It has long been the belief that high savings rates in China and other Asian economies will allow developing nations in Latin America to have cheap access to capital. Although Chinese personal savings rates remain high, there is increasing evidence that these rates will soon decline. At the same time, global investment rates will continue to increase as emerging economies catch up with the developed world. For this reason, developing countries with low savings rates need to be aware of the unique opportunity presented by cheap capital while simultaneously promoting financial development in order to increase national savings.

Much of the decline in global savings could come from China. In 2008, China’s government, households and companies saved a total of 53 percent of GDP, which is equal to nearly 1 in every 4 dollars saved worldwide. Many analysts believe China’s high rate of savings is a result of the corporate sector’s governance structure. This allows firms to keep their profits without paying a dividend to the shareholders, including the government. However, a recent comparison of corporate savings rates among companies worldwide rejects this hypothesis. On net, Chinese firms do not save significantly more, as a share of total assets, than that of their global competitors. Therefore, this leaves households as the major force behind the large surpluses in China.

In 2008, the savings rate among Chinese households was one of the highest in the world at 23 percent of GDP. There are good reasons to believe that this will not last very long. China has an aging population that will soon begin to withdraw heavily against accumulated savings as workers retire. Also as the Chinese government prepares to implement public programs to support health care and pensions, it is likely that Chinese households will have less reason to maintain their high rates of savings. Historical trends from Japan and South Korea show that as their economies became richer, household savings began to steadily decline.

A potential decline in the Chinese savings rate would have serious impacts on Latin American developing nations that have been able to invest and grow despite their low savings. In 2009, Latin American and Caribbean countries were saving only 22 percent of GDP collectively and this number has not moved higher than 23 percent in the last 20 years. More worrisome are demographic trends in these developing countries that could cause their savings to fall further from their already low levels. In particular, lower fertility rates in these countries will reduce the number of working individuals who are able to contribute to national savings. Also, as mortality rates continue to decrease, more elderly and retired individuals will need to withdraw from pensions, health care programs and personal saving accounts.

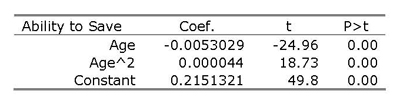

According Latinobarometro’s survey, in 2010 only 8 percent of Latin Americans said their income was enough to allow them to save. In 1997 that number was close to 11 percent and has been on a steady decline. A basic OLS regression comparing the ability to save against age and age-squared shows a highly significant nonlinear relationship. This means that as Latin Americans get older, fewer and fewer find themselves able to save. With the respondents’ ability to save represented as a binary dependent variable and the respondents’ age and age-squared as independent variables, we find the following results.

It should be noted that of the 241,614 respondents included in this regression, only 20,561 (8.51 percent) said that their income is enough to allow them to save, 221,052 (91.49 percent) said they are either just able to get by on their income or are having serious trouble paying their bills. The figure below illustrates the ability to save by age in Latin America. In this graph we see that Latin Americans are having the hardest time saving during the working years of life and this pressure is increasing overtime. The upturn in the ability to save toward the end of life indicates that those who are surviving until older age are doing so with greater personal savings. If this is true, it may also be true that if savings rates fall in Latin America, life expectancy could also decline.

##1##

The evidence outlined here describes a narrowing window of opportunity for Latin American nations to take advantage of low-cost capital. The policy implications are that these regions should begin to rapidly promote households to move from nonfinancial to financial forms of wealth in order to increase domestic savings. Governments can also play a role by raising their own savings. If financial developments aimed at increasing domestic savings are delayed in these countries, we can expect they will be forced to cut investment which will slow growth.

Commentary

Op-edLower Savings in China Could Slow Down Growth in Latin America

February 11, 2011