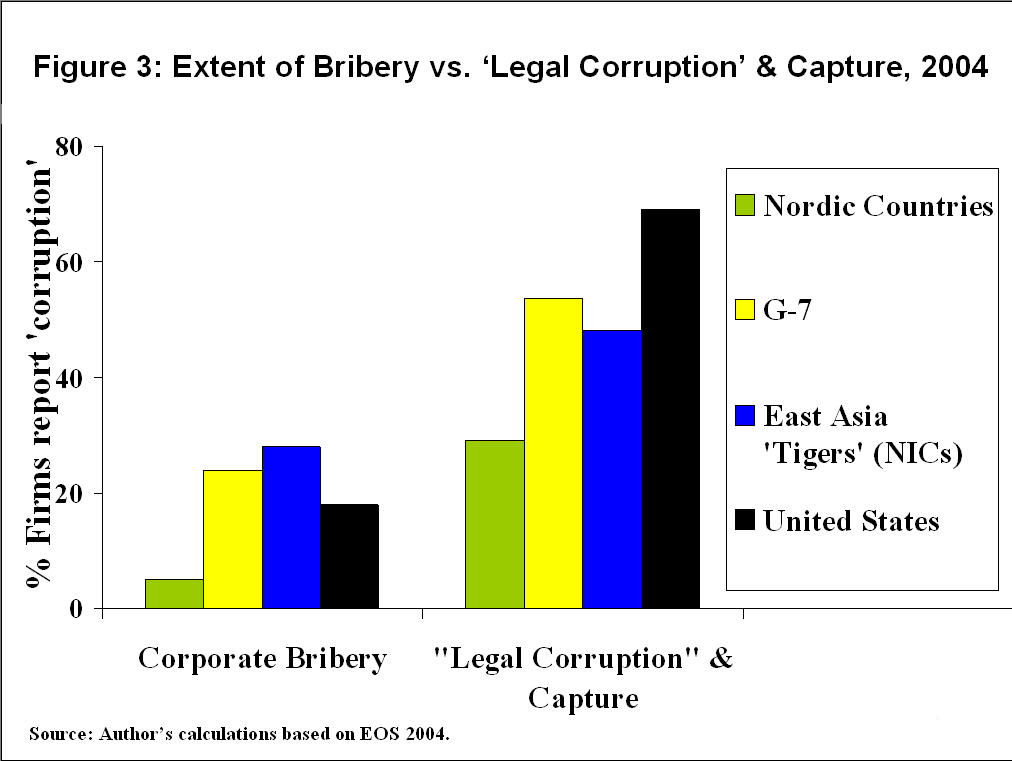

Third, the institution of legal and regulatory capture, which is a particularly insidious form of informality in the application of rule of law, has also been neglected in the literature. A few years back, based on a worldwide survey of enterprises, I calculated the extent of bribery in over a hundred countries.[17] But I also analyzed specially designed questions about legal corruption and capture.[18] I examined the extent to which firms, through legal means such as campaign contributions and connections, exerted undue influence on laws, regulations, and policies for their own private benefit and to the detriment of the rest of society.[19] As shown in Figure 3 below, the United States rated relatively well on the bribery scale, exhibiting relatively low levels of bribery.[20] In sharp contrast, it rated very poorly in the area of legal corruption and capture.[21]

Fourth, the three preceding observations—the gap between de jure and de facto rules of law, the informal rules of the game in general, and the phenomena of state and regulatory capture in particular—are all deeply political phenomena. Politics (not merely the political economy) ought to feature much more prominently in any diagnosis and action program related to rule of law and to law and development. Even today, in the United States, we tend to see technocratic knee-jerk approaches to financial regulatory reforms, as if technical regulatory fixes by fiat are the answer. There is limited debate (let alone reform) regarding the distortive role of money in politics, or on the need for campaign finance and lobby reform.[22]

Fifth, often the “rule of law” focus is overly narrow, concentrating on law and order (such as providing training and hardware to the police or study tours and computers to the judiciary), while neglecting the broader and more relevant role (for economic growth and social welfare) of the rule of law. A broader strategy would concentrate on key issues, such as increased accountability, checks and balances, and judiciary reform, alongside the narrow law and order concerns, such as those mentioned above.[23]

To come full circle: over 300 hundred years ago, what was the real story on maritime shipping in general and on piracy in particular? Peter Leeson’s gem of a paper on the comparative law and economics of shipping modalities is highly relevant.[24] He compares the internal organization of merchant, navy, and pirate ships in the 1700s.[25] Merchant and navy ships were absolute dictatorships, with the captain holding absolute unchallenged authority.[26] Pirate ships, by contrast, had democratic structures and regulations—internal rules of law—dividing authority between the captain and the crew.[27] There were checks and balances on the captain’s authority and “pirate constitutions” specified how the spoils of piracy were to be divided.[28]

In essence, pirates devised two institutions to establish a functional internal rule of law system that prevented internal predation and crew conflicts, while maximizing profits: first, checks by the crew constraining the captain (“not rule of man”) and, second, their internal democratic constitution that minimized conflict and created piratical law and order.

The bottom line was rather stark, and totally at odds with conventional wisdom: pirate ships were extraordinarily successful at enabling internal rule of law and cooperation among a bunch of bloodthirsty guys with swords. Unlike the commonly mutinous conditions on the authoritarian and strife-torn commercial and navy ships of the day, pirate gangs were very successful enterprises.

Thus, navy and commercial shipping were (failing) organizations that were part of the “official” economy (one governmental and the other not as much) and ostensibly “governed” by official rule of law (with government’s heavy hand), while the (“successful”) institution of piracy was wholly informal, generating internal rule of law in a manner totally unrelated to any official or governmental organization. In fact, an improved understanding of this historical picture may even yield implications to better address the piracy threats in the seas off Somalia today.[29]

In fact, reality is not always as it seems, or what de jure states it is supposed to be. As shown by the episodes in Kenya and the United States in recent years, if only pundits, bankers and donors had viewed reality through a less conventional lens, the landing may have been softer.

A further implication emerging from these observations relates to the use of data. With exceptions, the treatment of the theme of law and development (and rule of law) has often been prose-intensive; many scholars have been reticent to probe deeper into empirical analysis. The fact that empirical measures are imperfect is not an excuse for ignoring the information that is available, particularly nowadays with such a rich plethora of comparable worldwide indicators available.[30] Paying more attention to the data—and not just “official” statistics—would have raised flags about the extent of capture in the U.S. (see Figure 3 above, based on data from 2004), as well as on the subpar rule of law conditions in Kenya prior to those crises.

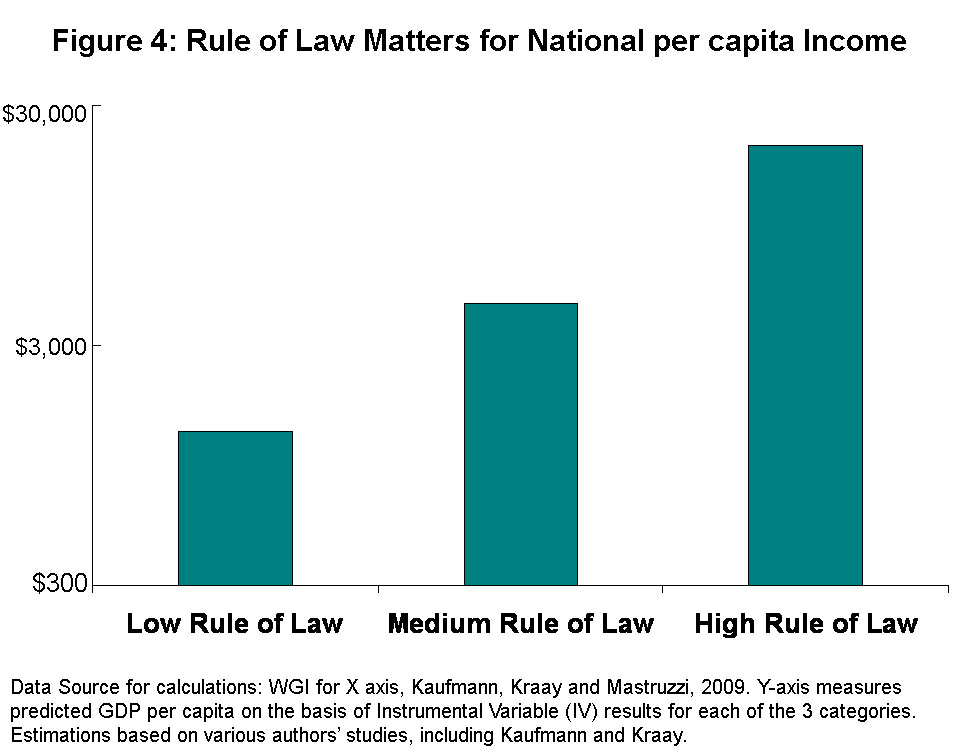

In fact, using non-official indicators as measures related to rule of law around the world, we and others[31] have been used to suggest that rule of law does causally impact economic development and growth, particularly in the long term (see Figure 4 below).[32]

Still to be determined through further research are what components in rule of law are particularly critical, how such components vary depending on country context and how they interact with one another, and how politics and informal institutions fundamentally affect the application of rule of law.

Probing deeper into these questions may lead to changes in the strategies of donor aid institutions in the rule of law field. But these aid donor institutions are also politically constrained. Often, the imperative to push funds out the door drives allocation, the engine being narrow short-term geopolitical considerations unrelated to longer term aid effectiveness.[33]

Thus, it is likely that the ongoing muddling through by the aid industry, hoping in vain that “business as usual” somehow delivers the legal goods, may continue for some time among the key bilateral and multilateral donor agencies. But the hope is that some exceptions among a few donors, possibly Australia and/or a Nordic country, for example, alongside a far-sighted private donor organization, may buck this ill-advised trend and challenge the conventional approach among the larger aid donors.

[1] The World Bank, Strengthening World Bank Group Engagement on Governance and Anti-Corruption Consultation Feedback: Kenya, January 26, 2007.

[2] The World Bank, Kenya Earns Global Prize for Progress in Governance, June 26, 2007;

Seven Questions: What’s the Matter with Kenya?, ForeignPolicy.com, February 2008, (interview with John Githongo, former anti-corruption czar in early years of Kenyan President Mwai Kibaki’s administration).

[3] Press Release, the World Bank, Kenya: World Bank Approves US $150 Million Water and Sanitation Project (December 20, 2007).

[4] Kenya’s Dubious Election, BBC.co.uk, January 8, 2008; U.S. DOS, Kenya: Country Reports on Human Rights Practices, 2008; Press Release, European Union Election Observation Mission: The Republic of Kenya, Doubts About the Credibility of Presidential Election Results Hamper Kenya’s Democratic Progress, January 1, 2008.

[5] See Kenya’s Dubious Election, supra note 4; U.S. DOS, supra note 4.

[6] Press Release, Joint Statement by the African Development Bank and the World Bank on the Situation in Kenya, January 18, 2008. Note that from the time of the alleged electoral rigging and the resulting eruption of violence took place, it took weeks for the multilateral institutions to come out with such a formal statement.

[7] Stephen Labaton, Agency’s ’04 Rule Let Banks Pile Up New Debt, NYTimes.com, October 2, 2008.

[8] Id.

[9] Id.

[10] Id.

[11] Id.

[12] See Daniel Kaufmann, Corruption and the Global Financial Crisis, Forbes.com, January 27, 2009.

[13] For the modern treatises on maritime law that build upon this tradition, see Steven F. Friedell, Benedict on Admiralty (7th ed. 1988); Thomas J. Schoebaum, Admiralty and Maritme Law (1987).

[14] For a detailed and probing critique of the ineffectiveness of law and development foreign aid programs (and on how different the “field” is today than it was 40 years ago), see the writings of Thomas Carothers, including his new book Promoting the Rule of Law Abroad: In Search of Knowledge (Thomas Carothers ed., 2006). For further critiques, see William Easterly, Can Foreign Aid Buy Growth?, 17 J. Econ. Persp. Summer 2003, at 23–48; Raghuram G. Rajan & Arvind Subramanian, Aid and Growth: What Does the Cross-Country Evidence Really Show? (IMF Working Paper No. WP/05/127, June 2005).

[15] Of course, there are scholarly contributions that are exceptions to my criticisms. But, often, exceptions prove the rule.

[16] The formal legal and regulatory requirements I refer to are those codified by the by the World Bank’s de jure Doing Business data collection legal experts. See The World Bank Group, Highlights from Doing Business 2010. For details on the dominance of informality over formality in explaining what it takes for an enterprise to start operations, see Daniel Kaufmann, Corruption, Governance, and Security: Challenges for the Rich Countries and the World, in World Economic Forum, The Global Competitiveness Report 2004-2005).

[17] Kaufmann, supra note 16, at 83.

[18] Id.

[19] Id.

[20] Id. at 92.

[21] Id. at 91–92. These findings are consistent with the SEC anecdote relayed above, which, like the survey, took place in 2004.

[22] A “technical fix” parallel illustration in development aid has been the fixation of aid donors with funding the creation of anti-corruption commissions following major corruption scandals in recipient countries. This reflects deep misunderstanding about the same corrupt vested interests that undermine the existing formal rule of law institutions and regulatory environment, which are highly likely to also capture these new (donor-funded) institutions.

[23] I am not a legal scholar, but an economist (and an admittedly selective student of rule of law). I have not found a definitive, compelling, or all-encompassing definition for rule of law. So I am drawn to the simple old antonym that views the rule of law as what is not rule of man. This view encompasses so much more than law and order, forcing one to oppose the tendency to equate the two.

[24] See Peter T. Leeson, An-aargh-chy: The Law and Economics of Pirate Organization, 115 J. Pol. Econ. 1049 (2007).

[25] Id. at 1053–76.

[26] Id. at 1055–58.

[27] Id. at 1064–69.

[28] See id. at 1072–75.

[29] See, e.g., Jeffrey Gettleman, Somali Pirates Seize Five Ships in 48 Hours, NYTimes.com, April 6, 2009.

[30] The increasing availability of governance data has been accompanied by increasingly sophisticated statistical techniques to address the existence of margins of error, which exist for any indicator. See www.govindicators.org.

[31] See Daron Acemoglu et al., Institutions as a Fundamental Cause of Long-Run Growth, in 1A Handbook of Economic Growth ch. 6, at 385 (Philippe Aghion & Stephen N. Durlauf eds., 2005).

[32] Posting to The Kaufmann Post, Myth #2: Only Rich Countries Can Afford Good Governance and the Rule of Law? On The Economist’s “Order in the Jungle,” March 13, 2008.

[33] OECD, The Challenge of Capacity Development: Working Towards Good Practice 7 (2006); Daniel Kaufmann, Aid Effectiveness and Governance: The Good, the Bad, and the Ugly, Brookings, March 17, 2009.