Almost everyone is agreed that we need to get our fiscal house in order and that the super committee needs to find the political will to get this done. As their deadline for acting draws nearer, a favorable outcome looks doubtful, and the prospect of an automatic sequester looms large. However, if action continues to be focused on a small slice of the budget, too much of any fiscal discipline will fall on a very limited number of programs without making a real dent in our long-term deficit problems.

To stabilize the ratio of debt-to-GDP we need deficit reduction in the neighborhood of $4 trillion over the coming decade. So far virtually all of the action has focused on discretionary spending. The Budget Control Act of 2011 (BCA), passed in the wake of the debt ceiling crisis, put new caps on discretionary spending that will, according to CBO, reduce such spending by about $900 billion between 2012 and 2021, including debt service. The law also called for a Joint Committee (aka the Super Committee) to come up with at least $1.5 trillion in additional spending cuts. At the present time, many observers are skeptical about the ability of the committee to come up with much in the way of savings, given partisan disagreements.

If the committee fails to enact savings of $1.2 trillion (including interest), the law calls for a sequester that, together with the committee’s actions (if any), would cut spending $1.2 trillion, half from defense and half from nondefense. Although not all of this second tranche needs to come from discretionary spending, it would once again take the brunt of the cuts because of the exemption of Social Security, Medicaid, and some other entitlement programs, a limit on cuts to Medicare, and no provision for new revenues. CBO estimates that the proportion borne by discretionary programs would be 71 percent and the proportion borne by nonexempted mandatories would be 13 percent (with the remainder taking the form of debt service savings). These new cuts would begin in 2013 and would be on top of the initial reduction achieved by reducing the caps in the first tranche. Thus, total discretionary spending would be reduced by about $1.6 trillion.

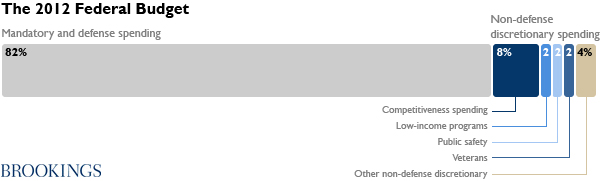

This scenario may seem quite reasonable to many members of the public. After all, people are justifiably disgruntled with government. They believe that a lot of money is wasted or spent ineffectively, they are suffering from a depressed economy, and they have little idea of exactly what the government does with their tax dollars. With this in mind, it is useful to look at these discretionary programs in a little more detail, focusing especially on the nondefense portion. (It’s a lot easier to imagine what defense dollars go for — weapons systems, the armed forces, and related expenses.) The roughly $600 billion spent on nondefense domestic discretionary programs in 2012 is a relatively small part of what the federal government spends every year. It accounts for only 18 percent of the total, but includes everything from education and the environment to transportation, housing assistance, veterans’ health care, and the FBI.

To help people better understand what this 18 percent is spent for, I categorize the total into four areas according to their purpose, broadly defined. One is programs that address the competitiveness gap that the president has frequently cited. This includes investments in education, training, infrastructure, and research. The second area is programs that help the disadvantaged, such as housing vouchers for low-income families and nutrition assistance for low-income women and their babies. The third is programs devoted to protecting the public—including the safety of the food supply, prescription drugs, airlines, nuclear plants, highways, workplaces, and patrolling the nation’s borders—along with disaster relief. The final is programs for veterans, especially their health care. If one were to wall off these four areas from cuts, there wouldn’t be a lot left from which to cut.

I estimate that out of the total nondefense domestic discretionary spending in 2012, 44 percent was for competitiveness purposes (mostly education, training, and transportation), another 12 percent was for low-income programs, 13 percent was for public safety and disaster relief, and 11 percent was for veterans. The remainder totals about $145 billion. That $145 billion may sound like a lot of money (and it is) but it is only 4 percent of total federal spending. I compare it to total federal spending since most of it is what I would call “overhead”—salaries and office space for the people who run the government, administer the laws, promulgate and enforce the regulations, prepare Social Security checks, monitor fraud, respond to Congressional and citizen requests, and so forth. Even relatively efficient organizations have overhead rates that are as high or higher than 4 percent.

Some important caveats: any exercise of this sort is no substitute for the kind of careful scrutiny of what actually goes on within each line item in a budget and allocating programs across these five categories is somewhat subjective. Are there efficiencies to be had and activities that could be privatized, consolidated, devolved to lower levels of government, or done away with entirely? Undoubtedly. Still, the kind of cuts the BCA has imposed will necessitate some extraordinarily tough choices and make it very difficult if not impossible to protect veterans, low-income families, public safety or “investments” in future growth. Moreover, cutting “overhead” — for example, such expenses as the administration of Social Security or disability benefits, will lead to some combination of poorer service for beneficiaries and inappropriate payments.

In sum, assuming that the members of the Joint Committee are unable to agree to an alternative set of actions, a sequester of these domestic discretionary programs on top on the caps already enacted are going to force draconian cuts in this relatively small portion of the budget. Those who are willing to accept such cuts should worry about the likely effects on our competitiveness, on the disadvantaged, on public safety, on veterans, and on the ability of the federal government to responsibly administer a wide variety of laws and programs in a way that does not lead to greater fraud and abuse. Instead, the debate badly needs to shift to the over $1 trillion we “spend” (through the backdoor) on tax subsidies, and the $1.5 trillion that funds just three big programs: Social Security, Medicare, and Medicaid. If we are serious about fiscal discipline, everything needs to be on the table. Everything.

Commentary

Op-edWhat Happens if the Super Committee Fails?

November 16, 2011