Editor’s note: This paper was published at part of the 5th annual Municipal Finance Conference hosted at Brookings on July 12, 2016. Visit the conference homepage to learn more and read nine other papers on municipal finance.

A shrinking proportion of U.S. households hold municipal bonds and that could weaken the political will of state and local borrowers to pay them off, argue Daniel Bergstresser of the Brandeis International Business School and Randolph Cohen of the Massachusetts Institute of Technology.

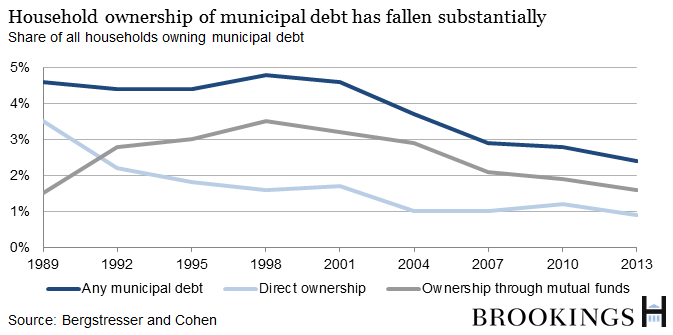

The interest on municipal bonds – typically issued by state and local governments – is exempt from federal (and some state and local) taxes, making them attractive to upper-income households, especially because default rates historically have been very low. Using data from the Federal Reserve’s Survey of Consumer Finances from 1989 through 2013, Bergstresser and Cohen find that the share of households holding municipal debt – either directly or through mutual funds – has fallen from 4.6 percent in 1989 to 2.4 percent in 2013.

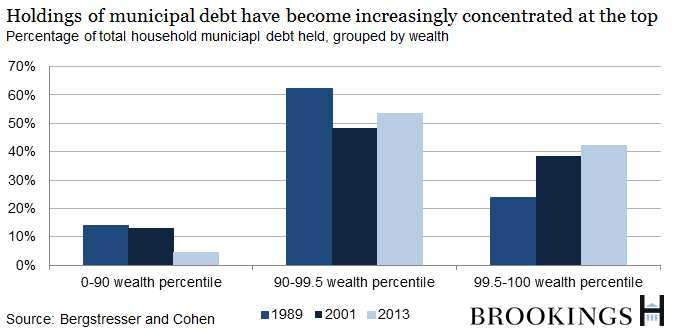

In addition, holdings of municipal bonds have become increasingly concentrated among the wealthiest households. As of 2013, 42 percent of all municipal debt was held by the wealthiest one-half of one percent if households, up from 24 percent in 1989.

One reason for the shrinking appeal of tax-exempt municipal debt, Bergstresser and Cohen suggest, is that households have an increasing share of their savings in tax-advantaged retirement investment accounts, such as IRA and 401(k) plans, in which it rarely makes sense to hold tax-exempt debt. The share of household assets in tax-differed accounts went from 19.4 percent in 1989 to 32.6 percent in 2013. The authors find that, the more of a household’s assets that are held in these retirement accounts, the less likely they are to hold municipal bonds, even after adjusted for annual income. Holding municipal bonds falls significantly the greater the share of a household’s assets that are held in these retirement account.

So what? The authors speculate that the constituency for repaying municipal bonds at moments of fiscal distress could shrink along with the fraction of voters who hold the securities. They also suggest that the continuation of the federal tax exemption for municipal interest also could be threatened as holdings of municipal debt are increasingly concentrated in a small number of wealthy households.