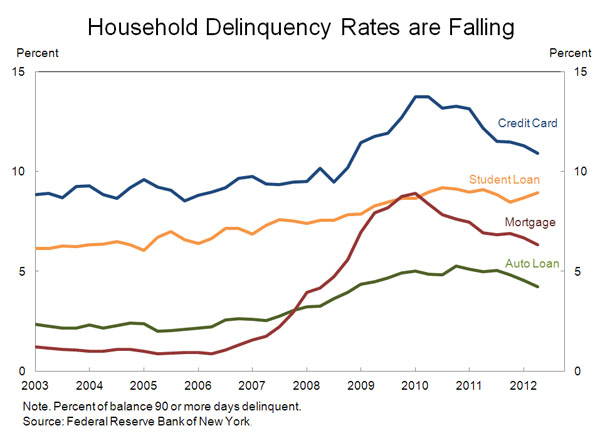

A report from the New York Fed last week showed that debt held by U.S. households has fallen to its lowest level since mid-2008. The report also showed that delinquency rates on most types of household loans have retraced a significant portion of their run-ups (see Figure 1).

Figure 1

While it is encouraging that Americans are continuing to chip away at the enormous debt overhang that has weighed on the economic recovery, digging into the data more deeply shows that the picture is more complicated and less cheering than it initially appears.

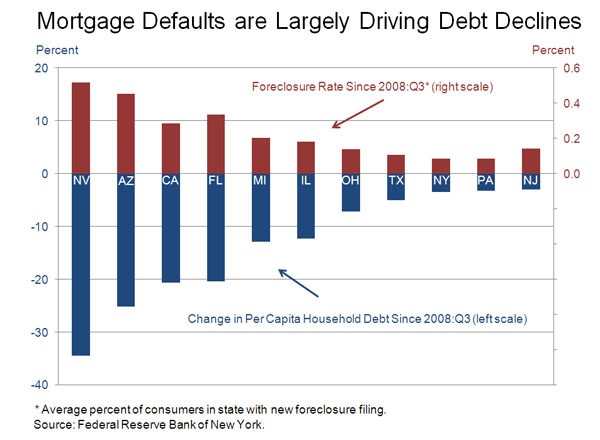

First, much of the paring back of household debt reflects loan defaults. Of the eleven states for which the New York Fed releases data, those with the largest declines in per capita household debt are also those that have seen the highest rates of late payments and foreclosure filings (see Figure 2). While being relieved of unmanageable debt payments frees up income to spend in other ways, a household that defaults can bear high personal costs such as loss of a home and reduced future access to credit. Analysis using credit bureau data suggests that credit scores decline sharply after a foreclosure and take several years to recover, if recovery comes at all.

Figure 2

A second complication is that another part of the decline in household debt occurred because many people cannot get loans. Surveys of bankers and other indicators suggest that lenders remain very cautious, having eased terms and standard only modestly from the stringent levels seen during the credit crunch, particularly for mortgages. Restrictive credit conditions mean that many people cannot get loans to finance purchases of homes and big-ticket consumption items. Indeed, a recent study found that the rate at which first-time homebuying is occurring is only about half of what it was at the beginning of the 2000s, suggesting that even those households with very little debt to begin with are having trouble accessing credit.

Tight terms and standards are not the only factor shutting some households out of the credit market. Many cash-strapped mortgage borrowers have not been able to qualify to refinance into loans at the historically low prevailing mortgage interest rates because their mortgages exceed the value of their homes; estimates suggest that these “underwater” households represent more than one-fifth of mortgage borrowers. Recent changes to the government’s Home Affordable Refinancing Program (HARP) have made it easier for such refinancings to occur, but about half of the banks surveyed recently by the Fed reported participating very little in the HARP program and, of those remaining, about one-third anticipated approving 60 percent or less of the HARP applications they received.

A third consideration to bear in mind is that the amount of debt reduction has been very uneven across households. While some households have dramatically reduced their debt load by defaulting, others who found themselves highly leveraged immediately following the financial crisis have remained so. In my own research, I compared households’ current mortgage leverage with reasonable target levels and found no decline in the share of households with excess leverage over the last couple of years. I also showed that high leverage is associated with lower consumption.

The economic recovery would be stronger if lenders were less reluctant to extend credit and households could more easily shed their excess debt. But the policy options for achieving these goals are not obvious. With fresh memories of the dangers of easy credit, regulators are (and should be) cautious about pushing financial institutions to make more loans, especially because their economic environment is challenging people’s ability to repay debt. In addition, government-subsidized loan forgiveness programs raise important questions of both efficiency and fairness. It may be the case that a stronger economic recovery spurred by others sorts of policies or other economic developments will ultimately improve debt burdens and conditions in credit markets rather than the other way around.

Commentary

Op-edThe Household Debt Picture: Better, But Still a Drag

September 6, 2012