Editor’s Note: In collaboration with the Financial Times (FT), Eswar Prasad and Karim Foda of Brookings have developed a set of composite indexes which track the global economic recovery. The Financial Times has produced the Tracking Indexes for the Global Economic Recovery (TIGER) interactive map, which appears on the FT Web site.

Despite all the recent shocks and setbacks that have struck the global economic recovery, it is nonetheless getting on to a firmer footing.

The April 2011 update of the Brookings Institution-Financial Times Tracking Indexes for the Global Economic Recovery (TIGER) indicates that resurgent job growth as well as rising business and consumer confidence are providing some needed strength to the recovery in advanced economies. Emerging markets are still doing well but some of the shine is coming off these economies as they tighten policies to cope with rising inflation.

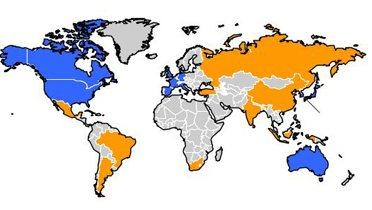

The updated interactive map below displays how fast individual G-20 economies are faring in global economic recovery. Underneath the map, links to updated key indicators display how fast those indicators are recovering for advanced economies, emerging markets and a composite total.

Economic Recovery in the World’s Advanced and Emerging Market Economies

Click on an individual country in the map to view charts for the main TIGER indexes for that country and charts for the indicators that make up the indexes, which are broken down by real activity, financial and confidence indicators.

As well as tracking country performance, the TIGER indexes also track the performance of key indicators across groups of advanced economies, emerging markets and a composite total. Click on the following links to view the updated charts for the following key indicators:

Real Activity Indicators Financial Indicators Confidence Indicators

For detailed information on the composition and construction of the indexes and a comprehensive description of the data and source information, please refer to the updated technical appendix.

Main highlights from the April 2011 Update:

- Real GDP growth and industrial production growth have not done too badly in recent months considering all the shocks that have hit the world economy, from debt crises in Europe to rising oil prices due to political instability in the Middle East, driving the gradual rebound in real economic activity which has given the Overall Growth Index a slight uptick in recent months for G20 economies.

- Consistent job growth in the advanced economies is helping to lift consumer confidence, and business confidence has risen sharply in tandem with large cash reserves built up by corporations in many major economies, possibly heralding a surge in investment activity.

- The emerging markets, after carrying the world economy on their shoulders, now face policy complications related to rising inflation and, in some cases, capital inflows and appreciating currencies. But they have been able to manage these pressures reasonably well so far.

- While it is still premature to declare victory, the world economy is now in much better shape than it was a year ago. However, a variety of unpleasant shocks – revolution, war, natural disasters, rising food prices and debt crises – all signal choppy waters ahead.

Read the full analysis and commentary: Economic Recovery Picks Up Pace, But Expect Some Turbulence Ahead