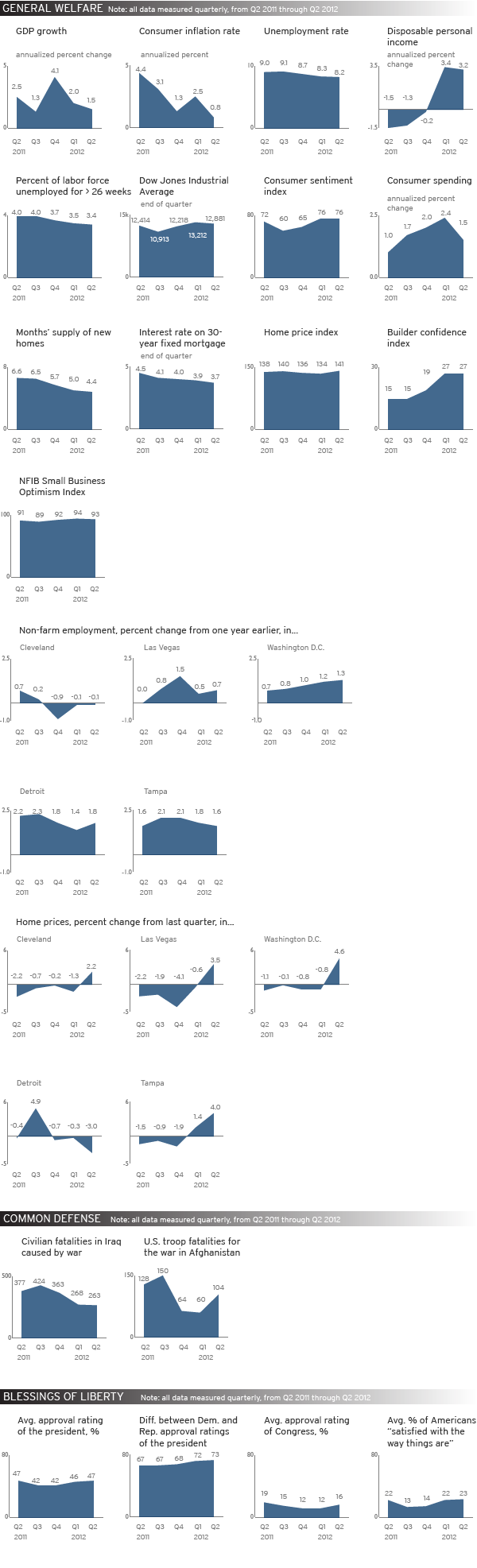

Index #13: Last Five Quarters

Will the 2012 presidential election follow historical trends and benchmarks, or are more complex dynamics at play this year? For the last “How We’re Doing” Index ahead of Election Day, a team of scholars at the Brookings Institution looked at U.S. economic growth over the past five quarters, which has decelerated while the “fiscal cliff” and the European financial crisis loom. Historically, high unemployment and poor economic growth have doomed incumbents, yet President Obama’s poll numbers remain relatively stable. Will the November election turn on the state of the national economy, or might relatively better economic conditions in key swing states be enough to carry Obama to reelection?Continue reading below chart »

Related Materials:

Past How We’re Doing indexes »

The U.S. economy continues to grow, but at a discouraging pace. U.S. real gross domestic product increased at an anemic 1.5 percent annual rate during the second quarter. While employment conditions strengthened earlier this year, new job growth has averaged about 100,000 positions per month since April. That’s not enough to keep the unemployment rate from rising. The one bright spot has been the recent moderate improvement in the long-depressed housing market. The glut of houses is beginning to subside, leading to more housing construction and higher prices.

The economic outlook is not expected to improve much, if at all, heading into the election. Growth is likely to remain below 2 percent in the third quarter, while the unemployment rate will stay above 8 percent. Concern is growing that Congress won’t act to avert the “fiscal cliff” of tax increases and spending cuts set to take effect in January, which the Congressional Budget Office has predicted would lead the United States into a recession.

The crisis in the euro zone is worsening, and the threat to the global economy escalating. Government bond yields of Italy and Spain have peaked vis-à-vis those of Germany, fueling speculation about the economic and political sustainability of the euro as their common currency. Partly because of continued uncertainty in Europe, the International Monetary Fund has revised growth projections for China and India downward for this year and next. In turn, the outlook for U.S. exports to Europe and the emerging economies is deteriorating. Above all, the dampening effect of the European crisis is likely to delay investment and hiring decisions, further slowing the anemic recovery we have seen so far in the United States.

What does this all mean for the U.S. presidential election?

It’s important to remember that this is not a national campaign but 50 simultaneous state elections – and the outcome for 40 of them can be predicted with some accuracy. This year, election observers shouldn’t obsess over national unemployment figures. The key is to watch economic and political indicators in the 10 states that are closely contested: Ohio, Florida, Pennsylvania, Nevada, Colorado, Iowa, Virginia, North Carolina, New Hampshire and Wisconsin.

Many of the swing states are doing better economically than the country as a whole. Ohio, for example, has a 7.2 percent unemployment rate, more than a point below the national average. And recent polls in several swing states show Obama running ahead of his national polling margins.

The biggest threat to Obama is a late surge for Mitt Romney, which could be precipitated by a collapse in the euro zone and further weakening of the domestic economy. In a bad economy, late-deciding voters often break for a credible challenger, so Obama’s team needs to establish a large lead now, before any further economic weakening. Presidents who fail to set the tone early usually end up losing, as Presidents Jimmy Carter and George H.W. Bush did.

So, yes, “it’s the economy, stupid.” But this year, it’s an economy that stretches from local indicators in just 10 key states to the threat of national and perhaps global economic weakening. Obama needs to hope that the swing-state economies at least stay stable and that any bad news from abroad waits until after Nov. 6.

Sources:

GDP growth:

U.S. Bureau of Economic Analysis

Unemployment rate:

U.S. Bureau of Labor Statistics

Percent unemployed for more than 26 weeks:

U.S. Bureau of Labor Statistics

Disposable personal income:

U.S. Bureau of Economic Analysis

Consumer inflation rate:

U.S. Bureau of Labor Statistics

Dow Jones Industrial Average:

Yahoo! Finance

Consumer sentiment:

Reuters/University of Michigan survey of consumers

Consumer spending:

U.S. Bureau of Economic Analysis

Months’ supply of new homes:

U.S. Census Bureau

Interest rate on 30-year fixed mortgage:

Freddie Mac

Metro area employment rates:

U.S. Bureau of Labor Statistics

Metro area home price growth:

Case-Shiller Index

U.S. combat fatalities, Afghanistan:

icasualties.org

Civilian fatalities, Iraq:

Brookings Iraq Index

Approval ratings of president and Congress:

Gallup

Percent of Americans “satisfied with the way things are”:

Gallup