In “A more equitable distribution of the positive fiscal benefits of immigration,” Tara Watson and Wendy Edelberg propose a transparent system for redistributing resources from the federal government to localities that experience adverse fiscal impacts when new immigrants arrive.

Immigration is good for the U.S. economy and for the fiscal picture at the federal level, but local areas with more newly arrived, less-educated immigrants are likely to face the most fiscal pressure, stemming largely from lower tax revenue generated per capita.

Watson and Edelberg propose redirecting some of the federal gains from immigration toward those communities that bear more of its near-term costs.

The proposal outlines a measure and method for determining the communities that qualify for funds, the Immigration Impact Index. Watson and Edelberg use information on the geographic dispersion of newly arrived less-educated immigrants as the key determinant of how funds are allocated.

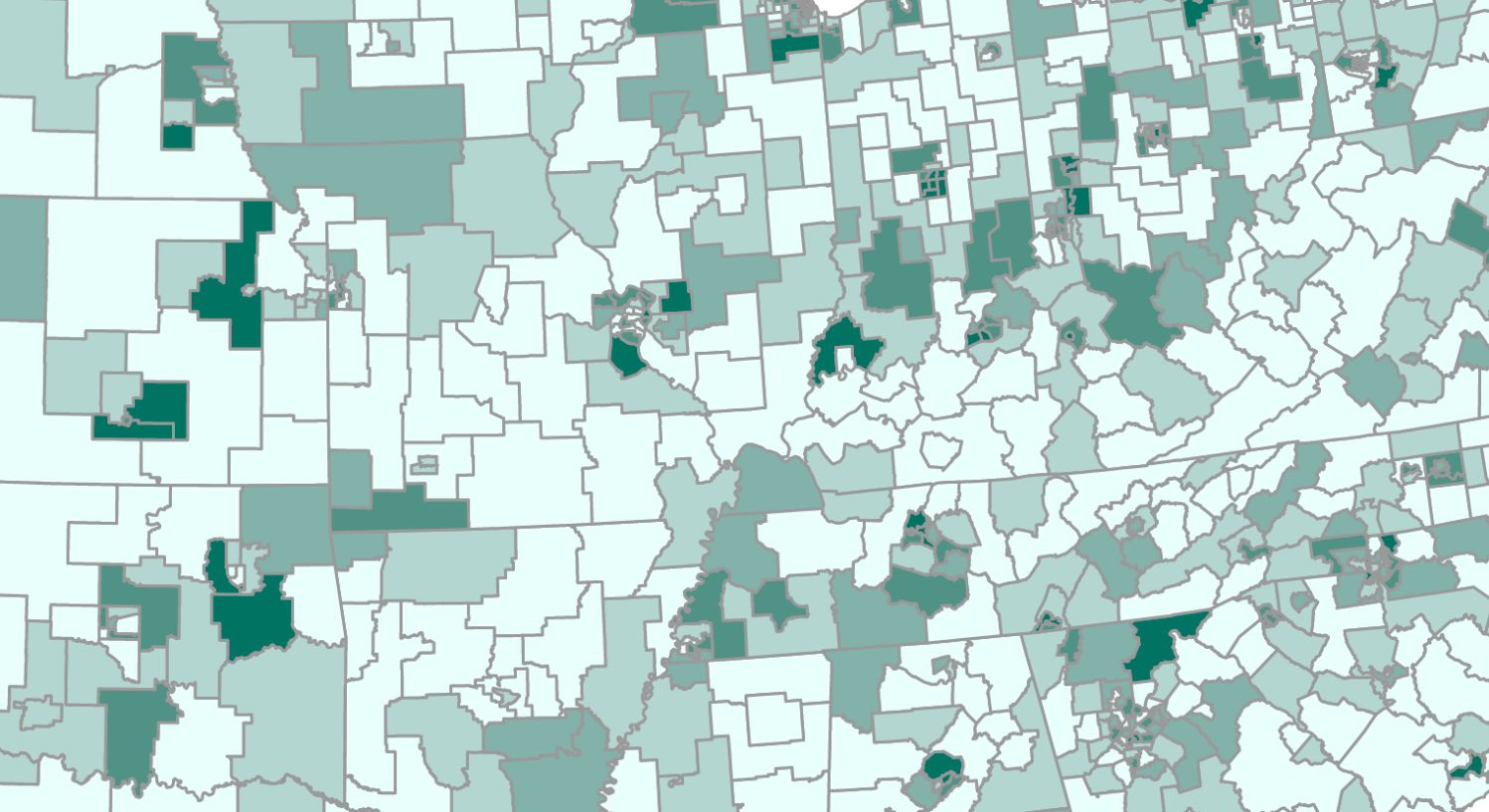

Share of Adult Population Comprised of Impact Index Immigrants

Source: U.S. Census Bureau 2015–19 (American Community Survey); authors’ calculations.

In particular, they focus on the local fiscal impact of immigration based on the share of adult population (ages 18 or older) in a community that meets all of the following criteria:[1]

- Adults are foreign born and arrived in the United States within the past five years.

- Adults are not dependent; individuals are identified as dependent if they are ages 18–22 and are in school.

- Adults do not have at least a bachelor’s degree.

This data interactive shows the Immigration Impact Index by Public Use Microdata Area (PUMA) and state. Learn more about the Index and proposal here.

[1] Adults are aged 18 and over noninstitutionalized population. Impact Index Immigrants are noninstitutionalized adults with less than a bachelor’s degree, who immigrated 5 or less years before they were surveyed. The index excludes college-age (18–22) immigrants who are in school and do not have a bachelor’s degree or more.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.