Below is the essay from Chapter 4 of the Foresight Africa 2018 report, which explores six overarching themes that provide opportunities for Africa to overcome its obstacles and spur inclusive growth. Download the paper to see the contributing viewpoints from high-level policymakers and other Africa experts. You can also join the conversation using #ForesightAfrica. Pour lire ce chapitre en Français, cliquez ici.

The road not taken: Structural change in Africa reconsidered

Economists have long regarded structural change—the movement of workers from lower to higher productivity employment—as essential to growth in low-income countries. Yet, until recently, Africa’s economic structure had changed very little, worrying both policymakers and analysts. The African Union, the African Development Bank, and the United Nations Economic Commission for Africa have all voiced concern with Africa’s slow pace of structural change. Earlier this year, The Economist noted, “Africa’s development model puzzles economists.”

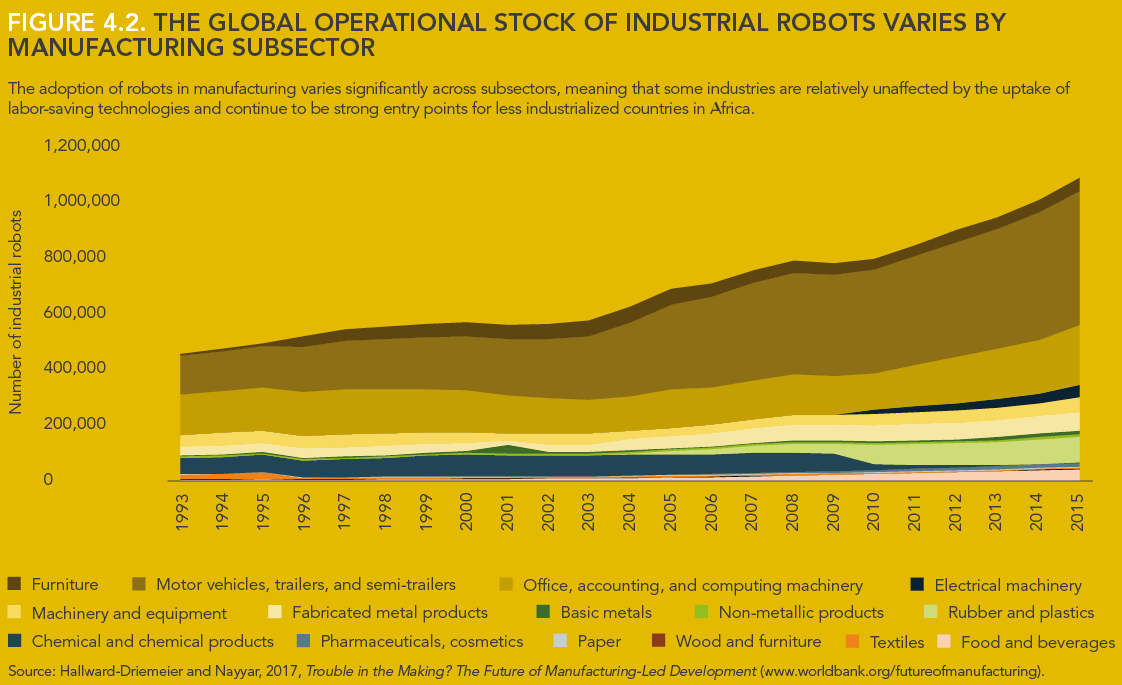

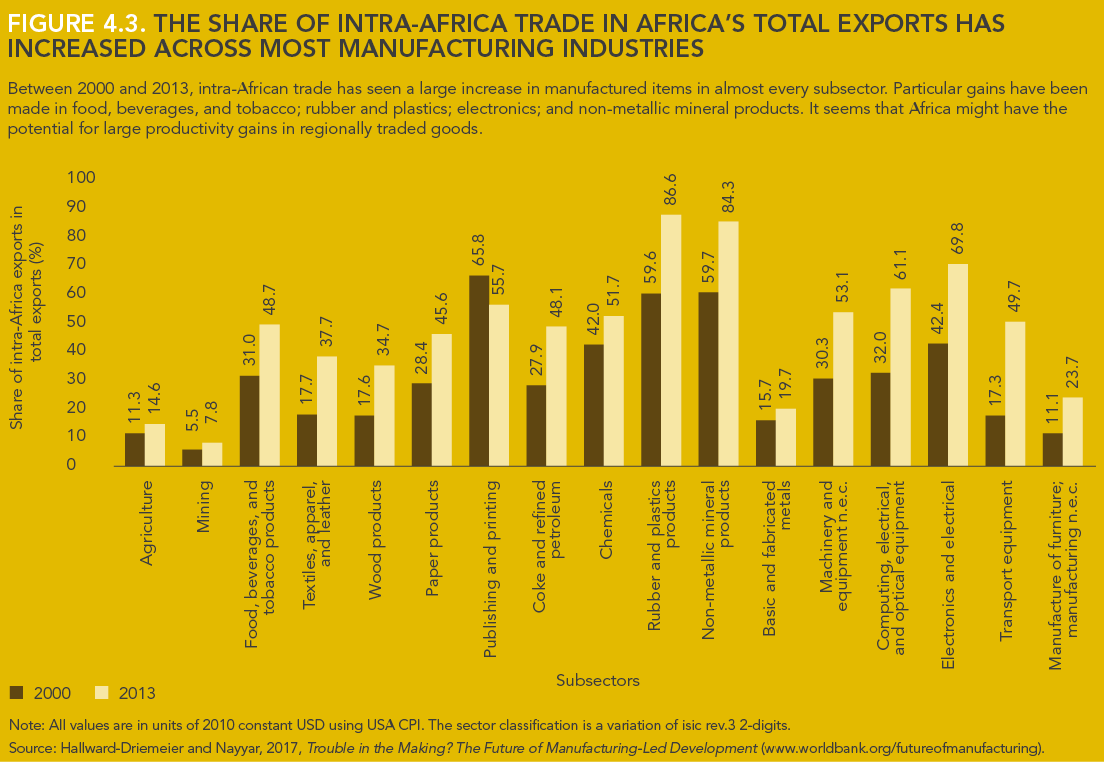

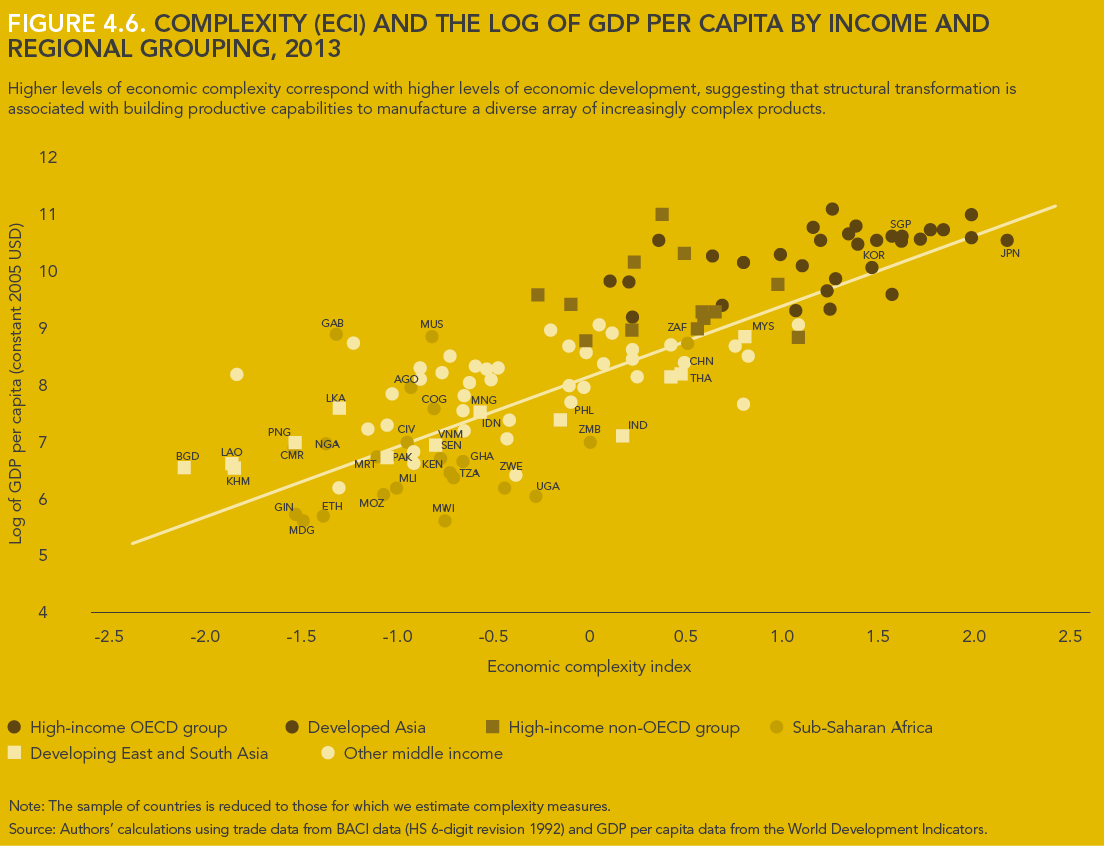

Historically, manufacturing drove economic transformation. Today, new technologies have spawned a growing number of services and agro-industries—including horticulture—that share many characteristics with manufacturing. They are tradable, have high value added per worker, and can absorb large numbers of moderately skilled workers. Like manufacturing, they benefit from technological change, productivity growth, scale, and agglomeration economies. These are “industries without smokestacks,” and in 2015, the Africa Growth Initiative and UNU-WIDER set out to study their role in Africa. The results are forthcoming in Industries Without Smokestacks: Industrialization in Africa Reconsidered (Oxford University Press, 2018).

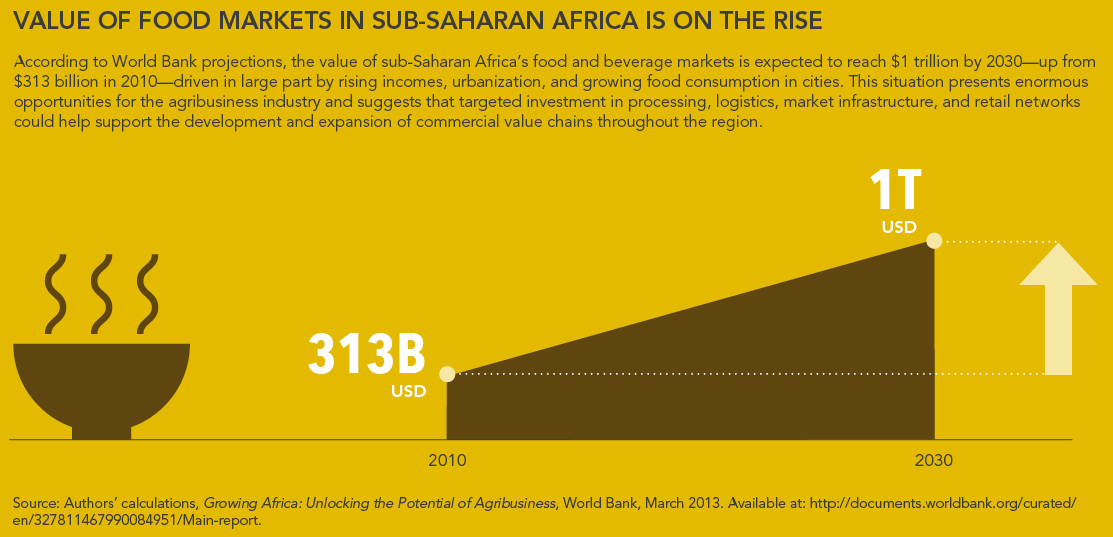

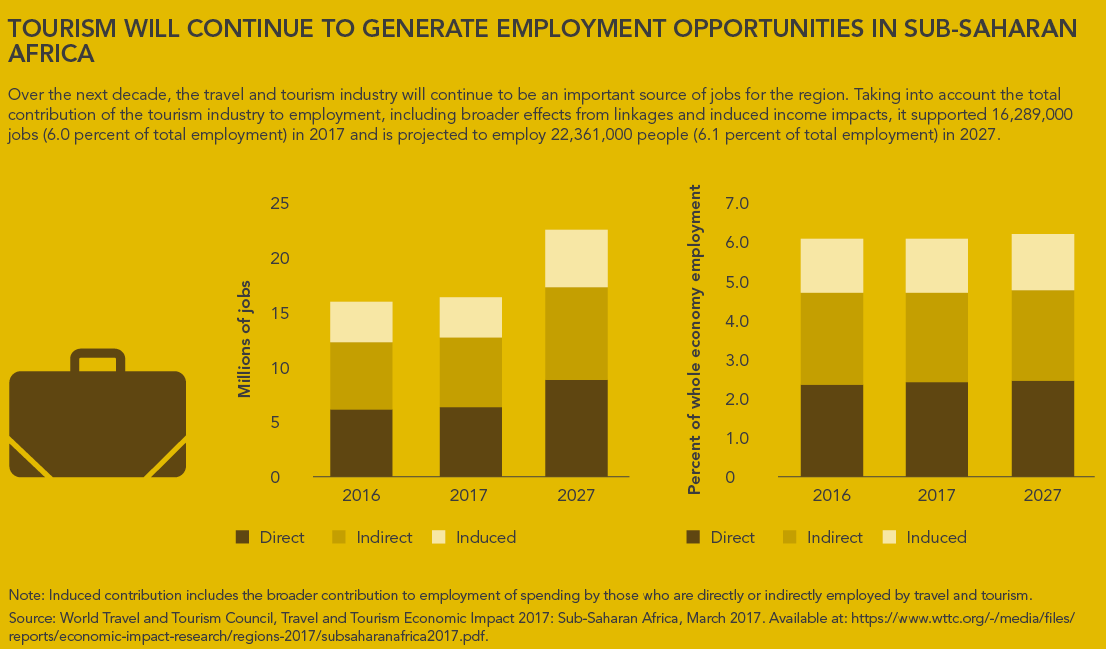

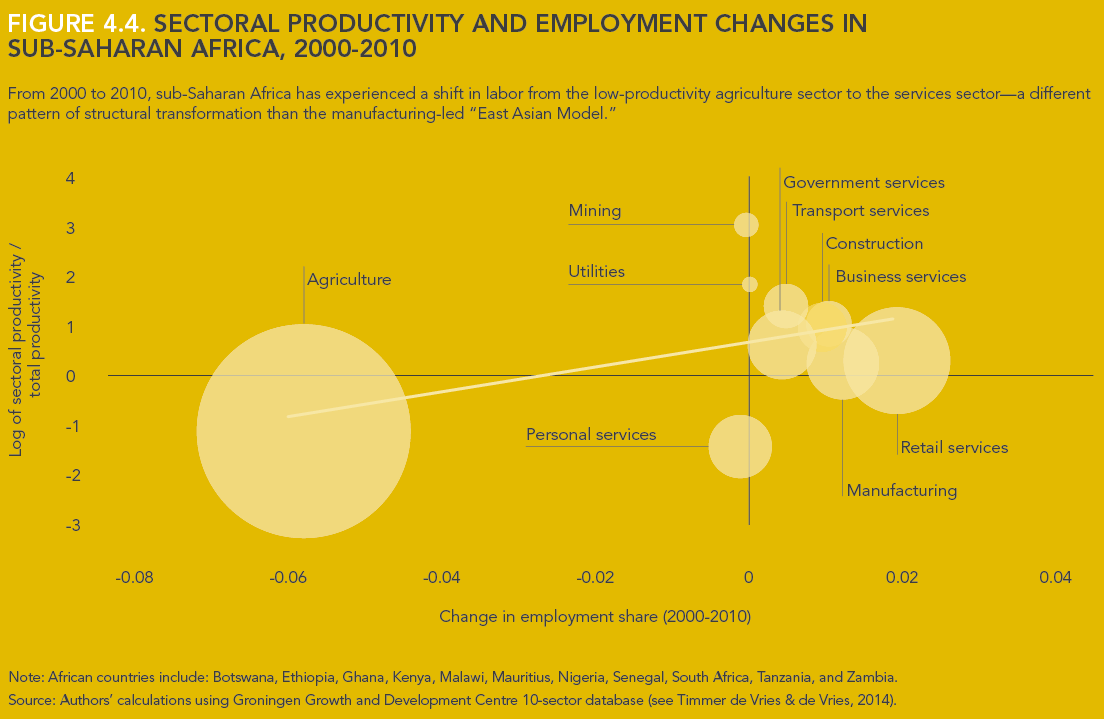

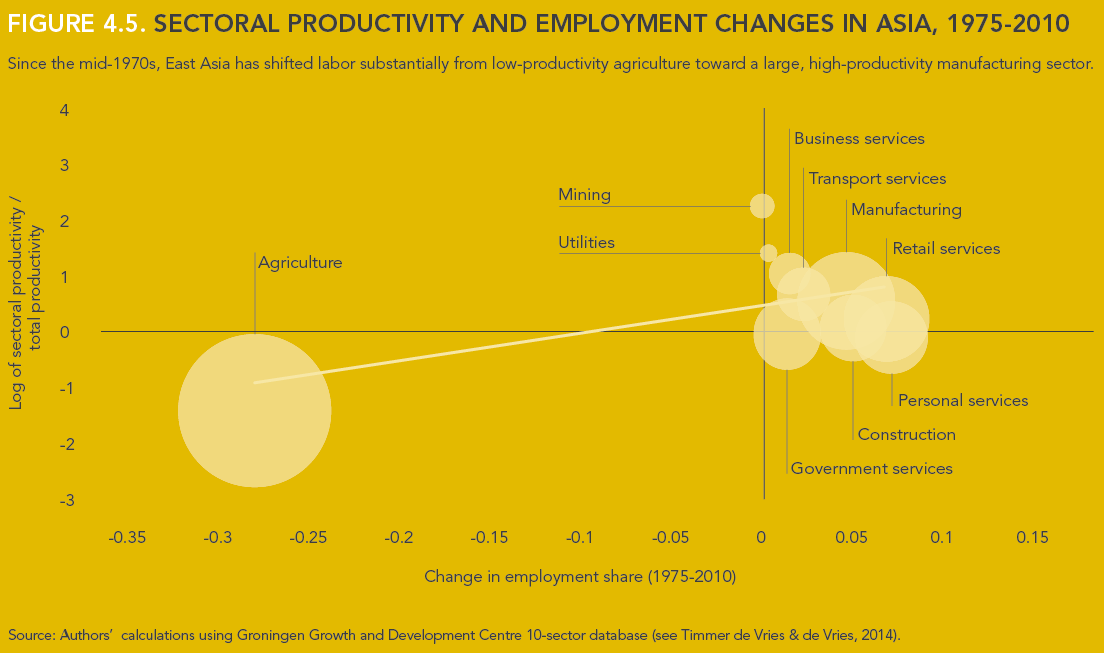

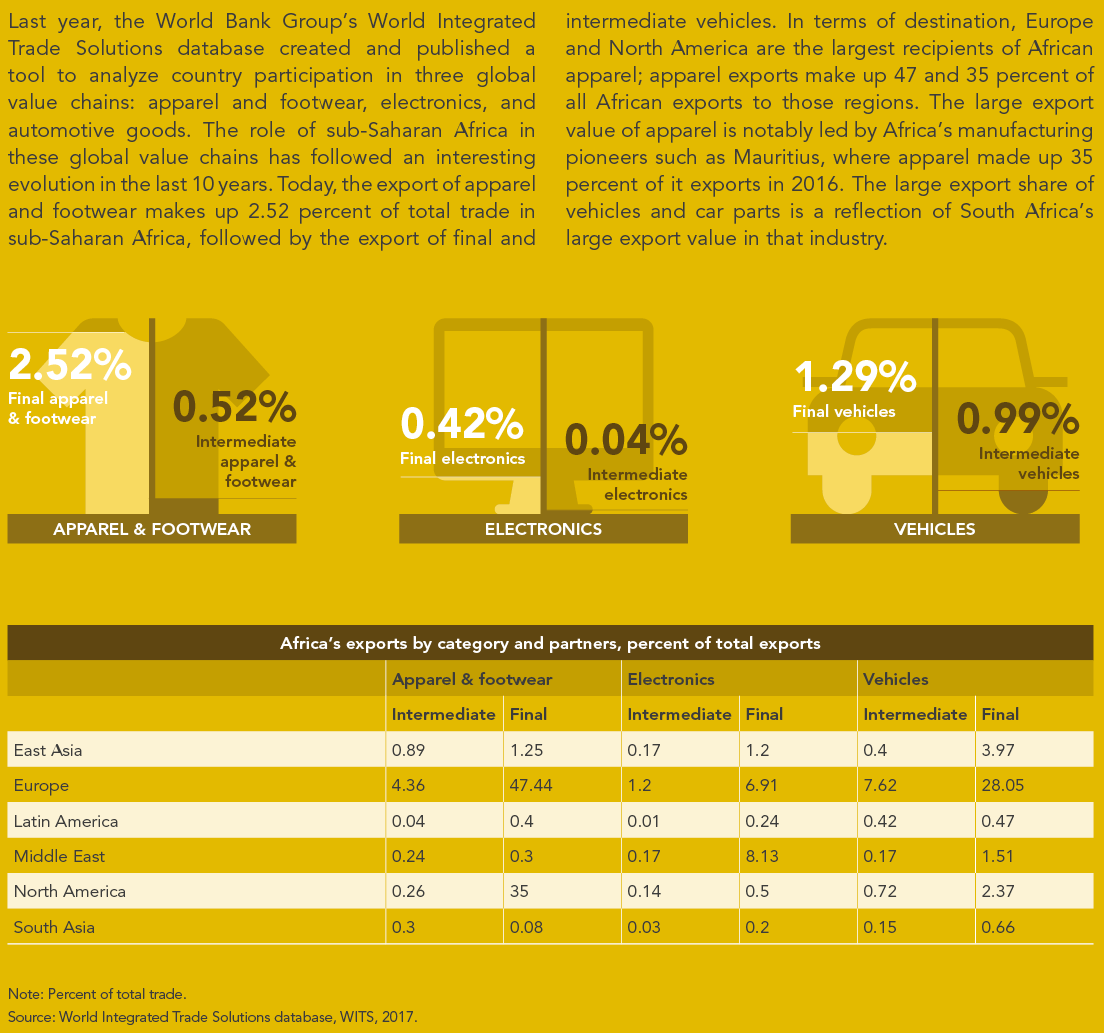

We have found a new pattern of structural change emerging in Africa, one different from the manufacturing-led transformation of East Asia. ICT-based services, tourism, and transport are outpacing the growth of manufacturing in many African countries. Between 1998 and 2015, services exports grew more than six times faster than merchandise exports. Kenya, Rwanda, Senegal, and South Africa have vibrant ICT-based services sectors. Tourism is Rwanda’s largest single export activity, accounting for about 30 percent of total exports. In 2014, 9.5 million tourists visited South Africa, contributing 3 percent to its GDP. Ethiopia, Ghana, Kenya, and Senegal all actively participate in global horticultural value chains. Ethiopia has achieved extraordinary success in flower exports, so much so that the country is now a global player in the sector.

We also found that, because tradable services, agro-industry, and horticulture share many firm characteristics with manufacturing, it is possible to develop a strategy for structural transformation based on three factors that have largely shaped the global distribution of manufacturing. The first is the “investment climate” (the environment within which firms operate). The second is the capacity to export, and the third is agglomeration. The three are inter-related, and to boost the pace of structural change African governments need to address them concurrently.

Infrastructure, skills, and competition are key elements of the investment climate. African firms pay a high productivity penalty because of poor infrastructure. High-speed data transmission is critical to exporting a wide range of services and especially to IT-intensive exports. A necessary condition for developing tourism is adequate tourist-related infrastructure. Investments in trade logistics are essential to agro-processing and horticulture exports. Skills matter as well. Attempts to expand the IT-enabled services industry have encountered manpower constraints. The skills needed to interact with tourists and provide back office services are critical to high-quality tourism. Lack of competition in transportation markets represents a significant barrier to competitiveness.

Exporting offers opportunities to acquire capabilities and enhance productivity, but individual firms face significant barriers to export. To address this, governments need to develop a package of trade and exchange rate policies, public investments, regulatory reforms, and institutional changes designed to increase the share of non-traditional exports in GDP. To date, few countries have succeeded in implementing such an “export push” strategy.

Agro-processing, horticulture, and ICT-based services—like manufacturing—benefit from agglomeration economies. Geography also plays an obvious role in tourism; tourist facilities tend to cluster close to the tourism resource. Governments can support agglomerations by concentrating investments in high-quality institutions and infrastructure in a special economic zone (SEZ). Ethiopia is successfully pursuing such an approach in both manufacturing and services, but the majority of Africa’s SEZs have failed to attract a critical mass of firms.

Globally, trade policy has an important role to play. Escalating tariffs in Asia for higher-stage processing of commodities discourages the development of Africa’s agro-industrial value chains. Here, China could play a leading role by shifting its preferential trading agreements from bilateral deals to a single, well-publicized Africa-wide initiative. Another priority is to implement the World Trade Organization Trade Facilitation Agreement (TFA) fully. In recent years, as concessional finance has become constrained, governments have turned to private borrowing. Because sovereign borrowing often involves high costs and short maturities, a better alternative would be to allow creditworthy countries to borrow from the non-concessional windows of the World Bank and other multilateral development banks.

Infrastructure, skills, and competition are key elements of the investment climate. African firms pay a high productivity penalty because of poor infrastructure.

Structural change in Africa is a “road less traveled by.” While some countries—perhaps those in coastal locations—will transform their economies through manufacturing, others will be able to turn to high value-added agriculture, agro-industry, and tradable services. From the perspective of public policy, it is, happily, not an either/or choice. Better national and global policies can support structural change—with or without smokestacks.

REFERENCES

Escribano, A., J.L. Guasch, and J. Pena. 2010. “Assessing the Impact of Infrastructure Quality on Firm Productivity in Africa: Cross-country Comparisons Based on Investment Climate Surveys from 1999-2005.” World Bank Policy Research Working Paper 5191. Washington, D.C.: World Bank Group. http://documents.worldbank.org/curated/en/792371467990385370/Assessing-the-impact-of-infrastructure-quality-on-firm-productivity-in-Africa-cross-country-comparisons-based-on-investment-climate-surveys-from-1999-to-2005.

Ghani, E., and H. Kharas. 2010. “The Service Revolution in South Asia: An Overview” in E. Ghani (ed.), The Service Revolution in South Asia. Oxford, U.K.: Oxford University Press.

McMillan, M., D. Rodrik, and I. Verduzco-Gallo. 2014. “Globalization, Structural Change, and Productivity Growth, with an Update on Africa.” World Development 63(1): 11-32.

Newman, C., J. Page, J. Rand, A. Shimeles, M. Soderbom, and F. Tarp. 2016. Made in Africa: Learning to Compete in Industry. Washington, D.C.: Brookings Institution Press.

Stern, N. 2001. A Strategy for Development. Beijing, China: China People’s University

UNIDO. 2009. Industrial Development Report, 2009. Vienna, Austria: United Nations Industrial Development Organization. https://www.unido.org/sites/default/files/2009-02/IDR_2009_print_0.PDF.