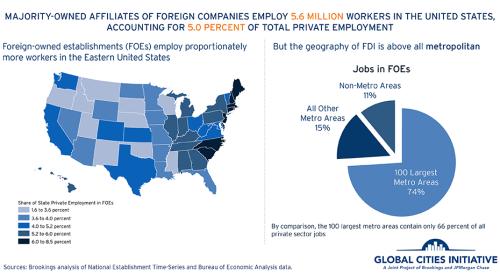

This paper advances the understanding of foreign direct investment (FDI)—that is to say, the U.S operations of foreign companies— in U.S. metro areas. It presents new data on jobs in foreign-owned establishments (FOEs) across the nation’s 100 largest metropolitan areas between 1991 and 2011. The new data on the geography of jobs in FOEs, available below, reveals that:

-

- Foreign-owned U.S. affiliates directly employ some 5.6 million workers spread across every sector of the economy. The number and share of U.S. workers employed in FOEs increased steadily through the 1990s before peaking in 2000 and then stagnating.

-

- The nation’s largest metro areas contain nearly three-quarters of all jobs in FOEs. Fully 74 percent of all jobs in FOEs are concentrated in the country’s 100 largest metro areas by population, compared to 68 percent of total private employment.

-

- FDI supports 5.5 percent of private employment in the average large metro area, with significant regional variation. This share runs from a high of over 13 percent in Bridgeport, CT, to a low of about 1 percent in Provo, UT, reflecting generally higher shares in the eastern half of the country.

-

- Mergers and acquisitions—not establishment openings—drive changes in the number of jobs in FOEs over time. Increases in the number of jobs supported by FDI in the average year reflect net transfers of jobs into foreign ownership through M&As, not new jobs created in FOEs. The data analysis suggests that FDI itself is not a net source of direct job creation.

-

- Jobs in FOEs are relatively concentrated in manufacturing and advanced industries; however they have become more services-oriented over time. In 2011, FDI employed 18.5 percent of U.S. manufacturing workers and FOEs employed 1.4 million U.S. workers in the nation’s technology- and skill-intensive advanced industries. However, the share of jobs in FOEs in services has increased over time as manufacturing’s share of jobs in FOEs fell.

-

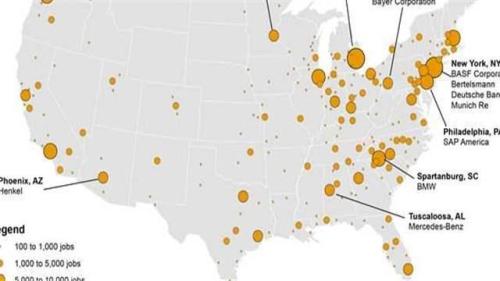

- FDI contributes to and in some cases drives industry specialization in metro areas. In several of the nation’s most significant regional industry concentrations, the foreign share of total jobs is double the foreign share of all jobs in the metro area. In several other metro areas FOEs drive regional industry specializations completely.

-

- The average large metro area contains FDI from 33 different countries and 77 different city-regions worldwide. Despite this diversity, in 2011 companies based in the 10 top countries and city-regions accounted for 75 percent and 46 percent of all jobs in FOEs, respectively. In total, companies from 445 different city-regions spread across 115 different countries have direct investments in the United States.

These findings together with the existing empirical literature suggest that good FDI policy does not treat FDI attraction as an end in itself but rather regards it as a tool for strengthening industry clusters, infusing new knowledge and technology into U.S. production systems, and increasing global engagement in U.S. regions.

Interactive and Profiles

The significance of FDI to local employment levels varies immensely across the U.S. landscape. Hover over each metro to view the share of Metro Area Private Employment in FOEs, and download full FDI profiles below.