Recent changes in American policy to make work pay have affected the labor market status of several million former, current, and potential recipients of government transfers. U.S. social policy has been reformed to expand tax credits for the working poor. At the same time, state and federal lawmakers have reduced the cash welfare available to the nonworking poor. In 1996 the federal government abolished the main social assistance program for indigent adults with children. Congress abolished the old program—Aid to Families with Dependent Children (or AFDC)—and replaced it with Temporary Assistance to Needy Families (TANF). The new federal program placed pressure on all states to adopt aggressive policies to curtail assistance benefits to poor parents who are capable of working. The head of each family on social assistance is now required to work within two years after assistance payments begin. Work-hour requirements are stringent, and states face increasingly harsh federal penalties if they fail to meet them. The new federal law stipulates that the great majority of families can receive benefits for no longer than five years, it and allows states to impose even shorter lifetime limits on benefits. Many states have taken advantage of this flexibility, and they have limited benefits to an even shorter period than the maximum permitted under federal law.

Most states now require adult aid recipients who are not disabled to actively seek work or face reductions in their monthly aid payments. States also provide improved job search services to help recipients find work. As noted, almost all states now impose time limits on recipients’ eligibility for cash assistance benefits. More rarely, recipients are offered training to increase their employability. Many states have also liberalized their earnings disregards, allowing recipients to keep more of their monthly benefits when they begin to work and earn wages.

The new welfare law helped produce an unprecedented drop in the nation’s social assistance rolls. Since reaching a peak in 1994, the number of families collecting cash public assistance for children has dropped more than 3 million or over 50%. No drop of this magnitude had occurred in the previous 40 years. The sharp decline in the assistance rolls from their peak in 1994 is at least partly due to state-level reforms that began even before Congress passed the federal reform law in August 1996. The decline is also due to marked improvements in the demand for low-skill workers, especially between 1995 and 2000, and changes in the Earned Income Tax Credit (EITC). The liberalization of the EITC greatly increased the amount of earnings supplementation available to low-wage workers. A better economy, the increased generosity of the EITC, and much tougher federal and state work requirements have contributed not only to a decline in the U.S. welfare rolls but also to a large jump in labor force participation and employment among lone parents, especially single mothers.

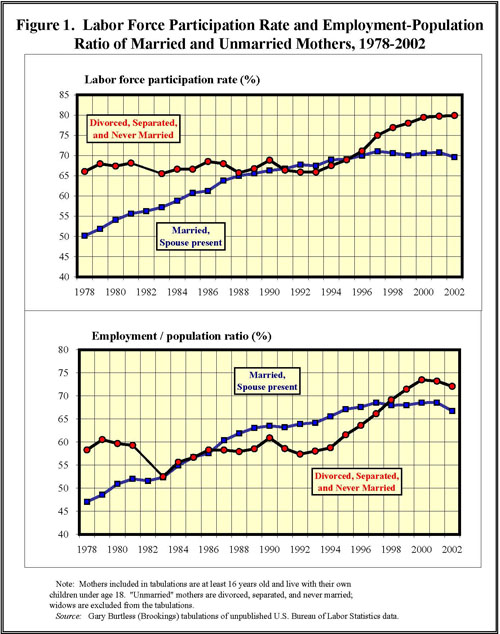

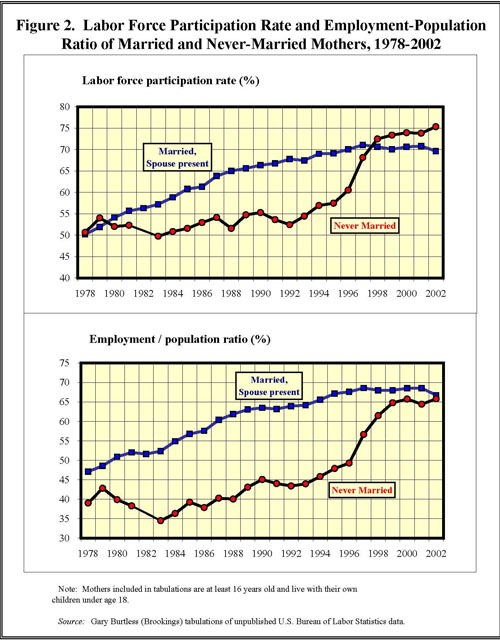

Figures 1 and 2 [see below] show trends in the labor force status of mothers who live with their own children under age 18. The top panel in both charts shows mothers’ labor force participation rates. A labor force participant is someone who either holds a job or is actively looking for a job but remains unemployed. The lower panel shows mothers’ employment-to-population ratio, that is, the actual percentage of all mothers who are employed. Figure 1 compares the labor force status of married mothers who live with their spouses, on the one hand, and mothers who are divorced or separated or who have never been married, on the other. Married mothers only rarely collect public assistance benefits, but a large fraction of divorced, separated, and never-married mothers were eligible to receive AFDC payments before the 1996 welfare reform law was passed. Notice that both the labor force participation rate and the employment-to-population ratio of unmarried mothers fell within a fairly narrow range between 1978 and 1994, but then began to climb rapidly after the latter year. In contrast, the participation rate and employment-population ratio of married mothers climbed substantially and fairly smoothly from 1978 through 1996. Since 1996, however, the percentages of married mothers who are in the labor force and who are employed have remained relatively stable.

The change in labor force behavior of the group most likely to receive assistance payments – never-married mothers who live with their own children under 18 – is shown in Figure 2. The chart shows a sharp rise in the employment rate of never-married mothers in relation to that of married mothers who live with their spouse. The jump began in 1994. The employment rate of never-married mothers remained relatively constant from the late 1970s through 1993, while the employment rate of married mothers living with husbands rose steadily over that period. Starting in 1994, the employment rate of unmarried mothers began to rise, and it rose very sharply. There is no evidence in Figure 2 that the employment rate of married mothers increased by a comparable amount. Even though the percentage of never-married mothers in the labor force rose substantially, the unemployment rate of these mothers actually fell 8.4 percentage points (43 percent) between 1994 and 2000. The recession in 2001 caused never-married mothers’ unemployment rate to rise, but the increase was very small (just 1.6 percentage points between March 2000 and March 2002). The liberalization of the EITC, new welfare-to-work reform programs at the state level, and the 1996 federal welfare reform produced major changes in the labor market behavior of unmarried mothers. If the American job market has had a serious problem absorbing indigent mothers who have been pushed off the welfare rolls, the fact is not apparent in these data.

Commentary

Op-edThe Labor Force Status of Mothers Who Are Most Likely to Receive Welfare: Changes Following Reform

March 30, 2004