As a candidate, Donald Trump deserved credit for identifying a policy that damages jobs, competitiveness, and economic growth: underinvestment in infrastructure.

Americans overwhelmingly agree. A poll this summer found that 89 percent of Americans believe infrastructure investment strengthens the economy, with 81 percent saying it would benefit them personally. More than half (56 percent) think U.S. infrastructure is in bad condition, compared to just 30 percent who say it is in good condition. Americans everyday confront the problems created by bad roads, broken public transit, ancient airports, and crumbling bridges, that are generations behind what is enjoyed in other parts of the world.

Unfortunately, Trump’s plans as president could make the situation worse. Yes, he still promises a $1 trillion federal infrastructure package, but his proposed budget cuts to infrastructure are $55 billion more than the new federal dollars he included. Moreover, his tax plans and congressional politics suggest his overall impact on infrastructure likely will be substantially more negative.

As a starting point, state and local governments are the primary source of public infrastructure spending, including $320 billion on transportation and water infrastructure in 2014 alone. While they use a broad array of methods to finance construction, their tax revenues are the primary source of infrastructure debt repayments and direct expenditures.

Yet state and local taxes are in the Trump administration’s tax plan’s crosshairs. Based on the administration’s official tax reform proposal, they seek to eliminate the federal deduction for state and local taxes (known as the SALT deduction).

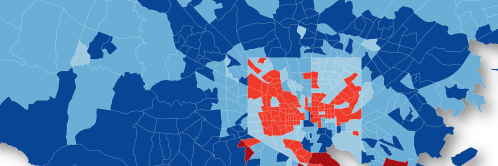

Eliminating this deduction will inevitably lower the amount of infrastructure spending. According to the Government Finance Officers Association, if cities reduced taxes to offset the effective tax increase of eliminating the SALT deduction, cities would effectively reduce their ability to pay for infrastructure by an average of $150 million per congressional district, meaning the Trump plan could reduce infrastructure capacity by over $60 billion per year. Just as importantly, it would impact both Republican and Democratic districts.

While the tax proposal is clearly a negative for infrastructure, it is fair to ask: would the long-promised $1 trillion infrastructure fund more than make up for the problems the tax bill creates?

The answer is no. As President Trump finally admitted, his plan will not work. Candidate Trump’s plan was premised on attracting private capital to fund infrastructure. But that would only help projects that directly produce revenues, leaving out such needed projects as local roads, schools, and fire stations, among others. Even where private financing has been used for infrastructure, it has been a minuscule factor. The Congressional Budget Office found, for example, that the amount spent on privately financed highways over the last 25 years was less than one percent of the amount governments spend on highways.

Public funding is also essential to building a broad coalition necessary to move forward with a national infrastructure bill. Private financing not only limits the kinds of projects financed, but also limits where the projects will be located. Other than in broadband, nearly all the kinds of infrastructure projects—airports, transit, bridges—capable of attracting the kinds of revenue necessary to secure funding, are in metropolitan areas. That would limit the political attractiveness of any legislation to rural congressional members, whose voting block is sizable.

The administration’s tax plan, however, now makes the fiscal politics for public funds impossible. The plan, in combination with Harvey and Irma recovery funds, will increase the debt and likely result in Republicans, and some Democrats, revolting against even more deficit spending. The only public money Trump had proposed for infrastructure involved funds to be repatriated from overseas. Trump, however, bowed to Republican congressional leaders, like House Ways and Means Committee Chair Kevin Brady (R-Texas) who wanted the funds used to pay for tax cuts. According to the Washington Post, “Now the administration wants to force states and localities to foot most of the bill” for infrastructure—but as noted above, the administration has raised the cost of those governments doing so.

In short: Trump’s tax plan would decrease funds for the principal sources of infrastructure financing; Trump’s original infrastructure plan is dead; and Trump’s tax plan will put the country in a position where no infrastructure plan is likely to move forward. That combination would only intensify national infrastructure challenges.

In 2015, Trump echoed many others bemoaning the quality of American infrastructure, writing, “Domestically, we need to undertake a massive rebuilding of our infrastructure. Too many bridges have become dangerous, our roads are decaying and full of potholes, while traffic jams are costing millions in lost income for drivers who have jobs in congested cities. Public transit is overcrowded and unreliable and our airports must be rebuilt.” The evidence all suggests that the Trump of 2015 is going to consider the Trump of 2017 a big-time loser when it comes to infrastructure. Far worse, our country could be the loser for generations to come.

This piece was originally published on RealClearPolitics

Commentary

Op-edIs the Trump administration a friend or foe of America’s infrastructure?

October 27, 2017